Allegheny Power 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Allegheny Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT

2013

Table of contents

-

Page 1

2013 ANNUAL REPORT -

Page 2

... multiyear program to enhance Jersey Central Power & Light's transmission system. FINANCIAL HIGHLIGHTS kEy ACCompLiShmENtS • Reduced debt by approximately $1.5 billion at FirstEnergy Solutions (FES) and Allegheny Energy Supply • Generated $2.7 billion in cash from operations • Reduced planned... -

Page 3

... than $1 billion in costs related to their response to unprecedented storm activity in 2011 and 2012. The recession also negatively impacted our competitive operations. Market prices for competitive generation in the past three years alone have dropped more than $20 per megawatt-hour (MWH), with 85... -

Page 4

... high-voltage transmission lines onto towers that run from the Davis-Besse Nuclear Power Station in Oak Harbor, Ohio, to the new Hayes Substation in Sandusky. right: One of two new 470-ton steam generators is offloaded at the Port of Toledo to be installed 2 at Davis-Besse to support its continued... -

Page 5

... on the long-term growth of our service area. Already, sales related to shale gas have resulted in 210 megawatts (MW) of new industrial demand and an additional 430 MW of planned expansions at customer facilities. Over the next two years, industrial sales are expected to increase by 4 percent, with... -

Page 6

... that increased its retail sales volume by 9 percent and its retail base by approximately 100,000 customers, bringing its total to more than 2.7 million customers. Although the realignment of our competitive generation assets and challenging retail markets are expected to result in lower sales over... -

Page 7

.... This is a direct result of the deactivation of certain plants and other cost-cutting measures. We now operate one of the cleanest and lowest-cost fleets in the U.S. As we complete our MATS compliance program and other current projects, nearly 100 percent of our power will be generated from non- or... -

Page 8

... value to our investors. Thank you for your continued support. Sincerely, Anthony J. Alexander President and Chief Executive Officer March 19, 2014 Our new Akron Control Center in Ohio uses advanced technologies to monitor the transmission system 6 serving our electric utility operating companies... -

Page 9

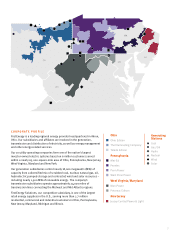

... and other energy-related services. Our 10 utility operating companies form one of the nation's largest investor-owned electric systems based on 6 million customers served within a nearly 65,000-square-mile area of Ohio, Pennsylvania, New Jersey, West Virginia, Maryland and New York. Our generation... -

Page 10

...: In 2013, your management team and employees made significant progress in strengthening the company's financial position, preserving its competitive business, and controlling costs. As FirstEnergy repositions its business to achieve more sustainable growth, your Board of Directors continues to... -

Page 11

-

Page 12

...Allegheny Transmission Company, LLC PATH West Virginia Transmission Company, LLC The Potomac Edison Company, a Maryland electric utility operating subsidiary of AE Pennsylvania Power Company, a Pennsylvania electric utility operating subsidiary of OE ME, PN, Penn and WP Pennsylvania Electric Company... -

Page 13

... Organization Employee Stock Ownership Plan Electric Security Plan Facebook is a registered trademark of Facebook, Inc. Financial Accounting Standards Board Federal Energy Regulatory Commission Fitch Ratings First Mortgage Bond Federal Power Act Financial Transmission Right Accounting Principles... -

Page 14

... Transmission Expansion Plan Multi-Value Project Megawatt Megawatt-hour Nuclear Decommissioning Trust Nuclear Electric Insurance Limited North American Electric Reliability Corporation Non-Governmental Organization New Jersey Board of Public Utilities Non-Market Based Non-Attainment New Source... -

Page 15

... Public Utility Commission Power Supply Agreement Prevention of Significant Deterioration Public Service Electric and Gas Company Public Utilities Commission of Ohio Public Utility Regulatory Policies Act of 1978 Research and Development Resource Conservation and Recovery Act Renewable Energy Credit... -

Page 16

.... Earnings per Share of Common Stock: Basic - Continuing Operations Basic - Discontinued Operations (Note 20) Basic - Earnings Available to FirstEnergy Corp. 2013 14,917 375 392 0.90 0.04 0.94 0.90 0.04 0.94 2012 15,273 755 770 1.81 0.04 1.85 1.80 0.04 1.84 2011 16,105 856 885 2.19 0.03 2.22... -

Page 17

... 31, 2013 and January 31, 2014, respectively. Information regarding retained earnings available for payment of cash dividends is given in Note 12, Capitalization of the Combined Notes to Consolidated Financial Statements. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL... -

Page 18

... nature of increased competition in the electric utility industry, in general, and the retail sales market in particular. • The ability to experience growth in the Regulated Distribution and Regulated Transmission segments and to continue to successfully implement our direct retail sales strategy... -

Page 19

... be taken by credit rating agencies that could negatively affect us and our subsidiaries' access to financing, increase the costs thereof, and increase requirements to post additional collateral to support outstanding commodity positions, LOCs and other financial guarantees. Changes in national and... -

Page 20

... Per Share - Prior Year Segment operating results Regulated Distribution Regulated Transmission Competitive Energy Services Regulatory charges Non-core asset sales/impairments Merger-related costs Merger accounting - commodity contracts Net merger accretion (1)(2) (1) 2013 $ 1.85 0.06 (0.03) (0.45... -

Page 21

... fourth quarter of 2013 representing refunds to customers associated with the excess purchase price received by MP above the net book value of MP's minority interest in the Pleasants Power Station. Hatfield's Ferry, Mitchell & Mad River Plant Deactivations As a result of the cost of compliance with... -

Page 22

...) was required to purchase higher volumes of power. Given the market conditions in PJM, the Competitive Energy Services segment (including FES) also experienced increased levels of transmission charges, primarily associated with ancillary expenses, such as synchronous and operating reserves, which... -

Page 23

... the balance sheets of its subsidiaries. Completion of the plan was also expected to significantly improve credit metrics at the Competitive Energy Services segment and included the net transfer of 1,476 MW of the Harrison and Pleasants power plants between AE Supply and MP, and the proposed sale of... -

Page 24

... distributes electricity through FirstEnergy's ten utility operating companies, serving approximately six million customers within 65,000 square miles of Ohio, Pennsylvania, West Virginia, Maryland, New Jersey and New York, and purchases power for its POLR, SOS, SSO and default service requirements... -

Page 25

...the related costs of electricity generation, including fuel, purchased power and net transmission (including congestion) and ancillary costs charged by PJM to deliver energy to the segment's customers. The Competitive Energy Services segment derives its revenues from the sale of generation to direct... -

Page 26

...modernize and improve the efficiency of its utility distribution system in order to continue to provide solid reliability to customers. For example, JCP&L has a pending rate case in New Jersey and MP plans to file a rate case in West Virginia in April 2014. In addition, Penn expects to seek approval... -

Page 27

... West Virginia asset transfer which occurred in October 2013. Lower operations and maintenance expense due to reduced overall benefit expenses and lower expenses at the Competitive Energy Services segment resulting from the plant deactivations and asset sales, partially offset by increased expenses... -

Page 28

... as air conditioners in New Jersey and Pennsylvania, to help manage peak loading on the electric distribution system. FirstEnergy has also made an online interactive energy efficiency tool, Home Energy Analyzer, available to our customers to help achieve electricity use reduction goals. RISKS AND... -

Page 29

... detail in Note 20, Discontinued Operations and Assets Held for Sale. Net income by business segment was as follows: Increase (Decrease) 2013 Net Income (Loss) By Business Segment: Regulated Distribution Regulated Transmission Competitive Energy Services Other and reconciling adjustments (1) Net... -

Page 30

... Operations - 2013 Compared with 2012 Financial results for FirstEnergy's business segments in 2013 and 2012 were as follows: Competitive Energy Services (In millions) Revenues: External Electric Other Internal Total Revenues Operating Expenses: Fuel Purchased power Other operating expenses Pension... -

Page 31

2012 Financial Results Revenues: External Electric Other Internal Total Revenues Operating Expenses: Fuel Purchased power Other operating expenses Pension and OPEB mark-to-market Provision for depreciation Deferral of storm costs Amortization of regulatory assets, net General taxes Total Operating ... -

Page 32

Changes Between 2013 and 2012 Financial Results Increase (Decrease) Revenues: External Electric Other Internal Total Revenues Operating Expenses: Fuel Purchased power Other operating expenses Pension and OPEB mark-to-market Provision for depreciation Deferral of storm costs Amortization of ... -

Page 33

...below 2012, and 3% above normal. Lower deliveries to the commercial sector primarily reflect increasing energy efficiency mandates and demand response initiatives. In the industrial sector, increased sales to steel, chemical, and shale gas customers were partially offset by lower sales to automotive... -

Page 34

...forced outages in 2012 and the asset transfer between MP and AE Supply of the Harrison Power Station effective October 9, 2013. Purchased power costs were $493 million lower in 2013 primarily due to a decrease in volumes required as a result of increased customer shopping, higher generation, reduced... -

Page 35

... efficiency program expenses of $40 million resulting from the completion of certain initiatives in Ohio and Pennsylvania, which are recoverable through rates; lower distribution operating and maintenance expenses of $363 million due to lower storm related maintenance activities during 2013 compared... -

Page 36

... 2013, compared to 2012, primarily due to a decline in wholesale sales. Although MWH sales increased 5.8% compared to the prior period, revenues were adversely impacted by lower unit prices compared to 2012 as a result of a significant decrease in power prices beginning in the fourth quarter of 2011... -

Page 37

... increase in rate primarily resulted from higher on-peak prices compared to 2012. The increase in purchased power volumes relates to the overall increase in sales volumes and decrease in fossil generation. Fossil operating costs decreased by $25 million due primarily to lower labor costs resulting... -

Page 38

... - 2013 Compared with 2012 Financial results from other operating segments and reconciling items, including interest expense on holding company debt and corporate support services revenues and expenses, resulted in a $107 million increase in net income in 2013 compared to 2012 primarily due to lower... -

Page 39

... Operations - 2012 Compared with 2011 Financial results for FirstEnergy's business segments in 2012 and 2011 were as follows: Competitive Energy Services (In millions) Revenues: External Electric Other Internal Total Revenues Operating Expenses: Fuel Purchased power Other operating expenses Pension... -

Page 40

2011 Financial Results Revenues: External Electric Other Internal Total Revenues Operating Expenses: Fuel Purchased power Other operating expenses Pension and OPEB mark-to-market Provision for depreciation Deferral of storm costs Amortization of regulatory assets, net General taxes Impairment of ... -

Page 41

Changes Between 2012 and 2011 Financial Results Increase (Decrease) Revenues: External Electric Other Internal Total Revenues Operating Expenses: Fuel Purchased power Other operating expenses Pension and OPEB mark-to-market Provision for depreciation Deferral of storm costs Amortization of ... -

Page 42

... resulted from the following sources: For the Years Ended December 31, Revenues by Type of Service Pre-merger companies: Distribution services Generation sales: Retail Wholesale Total generation sales Transmission Other Total pre-merger companies Allegheny Utilities(1) Total Revenues (1) Increase... -

Page 43

...'s and Penn's service areas and 50% from 44% for JCP&L. The decrease in retail generation prices resulted from the impact of lower auction prices on power supply prices in 2012 compared to 2011, partially offset by a full year of Ohio's RER Rider (recovers deferred costs relating to electric heating... -

Page 44

... the Allegheny merger. Merger-related costs decreased $60 million in 2012 compared to 2011. Pension and OPEB mark-to-market charges increased $87 million, reflecting lower discount rates to measure related obligations in 2012. Depreciation expense increased by $27 million due to a higher asset base... -

Page 45

... sale of RECs. Revenues were also adversely impacted by lower unit prices compared to 2011.These decreases were partially offset by growth in direct, governmental aggregation and mass market sales and the inclusion of the Allegheny companies for twelve months in 2012 compared to ten months in 2011... -

Page 46

...of Service Pre-merger Companies: Direct Governmental Aggregation Mass Market POLR and Structured Wholesale(1) Transmission RECs Other Allegheny companies Total Revenues Allegheny companies(2) Direct POLR and Structured Wholesale(1) Transmission Other Total Revenues (1) (2) Increase (Decrease) 2012... -

Page 47

... million resulted from the acquisition of new customers primarily in Ohio and Pennsylvania, partially offset by lower unit prices. The Direct, Governmental Aggregation and Mass Market customer base increased to 2.6 million customers in December 2012 as compared to 1.8 million in December 2011. The... -

Page 48

... in purchased power volumes primarily relates to the overall increase in direct and governmental aggregation sales volumes, economic purchases and lower generation resulting from the deactivation of fossil generating units and the temporary reduction in operations at Sammis. Fossil operating costs... -

Page 49

...39 110 1,582 Allegheny results include 12 months in 2012 and 10 months in 2011, and excludes items classified in Discontinued Operations. Fuel expenses increased due to higher generation levels and fuel prices. The purchased power expense decreased due to lower volumes purchased and lower capacity... -

Page 50

...credit facilities will continue to be available to manage working capital requirements along with continued access to long-term capital markets. As discussed in the Overview, FirstEnergy's 2013 financial plan also included a series of actions, including the net transfer of 1,476 MW between AE Supply... -

Page 51

.... On October 31, 2013, FE amended its existing $2.5 billion multi-year syndicated revolving credit facility to exclude certain after-tax, non-cash write-downs and non-cash charges of approximately $1.4 billion (primarily related to Pension and OPEB mark-to-market adjustments, impairment of long... -

Page 52

...the ability to borrow or accelerate payment of outstanding advances in the event of any change in credit ratings of the borrowers. Pricing is defined in "pricing grids," whereby the cost of funds borrowed under the Facilities is related to the credit ratings of the company borrowing the funds, other... -

Page 53

... direct pay LOCs. The subsidiary obligor is required to reimburse the applicable LOC bank for any such drawings or, if the LOC bank fails to honor its LOC for any reason, must itself pay the purchase price. The LOCs for FirstEnergy's variable interest rate PCRBs outstanding as of December 31, 2013... -

Page 54

... asset removal costs charged to income primarily related to hurricane Sandy in 2012. $146 million increase from materials and supplies, primarily due to reduced fuel inventory resulting primarily from plant deactivations in 2013 and 2012. $125 million decrease from lower accounts payable balances at... -

Page 55

... based upon changes in the credit ratings of FirstEnergy but will not decrease below the issued rates. The proceeds were used to repay short-term borrowings and to invest in the money pool for FES and AE Supply's use in funding a portion of their concurrent tender offers. On March 28, 2013... -

Page 56

... for 2013, 2012 and 2011: For the Years Ended December 31, Cash Used for Investing Activities Property Additions: Regulated distribution Regulated transmission Competitive energy services Other and reconciling adjustments Nuclear fuel Cash received from Allegheny merger Proceeds from asset sales... -

Page 57

... of the Utilities and under which they procure the power supply necessary to provide generation service to their customers who do not choose an alternative supplier. Although actual amounts will be determined by future customer behavior and consumption levels, management currently estimates these... -

Page 58

... the sale and purchase of electric capacity, energy, fuel, and emission allowances. Certain bilateral agreements and derivative instruments contain provisions that require FE or its subsidiaries to post collateral. This collateral may be posted in the form of cash or credit support with thresholds... -

Page 59

... activities throughout the company. Commodity Price Risk FirstEnergy is exposed to financial risks resulting from fluctuating commodity prices, including prices for electricity, natural gas, coal and energy transmission. FirstEnergy's Risk Management Committee is responsible for promoting the... -

Page 60

... on model-based information. The model provides estimates of future regional prices for electricity and an estimate of related price volatility. FirstEnergy uses these results to develop estimates of fair value for financial reporting purposes and for internal management decision making (see Note... -

Page 61

... by the NJBPU, in Pennsylvania by the PPUC, in West Virginia by the WVPSC and in New York by the NYPSC. The transmission operations of PE in Virginia are subject to certain regulations of the VSCC. In addition, under Ohio law, municipalities may regulate rates of a public utility, subject to appeal... -

Page 62

... reliability and customer satisfaction requirements. PE has advised the MDPSC that compliance with the new rules is expected to increase costs by approximately $106 million over the period 2012-2015. On April 1, 2013, the Maryland electric utilities, including PE, filed their first annual reports on... -

Page 63

...customers" and ordered JCP&L to file a base rate case using a historical 2011 test year. The rate case petition was filed on November 30, 2012. In the filing, JCP&L requested approval to increase its revenues by approximately $31.5 million and reserved the right to update the filing to include costs... -

Page 64

... market-based price set through an auction process; and • Continuing Rider DCR that allows continued investment in the distribution system for the benefit of customers. As approved, the ESP 3 plan provides additional provisions, including: • Securing generation supply for a longer period of time... -

Page 65

.... The default service supply is currently provided by wholesale suppliers through a mix of longterm and short-term contracts procured through descending clock auctions, competitive requests for proposals and spot market purchases. On November 4, 2013, the Pennsylvania Companies filed a DSP that... -

Page 66

... of energy efficiency and peak demand reduction programs. The PPUC found the energy efficiency programs to be cost effective and in an Order entered on August 3, 2012, the PPUC directed all of the electric utilities in Pennsylvania to submit by November 15, 2012, a Phase II EE&C Plan that... -

Page 67

... Pennsylvania Companies and FES on March 27, 2012. If implemented these rules could require a significant change in the ways FES and the Pennsylvania Companies do business in Pennsylvania, and could possibly have an adverse impact on their results of operations and financial condition. Pennsylvania... -

Page 68

... of the cost of high voltage transmission facilities on a beneficiary pays basis results in certain LSEs in PJM bearing the majority of the costs. FirstEnergy and a number of other utilities, industrial customers and state utility commissions supported the use of the beneficiary pays approach for... -

Page 69

...and the construction of new substations in Hardy County, West Virginia and Frederick County, Maryland. PJM initially authorized construction of the PATH project in June 2007. On August 24, 2012, the PJM Board of Managers canceled the PATH project, which it had suspended in February 2011. As a result... -

Page 70

... and they operate as a financial replacement for physical firm transmission service. FTRs are financially-settled instruments that entitle the holder to a stream of revenues based on the hourly congestion price differences across a specific transmission path in the PJM Day-ahead Energy Market. FE... -

Page 71

...NOx reduction requirements under the CAA and SIP(s) by burning lower-sulfur fuel, utilizing combustion controls and postcombustion controls, generating more electricity from lower or non-emitting plants and/or using emission allowances. In July 2008, three complaints representing multiple plaintiffs... -

Page 72

...can require the installation of additional air emission control equipment when a major modification of an existing facility results in an increase in emissions. In September 2007, AE received an NOV from the EPA alleging NSR and PSD violations under the CAA, as well as Pennsylvania and West Virginia... -

Page 73

... would be required including an emissions applicability threshold of 75,000 tons per year of CO2 equivalents for existing facilities under the CAA's PSD program. On April 13, 2012, the EPA proposed new source performance standards for GHG emissions from newly constructed fossil fuel generating units... -

Page 74

...could require significant capital and other expenditures or result in changes to its operations. The CO2 emissions per KWH of electricity generated by FirstEnergy is lower than many of its regional competitors due to its diversified generation sources, which include low or non-CO2 emitting gas-fired... -

Page 75

.... On December 14, 2012, a modified Consent Decree that addresses public comments received by PA DEP was entered by the court, requiring FG to conduct monitoring studies and submit a closure plan to the PA DEP, no later than March 31, 2013, and discontinue disposal to LBR as currently permitted by... -

Page 76

...in support of the decommissioning of the spent fuel storage facilities located at its Davis-Besse and Perry nuclear facilities. As required by the NRC, FirstEnergy annually recalculates and adjusts the amount of its parental guaranty, as appropriate. On October 4, 2013, during a refueling outage for... -

Page 77

... and MP filed a complaint in the Court of Common Pleas of Allegheny County, Pennsylvania against ICG, Anker WV, and Anker Coal. Anker WV entered into a long term Coal Sales Agreement with AE Supply and MP for the supply of coal to the Harrison generating facility. Prior to the time of trial, ICG was... -

Page 78

... of unbilled sales and revenues requires management to make estimates regarding electricity available for retail load, transmission and distribution line losses, demand by customer class, applicable billing demands, weather-related impacts, number of days unbilled and tariff rates in effect... -

Page 79

Postemployment Benefits Expense (Credits) Pensions OPEB Total $ $ 2013 (134) $ (196) (330) $ 2012 (In millions) 596 (34) 562 $ $ 2011 555 (112) 443 Health care cost trends continue to increase and will affect future OPEB costs. The 2013 composite health care trend rate assumptions were ... -

Page 80

...factors determined by FirstEnergy management. Assumptions used in the analysis include discount rates, future power and natural gas prices, projected operating and capital cash flows and the fair value of debt. The estimated fair value of the Competitive Energy Services segment exceeded its carrying... -

Page 81

... public accounting firm, has expressed an unqualified opinion on the Company's 2013 consolidated financial statements as stated in their audit report included herein. The Company's internal auditors, who are responsible to the Audit Committee of the Company's Board of Directors, review the results... -

Page 82

..., on the financial statement schedule, and on the Company's internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and... -

Page 83

...) REVENUES: Electric utilities Unregulated businesses Total revenues* OPERATING EXPENSES: Fuel Purchased power Other operating expenses Pensions and OPEB mark-to-market adjustment Provision for depreciation Deferral of storm costs Amortization of regulatory assets, net General taxes Impairment of... -

Page 84

...(In millions) NET INCOME OTHER COMPREHENSIVE INCOME (LOSS): Pensions and OPEB prior service costs Amortized losses on derivative hedges Change in unrealized gain on available-for-sale securities Other comprehensive loss Income tax benefits on other comprehensive loss Other comprehensive income (loss... -

Page 85

... accounts of $3 in 2013 and $4 in 2012 Materials and supplies, at average cost Prepaid taxes Derivatives Accumulated deferred income taxes Other PROPERTY, PLANT AND EQUIPMENT: In service Less - Accumulated provision for depreciation Construction work in progress INVESTMENTS: Nuclear plant... -

Page 86

...64 million of income tax benefits (Note 3) Stock-based compensation Allegheny merger Cash dividends declared on common stock Balance, December 31, 2011 Earnings available to FirstEnergy Corp. Amortized losses on derivative hedges, net of $1 million of income tax benefits Change in unrealized gain on... -

Page 87

...: Property additions Nuclear fuel Proceeds from asset sales Sales of investment securities held in trusts Purchases of investment securities held in trusts Cash investments Cash received in Allegheny merger Asset removal costs Other Net cash used for investing activities Net change in cash and... -

Page 88

... NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Note Number 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 Organization and Basis of Presentation Accumulated Other Comprehensive Income Pensions and Other Postemployment Benefits Stock-Based Compensation Plans Taxes Leases Intangible Assets... -

Page 89

... the related regulations, orders, policies and practices prescribed by the SEC, FERC, and, as applicable, the PUCO, the PPUC, the MDPSC, the NYPSC, the WVPSC, the VSCC and the NJBPU. The preparation of financial statements in conformity with GAAP requires management to make periodic estimates and... -

Page 90

... Consolidated Balance Sheets. REVENUES AND RECEIVABLES The Utilities' principal business is providing electric service to customers in Ohio, Pennsylvania, West Virginia, New Jersey and Maryland. FES' and AE Supply's principal business is supplying electric power to end-use customers through retail... -

Page 91

... and charged to fuel expense using the specific identification method. Net plant in service balances as of December 31, 2013 and 2012 were as follows: December 31, 2013 Property, Plant and Equipment Regulated Distribution Regulated Transmission Competitive Other/Corporate Total $ In Service $ 23... -

Page 92

... of Regulated Distribution, Regulated Transmission, Competitive Energy Services and Other/Corporate. Goodwill is allocated to these reportable segments based on the original purchase price allocation of acquisitions. Total goodwill recognized by segment in FirstEnergy's Consolidated Balance Sheet is... -

Page 93

... as of December 31, 2012 Classification to Assets Held for Sale(1) West Virginia asset transfer Balance as of December 31, 2013 (1) Regulated Distribution $ 5,025 - 67 $ 5,092 Regulated Transmission $ 526 - - $ 526 Competitive Energy Services (In millions) $ 896 (29) (67) $ 800 Other/ Corporate... -

Page 94

... 31, 2012 Other comprehensive income before reclassifications Amounts reclassified from AOCI Net other comprehensive income (loss) AOCI Balance, December 31, 2013 $ $ $ $ Unrealized Gains on AFS Securities 7 49 (37) 12 19 41 (45) (4) 15 29 (35) (6) 9 $ $ $ $ Defined Benefit Pension & OPEB Plans 472... -

Page 95

... Defined Benefit Pension & OPEB Plans Total (In millions) AOCI Balance, January 1, 2011 Other ...income (loss) AOCI Balance, December 31, 2012 Other comprehensive income before reclassifications Amounts reclassified from AOCI Net other comprehensive loss AOCI Balance, December 31, 2013 $ $ $ $ ... -

Page 96

... Realized gains on sales of securities $ $ Defined benefit pension and OPEB plans Prior-service costs $ (195) $ (191) $ (169) 75 74 65 (1) 2013 2012 (In millions) (9) $ 10 1 - $ 1 $ 2011 Affected Line Item in Consolidated Statements of Income 26 12 38 24 Other operating expenses Interest... -

Page 97

... years of service. The balance of these accounts will be provided to employees when they leave the company. FirstEnergy's pensions and OPEB funding policy is based on actuarial computations using the projected unit credit method. During the year ended December 31, 2013, FirstEnergy did not make any... -

Page 98

...the Balance Sheet: Current liabilities Noncurrent liabilities Net liability as of December 31 Amounts Recognized in AOCI: Prior service cost (credit) Assumptions Used to Determine Benefit Obligations (as of December 31) Discount rate Rate of compensation increase Assumed Health Care Cost Trend Rates... -

Page 99

...Net Periodic Benefit Costs Service cost Interest cost Expected return on plan assets Amortization of prior service cost (credit) Other adjustments (settlements, curtailments, etc.) Pensions & OPEB mark-to-market adjustment Net periodic cost Assumptions Used to Determine Net Periodic Benefit Cost for... -

Page 100

... of changes in the fair value of pension investments classified as Level 3 in the fair value hierarchy during 2013 and 2012: Private Equity Funds Balance as of January 1, 2012 Actual return on plan assets: Unrealized gains Realized gains Purchases, sales and settlements Transfers in (out) Balance as... -

Page 101

...48 88 59 5 9 21 - - $ 318 $ $ Level 3 5 5 $ Total (In millions) $ 183 4 8 195 Excludes ($9) million and ($10) million as of December 31, 2013 and December 31, 2012, respectively, of receivables, payables, taxes and accrued income associated with financial instruments reflected within the fair... -

Page 102

... of changes in the fair value of OPEB trust investments classified as Level 3 in the fair value hierarchy during 2013 and 2012: Private Equity Funds Balance as of January 1, 2012 Actual return on plan assets: Unrealized losses Realized gains (losses) Purchases, sales and settlements Transfers out... -

Page 103

Taking into account estimated employee future service, FirstEnergy expects to make the following benefit payments from plan assets and other payments, net of participant contributions: OPEB Pensions 2014 2015 2016 2017 2018 Years 2019-2023 $ 449 466 484 500 524 2,867 $ Benefit Payments (in millions)... -

Page 104

... the vesting period based on the fair value on the grant date, less estimated forfeitures. FirstEnergy records the actual tax benefit realized from tax deductions when awards are exercised or distributed. Realized tax benefits during the years ended December 31, 2013, 2012 and 2011 were $13 million... -

Page 105

... eligible employees allowing them to purchase a specified number of common shares at a fixed grant price over a defined period of time. Stock option activity during 2013 was as follows: Weighted Average Exercise Price $ 40.33 30.37 71.21 $ 42.59 Stock Option Activity Balance, January 1, 2013 (2,348... -

Page 106

...-year vesting period. 401(k) Savings Plan In 2013, 2012 and 2011, shares of FE common stock were purchased on the market and contributed to participants' accounts. EDCP Under the EDCP, covered employees can direct a portion of their compensation, including annual incentive awards and/or longterm... -

Page 107

...Units Performance Shares 401(k) Savings Plan EDCP Total Stock-based compensation costs capitalized $ $ $ Years ended December 31, 2013 6 (1) 4 - 9 1 $ $ 2012 (In millions) $ 6 1 6 - 13 1 $ $ $ 2011 4 1 5 1 11 - Tax benefits associated with stock based compensation plan expense was $23 million, $11... -

Page 108

...$8 million in 2013. During 2013, FirstEnergy made changes to state apportionment factors in certain jurisdictions based on sales sourcing rules for electricity, which reduced deferred tax liabilities by approximately $9 million. Furthermore, based on an assessment of business operations, FirstEnergy... -

Page 109

..., reducing income tax expense in 2011 by $27 million. During 2012, certain FirstEnergy operating companies adopted a new federal tax accounting method (effective for the 2011 consolidated federal tax return) for the deductibility of expenses for repairs to transmission and distribution assets... -

Page 110

... for income taxes 2012 Book income before provision for income taxes Federal income tax expense at statutory rate Increases (reductions) in taxes resulting fromAmortization of investment tax credits State income taxes, net of federal tax benefit Medicare Part D Effectively settled tax items State... -

Page 111

... transition charge Customer receivables for future income taxes Deferred MISO/PJM transmission costs Other regulatory assets - RCP Deferred sale and leaseback gain Non-utility generation costs Unamortized investment tax credits Unrealized losses on derivative hedges Pensions and OPEB Lease market... -

Page 112

... tax rate of approximately $7 million. The following table summarizes the changes in unrecognized tax positions for the years ended 2013, 2012 and 2011: FirstEnergy Balance, January 1, 2011 Increase due to merger with AE Prior years increases Prior years decreases Balance, December 31, 2011 Current... -

Page 113

... is expected to be utilized based on current estimates and assumptions. The ultimate utilization of these NOLs may be impacted by statutory limitations on the use of NOLs imposed by state and local tax jurisdictions, changes in statutory tax rates, and changes in business which, among other things... -

Page 114

... FirstEnergy (In millions) 2013 KWH excise State gross receipts Real and personal property Social security and unemployment Other Total general taxes 2012 KWH excise State gross receipts Real and personal property Social security and unemployment Other Total general taxes 2011 KWH excise State gross... -

Page 115

... have the right to purchase the facilities at the expiration of the basic lease term or any renewal term at a price equal to the fair market value of the facilities. The basic rental payments are adjusted when applicable federal tax law changes. In 2007, FG completed a sale and leaseback transaction... -

Page 116

... portion Present value of net minimum lease payments Less current portion Noncurrent portion $ $ FirstEnergy (In millions) 40 38 34 30 23 57 222 (34) 188 34 154 $ $ 6 6 5 5 2 - 24 (2) 22 5 17 FES FirstEnergy's future minimum consolidated operating lease payments as of December 31, 2013, are as... -

Page 117

... charges payable by retail electric customers in the service territories of the Ohio Companies) and the bondholder has no recourse to the general credit of FirstEnergy or any of the Ohio Companies. The SPEs are considered VIEs and each one is consolidated into its applicable utility. In June 2013... -

Page 118

...-market costs incurred to be recovered from customers. Purchased power costs related to the contracts that may contain a variable interest were $185 million and $253 million during the years ended December 31, 2013 and 2012, respectively. In 1998 the PPUC issued an order approving a transition plan... -

Page 119

... significant increases or decreases in inputs in isolation could result in a higher or lower fair value measurement. See Note 10, Derivative Instruments, for additional information regarding FirstEnergy's FTRs. NUG contracts represent purchase power agreements with third-party non-utility generators... -

Page 120

...multiplying the prices by the generation MWH. Generally, significant increases or decreases in inputs in isolation could result in a higher or lower fair value measurement. LCAPP contracts are financially settled agreements that allow eligible generators to receive payments from, or make payments to... -

Page 121

... that are classified as Level 3 in the fair value hierarchy for the period ended December 31, 2013: Fair Value, Net (In millions) FTRs NUG Contracts $ $ (8) (202) Valuation Technique Model Model Significant Input RTO auction clearing prices Generation Regional electricity prices Range ($2.80) to... -

Page 122

... 31, 2013 and December 31, 2012, respectively, of receivables, payables, taxes and accrued income associated with financial instruments reflected within the fair value table. Rollforward of Level 3 Measurements The following table provides a reconciliation of changes in the fair value of FTRs... -

Page 123

... of assets including private or direct placements, warrants, securities of FirstEnergy, investments in companies owning nuclear power plants, financial derivatives, securities convertible into common stock and securities of the trust funds' custodian or managers and their parents or subsidiaries... -

Page 124

... are defined as short-term financial instruments under GAAP and are reported as Short-term borrowings on the Consolidated Balance Sheets at cost. Since these borrowings are short-term in nature, FirstEnergy believes that their costs approximate their fair market value. The following table provides... -

Page 125

10. DERIVATIVE INSTRUMENTS FirstEnergy is exposed to financial risks resulting from fluctuating interest rates and commodity prices, including prices for electricity, natural gas, coal and energy transmission. To manage the volatility relating to these exposures, FirstEnergy's Risk Policy Committee,... -

Page 126

... used for risk management purposes to hedge exposures when it makes economic sense to do so, including circumstances where the hedging relationship does not qualify for hedge accounting. Electricity forwards are used to balance expected sales with expected generation and purchased power. Natural gas... -

Page 127

... of derivative instruments on FirstEnergy's Consolidated Balance Sheets: Derivative Assets Fair Value December 31, 2013 Current Assets Derivatives Commodity Contracts FTRs $ 162 4 166 $ 153 7 160 Noncurrent Liabilities Adverse Power Contract Liability NUGs Deferred Charges and Other Assets - Other... -

Page 128

... Balance Sheet December 31, 2012 Derivative...Received)/Pledged Net Fair Value (In millions) The following table summarizes the volumes associated with FirstEnergy's outstanding derivative transactions as of December 31, 2013: Purchases Power Contracts FTRs NUGs Natural Gas 34 43 11 77 Sales... -

Page 129

... Statements of Income during 2013 and 2012 are summarized in the following tables: Year Ended December 31 Interest FTRs Rate Swaps (In millions) Commodity Contracts 2013 Unrealized Gain (Loss) Recognized in: Other Operating Expense Realized Gain (Loss) Reclassified to: Revenues Purchased Power... -

Page 130

...fourth quarter of 2013 representing refunds to customers associated with the excess purchase price received by MP above the net book value of MP's minority interest in the Pleasants Power Station. Generating Plant Retirements - 2013 On July 8, 2013, officers of FirstEnergy and AE Supply committed to... -

Page 131

... Facilities During 2011, FirstEnergy assessed the carrying values of certain peaking facilities that were to be sold or disposed of before the end of their useful lives. The estimated fair values were based on estimated sales prices quoted in an active market and indicated that the carrying costs... -

Page 132

...,000,000 32,000,000 Par Value 100 100 25 100 no par 100 25 no par no par no par 100 0.01 no par 3,000,000 5,000,000 $ no par 25 8,000,000 no par Preference Stock Shares Authorized Par Value As of December 31, 2013, and 2012, there were no preferred or preference... -

Page 133

... based upon changes in the credit ratings of FirstEnergy but will not decrease below the issued rates. The proceeds were used to repay short-term borrowings and to invest in the money pool for FES and AE Supply's use in funding a portion of their concurrent tender offers. On March 28, 2013... -

Page 134

...bonds were used to construct environmental control facilities. The special purpose limited liability companies own the irrevocable right to collect non-bypassable environmental control charges from all customers who receive electric delivery service in MP's and PE's West Virginia service territories... -

Page 135

... various mortgage indentures amounted to payments of $7 million in 2013, all of which relate to Penn. Penn expects to meet its 2013 annual sinking fund requirement with a replacement credit under its mortgage indenture. As of December 31, 2013, FirstEnergy's currently payable long-term debt included... -

Page 136

...On May 8, 2013, FE, FES, AE Supply and FE's other borrowing subsidiaries entered into extensions and amendments to the three existing multi-year syndicated revolving credit facilities. Each facility was extended until May 2018, unless the lenders agree, at the request of the applicable borrowers, to... -

Page 137

...the ability to borrow or accelerate payment of outstanding advances in the event of any change in credit ratings of the borrowers. Pricing is defined in "pricing grids," whereby the cost of funds borrowed under the Facilities is related to the credit ratings of the company borrowing the funds, other... -

Page 138

... (18) 71 (3) 1,015 FES During 2013, revisions to estimated cash flows as a result of increased cost estimates for the closure of LBR increased the associated ARO liability of FES by $163 million. The revised cost estimates were the result of a Closure Plan submitted to the PA DEP by FG on March 28... -

Page 139

... reliability and customer satisfaction requirements. PE has advised the MDPSC that compliance with the new rules is expected to increase costs by approximately $106 million over the period 2012-2015. On April 1, 2013, the Maryland electric utilities, including PE, filed their first annual reports on... -

Page 140

...customers" and ordered JCP&L to file a base rate case using a historical 2011 test year. The rate case petition was filed on November 30, 2012. In the filing, JCP&L requested approval to increase its revenues by approximately $31.5 million and reserved the right to update the filing to include costs... -

Page 141

... market-based price set through an auction process; and • Continuing Rider DCR that allows continued investment in the distribution system for the benefit of customers. As approved, the ESP 3 plan provides additional provisions, including: • Securing generation supply for a longer period of time... -

Page 142

... from bidding energy efficiency and demand response reserves into the PJM auction. The PUCO also confirmed that the Ohio Companies can recover PJM costs and applicable penalties associated with PJM auctions, including the costs of purchasing replacement capacity from PJM incremental auctions, to the... -

Page 143

... of energy efficiency and peak demand reduction programs. The PPUC found the energy efficiency programs to be cost effective and in an Order entered on August 3, 2012, the PPUC directed all of the electric utilities in Pennsylvania to submit by November 15, 2012, a Phase II EE&C Plan that... -

Page 144

... Pennsylvania Companies and FES on March 27, 2012. If implemented these rules could require a significant change in the ways FES and the Pennsylvania Companies do business in Pennsylvania, and could possibly have an adverse impact on their results of operations and financial condition. Pennsylvania... -

Page 145

... of the cost of high voltage transmission facilities on a beneficiary pays basis results in certain LSEs in PJM bearing the majority of the costs. FirstEnergy and a number of other utilities, industrial customers and state utility commissions supported the use of the beneficiary pays approach for... -

Page 146

... be predicted at this time. California Claims Matters In October 2006, several California governmental and utility parties presented AE Supply with a settlement proposal to resolve alleged overcharges for power sales by AE Supply to the California Energy Resource Scheduling division of the CDWR... -

Page 147

...and the construction of new substations in Hardy County, West Virginia and Frederick County, Maryland. PJM initially authorized construction of the PATH project in June 2007. On August 24, 2012, the PJM Board of Managers canceled the PATH project, which it had suspended in February 2011. As a result... -

Page 148

... and they operate as a financial replacement for physical firm transmission service. FTRs are financially-settled instruments that entitle the holder to a stream of revenues based on the hourly congestion price differences across a specific transmission path in the PJM Day-ahead Energy Market. FE... -

Page 149

... the sale and purchase of electric capacity, energy, fuel, and emission allowances. Certain bilateral agreements and derivative instruments contain provisions that require FE or its subsidiaries to post collateral. This collateral may be posted in the form of cash or credit support with thresholds... -

Page 150

...NOx reduction requirements under the CAA and SIP(s) by burning lower-sulfur fuel, utilizing combustion controls and postcombustion controls, generating more electricity from lower or non-emitting plants and/or using emission allowances. In July 2008, three complaints representing multiple plaintiffs... -

Page 151

...can require the installation of additional air emission control equipment when a major modification of an existing facility results in an increase in emissions. In September 2007, AE received an NOV from the EPA alleging NSR and PSD violations under the CAA, as well as Pennsylvania and West Virginia... -

Page 152

...future cost of compliance may be substantial and changes to FirstEnergy's and FES' operations may result. Hazardous Air Pollutant Emissions On December 21, 2011, the EPA finalized the MATS imposing emission limits for mercury, PM, and HCL for all existing and new coal-fired electric generating units... -

Page 153

...could require significant capital and other expenditures or result in changes to its operations. The CO2 emissions per KWH of electricity generated by FirstEnergy is lower than many of its regional competitors due to its diversified generation sources, which include low or non-CO2 emitting gas-fired... -

Page 154

.... On December 14, 2012, a modified Consent Decree that addresses public comments received by PA DEP was entered by the court, requiring FG to conduct monitoring studies and submit a closure plan to the PA DEP, no later than March 31, 2013, and discontinue disposal to LBR as currently permitted by... -

Page 155

...in support of the decommissioning of the spent fuel storage facilities located at its Davis-Besse and Perry nuclear facilities. As required by the NRC, FirstEnergy annually recalculates and adjusts the amount of its parental guaranty, as appropriate. On October 4, 2013, during a refueling outage for... -

Page 156

... and MP filed a complaint in the Court of Common Pleas of Allegheny County, Pennsylvania against ICG, Anker WV, and Anker Coal. Anker WV entered into a long term Coal Sales Agreement with AE Supply and MP for the supply of coal to the Harrison generating facility. Prior to the time of trial, ICG was... -

Page 157

... of the Utilities' POLR and default service requirements. The primary affiliated company transactions for FES during the three years ended December 31, 2013 are as follows: FES Revenues: Electric sales to affiliates Other Expenses: Purchased power from affiliates Fuel Support services Investment... -

Page 158

...Cash Flows for the years ended December 31, 2013, 2012, and 2011, for FES (parent and guarantor), FG and NG (non-guarantor) are presented below. Investments in wholly owned subsidiaries are accounted for by FES using the equity method. Results of operations for FG and NG are, therefore, reflected in... -

Page 159

...BENEFITS) INCOME FROM CONTINUING OPERATIONS Discontinued operations (net of income taxes of $8) NET INCOME STATEMENTS OF COMPREHENSIVE INCOME NET INCOME OTHER COMPREHENSIVE LOSS: Pensions and OPEB prior service costs Amortized gain on derivative hedges Change in unrealized gain on available-for-sale... -

Page 160

... INCOME TAXES INCOME TAXES (BENEFITS) INCOME FROM CONTINUING OPERATIONS Discontinued operations (net of income taxes of $8) NET INCOME STATEMENTS OF COMPREHENSIVE INCOME NET INCOME OTHER COMPREHENSIVE INCOME (LOSS): Pensions and OPEB prior service costs Amortized gain on derivative hedges Change in... -

Page 161

... OPERATIONS Discontinued operations (net of income taxes of $5) NET INCOME (LOSS) STATEMENTS OF COMPREHENSIVE INCOME (LOSS) NET INCOME (LOSS) OTHER COMPREHENSIVE INCOME (LOSS): Pensions and OPEB prior service costs Amortized loss on derivative hedges Change in unrealized gain on available-for-sale... -

Page 162

... CORP. CONDENSED CONSOLIDATING BALANCE SHEETS (Unaudited) As of December 31, 2013 ASSETS CURRENT ASSETS: Cash and cash equivalents ReceivablesCustomers Affiliated companies Other Notes receivable from affiliated companies Materials and supplies Derivatives Prepayments and other PROPERTY, PLANT... -

Page 163

... CORP. CONDENSED CONSOLIDATING BALANCE SHEETS (Unaudited) As of December 31, 2012 ASSETS CURRENT ASSETS: Cash and cash equivalents ReceivablesCustomers Affiliated companies Other Notes receivable from affiliated companies Materials and supplies Derivatives Prepayments and other PROPERTY, PLANT... -

Page 164

... INVESTING ACTIVITIES: Property additions Nuclear fuel Proceeds from asset sales Sales of investment securities held in trusts Purchases of investment securities held in trusts Loans to affiliated companies, net Other Net cash provided from (used for) investing activities Net change in cash and cash... -

Page 165

...: Property additions Nuclear fuel Proceeds from asset sales Sales of investment securities held in trusts Purchases of investment securities held in trusts Loans to affiliated companies, net Dividend received Other Net cash provided from (used for) investing activities Net change in cash and... -

Page 166

...FROM INVESTING ACTIVITIES: Property additions Nuclear fuel Proceeds from asset sales Sales of investment securities held in trusts Purchases of investment securities held in trusts Loans to affiliated companies, net Other Net cash used for investing activities Net change in cash and cash equivalents... -

Page 167

... distributes electricity through FirstEnergy's ten utility operating companies, serving approximately six million customers within 65,000 square miles of Ohio, Pennsylvania, West Virginia, Maryland, New Jersey and New York, and purchases power for its POLR, SOS, SSO and default service requirements... -

Page 168

Segment Financial Information Competitive Energy Services For the Years Ended December 31, Regulated Distribution Regulated Transmission Other/ Corporate Reconciling Adjustments Consolidated (In millions) 2013 External revenues Internal revenues Total revenues Depreciation, amortization and ... -

Page 169

... power stations in Pennsylvania, Virginia and West Virginia to subsidiaries of Harbor Hydro, a subsidiary of LS Power. The asset purchase agreement was entered into on August 23, 2013, and amended and restated as of September 4, 2013. On February 12, 2014, the sale of the hydroelectric power plants... -

Page 170

...purchase price over the estimated fair values of the assets acquired and liabilities assumed was recognized as goodwill. The Allegheny delivery, transmission and unregulated generation businesses have been assigned to the Regulated Distribution, Regulated Transmission and Competitive Energy Services... -

Page 171

... costs, which included change in control and other benefit payments to AE executives, of approximately $2 million ($1 million net of tax), $1 million ($1 million net of tax), $91 million ($73 million net of tax) during 2013, 2012 and 2011, respectively. These costs are included in "Other operating... -

Page 172

...pro forma financial information reflects the consolidated results of operations of FirstEnergy as if the merger with AE had taken place on January 1, 2010. The unaudited pro forma information was calculated after applying FirstEnergy's accounting policies and adjusting Allegheny's results to reflect... -

Page 173

... OF QUARTERLY FINANCIAL DATA (UNAUDITED) The following summarizes certain consolidated operating results by quarter for 2013 and 2012. FirstEnergy CONSOLIDATED STATEMENTS OF INCOME (In millions, except per share amounts) Revenues Other operating expense Pensions and OPEB mark-to-market Provision for... -

Page 174

..., FirstEnergy Utilities (A) Senior Vice President, Energy Delivery & Customer Service (B) Senior Vice President (C)(D) President (E) President, FE Generation (B)(G) President (H)(K) Chief Nuclear Officer (F) President and Chief Nuclear Officer (F) President, FirstEnergy Nuclear Operating Company... -

Page 175

... company's Stock Investment Plan, visit AST's website at www.amstock.com/company/firstenergy.asp or contact AST toll-free at 1-800-736-3402. DIRECT DIVIDEND DEPOSIT Shareholders can have their dividend payments automatically deposited to checking, savings or credit union accounts at any financial... -

Page 176

presorted std u.s. postage Paid aKroN, oh permit No. 561 76 South Main Street, Akron, Ohio 44308-1890