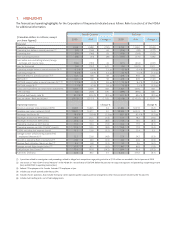

Air Canada 2009 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2009 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2009 Management’s Discussion and Analysis

7

2. INTRODUCTION

In this Management’s Discussion and Analysis of Results of Operations and Financial Condition (“MD&A”), the “Corporation”

refers to, as the context may require, Air Canada and/or one or more of Air Canada’s subsidiaries.

Air Canada’s 2009 MD&A provides the reader with a view and analysis, from the perspective of management, of Air Canada’s

fi nancial results for the fourth quarter of 2009 and for the full year 2009. This MD&A should be read in conjunction with

Air Canada’s audited consolidated fi nancial statements and notes for 2009. All fi nancial information has been prepared in

accordance with Generally Accepted Accounting Principles in Canada (“GAAP”), unless indicated otherwise.

Except as otherwise noted, all monetary amounts are stated in Canadian dollars. For an explanation of certain terms used in

this MD&A, refer to section 22 “Glossary”. Except as otherwise noted, this MD&A is current as of February 9, 2010.

Forward-looking statements are included in this MD&A. See “Caution Regarding Forward-Looking Information” below for

a discussion of risks, uncertainties and assumptions relating to these statements. For a description of the risks relating to

Air Canada, see section 19 “Risk Factors” of this MD&A.

The Corporation issued a news release dated February 10, 2010 reporting on its results for the fourth quarter of 2009 and

for the full year 2009. This news release is available on SEDAR at sedar.com and at aircanada.com.

For further information on Air Canada’s public disclosure fi le, including Air Canada’s Annual Information Form, consult

SEDAR at sedar.com or Air Canada’s website at aircanada.com.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

Air Canada’s public communications may include written or oral forward-looking statements within the meaning of

applicable securities laws. Such statements are included in this MD&A and may be included in other communications,

including fi lings with regulatory authorities and securities regulators. Forward-looking statements relate to analyses and

other information that are based on forecasts of future results and estimates of amounts not yet determinable. These

statements may involve, but are not limited to, comments relating to strategies, expectations, planned operations or

future actions. Forward-looking statements are identifi ed by the use of terms and phrases such as “anticipate”, “believe”,

“could”, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”, “project”, “will”, “would”, and similar terms and phrases,

including references to assumptions.

Forward-looking statements, by their nature, are based on assumptions, including those described herein and are subject

to important risks and uncertainties. Forward-looking statements cannot be relied upon due to, amongst other things,

changing external events and general uncertainties of the business. Actual results may differ materially from results

indicated in forward-looking statements due to a number of factors, including without limitation, industry, market,

credit and economic conditions, the ability to reduce operating costs and secure fi nancing, pension issues, energy prices,

currency exchange and interest rates, employee and labour relations, competition, war, terrorist acts, epidemic diseases,

insurance issues and costs, changes in demand due to the seasonal nature of the business, supply issues, changes in laws,

regulatory developments or proceedings, pending and future litigation and actions by third parties as well as the factors

identifi ed throughout this MD&A and, in particular, those identifi ed in section 19 “Risk Factors” of this MD&A. The

forward-looking statements contained in this MD&A represent Air Canada’s expectations as of the date of this MD&A

and are subject to change after such date. However, Air Canada disclaims any intention or obligation to update or revise

any forward-looking statements whether as a result of new information, future events or otherwise, except as required

under applicable securities regulations.

Assumptions were made by Air Canada in preparing and making forward-looking statements. Air Canada assumes that

the North American economy will start to slowly recover in 2010. In addition, Air Canada expects that the Canadian

dollar will trade, on average, at C$1.06 per U.S. dollar in the fi rst quarter of 2010 and C$1.04 per U.S. dollar for the full

year 2010 and that the price of fuel will average 69 cents per litre in the fi rst quarter of 2010 and for the full year 2010

(both net of fuel hedging positions).