Air Canada 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 Air Canada Annual Report

20

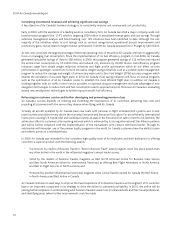

• Fuel hedging losses of $85 million in the fourth quarter of 2009 versus fuel hedging losses of $111 million in the

fourth quarter of 2008, a favourable variance of $26 million compared to the fourth quarter of 2008.

The table below provides Air Canada’s fuel cost per litre, excluding and including hedging, for the periods indicated.

(Canadian dollars in millions, except

where indicated)

Fourth Quarter Change

2009 2008 $ %

Aircraft fuel expense - GAAP (1) $ 599 $ 788 $ (189) (24)

Add: Fuel hedging gains (losses) included in aircraft

fuel expense (85) (111) 26 23

Add: Net cash settlements on maturing fuel

derivatives (designated under hedge accounting

and economic hedges) (2) 12 91 (79) (87)

Economic cost of fuel - Non-GAAP (3) $ 526 $ 768 $ (242) (32)

Fuel consumption (thousands of litres) 824,911 822,011 2,900 -

Fuel costs per litre (cents) - GAAP 72.6 95.8 (23.2) (24)

Fuel costs per litre (cents) - excluding fuel hedges 62.3 82.2 (19.9) (24)

Economic fuel costs per litre (cents) - Non-GAAP 63.7 93.2 (29.5) (32)

(1) Fuel expense excludes fuel related to third party carriers, other than Jazz, operating under capacity purchase agreement.

(2) Excluding early terminated hedging contracts in the fourth quarter of 2009 for $20 million covering 2010 fuel consumption.

(3) The economic cost of fuel is a non-GAAP measure used by Air Canada and may not be comparable to measures presented by other public companies. Air Canada uses

this measure to calculate Air Canada’s cash cost of fuel. It includes the actual net cash settlements from maturing fuel derivative contracts during the period. It excludes

non-cash accounting gains and losses from fuel derivative instruments.

Wages, salaries and benefi ts expense amounted to $418 million in the fourth quarter of 2009, a decrease of

$26 million or 6% from the fourth quarter of 2008

Wages and salaries expense totaled $362 million in the fourth quarter of 2009, a decrease of $7 million or 2% from the

fourth quarter of 2008. The decrease in wages and salaries was mainly due to a reduction of an average of 1,131 full-time

equivalent (“FTE”) employees or 4.8% versus the same period in 2008. Partly offsetting this decrease was an increase in

average wages for 0.8% compared to the fourth quarter of 2008. In addition, in the fourth quarter of 2009, Air Canada

recorded expenses of $5 million related to a non-unionized staff reduction program. No such expenses were recorded in

the same period in 2008.

Employee benefi ts expense amounted to $56 million in the fourth quarter of 2009, a decrease of $19 million or 29% from

the fourth quarter of 2008. The decrease was mainly due to reduced pension and post-employment benefi ts expenses

as a result of revised actuarial assumptions. The actuarial assumptions used for recording pension expense under GAAP

differ from those used in determining the solvency defi cit. Refer to section 10.6 of this MD&A for a discussion related to

Air Canada’s pension funding obligations.

Capacity purchase costs with Jazz decreased 4% from the fourth quarter of 2008

Capacity purchase costs with Jazz, pursuant to the Jazz CPA, amounted to $227 million in the fourth quarter of 2009

compared to $237 million in the fourth quarter of 2008, a decrease of $10 million or 4%. This year-over-year decrease in

capacity purchase costs was mainly due to the impact of reduced fl ying which accounted for a decrease of $8 million, the

favourable impact of foreign exchange on U.S. denominated Jazz CPA charges paid by Air Canada, which accounted for a

decrease of $6 million, and the impact of the reduction to the mark-up on Jazz CPA rates pursuant to an amendment to

the Jazz CPA effective August 1, 2009, which accounted for a decrease of $8 million. Partly offsetting these decreases was

a year-over-year increase in Jazz CPA rates of $12 million, of which $8 million was related to additional maintenance costs

due to the aging of Jazz’s fl eet.