Air Canada 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2009

Table of contents

-

Page 1

ANNUAL REPORT 2009 -

Page 2

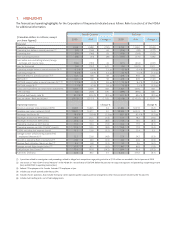

...special provision % (1) (2) EBITDAR margin % (2) Cash, cash equivalents and short-term investments Free cash ï¬,ow Adjusted debt/equity ratio % Loss per share - Basic and diluted Operating Statistics Revenue passenger miles (millions) (RPM) Available seat miles (millions) (ASM) Passenger load factor... -

Page 3

....6 Pension Funding Obligations ...10.7 Share Information ...11. Quarterly Financial Data ...12. Selected Annual Information ...13. Financial Instruments and Risk Management ...14. Off-Balance Sheet Arrangements ...15. Related Party Transactions ...16. Critical Accounting Estimates ...17. Accounting... -

Page 4

... drop in all-important premium customer revenue. At the same time, unit costs excluding fuel rose 3.3 per cent due mainly to the effects of a weaker Canadian dollar, increased maintenance costs and a capacity reduction that resulted in fewer available seat miles over which to allocate costs. However... -

Page 5

... our cash position amid very difficult capital markets. Air Canada raised $1.3 billion in new liquidity - including approximately $260 million in equity through a public share offering - to end 2009 with $1.4 billion in cash, cash equivalents and short term investments. At the beginning of 2010, we... -

Page 6

... new technologies for added customer convenience and a greater emphasis on service. The awards from Business Traveler and Global Traveler are evidence we are making significant headway in this area. Finally, Air Canada is committed to changing its corporate culture by instilling in employees a more... -

Page 7

... relating to these statements. For a description of the risks relating to Air Canada, see section 19 "Risk Factors" of this MD&A. The Corporation issued a news release dated February 10, 2010 reporting on its results for the fourth quarter of 2009 and for the full year 2009. This news release... -

Page 8

...and on international cargo services on routes between Canada and major markets in Europe, Asia, South America and Australia. Air Canada Vacations is one of Canada's leading tour operators. Based in Montreal and Toronto, Air Canada Vacations operates its business in the outbound leisure travel market... -

Page 9

... route rights, its newly refurbished ï¬,eet - one of the youngest in North America, its world-class global hub at Toronto, and strong international gateways at Montreal and Vancouver. Air Canada believes it is well positioned to grow its share of trafï¬c between Canada, and Europe and Asia. Air... -

Page 10

... In 2010, Air Canada's fuel saving initiatives will focus on several programs such as the optimization of all Air Canada's routes to establish the most efï¬cient ï¬,ight plan. In addition, Air Canada is working together with air trafï¬c control service providers to optimize airspace management and... -

Page 11

..., the use of new technologies such as the Air Canada iPhone App, which won the "Best Mobile Application" at the Canadian New Media Awards in 2009, the Blackberry App, as well as the self-service rebooking tool allow the airline to communicate more effectively with customers in times of disrupted... -

Page 12

... aircraft maintenance expense, increased Jazz CPA expense, higher unit costs of ownership, and the impact of the capacity reduction. The 3.3% increase in CASM (excluding fuel expense) for 2009 was in line with 3.0% to 3.5% CASM (excluding fuel expense) increase projected in Air Canada's news release... -

Page 13

... service contributions permitted under the Income Tax Act. Pursuant to the Pension MOUs, on October 26, 2009, the Corporation issued, to a trust, 17,647,059 Class B voting shares. This number of shares represented 15% of the shares of Air Canada issued and outstanding as at the date of the Pension... -

Page 14

2009 Air Canada Annual Report • The sale and leaseback of three Boeing 777 aircraft. The sale and leaseback transactions were substantially completed in November 2009 and provided initial cash proceeds of $95 million (net of deposits). Additional net cash proceeds of $20 million were received in ... -

Page 15

... 2009 2008 Change $ % (Canadian dollars in millions, except per share ï¬gures) Operating revenues Passenger Cargo Other Operating expenses Aircraft fuel Wages, salaries and beneï¬ts Airport and navigation fees Capacity purchase with Jazz Depreciation and amortization Aircraft maintenance Food... -

Page 16

... in line with the 1.0% to 2.0% ASM capacity increase projected in Air Canada's news release dated November 6, 2009. A system yield decline of 7.3% from the fourth quarter of 2008, which was due to a weak economy, greater fare discounting in an effort to stimulate trafï¬c and reduced fuel surcharges... -

Page 17

... on a capacity reduction of 1.8%, which resulted in a passenger load factor decline of 2.5 percentage points from the fourth quarter of 2008. Air Canada's Toronto - Austin and Vancouver - Sacramento routes were suspended in the second half of 2009 while these routes operated in the fourth quarter of... -

Page 18

2009 Air Canada Annual Report Paciï¬c with the re-introduction of the Toronto - Narita non-stop service with a Boeing 777 aircraft and additional frequencies from Vancouver to China. • A yield decline of 13.4% from the fourth quarter of 2008, which reï¬,ected the continued weak economic ... -

Page 19

... per ASM) Wages and salaries Beneï¬ts Ownership (DAR) (1) Airport user fees Capacity purchase with Jazz Aircraft maintenance Food, beverages and supplies Communications and information technology Commissions Other Operating expense, excluding fuel expense (2) Aircraft fuel Total operating expense... -

Page 20

... excludes fuel related to third party carriers, other than Jazz, operating under capacity purchase agreement. Excluding early terminated hedging contracts in the fourth quarter of 2009 for $20 million covering 2010 fuel consumption. The economic cost of fuel is a non-GAAP measure used by Air Canada... -

Page 21

... the timing and scope of airframe events related to the ï¬,eets of Airbus A319, A320 and Boeing 767-300 aircraft. In particular, scheduled heavy maintenance was required on the Airbus A319 aircraft which were delivered in the mid-1990s. The impact of cost reduction initiatives resulted in savings of... -

Page 22

...: Fourth Quarter 2009 2008 $ 47 45 45 35 33 29 92 $ 326 $ $ 49 44 45 35 30 30 115 348 $ $ Change $ (2) 1 3 (1) (23) (22) (Canadian dollars in millions) Air Canada Vacations' land costs Credit card fees Terminal handling Building rent and maintenance Miscellaneous fees and services Crew expenses... -

Page 23

... share ï¬gures) Operating revenues Passenger Cargo Other Operating expenses Aircraft fuel Wages, salaries and beneï¬ts Airport and navigation fees Capacity purchase with Jazz Depreciation and amortization Aircraft maintenance Food, beverages and supplies Communications and information technology... -

Page 24

...capacity reduction projected in Air Canada's news release dated November 6, 2009. A system yield decrease of 7.6% from 2008, which was due to a weak economy, reduced high-yield business travel and increased competitive pricing activities. A reduction in fuel surcharges was also a factor in the yield... -

Page 25

... were reï¬,ected on all major U.S. transborder services with the exception of U.S. short-haul business routes between Eastern Canada and Northeastern U.S. A weaker Canadian dollar in 2009 versus the fourth quarter of 2008, which had a positive impact on foreign currency denominated revenue of $60... -

Page 26

... decrease as pricing actions were taken to offer additional discounted Executive First fares and products in an effort to stimulate premium trafï¬c. Yield declines were reï¬,ected on all major Atlantic services. A weaker Canadian dollar in 2009 versus 2008, which had a positive impact on foreign... -

Page 27

...ï¬cant yield decrease as pricing actions were taken to offer additional discounted Executive First fares in an effort to stimulate trafï¬c. Yield decreases were reï¬,ected on all major Paciï¬c services. A weaker Canadian dollar in 2009 versus 2008, which had a positive impact on foreign currency... -

Page 28

...in third party revenues at Air Canada Vacations, mainly the result of higher passenger volumes, and an increase of $11 million in aircraft sublease revenues. Various factors, including a decrease in revenues from Aeroplan for services related to information technology, amounting to a net decrease of... -

Page 29

... per ASM) Wages and salaries Beneï¬ts Ownership (DAR) (1) Airport user fees Capacity purchase with Jazz Aircraft maintenance Food, beverages and supplies Communications and information technology Commissions Other Operating expense, excluding fuel expense (2) Aircraft fuel Total operating expense... -

Page 30

... of 1,286 full-time equivalent ("FTE") employees or 5.3%, which was mainly the result of the 4.4% ASM capacity reduction. In 2009, Air Canada recorded expenses of $25 million related to the "Sharing our Success" employee proï¬t sharing program versus expenses of $29 million in 2008. • The above... -

Page 31

... to the timing and scope of airframe events related to the ï¬,eets of Airbus A319, A320 and Boeing 767-300 aircraft. In particular, scheduled heavy overhaul maintenance was required on the Airbus A319 aircraft which were delivered in the mid-1990s. The impact of a weaker Canadian dollar versus the... -

Page 32

... dollars in millions) Air Canada Vacations' land costs Terminal handling Credit card fees Building rent and maintenance Crew expenses (meals, transportation and hotels) Miscellaneous fees and services Remaining other expenses $ $ Change 2008 $ 223 180 197 137 117 112 484 $ 1,450 $ $ 2009 250... -

Page 33

... such as web and fare technology but has suspended activity relating to the implementation of the reservation system. In addition, Air Canada recorded a loss on assets of $24 million pertaining to the sale and leaseback of three Boeing 777 aircraft. In 2008, Air Canada recorded an impairment charge... -

Page 34

... aircraft product in the international market to and from Canada, Air Canada progressively introduced 18 Boeing 777 aircraft into its ï¬,eet starting in 2007. During 2009, the Corporation took delivery of its last two planned Boeing 777 aircraft, one of which was leased under an operating lease... -

Page 35

2009 Management's Discussion and Analysis The following table provides the existing and planned ï¬,eet changes to Air Canada's operating ï¬,eet (excluding aircraft operated by Jazz under the Jazz CPA): Actual Planned 2010 Fleet Changes December 31, 2008 December 31, 2009 December 31, 2010 Fleet... -

Page 36

... MANAGEMENT 10.1 FINANCIAL POSITION The following table provides a condensed statement of ï¬nancial position of Air Canada as at December 31, 2009 and as at December 31, 2008. (Canadian dollars in millions) Assets Cash, cash equivalents and short-term investments Other current assets Current assets... -

Page 37

... Air Canada's adjusted net debt balances and net debt to net debt plus equity ratio as at December 31, 2009 and as at December 31, 2008. (Canadian dollars in millions) Total long-term debt and capital leases Current portion of long-term debt and capital leases Total long-term debt and capital leases... -

Page 38

...and short-term investments Accounts receivable Collateral deposits for fuel derivatives Other current assets Accounts payable and accrued liabilities Fuel derivatives in current liabilities Advance ticket sales Current portion of long-term debt and capital leases December 31, 2009 December 31, 2008... -

Page 39

... from sale of assets Proceeds from sale and leaseback transactions Funding of Aveos letter of credit Short-term investments Other Cash ï¬,ows from investing activities (excluding additions to capital assets) Borrowings Issue of common shares & warrants Reduction of long-term debt and capital lease... -

Page 40

2009 Air Canada Annual Report 10.4 CAPITAL EXPENDITURES AND RELATED FINANCING ARRANGEMENTS Air Canada has 37 ï¬rm orders for Boeing 787 aircraft with The Boeing Company ("Boeing"). Air Canada also holds purchase options for 13 Boeing 787 aircraft and purchase rights for 10 Boeing 787 aircraft and ... -

Page 41

... purchases relating to system development costs, facilities and leasehold improvements. Total contractual obligations exclude commitments for goods and services required in the ordinary course of business. Also excluded are other long-term liabilities mainly due to reasons of uncertainty of timing... -

Page 42

...of the Air Canada 2009 Pension Regulations, as outlined above, employer pension funding contributions amounted to $389 million in 2009. (Canadian dollars in millions) Past service cost for registered pension plans Current service cost for registered pension plans Other pension arrangements (1) Total... -

Page 43

... 2010 and for the next three years. Actual funding obligations are dependant on a number of factors, including the Air Canada 2009 Pension Regulations described above for past service, the assumptions used in the last ï¬led actuarial valuation reports for current service (including a discount rate... -

Page 44

...2009, Air Canada issued to a trust, 17,647,059 Class B voting shares. This number of shares represented 15% of the shares of Air Canada issued and outstanding as at the date of the Pension MOUs and the date of issuance (in both cases after taking into account such issuance). All net proceeds of sale... -

Page 45

2009 Management's Discussion and Analysis 11. QUARTERLY FINANCIAL DATA The following table summarizes quarterly ï¬nancial results and major operating statistics for Air Canada for the last eight quarters. (Canadian dollars in millions, except per share ï¬gures) Operating revenues Aircraft fuel ... -

Page 46

... (loss) EBITDAR EBITDAR excluding the provision for cargo investigations Earning (loss) per share - Basic - Diluted Cash, cash equivalents and short-term investments Total assets Total long-term liabilities (1) Total liabilities Shareholders' equity $ $ $ $ 2009 9,739 10,055 (316) (316) 292 (24... -

Page 47

... ($47 million in 2008) related to cash and cash equivalents, short-term investments, and collateral deposits for fuel derivatives, which are classiï¬ed as held for trading. Interest expense reï¬,ected on Air Canada's consolidated statement of operations relates to ï¬nancial liabilities recorded... -

Page 48

..., U.S. dollar net cash ï¬,ows, as well as the amount attributed to aircraft and debt payments. The following are the current derivatives employed in foreign exchange risk management activities and the adjustments recorded in 2009: As at December 31, 2009, the Corporation had outstanding foreign... -

Page 49

2009 Management's Discussion and Analysis In 2009, fuel derivative contracts cash settled with a fair value of $88 million in favour of the counterparties ($129 million in favour of the Corporation in 2008). After considering the costs and beneï¬ts speciï¬c to the application of cash ï¬,ow hedge ... -

Page 50

2009 Air Canada Annual Report (Canadian dollars in millions) Consolidated Statement of Financial Position Current assets Current liabilities(1) December 31, 2009 December 31, 2008 Collateral deposits for fuel derivatives Fair market value of fuel derivatives designated under hedge accounting Fair ... -

Page 51

... 31, 2009, the Corporation's credit risk exposure consists mainly of the carrying amounts of cash and cash equivalents, short-term investments and accounts receivable as well as collateral deposits for fuel derivatives extended to counterparties. Cash, cash equivalents and short-term investments are... -

Page 52

...and other assets. The carrying value as at December 31, 2009 is based on a number of assumptions as to the fair value of the investments including factors such as estimated cash ï¬,ow scenarios and risk adjusted discount rates. The assumptions used in estimating the fair value of the investments are... -

Page 53

... participating in a Fuel Facility Corporation shares pro-rata, based on system usage, in the guarantee of this debt. Indemniï¬cation agreements Air Canada enters into real estate leases or operating agreements, which grant a license to Air Canada to use certain premises, in substantially all cities... -

Page 54

...to Aveos or the ACTS Beneï¬t Arrangements, as applicable. Amounts with a present value equal to the solvency deï¬ciency in the deï¬ned beneï¬t pension plans as at October 16, 2007 related to transferring non-unionized employees will be paid by Air Canada through quarterly payments to Aveos until... -

Page 55

... which Air Canada previously held interests), or to carry on a business activity, related to the following commercial maintenance, repair and overhaul services in the airline industry, namely, airframe heavy maintenance and paint services, engine and auxiliary power unit ("APU") overhaul maintenance... -

Page 56

... and Air Canada are parties to a general terms and related services agreements effective October 1, 2006, pursuant to which Aveos provides technical services to the Corporation including engine and auxiliary power unit maintenance services, aircraft heavy maintenance services (excluding line and... -

Page 57

2009 Management's Discussion and Analysis Aveos Restructuring Plan On January 26, 2010, Aveos reached an agreement with its lenders and equity holders on the terms of a consensual restructuring plan to recapitalize the company. As part of this recapitalization, Air Canada and Aveos entered into a ... -

Page 58

2009 Air Canada Annual Report The related party balances resulting from the payment obligations in respect of the application of the related party agreements were as follows: (Canadian dollars in millions) Accounts receivable ACE Aveos Prepaid Maintenance Aveos Accounts payable and accrued ... -

Page 59

...cargo revenues Airline passenger and cargo advance sales are deferred and included in current liabilities. Advance sales also include the proceeds from the sale of ï¬,ight tickets to Aeroplan, a corporation that provides loyalty program services to the Corporation and purchases seats from Air Canada... -

Page 60

2009 Air Canada Annual Report Management makes a number of assumptions in the calculation of both the accrued beneï¬t obligation as well as the pension costs: December 31, 2009 Weighted average assumptions used to determine the accrued beneï¬t liability Discount rate Rate of compensation increase ... -

Page 61

2009 Management's Discussion and Analysis Domestic registered plans For the domestic registered plans, the investments conform to the Statement of Investment Policy and Objectives of the Air Canada Pension Master Trust Fund ("Fund") as amended during 2008. The investment return objective of the Fund... -

Page 62

... no compulsion to act". Assessing the fair value of intangible assets requires signiï¬cant management estimates on discount rates to be applied in the analysis and future cash ï¬,ows to be generated by the assets, including the estimated useful life of the assets. Discount rates are determined with... -

Page 63

2009 Management's Discussion and Analysis Intangible assets The identiï¬able intangible assets of the Corporation were recorded at their estimated fair values at September 30, 2004 upon emergence from CCAA. Since that time, the intangible assets have been reduced by a tax allocation of $914 million... -

Page 64

2009 Air Canada Annual Report 17. ACCOUNTING POLICIES 17.1 CHANGES IN ACCOUNTING POLICIES Stock-based compensation plans The Corporation changed its accounting policy for awards of stock-based compensation granted to Corporation employees with a graded vesting schedule. Prior to January 1, 2009, ... -

Page 65

... Current accounting policy Airline passenger and cargo advance sales are deferred and included in current liabilities. Advance sales also include the proceeds from the sale of ï¬,ight tickets to Aeroplan, a corporation that provides loyalty program services to Air Canada and purchases seats from Air... -

Page 66

... on service, market interest rates, and management's best estimate of expected plan investment performance, salary escalation, retirement ages of employees and health care costs. A market-related valuation method is used to value plan assets for the purpose of calculating the expected return on plan... -

Page 67

...and all past service cost is recognised immediately. The Corporation will adopt this revised accounting policy on transition to IFRS for other long-term employee beneï¬ts. Income taxes Current accounting policy The Corporation utilizes the assets and liability method of accounting for income taxes... -

Page 68

2009 Air Canada Annual Report Impairment of long-lived assets Current accounting policy Long-lived assets are tested for impairment whenever circumstances indicate that the carrying value may not be recoverable. When events or circumstances indicate that the carrying amount of long-lived assets, ... -

Page 69

... Corporation has developed internal indicators to assist in lease classiï¬cation under IFRS. Intangible assets Current accounting policy Intangible assets are initially recorded at cost. Indeï¬nite life assets are not amortized while assets with ï¬nite lives are amortized on a straight-line basis... -

Page 70

2009 Air Canada Annual Report Summary of the IFRS changeover plan The plan addresses the impact of IFRS on Accounting policies and implementation decisions, Infrastructure, Business activities and Control activities. A summary status of the key elements of the changeover plan is as follows: Key ... -

Page 71

...08) $ 23 (1) Excludes the impact of fuel surcharges and fuel hedging. Refer to section 13 of this MD&A for information on Air Canada's fuel derivative instruments. Key Variable Currency Exchange Cdn$ to US$ 2009 Measure Sensitivity Factor Favourable / (Unfavourable) Estimated Pre-Tax Income... -

Page 72

... beyond Air Canada's control. Need for Additional Capital and Liquidity Air Canada faces a number of challenges in its business, including in relation to economic conditions, pension plan funding, volatile fuel prices, contractual covenants which could require Air Canada to deposit cash collateral... -

Page 73

... the total operating costs of Air Canada in 2009. Fuel prices ï¬,uctuate widely depending on many factors including international market conditions, geopolitical events and the Canada/U.S. dollar exchange rate. Air Canada cannot accurately predict fuel prices. During 2006, 2007 and 2008, fuel prices... -

Page 74

... opposite change in the exchange rate would have had the opposite effect. Air Canada incurs signiï¬cant expenses in U.S. dollars for such items as fuel, aircraft rental and maintenance charges, interest payments, debt servicing and computerized reservations system fees, while a substantial portion... -

Page 75

... and, in many cases, increase these payments. The decision to modify Air Canada's current programs in order to remain competitive and maintain passenger trafï¬c could result in increased costs to Air Canada's business. In addition, consolidation in the airline industry could result in increased... -

Page 76

...authorities or otherwise required for Air Canada's operations such as fuel, aircraft and related parts and aircraft maintenance services (including maintenance services obtained from Aveos). In certain cases, Air Canada may only be able to access goods and services from a limited number of suppliers... -

Page 77

... and commercial arrangements with Star Alliance® members provide Air Canada with important beneï¬ts, including codesharing, efï¬cient connections and transfers, reciprocal participation in frequent ï¬,yer programs and use of airport lounges from the other members. Should a key member leave... -

Page 78

2009 Air Canada Annual Report Superior Court of Justice proceedings, Jazz commenced judicial review proceedings against the Toronto Port Authority ("TPA") before the Federal Court of Canada relating to Jazz's access to the TCCA. The Porter Defendants were granted intervener and party status in these... -

Page 79

... the World Health Organization (the "WHO"), including a travel advisory against non-essential travel to Toronto, Canada, had a signiï¬cant adverse effect on passenger demand for air travel in Air Canada's markets and resulted in a major negative impact on trafï¬c on the entire network. Air Canada... -

Page 80

... removing itself as a key component of any global plan. Risks related to the Corporation's relationship with ACE Control of Air Canada and Related Party Relationship As at September 30, 2009, ACE owned Class B voting shares representing 75% of the shares issued and outstanding. This voting control... -

Page 81

... and Risk Committee reviewed this MD&A, and the audited consolidated ï¬nancial statements, and the Corporation's Board of Directors approved these documents prior to their release. Management's report on disclosure controls and procedures Management, with the participation of the Corporation's CEO... -

Page 82

2009 Air Canada Annual Report 21. NON-GAAP FINANCIAL MEASURES EBITDAR EBITDAR (earnings before interest, taxes, depreciation and amortization, and aircraft rent) is a non-GAAP ï¬nancial measure commonly used in the airline industry to view operating results before depreciation and amortization, ... -

Page 83

... in the way airlines ï¬nance their aircraft and other assets. Refer to section 21 of this MD&A for additional information. Passenger Load Factor - A measure of passenger capacity utilization derived by expressing Revenue Passenger Miles as a percentage of Available Seat Miles. Passenger Revenue per... -

Page 84

... Board of Directors approves the Corporation's consolidated ï¬nancial statements, management's discussion and analysis and annual report disclosures prior to their release. The Audit, Finance and Risk Committee meets with management, the internal auditors and external auditors at least four times... -

Page 85

AUDITORS' REPORT TO THE SHAREHOLDERS OF AIR CANADA We have audited the consolidated statements of ï¬nancial position of Air Canada as at December 31, 2009 and December 31, 2008 and the consolidated statements of operations, changes in shareholders' equity, comprehensive income (loss) and cash ï¬,... -

Page 86

2009 Air Canada Annual Report CONSOLIDATED STATEMENT OF OPERATIONS For the year ended December 31 (Canadian dollars in millions except per share ï¬gures) Operating revenues Passenger Cargo Other 2009 2008 $ 8,499 358 882 9,739 $ 9,713 515 854 11,082 Operating expenses Aircraft fuel Wages, ... -

Page 87

Consolidated Financial Statements and Notes CONSOLIDATED STATEMENT OF FINANCIAL POSITION As at December 31 (Canadian dollars in millions) ASSETS Current Cash and cash equivalents Short-term investments 2009 2008 Note 2O Note 2P $ 1,115 292 1,407 78 701 63 64 43 295 2,651 6,369 916 470 10,406 ... -

Page 88

2009 Air Canada Annual Report CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY For the year ended December 31 (Canadian dollars in millions) Share Capital Common shares, beginning of year Shares issued under the pension MOUs Shares issued under the public offering Total share capital ... -

Page 89

...Shares issued under the public offering Warrants issued under the public offering and credit facility Reduction of long-term debt and capital lease obligations Other Note 6 Note 11 Notes 6 & 11 926 230 26 (1,237) (55) 871 (992) 5 (116) Investing Short-term investments Additions to capital assets... -

Page 90

... international cargo services on routes between Canada and major markets in Europe, Asia, South America and Australia using cargo capacity on Boeing 777 and other wide body aircraft operated by Air Canada. Air Canada Ground Handling Services provided passenger handling services to Air Canada, Jazz... -

Page 91

... service contributions permitted under the Income Tax Act. Pursuant to the Pension MOUs, on October 26, 2009 the Corporation issued, to a trust, 17,647,059 Class B Voting Shares. This number of shares represented 15% of the shares of Air Canada issued and outstanding as at the date of the Pension... -

Page 92

2009 Air Canada Annual Report • A memorandum of understanding with GE Capital Aviation Services (the "GECAS MOU") for the sale and leaseback of three Boeing 777 aircraft. The sale and leaseback transactions were substantially completed in early November 2009 and provided initial net cash proceeds ... -

Page 93

... value. C) PASSENGER AND CARGO REVENUES Airline passenger and cargo advance sales are deferred and included in Current liabilities. Advance sales also include the proceeds from the sale of ï¬,ight tickets to Aeroplan, a corporation that provides loyalty program services to Air Canada and purchases... -

Page 94

... on service, market interest rates, and management's best estimate of expected plan investment performance, salary escalation, retirement ages of employees and health care costs. A market-related valuation method is used to value plan assets for the purpose of calculating the expected return on plan... -

Page 95

... in management's estimate of the number of PSUs that are expected to vest. For grants of PSUs that are accounted for as cash settled instruments, the Corporation recognizes Compensation expense offset by Other long-term liabilities equal to the market value of an Air Canada common share at the date... -

Page 96

... related to building rent and maintenance, terminal handling, professional fees and services, crew meals and hotels, advertising and promotion, insurance costs, credit card fees, ground costs for Air Canada Vacations packages, and other expenses. Expenses are recognized as incurred. L) FINANCIAL... -

Page 97

.... Restricted cash is classiï¬ed as held-for-trading. Aircraft related and other deposits are classiï¬ed as held-to-maturity investments and are measured at amortized cost using the effective interest rate method. Interest income is recorded in net income, as applicable. Accounts receivable are... -

Page 98

... on Short-term investments as at December 31, 2009 is 0.53% (2008 - 2.90%). Q) RESTRICTED CASH The Corporation has recorded $78 (2008 - $45) in Restricted cash, under Current assets, representing funds held in trust by Air Canada Vacations in accordance with regulatory requirements governing advance... -

Page 99

... to nil over their estimated useful lives. Estimated Useful Life International route rights and slots Air Canada trade name Other marketing based trade names Star Alliance membership Other contract and customer based intangible assets Technology based intangible assets Indeï¬nite Indeï¬nite Inde... -

Page 100

... for fuel services at various major Canadian airports. The Fuel Facility Corporations are organizations incorporated under federal or provincial business corporations acts in order to acquire, ï¬nance and lease assets used in connection with the fuelling of aircraft and ground support equipment... -

Page 101

... equivalent to International Financial Reporting Standard IFRS 3 - Business Combinations. The section applies prospectively to business combinations for which the acquisition date is on or after the beginning of the ï¬rst annual reporting period beginning on or after January 1, 2011. Sections 1601... -

Page 102

... support from the Export-Import Bank of the United States ("EXIM"). The Corporation entered into a sale-leaseback transaction which closed during Quarter 1 2009 for a Boeing 777 aircraft, which was originally delivered in 2007 and debt ï¬nanced. The proceeds from the transaction of $172 were used... -

Page 103

... and a loss on sale of the aircraft of $24. The leases are accounted for as operating leases with a 12 year term, with monthly lease payments. • During 2008: • The Corporation received delivery of eight Boeing 777 aircraft. Three aircraft were ï¬nanced with guarantee support from EXIM (Note... -

Page 104

2009 Air Canada Annual Report 4. INTANGIBLE ASSETS 2009 Indeï¬nite life assets International route rights and slots Air Canada trade name Other marketing based trade names 2008 $ 329 298 31 658 $ 327 298 31 656 Finite life assets Star Alliance membership Other contract and customer based ... -

Page 105

Consolidated Financial Statements and Notes 5. DEPOSITS AND OTHER ASSETS 2009 Aircraft related deposits (a) Restricted cash Deposit related to the Pension and Beneï¬ts Agreement Asset backed commercial paper (b) Aircraft lease payments in excess of rent expense Other deposits Other $ Note 18 Note ... -

Page 106

2009 Air Canada Annual Report 6. LONG-TERM DEBT AND CAPITAL LEASES Base Currency Final Maturity Actual Interest Rate % 2.15 - 8.49 0.25 - 5.69 0.46 - 0.47 12.75 6.21 3.15 - 3.31 5.73 3.65 $ 2009 2008 Embraer aircraft ï¬nancing (a) Boeing aircraft ï¬nancing (b) Boeing aircraft ï¬nancing (c) ... -

Page 107

... termination of the lease. Aircraft related debt amounting to US$633 ($662) (US$676 ($828) as at December 31, 2008) is summarized as follows (in Canadian dollars): Final Maturity Canadian Regional Jet Boeing 767-300 Airbus 319 Airbus 321 Total 2010 - 2011 2011 - 2016 2011 - 2014 2017 $ 2009 211 141... -

Page 108

...time, in whole, with the payment of applicable fees. The carrying value of the two A340-500 aircraft provided as security under the conditional sales agreements is $212 as at December 31, 2009. (h) The Corporation is the primary beneï¬ciary of certain Fuel Facility Corporations in Canada. The debts... -

Page 109

...to the six month LIBOR rate plus 2.75% pre-payable on any interest payment date after September 21, 2009, without the payment of applicable fees. The next interest payment date is March 20, 2010. The debt is secured primarily by certain ï¬,ight training equipment with a current carrying value of $33... -

Page 110

2009 Air Canada Annual Report 7. FUTURE INCOME TAXES The following income tax related amounts appear in the Corporation's Consolidated Statement of Financial Position: 2009 Liability Tax payable (a) Future income tax liability (c) 2008 $ $ (10) (85) (95) $ $ (10) (88) (98) (a) Taxes Payable ... -

Page 111

... comprehensive income related to fuel derivatives designated under fuel hedge accounting. Income taxes recovered in 2009 by the Corporation were $5 (2008 - payments of less than $1). The balances of tax attributes as at December 31, 2009, namely the balances of non-capital loss carry forwards, vary... -

Page 112

...pensions requires management to make signiï¬cant estimates including estimates as to the discount rate applicable to the beneï¬t obligation and the expected rate of return on plan assets. Pension Plan Cash Funding Obligations As at January 1, 2009, based on the actuarial valuations which were used... -

Page 113

...2009, Air Canada issued to a trust, 17,647,059 Class B Voting Shares. This number of shares represented 15% of the shares of Air Canada issued and outstanding as at the date of the Pension MOUs and the date of issuance (in both cases after taking into account such issuance). All net proceeds of sale... -

Page 114

...Air Canada Annual Report Beneï¬t Obligation and Plan Assets The following table presents ï¬nancial information related to the changes in the pension and other post-employment beneï¬ts plans: Pension Beneï¬ts 2009 2008 Change in beneï¬t obligation Beneï¬t obligation at beginning of year Current... -

Page 115

..., and Aeroplan Net deï¬ned beneï¬t pension and other employee beneï¬ts expense Weighted average assumptions used to determine the accrued beneï¬t cost Discount rate Expected long-term rate of return on plan assets Rate of compensation increase (1) (1) Other Employee Future Beneï¬ts 2009 2008... -

Page 116

... to the Statement of Investment Policy and Objectives of the Air Canada Pension Master Trust Fund, as amended during 2009. The investment return objective is to achieve a total annualized rate of return that exceeds by a minimum of 1.0% before investment fees on average over the long term (i.e., 10... -

Page 117

... 3% to 6% of annual pay for those employees in Canada and 3% to 7% of annual pay for those participants in the United Kingdom. The Corporation contributes an equal amount. The Corporation's expense for deï¬ned contribution plans amounted to $1 for the year ended December 31, 2009 (2008 - $1). 117 -

Page 118

2009 Air Canada Annual Report 9. OTHER LONG-TERM LIABILITIES 2009 2008 $ 37 56 35 37 76 129 $ 370 Unfavourable contract liability on aircraft leases (a) Proceeds from contractual commitments (b) Aircraft rent in excess of lease payments Long-term employee liabilities (c) Workplace safety and ... -

Page 119

... Financial Statements and Notes 10. STOCK-BASED COMPENSATION Air Canada Long-Term Incentive Plan Certain of the Corporation's employees participate in the Air Canada Long-term Incentive Plan (the "Long-term Incentive Plan") administered by the Board of Directors of Air Canada. The Long-term... -

Page 120

.... Included in the total number of PSUs outstanding, 1,091,218 PSUs will entitle the employee to receive, at the discretion of the Corporation, Air Canada shares purchased on the secondary market and/or equivalent cash (2008 - 1,111,183). As at December 31, 2009, the liability related to these PSUs... -

Page 121

... Financial Statements and Notes 11. SHAREHOLDERS' EQUITY The issued and outstanding common shares of Air Canada, along with the potential common shares, were as follows: As at December 31 Outstanding shares Issued and outstanding Class A variable voting shares Class B voting shares Total... -

Page 122

... Shares on the Toronto Stock Exchange ("TSX") is equal to or greater than $4.00 or the 20-day volume weighted average trading price of the Voting Shares on the TSX is equal to or greater than $4.00 (each, an "Acceleration Event"), Air Canada shall have the right, at its option, within 10 business... -

Page 123

...659 (2008 - 1,701,447) outstanding options where the options' exercise prices were greater than the average market price of the common shares for the year. The 561,846 equity settled performance share units outstanding at December 31, 2009 (2008 - 559,885) were also excluded as management determined... -

Page 124

2009 Air Canada Annual Report 13. SEGMENT INFORMATION A reconciliation of the total amounts reported by geographic region for Passenger revenue and Cargo revenue on the Consolidated Statement of Operations is as follows: Passenger revenues Canada US Transborder Atlantic Paciï¬c Other $ 2009 3,... -

Page 125

... 13 Boeing 787 aircraft and purchase rights for 10 Boeing 787 aircraft. During 2009, the Corporation and Boeing agreed to amend certain commercial terms, including revisions to delivery dates. The Corporation's ï¬rst Boeing 787 aircraft is now scheduled for delivery in the second half of 2013. For... -

Page 126

... payment obligations on long-term debt and is based on interest rates and the applicable foreign exchange rate effective as at December 31, 2009. 2010 Long-term debt obligations Capital lease obligations Accounts payable and accrued liabilities Fuel derivatives $ $ 581 180 1,215 31 2,007 $ $ 2011... -

Page 127

... AND RISK MANAGEMENT Summary of Financial Instruments Carrying Amounts December 31, 2009 Financial instruments classiï¬cation Liabilities at amortized cost December 31, 2008 Held for trading Financial Assets Cash and cash equivalents Short-term investments Restricted cash Accounts receivable... -

Page 128

2009 Air Canada Annual Report Collateral Held in Leasing Arrangements The Corporation holds security deposits with a carrying value of $10 (2008 - $18), which approximates fair value, as security for certain aircraft leased and sub-leased to third parties. These deposits do not pay interest to the ... -

Page 129

... Financial Statements and Notes The following are the current derivatives employed in interest rate risk management activities and the adjustments recorded during 2009: • During 2009, the Corporation entered into an interest rate swap agreement, with a term to November 2011, relating to the Credit... -

Page 130

2009 Air Canada Annual Report Management believes however that the signiï¬cant events as described in Note 1C improve the Corporation's current liquidity position. Risks remain such as those related to the current economic environment, including risks related to market volatility in the price of ... -

Page 131

... Financial Statements and Notes Interest rate risk (1) Income 1% increase Cash and cash equivalents Short-term investments Aircraft related deposits Long-term debt and capital leases Fuel derivatives Foreign exchange derivatives Interest rate swaps (1) (2) (3) Foreign exchange rate risk... -

Page 132

2009 Air Canada Annual Report The Corporation has $43 in collateral deposits extended to fuel hedge counterparties. Credit risk related to these deposits is offset against the related liability to the counterparty under the fuel derivative. Refer to the Asset Backed Commercial Paper section below ... -

Page 133

... time prior to maturity. Financial Instrument Fair Values in the Consolidated Statement of Financial Position The carrying amounts reported in the Consolidated Statement of Financial Position for short term ï¬nancial assets and liabilities, which includes Accounts receivable and Accounts payable... -

Page 134

...cant unobservable inputs (Level 3) December 31 2009 Financial Assets Held-for-trading securities Cash equivalents Short-term investments Restricted cash in short-term investments Deposits and other assets Asset backed commercial paper Derivative instruments Interest rate swaps Total $ $ 323 292... -

Page 135

... debt to net debt plus shareholders' equity. Adjusted net debt is calculated as the sum of Long-term debt and capital lease obligations, Non-controlling interest, capitalized operating leases, and Shareholders' equity less Cash and cash equivalents and Short-term investments. The Corporation's main... -

Page 136

... in the Federal Court. Management views Porter's counterclaims in both jurisdictions as being without merit. Pay Equity The Canadian Union of Public Employees ("CUPE"), which represents Air Canada's ï¬,ight attendants, has ï¬led a complaint before the Canadian Human Rights Commission where... -

Page 137

... fuel services at various major airports in Canada. The Fuel Facility Corporations operate on a cost recovery basis. The purpose of the Fuel Facility Corporations is to own and ï¬nance the system that distributes the fuel to the contracting airlines, including leasing the Land Rights under the land... -

Page 138

2009 Air Canada Annual Report When the Corporation, as a customer, enters into technical service agreements with service providers, primarily service providers who operate an airline as their main business, the Corporation has from time to time agreed to indemnify the service provider against ... -

Page 139

...ACTS Aero Technical Support & Services Inc. ("ACTS Aero")), which conducts the business previously operated by ACTS LP ("ACTS") prior to the sale of ACTS by ACE on October 16, 2007. During 2008, ACTS LP settled certain contracts with Air Canada for $11, in relation to the October 2007 sale of assets... -

Page 140

2009 Air Canada Annual Report Summary of signiï¬cant related party agreements The Relationship between the Corporation and Aveos Refer to the "Aveos Restructuring Plan" section below for a description of a restructuring plan announced by Aveos on January 26, 2010. Closing of Aveos restructuring ... -

Page 141

... which Air Canada previously held interests), or to carry on a business activity, related to the following commercial maintenance, repair and overhaul services in the airline industry, namely, airframe heavy maintenance and paint services, engine and auxiliary power unit ("APU") overhaul maintenance... -

Page 142

2009 Air Canada Annual Report Agreement with Aveos on Revised Payment Terms Air Canada and Aveos entered into an agreement dated October 28, 2008 pursuant to which Air Canada has agreed to temporarily extend payment terms to Aveos under certain related party agreements. In exchange for the extended ... -

Page 143

... to the outstanding deposit under Air Canada's letter of credit facility of approximately $20 in the ï¬rst quarter of 2010. The accounting for the above agreements will be determined upon closing. The Relationship between the Corporation and ACE Term Credit Facility ACE is a participant lender in... -

Page 144

..., Montreal, Quebec Corporate Director, Minneapolis, Minnesota Director General and Chief Executive Officer, McGill University Health Centre, Montreal, Quebec Senior Fellow, Public Policy, University of Saskatchewan, Saskatoon, Saskatchewan President and Chief Executive Officer, Air Canada, Montreal... -

Page 145

... guidelines adopted by the Toronto Stock Exchange. Transfer Agents and Registrar CIBC Mellon Trust Company Telephone: 1-800-387-0825 Halifax, Montreal, Toronto, Calgary and Vancouver. * Air Canada Warrants commenced trading October 27, 2009 Duplicate Communication Shareholders receiving more than... -

Page 146

.... The Corporation's primary hubs are located in Toronto, Montreal, Vancouver and Calgary. Air Canada also operates an extensive global network in conjunction with its international partners. Air Canada is a founding member of the Star Alliance Network, the world's largest airline alliance group. The...