Aetna 2007 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2007 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

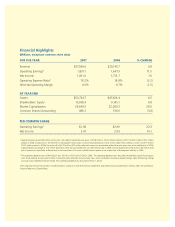

Financial Highlights

(Millions, except per common share data)

FOR THE YEAR 2007 2006 % CHANGE

Revenue $27,599.6 $25,145.7 9.8

Operating Earnings1 1,837.1 1,647.9 11.5

Net Income 1,831.0 1,701.7 7.6

Operating Expense Ratio2 18.2 % 18.8 % (3.2 )

After-tax Operating Margin 6.6 % 6.7 % (1.5 )

AT YEAR END

Assets $50,724.7 $47,626.4 6.5

Shareholders’ Equity 10,038.4 9,145.1 9.8

Market Capitalization 28,649.5 22,280.3 28.6

Common Shares Outstanding 496.3 516.0 (3.8 )

PER COMMON SHARE

Operating Earnings1 $3.49 $2.90 20.3

Net Income 3.47 2.99 16.1

1

Operating earnings excludes from net income: net realized capital (losses) gains of $(48) million, ($(74) million pretax) in 2007 and $24 million ($32 million

pretax) in 2006; a reduction of the reserve for anticipated future losses on discontinued products of $42 million ($64 million pretax) in 2007 and $75 million

($115 million pretax) in 2006; the write-off of a $72 million ($47 million after tax) insurance recoverable related to a prior-year class action settlement in 2006;

a debt refi nancing charge of $12 million ($8 million after tax) associated with our debt refi nancing in 2006; and an impairment of $8 million ($6 million after

tax) of previously capitalized software due to the acquisition of a more multifunctional system in our acquisition of Broadspire Disability in 2006.

2 The operating expense ratio (GAAP basis) was 18.3% in 2007 and 19.2% in 2006. The operating expense ratio excludes net realized capital (losses) gains

from total revenue as discussed in Note 1 above and also excludes the prior-year class action settlement insurance-related charge, debt refi nancing charge

and acquisition-related software charge from operating expenses as discussed in Note 1 above.

The foregoing fi nancial information should be read in conjunction with the fi nancial statements and related notes as presented in Aetna’s 2007 Annual Report,

Financial Report to Shareholders.