Aer Lingus 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 Aer Lingus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2010

9

Operating and fi nancial review Aer Lingus Group Plc

achieving the remaining savings in full, in

2012. That said, in-year delivery in 2011

from the additional initiatives is likely to be

reduced as it will take some time to implement

them. Areas that we are currently exploring

include the cross seasonal leasing of aircraft.

We will provide regular updates on our

progress during 2011.

Staff

2010 has been a year of substantial

achievement, none of which would have been

possible without the dedication and

commitment of our staff. We are extremely

appreciative of the loyalty shown by our staff,

their support of the Greenfi eld programme, and

their commitment to delivering great service

to our passengers. Whilst the majority of our

staff have been very supportive, 2010 has not

been entirely straightforward. In the second

half of 2010, we faced gradually escalating

industrial action from those members of our

cabin crew who are members of the IMPACT

union. These staff, who previously voted in

favour of fl ying 850 hours a year, expressed

dissatisfaction with some elements of the

rosters designed to implement the agreement.

Matters came to a head in early 2011, which

necessitated the hiring in of aircraft to

maintain our fl ight schedule. This and the

associated disruption to fl ights and bookings

will have an adverse effect on fi rst quarter

performance in 2011 performance. We believe

that the issue has now been satisfactorily

resolved without compromising on the

principle of 850 hours.

Pensions

The Irish Airline Superannuation Scheme

(IASS) is a multi employer scheme principally

for employees of the Dublin Airport Authority

(DAA) and Aer Lingus. The employers’

contribution is fi xed by the scheme’s Trust

Deed and Rules at 6.375% of pensionable

salaries. Under the Trust Deed, there is no

mechanism for increasing employer

contributions without the employers’ consent

and the company therefore accounts for the

scheme on a defi ned contribution basis.

However, for the purpose of paying benefi ts,

the scheme is a defi ned benefi t scheme as the

benefi ts payable are based on a member’s fi nal

salary. The IASS currently has a substantial

actuarial defi cit of circa €400 million on the

statutory minimum funding standard basis as

at 31/12/2010.

As part of the Greenfi eld agreements, Aer

Lingus agreed to take part in discussions with

Trade Unions representing members of the

IASS about the future of pension provision in

the group. These discussions have been taking

place under the auspices of the Labour

Relations Commission (LRC) and include the

DAA and representations of its staff. The terms

of reference of this process cover both the

provision of viable pension arrangements for

future service and a review of past service

arrangements.

No agreement has yet been reached, but

options under consideration for future pension

provisions for Aer Lingus employees include a

possible hybrid arrangement incorporating

either a capped defi ned benefi t or cash

balance element with a defi ned contribution

element above that cap.

Even if future service arrangements can be

agreed, the trustees of the IASS are likely to

be faced with a new deadline to agree a defi cit

reduction plan with the employers and to

submit a funding proposal to the Pensions

Board in summer 2011. Legislation permitting

pension scheme trustees to purchase sovereign

annuities was passed in December 2010. Such

annuity products may reference sovereign

bonds issued by Ireland and/or any other EU

country or countries. A launch date for this

arrangement remains uncertain and may be

linked to the outcome of a wider review of

funding standard issues.

Aer Lingus’ fi nancial obligation under the IASS

is limited to its contribution obligation as set

out in the Trust Deed and Rules and as

described above.

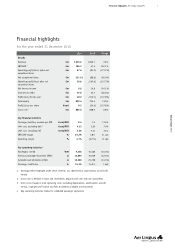

2010 fi nancial review

Summary

The Group returned to profi tability in 2010

with a €138.6m swing in the operating profi t

before net exceptional items, from a loss of

€81.0m in 2009 to a profi t of €57.6m in 2010.

Revenue increased slightly by 0.8%, with a

reduction in the number of passengers, arising

from capacity reductions, offset by strong yield

and strong ancillary revenue per passenger

performance. The key driver behind the

turnaround was the €128.7m reduction in

operating costs, with reduced fuel prices,

capacity related savings and Greenfi eld staff

costs savings being the key contributors.

EBITDAR has increased by €139.2m to €196.7m

and the Group recorded a net profi t for the year

of €49.2m (2009: loss of €130.1m).

Passenger fare and ancillary

revenue

Passenger fare and ancillary revenue for the

year was in line with 2009 at €1,166.2m,

despite a 10.0% reduction in the number of

passengers carried to 9.35m (2009: 10.38m).

Average fare per passenger increased by 12.0%

and revenue per passenger (i.e. fare revenue

plus ancillary revenue) increased by 11.0% to

€124.78. Total revenue per ASK rose 17.2% to

6.65 cents (2009: 5.68 cents). Total passenger

load factor increased by 1.6 points to 76.1%

refl ecting our strategy of achieving a better

match between the capacity we offer and the

natural level of demand in our markets.

Short haul

Short haul fare revenue was €725.0m, (2009:

€717.4m), an increase of 1.1%. However, short

haul passengers carried were down by 9.3% to

8.4m, indicating an 11.4% increase in average

fare to €85.92 (2009: €77.10). This

performance was largely due to a changed

approach to yield management. The increase

in short haul average fare was supplemented

by growth in ancillary revenue per passenger

of €0.92 or 5.5%.