Aer Lingus 2010 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2010 Aer Lingus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

Annual Report 2010

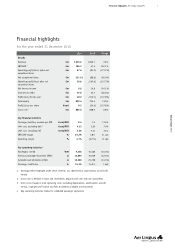

Operating and fi nancial review Aer Lingus Group Plc

We were encouraged that it was proving

possible to achieve these operational results

despite the adverse impact of the volcanic ash

and the continuing diffi cult conditions in the

key Irish market. At the time, passenger

numbers passing through Dublin airport were

16% lower than in the fi rst half of 2009.

The third quarter showed a continuation of

the trends seen in the second quarter, with

an operating profi t, again before exceptional

items, of €79.2 million against €58.5 million

in 2009. Again, average yield per passenger

was up 12.5% with average load factor up

3.0 percentage points at 83.4% overall. We

continued to make good progress on the

Greenfi eld programme with run-rate staff

savings of €39 million implemented at the

end of September.

As part of our cost reduction programme, we

negotiated terms to consolidate our property

portfolio at Dublin Airport and agreed that we

would move into Terminal 2 at Dublin, when it

opened. We had delayed committing to the

new terminal until it became clear that there

would be no differential pricing between

Terminal 1 and Terminal 2. Terminal 2 was

attractive to us because we were approaching

the limits of our ability to handle transfer

traffi c in Terminal 1.

The fourth quarter again showed a

continuation of previous trends, with

operating losses (before exceptional items)

reduced to €2.6 million from €46.6 million in

2009. Average fare per passenger was up 19.0

% with overall load factor up 1.4 percentage

points at 72.7%. We achieved this result

despite very signifi cant weather disruption and

fl ight cancellations at the end of December.

We ended 2010 having delivered our targeted

€50 million run-rate staff savings.

At the end of December, we made a lump-sum

payment to the Employee Share Ownership

Trust (“ESOT”) in order to extinguish our

obligation to pay the ESOT a share of annual

profi ts. At the time, the ESOT held 12.5% of

the Group’s share capital, in trust for some

4,700 current and former employees.

The obligation to pay profi t share from profi t

before taxation and exceptional items was

established at the time of the Group’s IPO in

2006 and would have remained in place until

the ESOT had received suffi cient cash from the

company to pay off approximately €25 million

of debt that it had borrowed in 2006. It made

economic sense to pre-pay the profi t share to

allow the ESOT to extinguish their debt

because of the very substantial interest burden

incurred by them. By making this payment to

the ESOT, we have capped a liability which was

not within our control and at the same time

the free fl oat of the company has increased

signifi cantly.

As a result, approximately 62.5 million shares

held by the ESOT have now transferred to the

direct ownership of current and former

employees. Once all necessary arrangements

are made for the withholding and payment of

applicable taxes in the relevant jurisdictions,

the balance of approximately 4.1 million

shares will be appropriated in respect of the

non-Irish benefi ciaries of the trust.

As we look back on 2010, and forward to 2011,

the following are apparent:

• Our brand and business is firmly rooted in

Ireland. Given the state of the Irish

economy and the fact that the Irish

market is conditioned to expect low fares,

growth will remain challenging for Aer

Lingus for at least the short-term.

• Our principal competitor on 85% of all our

routes is Ryanair, which has a structurally

lower cost base than Aer Lingus. Reducing

our costs is a strategic imperative,

particularly when 50% of our cost base

comprising of airport charges and fuel is

rising significantly faster than inflation

and is largely outside our control.

However, we cannot match Ryanair in

terms of cost and so differentiate

ourselves on grounds other than price

alone.

• We have significant further work to do

inside Aer Lingus to improve our

processes, procedures and the strength

and depth of management. This is a major

focus for 2011.

• The strategic changes that we have made

to our business model at the end of last

year have been substantially more

successful than we had expected. This

caused us to re-appraise our approach to

the Greenfield programme for 2011.

As originally conceived in Spring 2009,

Greenfi eld was intended as a programme to

eliminate many of the costs associated with the

value added carrier strategy that we are now

pursuing, with a view to moving the business

sharply toward the low cost/low fares model.

Some of the Greenfi eld initiatives, originally

planned to be implemented in 2011, would

have involved signifi cant down sizing of our

commercial, fi nance and IT departments as

we would have focused purely on internet

originating bookings and would have

substantially simplifi ed our approach

to yield management.

The changes we made to the business model in

2010 have proved very successful. This has led

us to the conclusion that, rather than

eliminating certain elements of cost as had

originally been planned under Greenfi eld, we

actually need to reinforce and invest in some

of these areas. As a consequence, we no longer

plan to pursue some €14 million of staff and

€18 million of non-staff savings, as to do so

would undermine the foundations of our

current success. For example, some of the

original planned non-staff savings would have

had us move to secondary airports, remove

airport lounges and downgrade our in-fl ight

entertainment and catering and important

parts of our product offering. However, the

€97 million target remains appropriate and

achievable and we are currently validating

further opportunities to reduce cost.

Adjusted for the savings which we will no

longer implement, the assigned Greenfi eld plan

represented €65 million of annual savings,

against the initial target of €97 million. By

the end of 2011, on the basis of fi rm plans

we currently have, we expect to deliver €84

million of savings in run-rate terms. Our goal

is to validate the new initiatives by the end

of the fi rst quarter of 2011, with a view to