Adaptec 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Adaptec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(5) Results for the year ended December 31, 2000 include costs of merger of $38.0 million and acquisition of in process research

and development of $38.2 million related to the acquisitions of AANetcom, Inc., Extreme Packet Devices, Inc., Quantum Effect

Devices, Inc. and SwitchOn Networks Inc.

(6) Results for the year ended December 31, 1999 include costs of merger of $0.9 million related to the acquisition of Toucan

Technology Limited.

(7) Reflects two 2−for−1 stock splits, in the form of 100% stock dividends, effective May 1999 and February 2000.

16

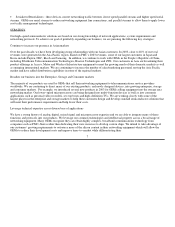

Quarterly Comparisons

The following tables set forth the consolidated statements of operations for each of the Company’s last eight quarters. This quarterly

information is derived from unaudited interim financial statements and has been prepared on the same basis as the annual

Consolidated Financial Statements. In management’s opinion, this quarterly information reflects all adjustments necessary for fair

presentation of the information for the periods presented. The operating results for any quarter are not necessarily indicative of results

for any future period.

Quarterly Data

(in thousands except for per share data)

Year Ended December 31, 2003 Year Ended December 31, 2002

Fourth (1) Third (2) Second (3) First (4) Fourth (5) Third Second First

STATEMENT OF

OPERATIONS DATA:

Net revenues $ 70,619 $ 63,100 $ 60,378 $ 55,386 $ 52,556 $ 59,584 $ 54,511 $ 51,442

Cost of revenues 22,821 21,868 21,301 21,885 24,996 23,229 20,774 20,543

Gross profit 47,798 41,232 39,077 33,501 27,560 36,355 33,737 30,899

Research and development 28,593 27,759 32,173 30,948 33,085 33,977 34,438 36,234

Marketing, general and

administrative 9,176 12,031 12,151 12,616 13,827 16,030 16,451 17,111

Amortization of deferred

stock compensation:

Research and development — — (82) 399 507 453 764 921

Marketing, general and

administrative 270 313 95 13 18 23 61 66

Impairment of property and

equipment — — — — 1,824 — — —

Restructuring costs and other

special charges 2,503 (1,093) 7,260 6,644 — — — —

Income (loss) from operations 7,256 2,222 (12,520) (17,119) (21,701) (14,128) (17,977) (23,433)

Gain on extinguishment of

debt — 1,700 — — — — — —

Gain (loss) on investments 85 (162) 1,962 531 (14,714) 71 619 2,445

Provision for (recovery of)

income taxes (2,157) 329 (1,499) (4,525) (5,105) (3,438) (4,428) (5,887)

Net income (loss) $ 9,525 $ 3,164 $ (9,165) $ (11,515) $ (30,491) $ (9,245) $ (11,591) $ (13,680)

Net income (loss) per share −

basic $ 0.05 $ 0.02 $ (0.05) $ (0.07) $ (0.18) $ (0.05) $ (0.07) $ (0.08)

Net income (loss) per share −

diluted $ 0.05 $ 0.02 $ (0.05) $ (0.07) $ (0.18) $ (0.05) $ (0.07) $ (0.08)

Shares used in per share

calculation − basic 176,464 174,118 172,289 171,402 170,594 170,525 169,798 169,513

Shares used in per share

calculation − diluted 190,694 186,137 172,289 171,402 170,594 170,525 169,798 169,513

(1) Results include a $2.5 million net charge for restructuring costs, $1.8 million elimination of a provision for potential litigation

costs and $3.5 million additional recovery of prior year income taxes. The $2.5 million net charge for restructuring costs is comprised

of $3.2 million additional excess facilities costs and the reversal of $0.7 million excess accrual for workforce reduction costs related to

our January 2003 restructuring plan.

(2) Results include $1.1 net reversal of restructuring costs and $1.7 million gain on extinguishment of debt. The $1.1 million net

reversal of restructuring charges is comprised of a $4.5 million reversal of excess facilities costs related to the Company’s

October 2001 restructuring plan, $3.1 million additional excess facilities costs related to sites abandoned in the March 2001

restructuring and $0.3 million of restructuring costs related to the January 2003 restructuring plan.