Adaptec 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Adaptec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10−K

PMC SIERRA INC − PMCS

Filed: March 12, 2004 (period: December 28, 2003)

Annual report which provides a comprehensive overview of the company for the past year

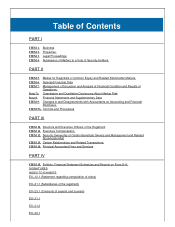

Table of contents

-

Page 1

FORM 10âˆ'K PMC SIERRA INC âˆ' PMCS Filed: March 12, 2004 (period: December 28, 2003) Annual report which provides a comprehensive overview of the company for the past year -

Page 2

... and Financial Disclosure. ITEM 9A. Controls and Procedures PART III ITEM 10. Directors and Executive Officers of the Registrant ITEM 11. Executive Compensation. ITEM 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matt ITEM 13. Certain Relationships... -

Page 3

EXâˆ'32.2 -

Page 4

...28, 2003 TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from: Commission File Number 0âˆ'19084 to PMCâˆ'Sierra, Inc. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation) 94... -

Page 5

-

Page 6

... highâˆ'speed broadband communications and storage semiconductors and MIPSâˆ'based processors for service provider, enterprise, storage, and wireless networking equipment. We have more than 180 different semiconductor devices that are sold to leading equipment manufacturers, who in turn supply... -

Page 7

... standard that packages information into a fixedâˆ'size cell format for transportation across networks is ATM, or Asynchronous Transfer Mode. Many service providers deploy equipment that handles this protocol because it can support voice, video, data, and multimedia applications simultaneously... -

Page 8

... protocols. PRODUCTS PMCâˆ'Sierra designs, develops, markets and supports a broad range of highâˆ'performance integrated circuits, which process analog and digital signals in a wide range of speeds and comply with multiple protocols, used in the telecommunications and data networking industries... -

Page 9

...single application (power amplification for wireless base stations). In some situations, different OEMs might use our chips or chipsets in equipment addressing more than one of the market areas noted below. Further, during the lifecycle of their products, our customers from time to time may redesign... -

Page 10

... such as setâˆ'top boxes, highâˆ'definition TVs, and personal video recorders. Our chips and chipsets can also be divided into the broadly defined functional categories identified below. As with descriptions of the network, particular categories may overlap and a device may be present in more... -

Page 11

... several new products in 2003 for OEMs selling equipment into the storage area networking market. Our lowerâˆ'speed microprocessors are being designed into multiâˆ'function devices as well as into consumer applications such as personal video recorders, setâˆ'top boxes and highâˆ'definition TVs... -

Page 12

...and product support to companies focused on equipment for the storage, enterprise or consumer customers. To better match our available sales resources to market opportunities, we also focus our sales and support efforts on target customers. We sell our products both directly and through distributors... -

Page 13

... the vendors that offer the best technology and service, at an attractive price. Typically, the complete manufacture of our chips requires 12 to 16 weeks, which we refer to as our leadâˆ'time. Based on this leadâˆ'time, our team of production planners will initiate purchase orders with our suppliers... -

Page 14

... of products that meet our customers future needs. At the end of fiscal 2003, we had design centers in the United States (California, Oregon, and Pennsylvania) and Canada (British Columbia, Saskatchewan, Manitoba, Ontario and Quebec). During 2003, we closed design centers in Maryland, Ireland and... -

Page 15

... of products as of December 31, 2002 for shipment within six months totaled $41.0 million. Our backlog includes our backlog of shipments to direct customers, minor distributors and a portion of shipments by our major distributor to end customers. Our customers may cancel, or defer to a future period... -

Page 16

...compete with major domestic and international semiconductor companies, including Agilent, Cypress Semiconductor, Intel, IBM, Infineon, Integrated Device Technology, Maxim Integrated Products, Motorola, and Texas Instruments. These companies are concentrating an increasing amount of their substantial... -

Page 17

...on microprocessor products. This license may be terminated only if we do not make the required royalty payments or breach confidentiality obligations. PMC and its logo are our registered trademarks and service marks. We own other trademarks and service marks not appearing in this Annual Report. Any... -

Page 18

PART II ITEM 5. Market for Registrant's Common Equity and Related Stockholder Matters. Stock Price Information. Our common stock trades on the Nasdaq National Market under the symbol PMCS. The following table sets forth, for the periods indicated, the high and low closing sale prices for our Common ... -

Page 19

... merger Acquisition of in process research and development Income (loss) from operations Gain on extinguishment of debt Gain (loss) on investments Provision for (recovery of) income taxes Net income (loss) Net income (loss) per share âˆ' basic: (7) Net income (loss) per share âˆ' diluted: (7) Shares... -

Page 20

...a $20.7 million allowance for inventories in excess of twelveâˆ'month demand, recorded in cost of revenues, a $195.2 million charge for restructuring and other ...charge for impairment of other investments, recorded in gain (loss) on investments, and a $2.9 million gain on sale of other investments. 15 -

Page 21

..., Inc., Extreme Packet Devices, Inc., Quantum Effect Devices, Inc. and SwitchOn Networks Inc. (6) Results for the year ended December 31, 1999 include costs of merger of $0.9 million related to the acquisition of Toucan Technology Limited. (7) Reflects two 2âˆ'forâˆ'1 stock splits, in the form of... -

Page 22

...million net gain on investments is comprised of $5.5 million gain on sale of other investments and $3.5 million charge for impairment of other ...âˆ'month demand, recorded in cost of revenues, and a charge of $15.3 million for impairment of other investments recorded in gain (loss) on investments.... -

Page 23

... 2001 and 2002. We saw improved demand for our microprocessor products in enterpriseâˆ'related applications and products used in asynchronous digital subscriber line (ADSL) infrastructure applications. Our customers began placing new orders for our products as they depleted their inventories of our... -

Page 24

...âˆ'networking Nonâˆ'networking revenues are comprised of sales of a single medical applicationâˆ'related chip, which declined $3.9 million, or 72%, in 2003 and $17.1 million, or 76%, in 2002 due to decreased unit sales to our principal customer in this segment. While we had wound down this product... -

Page 25

..., further reduced gross profit by 3 percentage points. Nonâˆ'networking In absolute dollar terms, nonâˆ'networking gross profit for both 2003 and 2002 decreased as a result of declining sales volume. Our nonâˆ'networking product is a single medical device chip. We do not expect to ship this... -

Page 26

... incurred for product development tools were $4.4 million lower in 2003 than in 2002 as less software and related maintenance was required to support current development activity levels. Contributing to this reduction in tooling costs was the closure of our development sites in Ireland, India and... -

Page 27

... part of our 2001 restructurings. Impairment of Property and Equipment In 2002, we recorded an impairment charge of $1.8 million reflecting a reduction in the estimated fair value of a product tester. This equipment was removed from service because lower manufacturing and product development volumes... -

Page 28

... to exit the remaining sites, payments relating to these facilities could extend to 2009. Restructuring - January 16, 2003 In the first quarter of 2003, as a result of the prolonged economic downturn in the semiconductor industry, we implemented another corporate restructuring aimed at further... -

Page 29

... of the technology purchased in acquisitions completed in 2000. Market opportunities for one of the products acquired were drastically reduced as our customers eliminated development programs that would use this product as a reaction to the severe reduction in capital spending by service providers... -

Page 30

...reported a net gain on investments of $2.4 million in 2003 and net losses of $11.6 million in 2002 and $14.6 million in 2001. In 2003, we sold our remaining investment in Sierra Wireless, Inc., a public company...recorded a $2.9 million gain on the sale of a portion of our investment in Sierra Wireless... -

Page 31

... in the United States. The preparation of these financial statements requires us to make estimates and assumptions that affect the amounts reported by us of assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. Management bases its estimates on... -

Page 32

... obligations for those affected sites. In the first quarter of 2003, we announced a further restructuring of our operations, which resulted in the closing of an additional four product development sites: two in Ireland, one in India and our Maryland site. During the year we recorded total charges of... -

Page 33

.... In 2002, we recorded an impairment charge of $1.8 million reflecting the reduction in fair value of a product tester. We did not identify any impairment to goodwill or purchased intangibles during our annual assessments in 2002 or 2003. Business Outlook We expect our networking revenues for the... -

Page 34

... our networking product inventories; a $5.0 million increase in accounts receivable, as a result of an increase in revenues; a $4.5 million reduction in prepaid expenses and other assets, as we reduced spending on development software and maintenance in accordance with current cost control programs... -

Page 35

... and other assets, $8.4 million of which was from the sale of the remainder of our investment in Sierra Wireless Inc., a public company; and the purchase of $4.9 million in venture investments and other real estate assets. In 2003 cash flows from our financing activities included: • • $96... -

Page 36

...obligations related to development tools for $7.4 million, $1.0 million and $0.3 million for the years 2004, 2005 and 2006, respectively. In 1999 and 2000, we were passive investors, like many of our peers, in four professionally managed venture funds. These investments help us monitor technological... -

Page 37

... for additional manufacturing capacity. This makes forecasting their production requirements difficult and can lead to an inventory surplus of certain of their components. Our customers often shift buying patterns as they manage inventory levels, decide to use competing products, are acquired or... -

Page 38

... prices significantly to win a design. We may lose design opportunities or may experience overall declines in gross margins as a result of increased price competition. In addition, our networking products range widely in terms of the margins they generate. A change in product sales mix could impact... -

Page 39

... not translate into nearâˆ'term revenues and the timing of revenues from newly designed products is often uncertain. We have announced a number of new products and design wins for existing and new products. While some industry analysts may use design wins as a metric for future revenues, many design... -

Page 40

... design tools, wafer manufacturing techniques, process tools and alternate networking technologies. We may not be able to develop new products at competitive pricing and performance levels. Even if we are able to do so, we may not complete a new product and introduce it to market in a timely manner... -

Page 41

..., and new manufacturing and design technologies. Many of the standards and protocols for our products are based on highâˆ'speed networking technologies that have not been widely adopted or ratified by one or more of the standardâˆ'setting bodies in our customers' industry. Our customers often delay... -

Page 42

.... Many of our customers employ contract manufacturers to produce their products and manage their inventories. Many of these contract manufacturers represent greater credit risk than our networking equipment customers, who generally do not guarantee our credit receivables related to their contract... -

Page 43

... these delays, or allow competitors' parts to be chosen by customers during the design process. Our business strategy contemplates acquisition of other companies or technologies, which could adversely affect our operating performance. Acquiring products, technologies or businesses from third parties... -

Page 44

... demand for their endâˆ'user networking equipment, our customers are focusing more on cash preservation and tighter inventory management, and because we supply a large number of products to a variety of customers and contract manufacturers who have many equipment programs for which they purchase our... -

Page 45

...A limited number of suppliers provide the computer aided design, or CAD, software we use to design our products. Factors affecting the price, availability or technical capability of these products could affect our ability to access appropriate CAD tools for the development of highly complex products... -

Page 46

... significant liabilities upon judgment. We become defendants in legal proceedings from time to time. Companies in our industry have been subject to claims related to patent infringement and product liability, as well as contract and personal claims. We may not be able to accurately assess the risk... -

Page 47

... competitors and customers. Our customers are required to obtain licenses from and pay royalties to third parties for the sale of systems incorporating our semiconductor devices. Customers may also make claims against us with respect to infringement. Furthermore, we may initiate claims or litigation... -

Page 48

... to momentum, hedge or dayâˆ'trading investors who often shift funds into and out of stocks rapidly, exacerbating price fluctuations in either direction particularly when viewed on a quarterly basis. Securities class action litigation has often been instituted against a company following periods of... -

Page 49

...impaired. Subsequent to yearâˆ'end, we sold our interest in a private technology company in exchange for total consideration of $10.6 million in cash. We expect to record the disposition of this investment, which had a carrying value of $1.3 million at December 31, 2003, in the first quarter of 2004... -

Page 50

...not independently verified. The average bid and ask price of our convertible subordinated notes on December 31, 2003 approximated their face value. 45 Item 8. Financial Statements and Supplementary Data The chart entitled "Quarterly Data" contained in Item 6 Part II hereof is hereby incorporated by... -

Page 51

Schedules not listed above have been omitted because they are not applicable or are not required, or the information required to be set forth therein is included in the financial statements or the notes thereto. 46 -

Page 52

Independent Auditors' Report The Board of Directors of PMCâˆ'Sierra, Inc. We have audited the accompanying consolidated balance sheets of PMCâˆ'Sierra, Inc. and subsidiaries ("the Company") as of December 31, 2003 and 2002 and the related consolidated statements of operations, stockholders' equity ... -

Page 53

... tax liabilities Commitments and contingencies (Note 8) PMC special shares convertible into 2,921 (2002 âˆ' 3,196) shares of common stock Stockholders' equity Common stock and additional paid in capital, par value $.001: 900,000 shares authorized; 174,289 shares issued and outstanding (2002 âˆ' 167... -

Page 54

PMCâˆ'Sierra, Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except for per share amounts) 2003 Year Ended December 31, 2002 2001 Net revenues Cost of revenues Gross profit Other costs and expenses: Research and development Marketing, general and administrative Amortization ... -

Page 55

PMCâˆ'Sierra, Inc. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) Year ended December 31, 2002 2003 2001 Cash flows from operating activities: Net loss Adjustments to reconcile net loss to net cash used in operating activities: Depreciation of property and equipment Amortization ... -

Page 56

... disclosures of nonâˆ'cash investing and financing activities: Equity securities received in exchange for other longâˆ'term investment Conversion of PMCâˆ'Sierra special shares into common stock 23,943 295 - 533 29,357 411 - 265 4,498 41,177 1,713 1,050 See notes to the consolidated financial... -

Page 57

... value of derivatives Comprehensive loss Conversion of special shares into common stock Issuance of common stock under stock benefit plans Conversion of warrants into common stock Deferred stock compensation Amortization of deferred stock compensation Balances at December 31, 2003 162,284 - - - 373... -

Page 58

...âˆ'Sierra, Inc (the "Company" or "PMC") designs, develops, markets and supports highâˆ'speed broadband communications and storage semiconductors and MIPSâˆ'based processors for service provider, enterprise, storage, and wireless networking equipment. The Company offers worldwide technical and sales... -

Page 59

... the Company's volume requirements change in relation to sales of its products. In each year, the Company is entitled to receive a refund of a portion of the deposits based on the annual purchases from these suppliers compared to the target levels in the wafer supply agreements. In 2003, PMC renewed... -

Page 60

...,157 13,448 4,889 4,668 1,027 51,189 In 2003, the Company sold a property it held in Burnaby, Canada for proceeds of $15.3 million. This asset was classified as Land and Constructionâˆ'inâˆ'progress at the end of 2002. The Company recorded a nominal gain on this transaction, which it classified in... -

Page 61

... recoverability, the Company compares the carrying value of the assets to the estimated future undiscounted cash flows. Measurement of an impairment loss for longâˆ'lived assets held for use is based on the fair value of the asset. Longâˆ'lived assets classified as held for sale are reported at the... -

Page 62

.... Derivatives and Hedging Activities. PMC's net income (loss) and cash flows may be negatively impacted by fluctuating foreign exchange rates. The Company periodically hedges foreign currency forecasted transactions related to certain operating expenses. All derivatives are recorded in the balance... -

Page 63

...in the sales from this distributor to end customers and the Company may utilize inventory at the major distributor to satisfy product demand by other customers. PMC recognizes revenues from minor distributors at the time of shipment. At the time of shipment, product prices are fixed and determinable... -

Page 64

... Product warranties. The Company provides a oneâˆ'year limited warranty on most of its standard products and accrues for the cost of this warranty based on its experience at the time of shipment. The following table summarizes the activity related to the product warranty liability during fiscal 2003... -

Page 65

... share amounts) 2003 2001 Net loss, as reported Adjustments: Additional stockâˆ'based employee compensation expense under fair value based method for all awards, net of related tax effects Net loss, adjusted Basic net loss per share, as reported Basic net loss per share, adjusted Diluted net loss... -

Page 66

...deferred tax assets will not be realized. Net income (loss) per common share. Basic net income (loss) per share is computed using the weighted average number of common shares outstanding during the period. The PMCâˆ'Sierra Ltd. Special Shares have been included in the calculation of basic net income... -

Page 67

... financial support from other parties. FIN 46 is effective for all new variable interest entities created or acquired after January 31, 2003. For variable interest entities created or acquired prior to February 1, 2003, the provisions of FIN 46 must be applied for the first interim or annual period... -

Page 68

... efforts on key projects and reducing operating costs. By the first quarter of 2003, the Company was still operating in a challenging economic climate, making it necessary to again streamline operations and announce a further restructuring. PMC's assessment of market demand for its products and the... -

Page 69

... (5,330) (116,790) 7,379 $ (12,241 (12,241) (6,051) 156,994 - (27,495) 129,499 (5,330) (116,790) - $ 7,379 On July 7, 2003, PMC terminated its remaining rental commitment for Mission Towers Two, located in Santa Clara, CA, by purchasing the facility for $133 million and then immediately 63 -

Page 70

... of certain products to the market, the Company completed an assessment of the future revenue potential and estimated costs associated with all acquired technologies. As a result of this review, the Company recorded a further impairment charge of $80.8 million related to the acquired goodwill and... -

Page 71

.... The securities were sold in the third quarter to partially fund the repurchase of $100 million face value of convertible subordinated notes. As a result of this sale, all debt investments were reclassified as availableâˆ'forâˆ'sale. The realized gain or loss on these sales was immaterial. The... -

Page 72

... or loss on these sales was immaterial. These sales did not impact the classification of any other heldâˆ'toâˆ'maturity securities. NOTE 5. Other Investments and Assets The components of other investments and assets are as follows: December 31, (in thousands) 2003 2002 Investment in Sierra Wireless... -

Page 73

...bear interest at 3.75% payable semiâˆ'annually and are convertible into an aggregate of approximately 6.5 million shares of PMC's common stock at any time prior to maturity at a conversion price of approximately $42.43 per share. The Company may redeem the notes at any time after August 19, 2004. In... -

Page 74

... is able to continue to offer competitive technology, pricing, quality and delivery. The agreements may be terminated if either party does not comply with the terms. Investment agreements. The Company participates in four professionally managed venture funds that invest in earlyâˆ'stage private... -

Page 75

...preference the number of shares of PMC common stock issuable on conversion plus a nominal amount per share plus unpaid dividends, or at the holder's option convert into LTD ordinary shares, which are the functional equivalent of voting common stock. If the Company files for bankruptcy, is liquidated... -

Page 76

...45,000,000 shares, or (iii) an amount to be determined by the Board of Directors. In 2001, the company simplified its plan structure. The 2001 Stock Option Plan (the "2001 Plan"), which was created to replace a number of stock option plans assumed by us in connection with mergers and acquisitions we... -

Page 77

... plus (ii) the number of options that were outstanding at the time the plans were assumed but that have subsequently been cancelled plus (iii) 10 million shares that were added to the plan in 2003. Option activity under the option plans was as follows: Weighted Average Exercise Price Per Share... -

Page 78

... a new option to purchase a number of PMC shares equal to one share for each four unexercised shares subject to the tendered option. On September 26, 2002, the Company cancelled options to purchase approximately 19.3 million shares of common stock with a weighted average exercise price of $35.98. In... -

Page 79

... 85,643 (17,763) Significant components of the Company's deferred tax assets and liabilities are as follows: December 31, (in thousands) 2003 2002 Deferred tax assets: Net operating loss carryforwards State tax loss carryforwards Credit carryforwards Reserves and accrued expenses Restructuring and... -

Page 80

... semiconductor devices and related technical service and support to equipment manufacturers for use in their communications and networking equipment. The nonâˆ'networking segment consists of a single medical device. The Company is supporting this nonâˆ'networking product for existing customers, but... -

Page 81

... 322,738 65,634 37,968 2,803 106,405 During 2003, the Company had three customers whose purchases represented a significant portion of net revenues, based on billing, including contract manufacturers and distributors. Net revenues from one customer represented approximately 14% of net revenues in... -

Page 82

... and diluted net loss per share $ (7,991) $ 173,568 (65,007) $ 170,107 (0.38) $ (639,054) 167,967 (3.80) $ (0.05) $ (1) PMCâˆ'Sierra, Ltd. Special Shares are included in the calculation of basic weighted average common shares outstanding. In 2003, the Company had approximately 9.3 million... -

Page 83

... annual report. They concluded that as of the evaluation date, our disclosure controls and procedures are effective to ensure that information we are required to disclose in reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods... -

Page 84

(3) Consists of the 2001 Stock Option Plan (the "2001 Plan"), which was created to replace a number of stock option plans assumed by us in connection with mergers and acquisitions 78 -

Page 85

...âˆ'K Annual Report. (b) Reports on Form 8âˆ'K On September 16, 2003, we filed a report on Form 8âˆ'K relating to the results of our third fiscal quarter ended September 28, 2003. Under the Form 8âˆ'K, we furnished (not filed) pursuant to Item 12 under Item 7 the press release entitled "PMCâˆ'Sierra... -

Page 86

... of PMCâˆ'Sierra, Ltd. Special Shares Preferred Stock Rights Agreement, as amended and restated as of July 27, 2001, by and between the Registrant and American Stock Transfer and Trust Company Form of Convertible Note and Indenture dated August 6, 2001 by and between the Registrant and State Street... -

Page 87

... Kanata Research Park Corporation and PMCâˆ'Sierra, Ltd. Building Lease Agreement between Transwestern - Robinson I, LLC and PMCâˆ'Sierra US, Inc. Forecast and Option Agreement by and among the Registrant, PMCâˆ'Sierra, Ltd., and Taiwan Semiconductor Manufacturing Corporation Deposit agreement dated... -

Page 88

... Circle Partners II, L.L.C. and PMCâˆ'Sierra, Inc. Amendment for Purchase and Sale of Real Property between PMCâˆ'Sierra, Inc. and WB Mission Towers, L.L.C. Calculation of earnings per share (1) Statement of Computation of Ratio of Earnings to Fixed Charges Subsidiaries of the Registrant Consent... -

Page 89

... with the Commission. ^ Indicates management compensatory plan or arrangement required to be filed as an exhibit pursuant to Item 15(c) of Form 10K. (1) Refer to Note 14 of the consolidated financial statements included in Item 8 of Part II of this Annual Report. (2) Refer to Signature page... -

Page 90

... the undersigned, thereunto duly authorized. PMCâˆ'SIERRA, INC. (Registrant) Date: March 12, 2004 /s/ Alan F. Krock Alan F. Krock Vice President, Finance (duly authorized officer) Chief Financial Officer and Principal Accounting Officer POWER OF ATTORNEY KNOW ALL PERSONS BY THESE PRESENTS, that each... -

Page 91

Vice Chairman James V. Diller /s/ William Kurtz William Kurtz /s/ Frank Marshall Frank Marshall /s/ Lewis O. Wilks Lewis O. Wilks Director Director Director March 12, 2004 March 12, 2004 March 12, 2004 March 12, 2004 85 -

Page 92

SCHEDULE II âˆ' Valuation and Qualifying Accounts Years ended December 31, 2003, 2002, and 2001 (in thousands) Charged to expenses or other accounts Balance at beginning of year Writeâˆ'offs Balance at end of year Allowance for doubtful accounts: 2003 2002 2001 Allowance for obsolete inventory ... -

Page 93

INDEX TO EXHIBITS Exhibit Number Description 12.1 21.1 23.1 31.1 31.2 32.1 32.2 Statement of Computation of Ratio of Earnings to Fixed Charges Subsidiaries of the Registrant Consent of Deloitte & Touche LLP Certification of Chief Executive Officer pursuant to Section 302 (a) of the Sarbanesâˆ'... -

Page 94

Exhibit 12.1 PMCâˆ'SIERRA, INC. COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES (Unaudited) Year Ended December 31 (2) 2001 2003 2002 2000 1999 Earnings: Income (loss) before income taxes and before income from equity investees Fixed charges: Interest expense and amortization of debt issuance... -

Page 95

...the United Kingdom, doing business only under its official name or under PMCâˆ'Sierra, Inc. 4. PMCâˆ'Sierra Ireland Limited, organized under the laws of the Ireland, doing business only under its official name or under PMCâˆ'Sierra, Inc. 5. PMCâˆ'Sierra US, Inc., organized under the laws of Delaware... -

Page 96

... the change in method of accounting for goodwill in accordance with Statement of Financial Accounting Standards No. 142), appearing in this Annual Report on Form 10âˆ'K of PMCâˆ'Sierra, Inc. for the year ended December 28, 2003. /s/ Deloitte & Touche LLP Vancouver, British Columbia, Canada March 10... -

Page 97

... certify that: 1. I have reviewed this annual report on Form 10âˆ'K of PMCâˆ'Sierra, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which... -

Page 98

... CERTIFICATION I, Alan F. Krock, certify that: 1. I have reviewed this annual report on Form 10âˆ'K of PMCâˆ'Sierra, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light... -

Page 99

Exhibit 32.1 CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT TO 18 U.S.C. SECTION 1350 AS...in my capacity as an officer of PMCâˆ'Sierra, Inc. ("PMC"), that, to my knowledge, the Annual Report of PMC on Form 10âˆ'K for the annual period ended December 28, 2003, fully complies with the requirements of... -

Page 100

... of the Sarbanesâˆ'Oxley Act of 2002, in my capacity as an officer of PMCâˆ'Sierra, Inc. ("PMC"), that, to my knowledge, the Annual Report of PMC on Form 10âˆ'K for the annual period ended December 28, 2003, fully complies with the requirements of Section 13 (a) or 15(d) of the Securities Exchange...