Aarons 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2010 | Our 55th Year

Ready for the Future.

Reflecting on the Past.

Table of contents

-

Page 1

Ready for the Future. Reï¬,ecting on the Past. Annual Report 2010 | Our 55th Year -

Page 2

-

Page 3

-

Page 4

..., quality merchandise and superior service. The Company's strategic focus is on growing the sales and lease ownership business through the addition of new Companyoperated stores by both internal expansion and acquisitions, as well as through its successful and expanding franchise program. Financial... -

Page 5

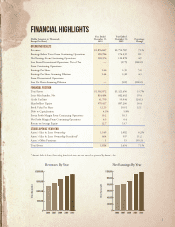

... Operations Return on Average Equity Stores Open at Year-end Aaron's Sales & Lease Ownership Aaron's Sales & Lease Ownership Franchised* Aaron's Office Furniture Total Stores * Aaron's Sales & Lease Ownership franchised stores are not owned or operated by Aaron's, Inc. Revenues By Year $2,000... -

Page 6

...table for a number of years. At the end of the year, there was one store open to liquidate remaining merchandise. The closure of this division resulted in charges to operating expenses during the year of approximately $.07 per diluted share. During 2010, Aaron's opened 91 new Companyoperated stores... -

Page 7

..., you know we are doing something right. The Company did more than weather the recent recession - Aaron's increased earnings and market share and added customers. Aaron's provides desired and needed basic home furnishings, and our customers' demand for these products remains strong. In reï¬,ecting... -

Page 8

... hard work, attention to detail and customer service. The Company's ï¬rst transaction was the rental of 300 folding chairs for an estate sale in Atlanta. We made $90 on that deal. In the early years, we nearly drowned in an ocean of opportunity. At ï¬rst, the notion of inventory that could go out... -

Page 9

...with annual revenues of more than $80 million. We grew through acquisitions as well as developing our own store locations. As the rental industry changed, the Company developed the sales and lease ownership model, which is the foundation of our business today. As a boy in working-class Atlanta, what... -

Page 10

...: Early in our corporate history, our typical customer was a renter looking for temporary furnishings. At the time, there were dozens of home furnishings retailers across the country catering to the middle class. Most of those home furnishings chains have gone out of business while Aaron's has grown... -

Page 11

... of sports teams such as the University of Alabama, University of Texas and Georgia Tech athletic programs, the Atlanta Thrashers One of our marketing themes - "Aaron's Drives Dreams Home"- says it all. We are in the business of furnishing homes. - William K. Butler, Jr., Chief Operating Officer 7 -

Page 12

Company-Operated Sales and Lease Ownership Store Revenues Other 3% Computers 13% Electronics 37% Furniture 31% Appliances 16% 8 -

Page 13

... your numbers say you are." We track agreements and lease payments daily, weekly and monthly. Each store's manager is responsible for the leases originating in his store. That manager is responsible for those customers - their satisfaction and their service. At corporate, we try to source the best... -

Page 14

... team. A number of our top executives have been with Aaron's for many, many years. That says a great deal about the character of our culture and the talent and loyalty of our management. For many years, we were a rental company and Aaron Rents was our trade name. Our customer today wants to own home... -

Page 15

...ï¬table expansion. We entered the Canadian market through franchise arrangements a number of years ago and are studying other markets. The management team also continuously reviews potential opportunities in the United States and opened three HomeSmart stores as a pilot project several months ago... -

Page 16

... 55 years. Our business model has evolved, adjusted and is now tested and solid. A greater portion than ever of American households makes for potential customers. We have a highly respected brand name and image, a commitment to customer service and the ï¬nancial and human resources to pursue market... -

Page 17

... Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Management Report on Internal Control Over Financial Reporting Report of Independent Registered Public Accounting Firm on Financial Statements Report of Independent Registered Public Accounting Firm on Internal Control... -

Page 18

...102 224,489 33,626 14,358 1,228,447 Financial Position Lease Merchandise, Net Property, Plant and Equipment, Net Total Assets Debt Shareholders' Equity At Year End Stores Open: Company-Operated Franchised Lease Agreements in Effect Number of Employees 1,150 664 1,325,000 10,400 1,097 597 1,171,000... -

Page 19

...revenues and fees include all revenues derived from lease agreements from our stores, including agreements that result in our customers acquiring ownership at the end of the term. Retail sales represent sales of both new and lease return merchandise from our stores. Non-retail sales mainly represent... -

Page 20

... 2010. INSURANCE PROGRAMS. Aaron's maintains insurance contracts depreciates merchandise over the applicable agreement period, generally 12 to 24 months when leased, and 36 months when not leased, to 0% salvage value. Our office furniture stores depreciate merchandise over its estimated useful life... -

Page 21

... than the carrying value of the deferred tax asset. Results of Operations Year Ended December 31, 2010 Versus Year Ended December 31, 2009 The Aaron's Corporate Furnishings division is reflected as a discontinued operation for all periods presented. The following table shows key selected financial... -

Page 22

...total revenues, operating expenses were 44.0% for both the year ended December 31, 2010, and 2009. We began ceasing the operations of the Aaron's Office Furniture division in June 2010. We closed 14 Aaron's Office Furniture stores during 2010 and had one remaining store open to liquidate merchandise... -

Page 23

... to our sales and lease ownership division, which had an 8.1% increase in same store revenues during the 24-month period ended December 31, 2009 and added a net 68 company-operated stores since the beginning of 2008. The 6.0% increase in non-retail sales (which mainly represents merchandise sold to... -

Page 24

... result of continued revenue growth of new and existing company-operated stores, partially offset by lower product costs. PROPERTY, PLANT AND EQUIPMENT, NET. The decrease of Liquidity and Capital Resources General Cash flows from continuing operations for the year ended December 31, 2010 and 2009... -

Page 25

... from the sale of the Aaron's Corporate Furnishings division shown under investing activities were $76.4 million. Our cash flows include profits on the sale of lease return merchandise. Our primary capital requirements consist of buying lease merchandise for sales and lease ownership stores. As we... -

Page 26

... provided additional cash flow from operations. Because of our sales and lease ownership model where Aaron's remains the owner of merchandise on lease, we benefit more from bonus depreciation, relatively, than traditional furniture, electronics and appliance retailers. In future years, we anticipate... -

Page 27

... to certain advertising and marketing programs. Purchase orders or contracts for the purchase of lease merchandise and other goods and services are not included in the tables above. We are not able to determine the aggregate amount of such purchase orders that represent contractual obligations, as... -

Page 28

...' Equity: Accounts Payable and Accrued Expenses Deferred Income Taxes Payable Customer Deposits and Advance Payments Credit Facilities Total Liabilities Shareholders' Equity: Common Stock, Par Value $.50 Per Share; Authorized: 225,000,000 and 125,000,000 Shares at December 31, 2010 and 2009... -

Page 29

Consolidated Statements of Earnings Year Ended December 31, 2010 Year Ended December 31, 2009 Year Ended December 31, 2008 (In Thousands, Except Per Share) Revenues: Lease Revenues and Fees Retail Sales Non-Retail Sales Franchise Royalties and Fees Other $1,402,053 40,556 362,273 59,112 12,853 1,... -

Page 30

Consolidated Statements of Shareholders' Equity Accumulated Other Comprehensive (Loss) Income Foreign Retained Comprehensive Currency Marketable Earnings Income Translation Securities (In Thousands, Except Per Share) Treasury Stock Shares Amount Common Stock Additional Paid-In Capital Balance, ... -

Page 31

... of Businesses and Contracts Proceeds from Dispositions of Businesses and Contracts Proceeds from Sale of Property, Plant, and Equipment Cash Used by Investing Activities Financing Activities: Proceeds from Credit Facilities Repayments on Credit Facilities Dividends Paid Excess Tax Benefits from... -

Page 32

...ranges from 24 months to 48 months, net of salvage value, which ranges from 0% to 30%. The Company's policies require weekly lease merchandise counts by Note 28 A Summary of Significant Accounting Policies As of December 31, 2010 and 2009, and for the Years Ended December 31, 2010, 2009 and 2008... -

Page 33

... represents tions of the Aaron's Office Furniture division in June 2010. The Company closed 14 of its Aaron's Office Furniture stores during 2010 and had one remaining store open to liquidate merchandise. As a result, the Company recorded $3.3 million in closed-store reserves, $4.7 million in lease... -

Page 34

... of the Company's cash and cash equivalents, accounts receivable and accounts payable approximate their carrying amounts due to their short-term nature. DEFERRED INCOME TAXES - Deferred income taxes represent the month due are recorded as deferred lease revenue. Until all payments are received... -

Page 35

..., 2009 and 2008, respectively. Capital leases consist of buildings and improvements. Earnings per share is computed by dividing net earnings by the weighted average number of shares of Common Stock outstanding during the year for the year ended December 31, 2010 and Nonvoting Common Stock and Class... -

Page 36

... 31, 2010, the fair value of fixed-rate long-term debt approximated its carrying value. The fair value of debt is estimated using valuation techniques that consider risk-free borrowing rates and credit risk. CAPITAL LEASES WITH RELATED PARTIES - In October (In Thousands) 2011 2012 2013 2014 2015... -

Page 37

... the lease term. The Company also leases transportation and computer equipment under operating leases expiring during the next five years. Management expects that most leases will be renewed or replaced by other leases in the normal course of business. Future minimum lease payments required under... -

Page 38

... Company is currently a party to the following proceeding: In Kunstmann et al v. Aaron Rents, Inc. originally filed with the United States District Court, Northern District of Alabama (the "court") on October 28, 2008, plaintiffs alleged that the Company improperly classified store general managers... -

Page 39

... there is an approved plan to increase the dividend in the near term. Shares are issued from the Company's treasury shares upon share option exercises. The results of operations for the year ended December 31, 2010, 2009 and 2008 include $3.2 million, $2.4 million and $1.4 million, respectively, in... -

Page 40

... per location are satisfied, generally at the date of the store opening. Franchise fees and area development fees are received before the substantial completion of the Company's obligations and deferred. Substantially all of the amounts reported as non-retail sales and non-retail cost of sales in... -

Page 41

... 2008, the Company sold its corporate furnishings division. The sales and lease ownership division offers electronics, residential furniture, appliances and computers to consumers primarily on a monthly payment basis with no credit requirements. The Company's franchise operation sells and supports... -

Page 42

... of each year. Interest is then allocated to operating segments based on relative total assets. Revenues in the "Other" category are primarily revenues of the Aaron's Office Furniture division, from leasing space to unrelated third parties in the corporate headquarters building and revenues from... -

Page 43

...) Year Ended December 31, 2010 Year Ended December 31, 2009 Year Ended December 31, 2008 Revenues From External Customers: Sales and Lease Ownership Franchise Other Manufacturing Revenues of Reportable Segments Elimination of Intersegment Revenues Cash to Accrual Adjustments Total Revenues from... -

Page 44

... also paid $22,000 for team decals, apparel and driver travel to corporate promotional events. The sponsorship agreement expired at the end of the year and was not renewed. Motor sports promotions and sponsorships are an integral part of the Company's marketing programs. In the second quarter of... -

Page 45

... business of leasing and selling residential furniture, electronics, appliances, housewares and accessories. The Company consummated the sale of the Aaron's Corporate Furnishings division in the fourth quarter of 2008. The consideration for the assets consisted of $72 million in cash plus payments... -

Page 46

... and their cash flows for each of the three years in the period ended December 31, 2010, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Aaron's, Inc. and... -

Page 47

... of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Aaron's, Inc. and subsidiaries as of December 31, 2010 and 2009 and the related consolidated statements of earnings, shareholders' equity and cash flows for each of the three years in the period... -

Page 48

...is listed on the New York Stock Exchange under the symbol "AAN." The number of shareholders of record of the Company's Common Stock at February 24, 2011 was 282. The closing price for the Common Stock at February 23, 2011 was $23.18. The following table shows the range of high and low closing prices... -

Page 49

..., Northern Operations Aaron's Sales & Lease Ownership Division K. Todd Evans* Vice President, Franchising Marco A. Scalise Vice President, Customer Account Management Mitchell S. Paull* Senior Vice President, Merchandising and Logistics Aaron's Office Furniture Division Ronald M. Benedit... -

Page 50

... Investor Services Canton, Massachusetts General Counsel Kilpatrick Townsend & Stockton LLP Atlanta, Georgia Aaron's Canada, ULC 309 E. Paces Ferry Rd., N.E. Atlanta, Georgia 30305-2377 (404) 231-0011 Form 10-K Shareholders may obtain a copy of the Company's annual report on Form 10-K filed with... -

Page 51

-

Page 52

309 E. Paces Ferry Rd., N.E. Atlanta, Georgia 30305-2377 (404) 231-0011 www.aarons.com www.aaronsinc.com