AT&T Uverse 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 AT&T Uverse annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 AT&T Annual Report : :

75

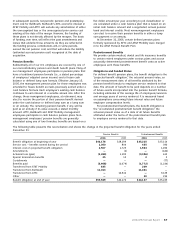

Goodwill and Other Intangible Assets

Changes in the carrying amounts of goodwill for the years ended December 31, 2006 and 2005 are as follows:

Wireline Wireless Directory Other

Segment Segment Segment Segment Total

Balance as of January 1, 2005 $ 724 $ — $ 8 $ 893 $ 1,625

Goodwill acquired 12,071 — — 370 12,441

Goodwill written off related to sale of business unit — — — (11) (11)

Balance as of December 31, 2005 12,795 — 8 1,252 14,055

Goodwill acquired 197 27,429 128 26,606 54,360

Goodwill adjustment related to ATTC acquisition (989) — — — (989)

Other — 155 — 76 231

Balance as of December 31, 2006 $12,003 $27,584 $136 $27,934 $67,657

Goodwill is tested annually for impairment, with any impairments being expensed in that period’s income statement. Goodwill

recorded in 2005 to our ATTC segment related to our November 2005 acquisition of ATTC was reallocated in 2006 primarily to

our wireline segment and was further reduced in 2006 by $976 upon completion of purchase accounting adjustments and by

$13 for the tax effect of stock options exercised (see Note 2). Goodwill recorded in 2006 to our wireless and other segments

primarily relates to our December 2006 acquisition of BellSouth and, as allowed by GAAP, is subject to adjustment for one-year

as we finalize the valuations of assets acquired and liabilities assumed in that transaction. As part of the final valuation we will

determine to which entities and to what extent the benefit of the acquisition applies, and will record the appropriate goodwill

to that entity, which may affect our segment presentation.

Our other intangible assets are summarized as follows:

December 31, 2006 December 31, 2005

Gross Carrying Accumulated Gross Carrying Accumulated

Other Intangible Assets Amount Amortization Amount Amortization

Amortized intangible assets:

Customer lists and relationships:

AT&T Mobility $ 9,530 $ 1,948 $ — $ —

BellSouth 9,230 — — —

ATTC 3,050 1,082 3,050 184

Other 395 253 380 213

Subtotal 22,205 3,283 3,430 397

Other 1,973 714 1,100 589

Total $24,178 $3,997 $4,530 $986

Indefinite life intangible assets not subject to amortization:

Licenses $34,252 $ 59

Trade name 5,307 4,900

Total $39,559 $4,959

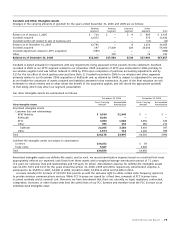

Amortized intangible assets are definite-life assets, and as such, we record amortization expense based on a method that most

appropriately reflects our expected cash flows from these assets with a weighted-average amortization period of 7.1 years

(7.2 years for customer lists and relationships and 5.8 years for other). Amortization expense for definite-life intangible assets

was $1,033, $271 and $117 for the years ended December 31, 2006, 2005 and 2004, respectively. Amortization expense is

estimated to be $5,870 in 2007, $4,190 in 2008, $3,340 in 2009, $2,550 in 2010 and $1,680 in 2011.

Licenses includes FCC licenses of $33,979 that provide us with the exclusive right to utilize certain radio frequency spectrum

to provide wireless communications services. While FCC licenses are issued for a fixed time, renewals of FCC licenses have

occurred routinely and at nominal cost. Moreover, we have determined that there are currently no legal, regulatory, contractual,

competitive, economic or other factors that limit the useful lives of our FCC licenses and therefore treat the FCC licenses as an

indefinite-lived intangible asset.