ADP 2011 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2011 ADP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We may be unable to attract and retain qualified personnel

Our ability to grow and provide our clients with competitive services is partially dependent on our ability to attract and retain

highly motivated people with the skills to serve our clients. Competition for skilled employees in the outsourcing and other markets

in which we operate is intense and if we are unable to attract and retain highly skilled and motivated personnel, results from our

operations may suffer.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

ADP owns 13 of its processing/print centers, and 26 other operational offices, sales offices and its corporate headquarters

complex in Roseland, New Jersey, which aggregate approximately 3,912,205 square feet. None of ADP

’

s owned facilities is subject to

any material encumbrances. ADP leases space for some of its processing centers, other operational offices and sales offices. All of

these leases, which aggregate approximately 5,833,131 square feet in North America, Europe, South America (primarily Brazil), Asia,

Australia and Africa, expire at various times up to the year 2036. ADP believes its facilities are currently adequate for their intended

purposes and are adequately maintained.

Item 3. Legal Proceedings

In the normal course of business, the Company is subject to various claims and litigation. While the outcome of any litigation is

inherently unpredictable, the Company believes it has valid defenses with respect to the legal matters pending against it and the

Company believes that the ultimate resolution of these matters will not have a material adverse impact on its financial condition,

results of operations or cash flows.

Part II

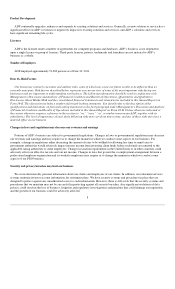

Item 5. Market for the Registrant

’

s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market for the Registrant

’

s Common Equity

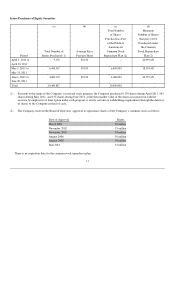

The principal market for the Company

’

s common stock (symbol: ADP) is the NASDAQ Global Select Market. The following table

sets forth the reported high and low sales prices of the Company

’

s common stock reported on the NASDAQ Global Select Market

and the cash dividends per share of common stock declared, during the past two fiscal years. As of June 30, 2011, there were 43,453

holders of record of the Company

’

s common stock. As of such date, 352,759 additional holders held their common stock in “street

name.”

10

Price Per Share

Dividends

High

Low

Per Share

Fiscal 2011 quarter ended:

June 30

$

55.12

$

50.82

$

0.360

March 31

$

51.50

$

46.73

$

0.360

December 31

$

47.17

$

41.50

$

0.360

September 30

$

42.72

$

38.41

$

0.340

Fiscal 2010 quarter ended:

June 30

$

45.74

$

39.27

*

$

0.340

March 31

$

45.22

$

39.72

$

0.340

December 31

$

44.50

$

38.51

$

0.340

September 30

$

40.44

$

33.26

$

0.330

*

Excludes trading on May 6, 2010, during which a low sales price of $26.46 was reported.