iHeartMedia 2012 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2012 iHeartMedia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5

Internet-based media, mobile applications and satellite-based digital radio services. Such services reach national and local audiences

with multi-channel, multi-format, digital radio services.

Our broadcast radio stations compete for listeners primarily on the basis of program content that appeals to a particular

demographic group. Our targeted listener base of specific demographic groups in each of our markets allows us to attract advertisers

seeking to reach those listeners.

Americas Outdoor Advertising

We are the largest outdoor advertising company in North America (based on revenues), which includes the United States and

Canada. Approximately 95% of our revenue in our Americas outdoor advertising segment was derived from the United States in each

of the years ended December 31, 2012, 2011 and 2010. We own or operate approximately 108,000 display structures in our Americas

outdoor segment with operations in 48 of the 50 largest markets in the United States, including all of the 20 largest markets.

Our Americas outdoor assets consist of traditional and digital billboards, street furniture and transit displays, airport displays,

mall displays, and wallscapes and other spectaculars, which we own or operate under lease management agreements. Our Americas

outdoor advertising business is focused on metropolitan areas with dense populations.

Strategy

We seek to capitalize on our Americas outdoor network and diversified product mix to maximize revenue. In addition, by

sharing best practices among our business segments, we believe we can quickly and effectively replicate our successes in our other

markets. Our outdoor strategy focuses on leveraging our diversified product mix and long-standing presence in many of our existing

markets, which provides us with the ability to launch new products and test new initiatives in a reliable and cost-effective manner.

Promote Outdoor Media Spending. Given the attractive industry fundamentals of outdoor media and our depth and breadth

of relationships with both local and national advertisers, we believe we can drive outdoor advertising's share of total media spending

by using our dedicated national sales team to highlight the value of outdoor advertising relative to other media. Outdoor advertising

only represented 3% of total dollars spent on advertising in the United States in 2011. We have made and continue to make significant

investments in research tools that enable our clients to better understand how our displays can successfully reach their target audiences

and promote their advertising campaigns. Also, we are working closely with clients, advertising agencies and other diversified media

companies to develop more sophisticated systems that will provide improved audience metrics for outdoor advertising. For example,

we have implemented the TAB Out of Home Ratings audience measurement system which: (1) separately reports audiences for

billboards, posters, junior posters, transit shelters and phone kiosks, (2) reports for geographically sensitive reach and frequency,

(3) provides granular detail, reporting individual out of home units in over 200 designated market areas, (4) provides detailed

demographic data comparable to other media, and (5) provides true commercial ratings based on people who see the advertising.

Continue to Deploy Digital Displays. Digital outdoor advertising provides significant advantages over traditional outdoor

media. Our electronic displays are linked through centralized computer systems to instantaneously and simultaneously change

advertising copy on a large number of displays, allowing us to sell more advertising opportunities to advertisers. The ability to change

copy by time of day and quickly change messaging based on advertisers’ needs creates additional flexibility for our customers.

Although digital displays require more capital to construct compared to traditional bulletins, the advantages of digital allow us to

penetrate new accounts and categories of advertisers, as well as serve a broader set of needs for existing advertisers. Digital displays

allow for high-frequency, 24-hour advertising changes in high-traffic locations and allow us to offer our clients optimal flexibility,

distribution, circulation and visibility. We expect this trend to continue as we increase our quantity of digital inventory. As of

December 31, 2012, we have deployed more than 1,000 digital billboards in 37 markets in the United States.

Sources of Revenue

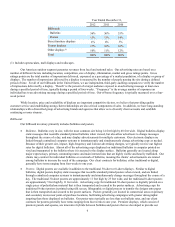

Americas outdoor generated 20%, 20% and 21% of our revenue in 2012, 2011 and 2010, respectively. Americas outdoor

revenue is derived from the sale of advertising copy placed on our traditional and digital displays. Our display inventory consists

primarily of billboards, street furniture displays and transit displays. The margins on our billboard contracts, including those related to

digital billboards, tend to be higher than those on contracts for other displays, due to their greater size, impact and location along

major roadways that are highly trafficked. Billboards comprise approximately two-thirds of our display revenues. The following

table shows the approximate percentage of revenue derived from each category for our Americas outdoor inventory: