iHeartMedia 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 iHeartMedia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Recent Developments

On November 16, 2006, we announced plans to sell 448 non-core radio stations and all of our television stations. As of February 13,

2008, we sold 217 non-core radio stations and were party to definitive purchase agreements to sell 28 non-core radio stations.

On April 20, 2007, we entered into a definitive agreement with an affiliate (“buyer”) of Providence Equity Partners Inc. (“Providence”)

to sell our television business. Subsequently, a representative of Providence informed us that the buyer is considering its options under the

definitive agreement, including not closing the acquisition on the terms and conditions in the definitive agreement. The definitive agreement is

in full force and effect, has not been terminated and contains customary closing conditions. There have been no allegations that we have

breached any of the terms or conditions of the definitive agreement or that there is a failure of a condition to closing the acquisition. On

November 29, 2007, the FCC issued its initial consent order approving the assignment of our television station licenses to the buyer.

On January 17, 2008, we entered into an agreement to sell our equity investment in Clear Channel Independent, an out-of-home

advertising company headquartered in South Africa with operations in Angola, Botswana, Lesotho, Malawi, Mauritius, Mozambique, Namibia,

South Africa, Swaziland, Tanzania, Uganda and Zambia. The closing of the transaction is subject to regulatory approval and other customary

closing conditions.

The sale of these assets is not a condition to the closing of the merger and is not contingent on the closing of the merger.

Operating Segments

We have three reportable business segments: Radio Broadcasting, Americas Outdoor Advertising and International Outdoor Advertising.

4

•

R

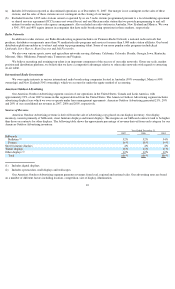

adio Broadcasting. As of December 31, 2007, we owned 717 core domestic radio stations, with 275 stations operating in the top 50

markets. Our portfolio of stations offers a broad assortment of programming formats, including adult contemporary, country,

contemporary hit radio, rock, urban and oldies, among others, to a total weekly listening base of over 93 million individuals based on

Arbitron National Regional Database figures for the Spring 2007 ratings period. In addition to our radio broadcasting business, we

operate a national radio network that produces, distributes or represents approximately 70 syndicated radio programs and services for

approximately 5,000 radio stations. Some of our more popular syndicated programs include Rush Limbaugh, Steve Harvey, Ryan

Seacrest and Jeff Foxworthy. We also own various sports, news and agriculture networks. In addition, we own 288 smaller market

non-core radio stations which we previously announced are being marketed for sale. Of these stations, 73 were under definitive asset

purchase agreements as of December 31, 2007. For the year ended December 31, 2007, Radio Broadcasting represented 50% of our

net revenue.

•

A

mericas Outdoor Advertising. Our Americas Outdoor Advertising, or Americas, business segment includes our operations in the

United States, Canada and Latin America. We own or operate approximately 209,000 displays in our Americas Outdoor Advertising

segment. Our outdoor assets consist of billboards, street furniture and transit displays, airport displays, mall displays, and wallscapes

and other spectaculars. We have operations in 49 of the top 50 markets in the United States, including all of the top 20 markets. For the

year ended December 31, 2007, Americas represented 21% of our net revenue.

•

I

nternational Outdoor Advertising. Our International Outdoor Advertising business segment includes our operations in Africa, Asia,

Australia and Europe. We own or operate approximately 687,000 displays in approximately 50 countries. Our international outdoor

assets consist of billboards, street furniture displays, transit displays and other out-of-home advertising displays. Subsequent to

December 31, 2007 we entered into an agreement to sell our operations in Africa. For the year ended December 31, 2007 International

represented 26% of our net revenue.

• Other. The Other category includes our media representation business, Katz Media, and general support services and initiatives which

are ancillary to our other businesses. Katz Media is a full-service media representation firm that sells national spot advertising time for

clients in the radio and television industries throughout the United States. Katz Media represents approximately 3,200 radio stations,

nearly one third of which are owned by us, and approximately 380 television stations, nearly one tenth of which are owned by us.

Our television operations include 56 stations, 18 of which are distributed as digital multicast stations. Our stations are affiliated with

various television networks including ABC, CBS, NBC and FOX. On April 20, 2007, we entered into a definitive agreement to sell all

of our television operations. Our television business is