iHeartMedia 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 iHeartMedia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

Commission File Number

1-9645

CLEAR CHANNEL COMMUNICATIONS, INC.

(Exact name of registrant as specified in its charter)

200 East Basse Road

San Antonio, Texas 78209

Telephone (210) 822-2828

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act: Common Stock, $.10 par value per share.

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. YES NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is an accelerated filer (as defined in Exchange Act Rule 12b-2). YES NO

On June 30, 2004, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the

Common Stock beneficially held by non-affiliates of the Company was approximately $17.3 billion. (For purposes hereof, directors, executive

officers and 10% or greater shareholders have been deemed affiliates).

On February 28, 2005, there were 560,711,385 outstanding shares of Common Stock, excluding 224,568 shares held in treasury.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our Definitive Proxy Statement for the 2005 Annual Meeting, expected to be filed within 120 days of our fiscal year end, are

incorporated by reference into Part III.

Annual re

p

ort

p

ursuant to Section 13 or 15(d) of the Securities Exchan

g

e Act of 1934

For the fiscal

y

ear ended December 31, 2004, or

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition

p

eriod from ___to ___.

Texas 74-1787539

(State of Incorporation) (I.R.S. Employer Identification No.)

Table of contents

-

Page 1

... ___. Commission File Number 1-9645 CLEAR CHANNEL COMMUNICATIONS, INC. (Exact name of registrant as specified in its charter) Texas (State of Incorporation) 74-1787539 (I.R.S. Employer Identification No.) 200 East Basse Road San Antonio, Texas 78209 Telephone (210) 822-2828 (Address, including zip... -

Page 2

...15. Directors and Executive Officers of the Registrant Executive Compensation Security Ownership of Certain Beneficial Owners and Management Certain Relationships and Related Transactions Principal Accountant Fees and Services Exhibits and Financial Statement Schedules 2 93 94 94 94 94 94 Market for... -

Page 3

... 1. Business The Company Clear Channel Communications, Inc. is a diversified media company with three reportable business segments: radio broadcasting, outdoor advertising and live entertainment. We were incorporated in Texas in 1974. As of December 31, 2004, we owned 1,189 domestic radio stations... -

Page 4

... the benefits of outdoor media and helping potential clients develop an advertising strategy using outdoor advertising. While price and availability are important competitive factors, service and customer relationships are also critical components of national and local sales. Advertising rates are... -

Page 5

...-service media representation firm that sells national spot advertising time for clients in the radio and television industries throughout the United States. As of December 31, 2004, Katz Media represented over 2,800 radio stations and 390 television stations. Katz Media generates revenues primarily... -

Page 6

... benefits, such as the use of otherwise vacant advertising space to cross promote our other media assets, or the sharing of on-air talent and news and information across our radio and televisions stations. To support our strategy, we have assembled a highly experienced corporate and local management... -

Page 7

... radio, television, newspaper, direct mail, cable, yellow pages, Internet, satellite radio and other forms of advertisement. We implement this strategy by acquiring additional displays in our existing markets, expanding into new domestic and international markets and helping our outdoor advertisers... -

Page 8

... in corporate related activities. In addition, our live entertainment operations hire approximately 28,000 seasonal employees during peak time periods. Operating Segments Our business consists of three reportable operating segments: radio broadcasting, outdoor advertising and live entertainment. The... -

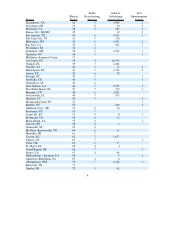

Page 9

...68 69 70 71 72 Radio Broadcasting Stations 4 8 5 6 7 6 3 4 5 5 4 7 4 3 6 5 5 4 7 7 6 7 5 6 7 8 6 4 8 6 6 7 7 7 6 4 7 9 4 7 5 9 Outdoor Advertising Display Faces 1,006 22 365 22 3,133 118 1,932 921 1,105 12,156 2,464 11 1,534 20 Live Entertainment Venues 2 3 1 2 1 1 2 1 1 1 2 1 1 2,757 193 2,052... -

Page 10

...94 95 96 97 98 99 100 101-150 151-200 201-250 251+ unranked n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a Radio Broadcasting Stations 5 2 6 5 6 7 6 4 6 6 5 5 6 Outdoor Advertising Display Faces 739 1,019 4 1,335 30 8 20 73 16 1,346 11 Live Entertainment Venues 6 5 6 4 4 6 4 4 459 385 24 656 12... -

Page 11

... in the above table. Radio Broadcasting In addition to the radio stations listed above, our radio broadcasting segment includes a national radio network that produces or distributes more than 100 syndicated radio programs and services for more than 5,000 radio stations including Rush Limbaugh, Fox... -

Page 12

... television stations are affiliated with various television networks, including ABC, CBS, NBC, FOX, UPN, WB, Telemundo and PAX. Media Representation We own the Katz Media Group, a full-service media representation firm that sells national spot advertising time for clients in the radio and television... -

Page 13

12 -

Page 14

... total number of radio stations in that market, as determined using a method prescribed by the FCC. In markets with 45 or more stations, one company may own, operate or control eight stations, with no more than five in any one service (AM or FM). In markets with 30-44 stations, one company may own... -

Page 15

... one or more radio or television stations in a market and programs more than 15% of the broadcast time on another station in the same service (radio or television) in the same market pursuant to an LMA is generally required to count the LMA station toward its media ownership limits even though it... -

Page 16

... weekly broadcast programming hours) or a same-market media owner (including broadcasters, cable operators, and newspapers). To the best of our knowledge at present, none of our officers, directors or five percent or greater stockholders holds an interest in another television station, radio station... -

Page 17

... a broadcast station, and limiting ownership of television and radio stations, in the same market. In place of those rules, the FCC adopted new "cross-media limits" that would apply to certain markets depending on the number of television stations in the relevant television DMA. These limits would... -

Page 18

... the laws of a foreign nation are barred from holding broadcast licenses. Non-U.S. citizens, collectively, may own or vote up to twenty percent of the capital stock of a corporate licensee. A broadcast license may not be granted to or held by any entity that is controlled, directly or indirectly, by... -

Page 19

... broadcasting. We cannot predict the impact of either satellite or terrestrial digital audio radio service on our business. Low Power FM Radio Service. In January 2000, the FCC created two new classes of noncommercial low power FM radio stations ("LPFM"). One class (LP100) is authorized to operate... -

Page 20

... in the mass communications industry, such as direct broadcast satellite service, the continued establishment of wireless cable systems and low power television stations, "streaming" of audio and video programming via the Internet, digital television and radio technologies, the establishment of... -

Page 21

... portion of our revenues from international radio broadcasting, outdoor advertising and live entertainment operations in countries around the world and a key element of our business strategy is to expand our international operations. The risks of doing business in foreign countries that could result... -

Page 22

The federal communications laws limit the number of broadcasting properties we may own in a particular area. While the Telecommunications Act of 1996 relaxed the FCC's multiple ownership limits, any subsequent modifications that tighten those limits could make it impossible for us to complete ... -

Page 23

... one or more of our broadcasting licenses. Antitrust Regulations May Limit Future Acquisitions Additional acquisitions by us of radio and television stations, outdoor advertising properties and live entertainment operations or entities may require antitrust review by federal antitrust agencies and... -

Page 24

... international broadcasting properties. Environmental, Health, Safety and Land Use Laws and Regulations May Limit or Restrict Some of Our Operations As the owner or operator of various real properties and facilities, especially in our outdoor advertising and live entertainment venue operations... -

Page 25

...ratings and advertising and sales revenues. Our radio stations and outdoor advertising properties compete for audiences and advertising revenues with other radio stations and outdoor advertising companies, as well as with other media, such as newspapers, magazines, television, direct mail, satellite... -

Page 26

... in overall revenues, the numbers of advertising customers, advertising fees, event attendance, ticket prices or profit margins include: • unfavorable economic conditions, both general and relative to the radio broadcasting, outdoor advertising, live entertainment and all related media industries... -

Page 27

... could limit our ability to generate revenues. In addition, we require access to venues to generate revenues from live entertainment events. We operate a number of our live entertainment venues under leasing or booking agreements. Our long-term success in the live entertainment business will... -

Page 28

... foot data and administrative service center. Operations Radio Broadcasting Certain radio executive corporate operations moved to our executive corporate headquarters in San Antonio, Texas during 2002. Previously, our radio operations were headquartered in 21,201 square feet of leased office space... -

Page 29

district. We own or have permanent easements on relatively few parcels of real property that serve as the sites for our outdoor displays. Our remaining outdoor display sites are leased. Our leases are for varying terms ranging from 26 -

Page 30

... used in our radio broadcasting, outdoor advertising and live entertainment businesses. As noted in Item 1 above, as of December 31, 2004, we owned 1,189 radio stations, owned or leased 823,580 outdoor advertising display faces and owned or operated 104 entertainment venues in various markets... -

Page 31

ITEM 4. Submission of Matters to a Vote of Security Holders. There were no matters submitted to a vote of security holders in the fourth quarter of fiscal year 2004. 28 -

Page 32

...and low sales prices of the common stock as reported on the NYSE. Common Stock Market Price High Low 2003 First Quarter Second Quarter Third Quarter Fourth Quarter 2004 First Quarter Second Quarter Third Quarter Fourth Quarter Dividend Policy Our Board of Directors declared a quarterly cash dividend... -

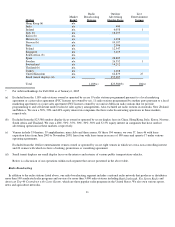

Page 33

... share data) Results of Operations Information: Revenue Operating Expenses: Divisional operating expenses Non-cash compensation expense Depreciation and amortization Corporate expenses Operating income (loss) Interest expense Gain (loss) on sale of assets related to mergers Gain (loss) on marketable... -

Page 34

...29,736,063 30,347,173 (1) Acquisitions and dispositions significantly impact the comparability of the historical consolidated financial data reflected in this schedule of Selected Financial Data. The Selected Financial Data should be read in conjunction with Management's Discussion and Analysis. 31 -

Page 35

... Our reportable operating segments are Radio Broadcasting, which includes our national syndication business, Outdoor Advertising and Live Entertainment. Included in the "other" segment are television broadcasting, sports representation and our media representation business, Katz Media. We manage our... -

Page 36

... in relation to the demographics of a particular market and its location within a market. Our outdoor advertising contracts are typically based on the number of months or weeks the advertisement is displayed. To monitor the health of our outdoor business, management reviews average rates, average... -

Page 37

... sales as well as the opportunity to sell sponsorships for venue naming rights and signage. To judge the health of our live entertainment business, management monitors the number of shows, average paid attendance, talent cost as a percent of revenue, sponsorship dollars and ticket revenues... -

Page 38

...revenues up for the year. International outdoor revenue grew on higher street furniture sales, driven by an increase in average revenue per display for 2004 as compared to 2003. International outdoor revenues also benefited from $128.6 million in foreign exchange fluctuations. Our live entertainment... -

Page 39

... an impairment charge on a radio technology investment for $7.0 million due to a decline in its market value that we considered to be other-than-temporary. Other Income (Expense) - Net The principal components of other income (expense) - net for the years ended December 31, 2004 and 2003 were: (In... -

Page 40

... occurred across the nation, fueled by growth in Los Angeles, New York, Miami, San Antonio, Seattle and Cleveland. The domestic advertising categories leading revenue growth remained consistent throughout the year, the largest being entertainment. Business and consumer services was also a strong... -

Page 41

... Operating Income (Loss) Years Ended December 31, 2004 2003 $ 1,431,881 $ 1,409,236 301,799 201,221 94,997 130,232 65,176 51,131 (219,423) (200,287) $ 1,674,430 $ 1,591,533 38 (In thousands) Radio Broadcasting Outdoor Advertising Live Entertainment Other Corporate Consolidated Operating Income -

Page 42

... our acquisition of Ackerley. In addition to foreign exchange and the six-month contribution from Ackerley, our outdoor advertising and live entertainment segments contributed $75.1 million and $84.9 million, respectively, to the divisional operating expenses increase. Our radio broadcasting segment... -

Page 43

... Univision for an aggregate sales price of $599.4 million, resulting in a pre-tax book gain of $47.0 million. Proceeds were used to pay down our domestic credit facilities. Other Income (Expense) - Net The principle components of other income (expense) - net for the years ended December 31, 2003 and... -

Page 44

... strongest top 50 markets during 2003 were New York, Los Angeles, Cleveland, Sacramento and Austin. Leading national advertising categories in 2003 were entertainment, finance, telecom/utility, retail and auto. In total, radio's divisional operating expenses were flat year over year. We saw declines... -

Page 45

... New York, San Francisco, Miami and Tampa and in smaller markets such as Albuquerque and Chattanooga. Top domestic advertising categories for us during 2003 were business and consumer services, entertainment and automotive. International revenue growth was spurred by our transit and street furniture... -

Page 46

... (In thousands) Radio Broadcasting Outdoor Advertising Live Entertainment Other Corporate Consolidated Operating Income LIQUIDITY AND CAPITAL RESOURCES Cash Flow Operating Activities Net cash flow from operating activities of $1.8 billion for the year ended December 31, 2004 principally reflects... -

Page 47

... 31, 2004, we had a multi-currency revolving credit facility in the amount of $1.75 billion. This facility can be used for general working capital purposes including commercial paper support as well as to fund capital expenditures, share repurchases, acquisitions and the refinancing of public debt... -

Page 48

... $57.2 million, respectively, primarily related to long-term operating contracts. The third parties' associated operating assets secure a substantial portion of these obligations. Sale of Investments On January 12, 2004, we sold our remaining investment in Univision Corporation for $599.4 million in... -

Page 49

....8 Additionally, on February 16, 2005, our Board of Directors declared a quarterly cash dividend of $0.125 per share of our Common Stock to be paid on April 15, 2005, to shareholders of record on March 31, 2005. Acquisitions During 2004, we acquired radio stations for $59.4 million in cash and $38... -

Page 50

... annual payment. Also, we have non-cancelable contracts in our entertainment operations related to minimum performance payments with artists as well as various other contracts in our radio broadcasting operations related to program rights and music license fees. In the normal course of business... -

Page 51

... countries in which we operate. As a result, our financial results could be affected by factors such as changes in foreign currency exchange rates or weak economic conditions in the foreign markets in which we have operations. To mitigate a portion of the exposure of international currency... -

Page 52

... net of deferred taxes of $3.0 billion, as a cumulative effect of a change in accounting principle during the fourth quarter of 2004. In December 2004 the Financial Accounting Standards Board, ("FASB") issued FASB Statement No. 153, Exchanges of Nonmonetary Assets, an amendment of APB Opinion No. 29... -

Page 53

... not yet been issued. We expect to adopt Statement 123(R) in the third quarter of 2005. As permitted by Statement 123, we currently account for share-based payments to employees using APB 25's intrinsic value method and, as such, generally recognize no compensation cost for employee stock options... -

Page 54

...lived assets such as FCC licenses are reviewed annually for possible impairment using the direct method. Under the direct method, it is assumed that rather than acquiring a radio station as a going concern business, the buyer hypothetically obtains a FCC license and builds a new station or operation... -

Page 55

... We review the value of these investments and record an impairment charge in the statement of operations for any decline in value that is determined to be other-than-temporary. Tax Accruals The Internal Revenue Service and other taxing authorities routinely examine our tax returns. From time to time... -

Page 56

... have offset these higher costs by increasing the effective advertising rates of most of our broadcasting stations and outdoor display faces. Ratio of Earnings to Fixed Charges The ratio of earnings to fixed charges is as follows: Year Ended December 31, 2002 3.62 2.62 2004 2.80 2003 2001 * 2000... -

Page 57

... public accounting firm has unrestricted access to the Board, without management present, to discuss the results of their audit and the quality of financial reporting and internal accounting controls. /s/Mark P. Mays President/Chief Executive Officer /s/Randall T. Mays Executive Vice President/Chief... -

Page 58

... sheets of Clear Channel Communications, Inc. and subsidiaries (the Company) as of December 31, 2004 and 2003, and the related consolidated statements of operations, changes in shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2004. These financial... -

Page 59

...and cash equivalents Accounts receivable, less allowance of $57,574 in 2004 and $56,586 in 2003 Prepaid expenses Other current assets Total Current Assets PROPERTY, PLANT AND EQUIPMENT Land, buildings and improvements Structures Towers, transmitters and studio equipment Furniture and other equipment... -

Page 60

LIABILITIES AND SHAREHOLDERS' EQUITY (In thousands, except share data) December 31, 2004 2003 CURRENT LIABILITIES Accounts payable and accrued expenses Accrued interest Accrued income taxes Current portion of long-term debt Deferred income Other current liabilities Total Current Liabilities Long-... -

Page 61

... Corporate expenses (excludes non-cash compensation expense of $3,690, $3,409 and $1,036 in 2004, 2003 and 2002, respectively) Operating income Interest expense Gain (loss) on sale of assets related to mergers Gain (loss) on marketable securities Equity in earnings of nonconsolidated affiliates... -

Page 62

... $ 12,373 Accumulated Other Comprehensive Income (Loss) $ (34,470) (In thousands, except share data) Balances at December 31, 2001 Net loss Common Stock and stock options issued for business acquisitions Conversion of Notes Exercise of stock options, common stock warrants and other Amortization and... -

Page 63

...on sale of assets related to mergers (Gain) loss on forward exchange contract (Gain) loss on trading securities Equity in earnings of nonconsolidated affiliates Increase (decrease) other, net Changes in operating assets and liabilities, net of effects of acquisitions: Decrease (increase) in accounts... -

Page 64

... Payments on long-term debt Proceeds from extinguishment of derivative agreement Proceeds from forward exchange contract Proceeds from exercise of stock options, stock purchase plan and common stock warrants Dividends paid Payments for purchase of common shares Net cash used in financing activities... -

Page 65

... Clear Channel Communications, Inc., incorporated in Texas in 1974, is a diversified media company with three principal business segments: radio broadcasting, outdoor advertising and live entertainment. The Company's radio broadcasting segment owns, programs and sells airtime generating revenue... -

Page 66

..."), which the Company adopted in the fourth quarter of 2004. Certain assumptions are used under the Company's direct valuation technique, including market penetration leading to revenue potential, profit margin, duration and profile of the build-up period, estimated start-up cost and losses incurred... -

Page 67

... have quoted market prices. The Company periodically reviews the value of available-for-sale, trading and non-marketable securities and records impairment charges in the statement of operations for any decline in value that is determined to be other-than-temporary. The average cost method is used to... -

Page 68

...the advertisements are broadcasted or displayed, or the event occurs for which the tickets are exchanged. Expenses are recorded ratably over a period that estimates when the merchandise, service received is utilized or the event occurs. Barter and trade revenues for the years ended December 31, 2004... -

Page 69

... quarter of 2005. As permitted by Statement 123, the Company currently accounts for share-based payments to employees using Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees ("APB 25") intrinsic value method and, as such, generally recognizes no compensation cost... -

Page 70

... and street furniture contracts and other contractual rights in the outdoor segment, talent and program right contracts in the radio segment, and in the Company's other segment, representation contracts for non-affiliated television stations, all of which are amortized over the respective lives of... -

Page 71

... not amortize its FCC broadcast licenses or billboard permits. The Company tests these indefinite-lived intangible assets for impairment at least annually. The following table presents the carrying amount for each major class of indefinite-lived intangible assets at December 31, 2004 and 2003: (In... -

Page 72

...02-07. The Company's key assumptions using the direct method are market revenue growth rates, market share, profit margin, duration and profile of the build-up period, estimated start-up capital costs and losses incurred during the build-up period, the risk-adjusted discount rate and terminal values... -

Page 73

... Company's live entertainment segment made cash payments of $2.8 million during the year ended December 31, 2003, primarily related to various earn-outs and deferred purchase price consideration on prior year acquisitions. Also, the Company's national representation business acquired new contracts... -

Page 74

..., nor is it indicative of future results of operations. Other In addition to the acquisition discussed above, during 2002 the Company acquired radio stations, outdoor display faces and certain music, racing events promotional and exhibition related assets. The aggregate cash and restricted cash paid... -

Page 75

...'s mergers in 2000 with SFX Entertainment, Inc. ("SFX") and AMFM Inc. ("AMFM"), the Company restructured the SFX and AMFM operations. The AMFM corporate offices in Dallas and Austin, Texas were closed on March 31, 2001 and a portion of the SFX corporate office in New York was closed on June 30, 2001... -

Page 76

...broadcasting company. ACIR owns and operates radio stations throughout Mexico. Clear Media The Company owns 48.1% of the total number of shares of Hainan White Horse Advertising Media Investment Co. Ltd. ("Clear Media"), formerly known as White Horse, a Chinese company that operates street furniture... -

Page 77

... on the statement of operations in "Gain (loss) on marketable securities" related to the exchange of the Company's HBC investment, which had been accounted for as an equity method investment, for Univision Communications Inc. shares, which were recorded as an available-for-sale cost investment. On... -

Page 78

...25% Debentures Due 2027 Original issue (discount) premium Fair value adjustments related to interest rate swaps Various subsidiary level notes Other long-term debt Less: current portion Total long-term debt Bank Credit Facility On July 13, 2004, the Company entered into a five-year, multi-currency... -

Page 79

... long-term bonds, of which are all 8% senior notes due 2008, was $685.1 million at December 31, 2004, which includes a purchase accounting premium of $13.8 million. Debt Covenants The Company's significant covenants on its $1.75 billion five-year, multi-currency revolving credit facility relate to... -

Page 80

... default upon a change in long-term debt ratings that would have a material impact to its financial statements. Additionally, the AMFM long-term bonds contain certain restrictive covenants that limit the ability of AMFM Operating Inc., a wholly-owned subsidiary of Clear Channel, to incur additional... -

Page 81

.... During the years ended December 31, 2004, 2003 and 2002, the Company recognized income of $15.2 million, $13.8 million and a loss of $11.9 million, respectively, in "Gain (loss) on marketable securities" related to the change in the fair value of the shares. Foreign Currency Rate Management As... -

Page 82

...guaranteed minimum annual payment. Also, the Company has non-cancelable contracts in its live entertainment operations related to minimum performance payments with various artists as well as various other contracts in its radio broadcasting operations related to program rights and music license fees... -

Page 83

... working capital needs. Subsidiary borrowings under this sub-limit are guaranteed by the Company. At December 31, 2004, this portion of the $1.75 billion credit facility's outstanding balance was $23.9 million, which is recorded in "Long-term debt" on the Company's financial statements. Within... -

Page 84

... the Company's various stock acquisitions. As discussed in Note B, in 2004 the Company adopted D-108, which resulted in the Company recording a non-cash charge of approximately $4.9 billion, net of deferred tax of $3.0 billion, related to its FCC licenses and permits. In accordance with Statement No... -

Page 85

... their acquisition by the Company. The utilization of the net operating loss carryforwards reduced current taxes payable and current tax expense as of and for the year ended December 31, 2004. As a result of the favorable resolution of certain tax contingencies, current tax expense includes benefits... -

Page 86

...options to purchase its common stock to employees and directors of the Company and its affiliates under various stock option plans at no less than the fair market value of the underlying stock on the date of grant. These options are granted for a term not exceeding ten years and are forfeited in the... -

Page 87

... the company's employee stock options are not traded on an exchange, employees can receive no value nor derive any benefit from holding stock options under these plans without an increase in the market price of Clear Channel stock. Such an increase in stock price would benefit all stockholders... -

Page 88

... the Company holds in Rabbi Trusts at December 31, 2004 and 2003, respectively, relating to a performance guarantee and the Company's non-qualified deferred compensation plan. During the year ended December 31, 2004, 51.6 million shares were retired from the Company's shares held in treasury account... -

Page 89

... stock warrants Convertible debt - 2.625% issued in 1998 Convertible debt - 1.5% issued in 1999 LYONS - 1998 issue Less: Anti-dilutive items Denominator for net income (loss) per common share - diluted Net income (loss) per common share: Income before cumulative effect of a change in accounting... -

Page 90

... 2004, 2003 and 2002, employees purchased 262,163, 266,978 and 319,817 shares at weighted average share prices of $32.05, $34.01 and $33.85, respectively. The Company offers a non-qualified deferred compensation plan for highly compensated executives allowing deferrals up to 50% of their annual... -

Page 91

... other comprehensive income (loss) As of December 31, 2004 2003 $ 138,831 185,113 (129,354) $ 194,590 $ 88,109 169,824 (63,527) $194,406 NOTE N - SEGMENT DATA The Company has three reportable operating segments - radio broadcasting, outdoor advertising and live entertainment. Revenue and expenses... -

Page 92

...) 2002 Revenue Divisional operating expenses Non-cash compensation Depreciation and amortization Corporate expenses Operating income (loss) Intersegment revenues Identifiable assets Capital expenditures Radio Broadcasting Outdoor Advertising Live Entertainment Other Corporate Eliminations... -

Page 93

...amortization Corporate expenses Operating income Interest expense Gain (loss)on marketable securities Equity in earnings of nonconsolidated affiliates Other income (expense) - net Income before income taxes and cumulative effect of a change in accounting principle Income tax (expense) benefit Income... -

Page 94

...The management of Clear Channel Communications Inc. (the "Company") is responsible for establishing and maintaining adequate internal control over financial reporting. The Company's internal control over financial reporting is a process designed under the supervision of the Company's Chief Executive... -

Page 95

... statements of operations, changes in shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2004 of Clear Channel Communications, Inc. and our report dated March 8, 2005 expressed an unqualified opinion thereon. /s/Ernst & Young LLP San Antonio, Texas... -

Page 96

...Clear Channel Outdoor Chief Executive Officer - Clear Channel International Chairman/Chief Executive Officer - Clear Channel Entertainment President - Clear Channel Television President/Chief Executive Officer - Clear Channel Radio Executive Vice President and Chief Legal Officer The officers named... -

Page 97

... - Clear Channel Television in January 2001. Prior thereto, he was the President, WKRC-TV, Cincinnati, OH for the remainder of the relevant five-year period. Mr. Hogan was appointed Chief Executive Officer of Clear Channel Radio in August 2002. Prior thereto he was Chief Operating Officer of Clear... -

Page 98

...following financial statement schedule for the years ended December 31, 2004, 2003 and 2002 and related report of independent auditors is filed as part of this report and should be read in conjunction with the consolidated financial statements. Schedule II Valuation and Qualifying Accounts All other... -

Page 99

...,338 $ 56,586 $ 57,574 Description Year ended December 31, 2002 Year ended December 31, 2003 Year ended December 31, 2004 Other $ 637(1) $ 838(2) $ 357(2) (1) (2) Allowance for accounts receivable acquired in acquisitions net of deletions related to dispositions. Foreign currency adjustments. 96 -

Page 100

... Year ended December 31, 2002 Year ended December 31, 2003 Year ended December 31, 2004 Deletions (2) $ 97,403 $ $ 5,995 60,672 Other (1 (1) (2) Related to allowance for net operating loss carryforwards and other deferred tax assets assumed in acquisitions. In 2002, 2003 and 2004, the Company... -

Page 101

... the Company's Registration Statement on Form S-1 (Reg. No. 33-289161) dated April 19, 1984). Senior Indenture dated October 1, 1997, by and between Clear Channel Communications, Inc. and The Bank of New York as Trustee (incorporated by reference to the exhibits to the Company's Quarterly Report on... -

Page 102

... Senior Indenture dated October 1, 1997, by and between Clear Channel Communications, Inc. and The Bank of New York as Trustee (incorporated by reference to the exhibits to Clear Channel's Annual Report on Form 10-K for the year ended December 31, 2002). Twelfth Supplemental Indenture dated March 17... -

Page 103

... Bank of New York, as Trustee (incorporated by reference to the exhibits to Clear Channel's Current Report on Form 8-K dated December 13, 2004). Clear Channel Communications, Inc. 1994 Incentive Stock Option Plan (incorporated by reference to the exhibits of the Company's Registration Statement on... -

Page 104

... Clear Channel's Annual Report on Form 10-K filed March 15, 2004). Statement re: Computation of Per Share Earnings. Statement re: Computation of Ratios. Subsidiaries of the Company. Consent of Ernst & Young LLP. Power of Attorney (included on signature page). Certification of Chief Executive Officer... -

Page 105

... of Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Report of Independent Registered Public Accounting Firm on Financial Statement Schedules - Ernst & Young LLP. The Company has not filed long-term debt instruments... -

Page 106

... Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on March 11, 2005. CLEAR CHANNEL COMMUNICATIONS, INC. By: /S/ Mark P. Mays Mark P. Mays President and Chief Executive Officer Power of Attorney Each person... -

Page 107

Name Title Date /S/ Phyllis Riggins Phyllis Riggins /S/ Theodore H. Strauss Theodore H. Strauss /S/ J.C. Watts J. C. Watts /S/ John H. Williams John H. Williams Director Director Director Director March 11, 2005 March 11, 2005 March 11, 2005 March 11, 2005 -

Page 108

... the Company's Registration Statement on Form S-1 (Reg. No. 33-289161) dated April 19, 1984). Senior Indenture dated October 1, 1997, by and between Clear Channel Communications, Inc. and The Bank of New York as Trustee (incorporated by reference to the exhibits to the Company's Quarterly Report on... -

Page 109

... Senior Indenture dated October 1, 1997, by and between Clear Channel Communications, Inc. and The Bank of New York as Trustee (incorporated by reference to the exhibits to Clear Channel's Annual Report on Form 10-K for the year ended December 31, 2002). Twelfth Supplemental Indenture dated March 17... -

Page 110

... Bank of New York, as Trustee (incorporated by reference to the exhibits to Clear Channel's Current Report on Form 8-K dated December 13, 2004). Clear Channel Communications, Inc. 1994 Incentive Stock Option Plan (incorporated by reference to the exhibits of the Company's Registration Statement on... -

Page 111

... Clear Channel's Annual Report on Form 10-K filed March 15, 2004). Statement re: Computation of Per Share Earnings. Statement re: Computation of Ratios. Subsidiaries of the Company. Consent of Ernst & Young LLP. Power of Attorney (included on signature page). Certification of Chief Executive Officer... -

Page 112

... of Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Report of Independent Registered Public Accounting Firm on Financial Statement Schedules - Ernst & Young LLP. The Company has not filed long-term debt instruments... -

Page 113

... AGREEMENT, dated effective as of March 10, 2005, by and between Clear Channel Communications, Inc., a Texas corporation (the "Company"), and L. Lowry Mays ("Executive"). WHEREAS, the Company and the Executive previously entered into that certain Employment Agreement dated as of October 1, 1999... -

Page 114

... be at the Company's principal executive offices in San Antonio, Texas. 5. Compensation and Related Matters. (a) Base Salary and Bonus. During the Employment Period, the Company shall pay Executive a base salary at the rate of not less than $350,000 per year ("Base Salary"). Executive's Base Salary... -

Page 115

...following terms and conditions: (A) except as provided below, the Options shall be granted under and subject to the Company's stock option plan; (B) the exercise price per share of each Option shall be equal to the last reported sale price of the Company's common stock on the New York Stock Exchange... -

Page 116

... statement or, if no such criteria are in force, as determined applying the listing standards of the New York Stock Exchange) at a meeting of the Board called and held for such purpose (after reasonable (but in no event less than thirty (30) days) notice to Executive and an opportunity for Executive... -

Page 117

... permitted to participate in other plans providing Executive with substantially equivalent benefits; (v) any refusal by the Company or any Affiliate to continue to permit Executive to engage in activities not directly related to the business of the Company which Executive was permitted to engage in... -

Page 118

... defined in paragraph (3)), or (E) Executive or any group of persons including Executive (or any entity controlled by Executive or any group of persons including Executive). (3) the approval by the shareholders of the Company of a merger, consolidation, share exchange or similar form of transaction... -

Page 119

...Good Reason: (i) within five (5) days following such termination, the Company shall pay to Executive (A) his Base Salary, Bonus and accrued vacation pay through the Date of Termination, as soon as practicable following the Date of Termination, and (B) a lump-sum cash payment equal to seven (7) times... -

Page 120

... to the Company's stock option plan, if available and to the extent that the Executive would be eligible for a grant thereunder; (2) the exercise price per share of the Termination Option shall be equal to the last reported sale price of the Company's common stock on the New York Stock Exchange (or... -

Page 121

... by (2) the number (rounded to four decimal places) computed by dividing: (x) the last reported sale price of the Company's common stock on the New York Stock Exchange (or such other principal trading market for the Company's common stock) at the close of the trading day immediately preceding the... -

Page 122

... shall be entitled to any other rights, compensation and/or benefits as may be due to Executive in accordance with the terms and provisions of any agreements, plans or programs of the Company. (c) Disability. During any period that Executive fails to perform his duties hereunder as a result of... -

Page 123

... may be, shall be entitled to any other rights, compensation and benefits as may be due to any such persons or estate in accordance with the terms and provisions of any agreements, plans or programs of the Company; and (iv) Executive's beneficiary, legal representatives or estate, as the case may... -

Page 124

...that is selected by Executive (the "Accounting Firm") which shall provide detailed supporting calculations both to the Company and Executive within fifteen (15) business days of the receipt of notice from the Company or Executive that there has been a Payment, or such earlier time as is requested by... -

Page 125

... for the benefit of the Company all trade secrets and confidential information, knowledge or data relating to the Company and its businesses and investments, which shall have been obtained by Executive during Executive's employment by the Company and which is not generally available public knowledge... -

Page 126

... at the request of the Company or any subsidiary as a trustee, director, officer, member, employee or agent of another corporation or a partnership, joint venture, trust or other enterprise, including, without limitation, service with respect to employee benefit plans, whether or not the basis... -

Page 127

...a claim or request under this Agreement is not paid by the Company or on its behalf, within thirty (30) days after a written claim or request has been received by the Company, Executive may at any time thereafter bring suit against the Company to recover the unpaid amount of the claim or request and... -

Page 128

... to the extent any such person succeeds to Executive's interests under this Agreement. Executive shall be entitled to select and change a beneficiary or beneficiaries to receive any benefit or compensation payable hereunder following Executive's death by giving the Company written notice thereof. In... -

Page 129

..., addressed as follows: If to Executive: L. Lowry Mays 200 East Basse Road San Antonio, Texas 78209 If to the Company: Clear Channel Communications, Inc. 200 East Basse Road San Antonio, Texas 78209 Attention: Chief Executive Officer and Clear Channel Communications, Inc. 200 East Basse Road San... -

Page 130

...17. Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original but all of which together will constitute... communications, representations or warranties, whether oral or written, by any officer, employee or representative of any party ... -

Page 131

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written. CLEAR CHANNEL COMMUNICATIONS, INC. By: /s/ JOHN H. WILLIAMS Name: John H. Williams Title: Chairman of the Compensation Committee /s/ L. LOWRY MAYS L. Lowry Mays 19 -

Page 132

... by either party in accordance with Section 6 of this Agreement. 3. Position and Duties. During the Employment Period, Executive shall serve as President and Chief Executive Officer of the Company, and shall report solely and directly to the Company's Chairman and the Board of Directors of the... -

Page 133

... be at the Company's principal executive offices in San Antonio, Texas. 5. Compensation and Related Matters. (a) Base Salary and Bonus. During the Employment Period, the Company shall pay Executive a base salary at the rate of not less than $350,000 per year ("Base Salary"). Executive's Base Salary... -

Page 134

...following terms and conditions: (A) except as provided below, the Options shall be granted under and subject to the Company's stock option plan; (B) the exercise price per share of each Option shall be equal to the last reported sale price of the Company's common stock on the New York Stock Exchange... -

Page 135

... statement or, if no such criteria are in force, as determined applying the listing standards of the New York Stock Exchange) at a meeting of the Board called and held for such purpose (after reasonable (but in no event less than thirty (30) days) notice to Executive and an opportunity for Executive... -

Page 136

...executive offices or Executive's own office location to a location more than fifteen (15) miles from their location immediately prior to the date hereof; (iv) the failure of the Company or any Affiliate to continue in effect any material employee benefit plan, compensation plan, welfare benefit plan... -

Page 137

... the Board shall be an Incumbent Director; (2) any "person" (as such term is defined in Section 3(a)(9) of the Securities Exchange Act of 1934 (the "Exchange Act") and as used in Sections 13(d)(3) and 14(d)(2) of the Exchange Act) is or becomes, after the Commencement Date, a "beneficial owner" (as... -

Page 138

... prior to any such Business Transaction, and (ii) no person (other than the persons set forth in clauses (A), (B), or (C) of paragraph (2) above or any tax-qualified, broad-based employee benefit plan of the Surviving Corporation or its Affiliates) beneficially owns, directly or indirectly, 20% or... -

Page 139

... be granted under and subject to the Company's stock option plan, if available and to the extent that the Executive would be eligible for a grant thereunder; (2) the exercise price per share of the Termination Option shall be equal to the last reported sale price of the Company's common stock on 8 -

Page 140

... by (2) the number (rounded to four decimal places) computed by dividing: (x) the last reported sale price of the Company's common stock on the New York Stock Exchange (or such other principal trading market for the Company's common stock) at the close of the trading day immediately preceding the... -

Page 141

... reasonable expenses incurred, but not paid prior to such termination of employment; and (iii) Executive shall be entitled to any other rights, compensation and/or benefits as may be due to Executive in accordance with the terms and provisions of any agreements, plans or programs of the Company. 10 -

Page 142

... may be, shall be entitled to any other rights, compensation and benefits as may be due to any such persons or estate in accordance with the terms and provisions of any agreements, plans or programs of the Company; and (iv) Executive's beneficiary, legal representatives or estate, as the case may... -

Page 143

...that is selected by Executive (the "Accounting Firm") which shall provide detailed supporting calculations both to the Company and Executive within fifteen (15) business days of the receipt of notice from the Company or Executive that there has been a Payment, or such earlier time as is requested by... -

Page 144

... for the benefit of the Company all trade secrets and confidential information, knowledge or data relating to the Company and its businesses and investments, which shall have been obtained by Executive during Executive's employment by the Company and which is not generally available public knowledge... -

Page 145

... at the request of the Company or any subsidiary as a trustee, director, officer, member, employee or agent of another corporation or a partnership, joint venture, trust or other enterprise, including, without limitation, service with respect to employee benefit plans, whether or not the basis... -

Page 146

... shall continue as to Executive even if Executive has ceased to be an officer, director, trustee or agent, or is no longer employed by the Company and shall inure to the benefit of his heirs, executors and administrators. (b) Expenses. As used in this Agreement, the term "Expenses" shall include... -

Page 147

.... As used in this Agreement, "Company" shall mean the Company as herein before defined and any successor to its business and/or assets (by merger, purchase or otherwise) which executes and delivers the agreement provided for in this Section 13 or which otherwise becomes bound by all the terms and... -

Page 148

... either personally or by United States certified or registered mail, return receipt requested, postage prepaid, addressed as follows: If to Executive: Mark Mays 200 East Basse Road San Antonio, Texas 78209 If to the Company: Clear Channel Communications, Inc. 200 East Basse Road San Antonio, Texas... -

Page 149

... is agreed to in writing signed by Executive and by a duly authorized officer of the Company, and such waiver is set forth in writing and signed by the party to be charged. No waiver by either party hereto at any time of any breach by the other party hereto of any condition or provision of this... -

Page 150

IN WITNESS WHEREOF, the parties hereto have executed this Agreement effective as of the date first above written. CLEAR CHANNEL COMMUNICATIONS, INC. By: /s/ JOHN H. WILLIAMS Name: John H. Williams Title: Chairman of the Compensation Committee /s/ MARK MAYS Mark Mays 19 -

Page 151

... AGREEMENT, dated effective as of March 10, 2005, by and between Clear Channel Communications, Inc., a Texas corporation (the "Company"), and Randall Mays ("Executive"). WHEREAS, the Company and the Executive previously entered into that certain Employment Agreement dated as of October 1, 1999... -

Page 152

... be at the Company's principal executive offices in San Antonio, Texas. 5. Compensation and Related Matters. (a) Base Salary and Bonus. During the Employment Period, the Company shall pay Executive a base salary at the rate of not less than $325,000 per year ("Base Salary"). Executive's Base Salary... -

Page 153

...following terms and conditions: (A) except as provided below, the Options shall be granted under and subject to the Company's stock option plan; (B) the exercise price per share of each Option shall be equal to the last reported sale price of the Company's common stock on the New York Stock Exchange... -

Page 154

... statement or, if no such criteria are in force, as determined applying the listing standards of the New York Stock Exchange) at a meeting of the Board called and held for such purpose (after reasonable (but in no event less than thirty (30) days) notice to Executive and an opportunity for Executive... -

Page 155

...executive offices or Executive's own office location to a location more than fifteen (15) miles from their location immediately prior to the date hereof; (iv) the failure of the Company or any Affiliate to continue in effect any material employee benefit plan, compensation plan, welfare benefit plan... -

Page 156

... the Board shall be an Incumbent Director; (2) any "person" (as such term is defined in Section 3(a)(9) of the Securities Exchange Act of 1934 (the "Exchange Act") and as used in Sections 13(d)(3) and 14(d)(2) of the Exchange Act) is or becomes, after the Commencement Date, a "beneficial owner" (as... -

Page 157

... prior to any such Business Transaction, and (ii) no person (other than the persons set forth in clauses (A), (B), or (C) of paragraph (2) above or any tax-qualified, broad-based employee benefit plan of the Surviving Corporation or its Affiliates) beneficially owns, directly or indirectly, 20% or... -

Page 158

... to the Company's stock option plan, if available and to the extent that the Executive would be eligible for a grant thereunder; (2) the exercise price per share of the Termination Option shall be equal to the last reported sale price of the Company's common stock on the New York Stock Exchange (or... -

Page 159

... by (2) the number (rounded to four decimal places) computed by dividing: (x) the last reported sale price of the Company's common stock on the New York Stock Exchange (or such other principal trading market for the Company's common stock) at the close of the trading day immediately preceding the... -

Page 160

... shall be entitled to any other rights, compensation and/or benefits as may be due to Executive in accordance with the terms and provisions of any agreements, plans or programs of the Company. (c) Disability. During any period that Executive fails to perform his duties hereunder as a result of... -

Page 161

... may be, shall be entitled to any other rights, compensation and benefits as may be due to any such persons or estate in accordance with the terms and provisions of any agreements, plans or programs of the Company; and (iv) Executive's beneficiary, legal representatives or estate, as the case may... -

Page 162

...that is selected by Executive (the "Accounting Firm") which shall provide detailed supporting calculations both to the Company and Executive within fifteen (15) business days of the receipt of notice from the Company or Executive that there has been a Payment, or such earlier time as is requested by... -

Page 163

... for the benefit of the Company all trade secrets and confidential information, knowledge or data relating to the Company and its businesses and investments, which shall have been obtained by Executive during Executive's employment by the Company and which is not generally available public knowledge... -

Page 164

... at the request of the Company or any subsidiary as a trustee, director, officer, member, employee or agent of another corporation or a partnership, joint venture, trust or other enterprise, including, without limitation, service with respect to employee benefit plans, whether or not the basis... -

Page 165

...a claim or request under this Agreement is not paid by the Company or on its behalf, within thirty (30) days after a written claim or request has been received by the Company, Executive may at any time thereafter bring suit against the Company to recover the unpaid amount of the claim or request and... -

Page 166

... to the extent any such person succeeds to Executive's interests under this Agreement. Executive shall be entitled to select and change a beneficiary or beneficiaries to receive any benefit or compensation payable hereunder following Executive's death by giving the Company written notice thereof. In... -

Page 167

..., addressed as follows: If to Executive: Randall Mays 200 East Basse Road San Antonio, Texas 78209 If to the Company: Clear Channel Communications, Inc. 200 East Basse Road San Antonio, Texas 78209 Attention: Chief Executive Officer and Clear Channel Communications, Inc. 200 East Basse Road San... -

Page 168

...17. Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original but all of which together will constitute... communications, representations or warranties, whether oral or written, by any officer, employee or representative of any party ... -

Page 169

IN WITNESS WHEREOF, the parties hereto have executed this Agreement effective as of the date first above written. CLEAR CHANNEL COMMUNICATIONS, INC. By: /s/ JOHN H. WILLIAMS Name: John H. Williams Title: Chairman of the Compensation Committee /s/ RANDALL MAYS Randall Mays 19 -

Page 170

... common stock warrants Convertible debt - 2.625% issued in 1998 Convertible debt - 1.5% issued in 1999 LYONS - 1998 issue Less: Anti-dilutive items Denominator for net income (loss) per common share diluted Net income (loss) per common share: Income before cumulative effect of a change in accounting... -

Page 171

...> (In thousands, except ratio) Year Ended 2004 2003 2002 2001 2000 C> Income (loss) before income taxes, equity in earnings of non-consolidated affiliates, extraordinary item and cumulative effect of a change in accounting principle Dividends and other received from... -

Page 172

... (1) Clear Channel Broadcasting Licenses, Inc. Clear Channel Broadcasting, Inc. (2) Eller Media Corporation Clear Channel Outdoor, Inc. (3) Universal Outdoor, Inc. Clear Channel International, Ltd. (4) Jacor Communications Company (5) AMFM Inc. (6) SFX Entertainment, Inc. (7) The Ackerley Group, Inc... -

Page 173

...effectiveness of internal control over financial reporting, and the effectiveness of internal control over financial reporting of Clear Channel Communications, Inc. included in this Annual Report (Form 10-K) for the year ended December 31, 2004. /s/ Ernst & Young LLP San Antonio, Texas March 8, 2005 -

Page 174

... P Mays, President and Chief Executive Officer of Clear Channel Communications, Inc. certify that: 1. I have reviewed this Annual Report on Form 10-K of Clear Channel Communications, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state... -

Page 175

...OF 2002 I, Randall T. Mays, Chief Financial Officer of Clear Channel Communications, Inc. certify that: 1. I have reviewed this Annual Report on Form 10-K of Clear Channel Communications, Inc.; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to... -

Page 176

... operations of the Issuer. Dated: March 11, 2005 By: /s/ Mark P. MAYS Name: Mark P. Mays Title: President and Chief Executive Officer A signed original of this written statement required by Section 906 has been provided to the Issuer and will be furnished to the Securities and Exchange Commission... -

Page 177

... provided pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and accompanies the Annual Report on Form 10-K (the "Form 10-K") for the year ended December 31, 2004 of Clear Channel Communications, Inc. (the "Issuer"). The undersigned hereby certifies that the Form 10-K fully complies with the... -

Page 178

... statements of Clear Channel Communications, Inc. and subsidiaries, as of December 31, 2004 and 2003, and for each of the three years in the period ended December 31, 2003, and have issued our report thereon dated March 8, 2005. Our audits also included the financial statement schedule listed...