Yamaha 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Yamaha annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

05Annual Report 2008

Question 2:

Prospects for achieving the financial targets in “YGP2010” depend on smooth progress of

“The Sound Company” growth strategy. Could you provide a brief overview of the growth

strategy and progress with its implementation?

When formulating “YGP2010,” we considered the business envi-

ronment Yamaha would face during the coming three to five years.

From that standpoint, I believe the key to achieving our targets

is to grow by nurturing businesses in “The Sound Company”

business domain, which is founded on sound, music and network

technologies. That is why this business domain is now focusing

on the development of appealing products that leverage Yamaha’s

strengths, whether they are for end-users or for businesses. At the

same time, we are putting in place an optimal production structure,

and conducting marketing activities in ways that put the market’s

perspective first.

Specifically, we are developing a new concept in pianos that

transcends the conventional acoustic/digital categorization, and

we plan to make the customer’s perspective central in efforts to

enhance our product range. In the guitar business, we are upgrad-

ing product quality and working to expand sales of electric acous-

tic guitars leveraging Yamaha’s strengths, with a focus on

North America, the largest guitar market in the world. We are also

taking action in manufacturing by further strengthening our musical

instrument manufacturing bases. This entails establishing optimal

production networks to clearly define the respective roles of plants

in Japan, China and Indonesia—the most important production

bases for acoustic musical instruments—with regard to high-value-

added products and affordable-price-range products. In the music

entertainment business, we will finish developing the necessary

infrastructure under Yamaha Music Entertainment Holdings, Inc., a

management company established last year, and make 2008 the

first year of business expansion for related companies.

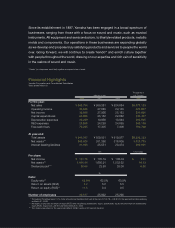

Emerging markets

· China

· Russia

Music &

Musical

Instruments

Market measures

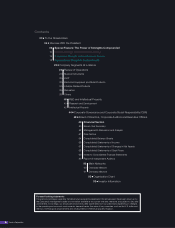

Piano business (Total Piano Strategy)

Commenced new product development

Prepared for introduction of new marketing policy

Guitar business

Improved product quality and reinforced supply capability (China and Indonesia)

Music entertainment business

Realigned six companies to create Yamaha Music Entertainment Holdings, Inc.

Commercial audio equipment business

Accelerated growth through collaboration

Launched OEM amplifiers for NEXO

Decided on merger of commercial audio equipment

engineering subsidiaries in Japan

AV equipment business

Expanded sales of the Digital Sound Projector

Sound

Networks

Audio

Upgraded capability to pursue M&A/alliances

Acquired Bösendorfer

Enhance acoustic

instrument

manufacturing plants

Increased number of

music schools in China

Established local

subsidiary in Russia

Established local

subsidiary in India

Increased production

in China and Indonesia

Proceeded with integration

of domestic piano

manufacturing plants

Conferencing systems business

Sales channel development delayed

Semiconductor business (new device development)

Achieved growth in sales of graphics LSIs and digital amplifiers

Silicon microphone development delayed

Active investment of management resources

(strategic M&A/alliances, etc.)

Progress of Growth Strategy in “The Sound Company” Business Domain

In commercial audio equipment, business conditions are con-

tinuing to work in our favor, and we are pursuing strategic alliances

to supplement our mixers—a product line in which we excel—by

enhancing the lineup of amplifiers, speakers and other “output-side”

products. At the same time, we are stepping up the pace of our

development as a systems solutions provider that provides services

to meet a wide range of customer needs, including installation and

maintenance. The commercial audio equipment market is expected

to expand in emerging markets such as China, Russia, India and

Brazil as well as in Europe and North America, and we have high

hopes that growth in this sector could even exceed that of musical

instruments. In the AV equipment business, meanwhile, our plans

are to enter new business domains such as desktop audio systems

to complement our mainstay home theater AV receivers, front

surround systems, and HiFi audio products.

Despite these promising developments, however, issues

remain that must be addressed. In the semiconductor business,

existing demand for mobile phone LSI sound chips is expected

to decrease, while demand for silicon microphones, primarily for

use in mobile phones, should increase. However, development

of these products has taken longer than expected, resulting in

delays to market introduction. In addition, our efforts to launch

new conferencing systems leveraging Yamaha’s sound and

network technologies to deliver smooth, high-quality sound were

hampered by delays in developing the relevant sales channels.

As we enter an era in which achieving product differentiation

is more difficult than ever, we continue striving to develop

appealing products with the unique Yamaha identity.