Yamaha 1999 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1999 Yamaha annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YAMAHA CONSOLIDATED FINANCIAL REPORT 10

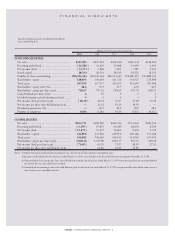

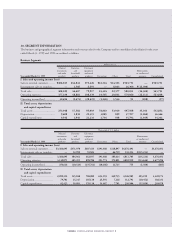

Millions of yen

Musical Furniture Electronic

instruments and equipment

Eliminations

and audio household and metal or unallocated

Year ended March 31, 1998 products products products

Recreation Others Total amounts Consolidated

I. Sales and operating income (loss)

Sales to external customers.......... ¥383,365 ¥59,067 ¥128,298 ¥23,727 ¥14,530 ¥608,990 — ¥608,990

Intersegment sales or transfers..... — 1,613 14,189 — 8,546 24,349 ¥(24,349) —

Total sales................................... 383,365 60,681 142,488 23,727 23,077 633,340 (24,349) 608,990

Operating expenses..................... 363,546 60,314 137,062 25,483 22,374 608,780 (23,893) 584,886

Operating income(loss) .............. 19,819 367 5,425 (1,755) 702 24,559 (455) 24,103

II. Total assets, depreciation

and capital expenditures

Total assets ................................. 243,496 22,993 111,635 80,354 57,234 515,716 28,749 544,465

Depreciation............................... 7,696 1,914 23,036 3,075 729 36,454 (1,054) 35,399

Capital expenditures................... 9,312 2,793 22,442 1,963 1,983 38,495 (1,428) 37,066

Notes: (1) Basis of segmentation

Business segments are divided into categories based on the application or nature each product in the market.

The demand for the telecommunication equipments (renamed from CD-Rs as in previous years) which consist primarily of CD-RW

products, has increased. This rise in demand may be attributable to the recent sharp decline in the prices. In addition, these products are

frequently used in conjunction with the audio products in our musical instruments and audio products segment. Effective the current fiscal

year, products have been transferred to the musical instruments and audio products segment.

Under the current classification, sales to external customers and total assets in 1998 would have decreased by ¥12,468 million ($103,426

thousand) and ¥10,450 million ($86,686 thousand), respectively, in the electrical equipment and metal products segment, and would have

increased by the same amounts in the musical instruments and audio products segment, respectively. The effect of this change on operating

income, depre ciation and capital expenditure was immaterial.

(2) Major products in each business segment:

Business segment Major products

Musical instruments Pianos, digital musical instruments, wind instruments, guitars, percussion instruments, educational musical

and audio products instruments, pro-audios, audio products, music schools,telecommunication equipments

Furniture and System kitchens, bathtubs, washstands, furniture, parts for housing facilities, sound equipment for residential use

household products

Electronic equipment LSIs, thin-film head, electronic alloys

and metal products

Recreation Management of leisure facilities

Others Golf and archery equipment, car interior parts, industrial robots.

(3) In connection with a revision to the “Regulations Concerning the Terminology, Forms and Preparation of Consolidated Financial Statements,”

enterprise tax and the related consolidated adjustment have been reclassified. The effect of this change on operating income (loss) was immaterial.

(4) Eliminations or unallocated amounts of total assets principally consist of translation adjustments, which amounted to ¥36,739 million

($304,762 thousand) and ¥29,737 million for the years ended March 31, 1999 and 1998, respectively.