Xcel Energy 2014 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

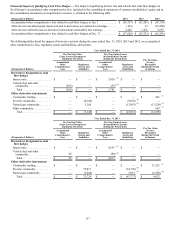

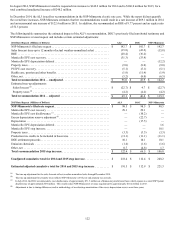

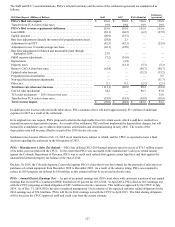

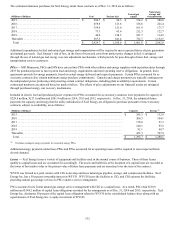

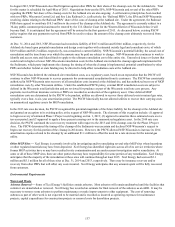

The Staff and OCC’s recommendations, PSCo’s rebuttal testimony and the terms of the settlement agreement are summarized as

follows:

2015 Rate Request (Millions of Dollars) Staff OCC PSCo Rebuttal Settlement

Agreement

PSCo’s filed rate request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 136.0 $ 136.0 $ 136.0 $ 136.0

Transfer from TCA rider to base rates . . . . . . . . . . . . . . . . . . . . . . . . . . 19.9 19.9 19.9 19.9

PSCo’s filed revenue requirement deficiency. . . . . . . . . . . . . . . . . . . 155.9 155.9 155.9 155.9

Lower ROE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (69.1)(66.5)(6.2) (27.9)

Capital structure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (20.9)(23.7) — —

Rate base adjustments (largely the removal of prepaid pension asset). . (20.8) 2.3 — —

Adjustment to an HTY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (82.5)(82.5) — (23.9)

Adjustment to use 13-month average rate base. . . . . . . . . . . . . . . . . . . . (26.1)(22.0) — —

Rate base adjustments for known and measurable plant through

September 2014. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21.9 — — —

O&M expense adjustments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7.2)(16.6) — —

Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (3.8) — —

Property taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (12.1)(5.3) (5.3)

Remove CACJA from base rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (62.4) — (98.7) (98.7)

Updated sales forecast. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (15.2) (15.2)

Prepaid pension amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — — 9.5

Non-specified settlement adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . — — — (31.7)

Other, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.1 0.1 (2.1) (2.1)

Total base rate (decrease) increase . . . . . . . . . . . . . . . . . . . . . . . . . . . (111.1)(68.9) 28.4 (39.4)

CACJA rider mechanism . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54.2 — 98.7 97.0

TCA rider mechanism — 2015 forecast test year. . . . . . . . . . . . . . . . . . — — — 15.6

Transfer from TCA rider to base rates . . . . . . . . . . . . . . . . . . . . . . . . . . (19.9)(19.9)(19.9) (19.9)

Total revenue impact. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (76.8) $ (88.8) $ 107.2 $ 53.3

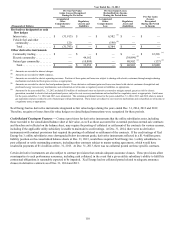

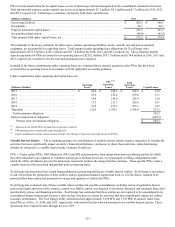

In addition to the revenue reflected in the table above, PSCo estimates that it will defer approximately $3.1 million of additional

expenses in 2015 as a result of the settlement.

In its original rate case request, PSCo proposed to shorten the depreciable lives for certain assets, which would have resulted in a

material increase in depreciation expense. As a result of the settlement, PSCo will not implement the depreciation changes, but will

instead file a standalone case to address depreciation, amortization and decommissioning in early 2016. The results of the

depreciation case will become effective as part of the 2018 electric rate case.

Settlement rates became effective Feb. 13, 2015 on an interim basis, subject to refund, and the CPUC is expected to issue a final

decision regarding the settlement in the first quarter of 2015.

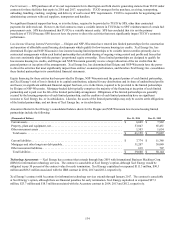

PSCo – Manufacturer’s Sales Tax Refund — PSCo has deferred 2012-2014 annual property taxes in excess of $76.7 million as part

of its multi-year rate plan with the CPUC. To the extent that PSCo was successful in the manufacturer’s sales tax refund lawsuit

against the Colorado Department of Revenue, PSCo was to credit such refunds first against certain legal fees, and then against the

unamortized deferred property tax balance at the end of 2014.

On June 30, 2014, the Colorado Supreme Court ruled against PSCo’s claim that it was due refunds for the payment of sales taxes on

purchases of certain equipment from December 1998 to December 2001. As a result of the adverse ruling, PSCo was required to

reduce its 2014 property tax deferral by $10 million, as this amount will not be recovered in electric rates.

PSCo – Annual Electric Earnings Test — As part of an annual earnings test, PSCo must share with customers a portion of any annual

earnings that exceed PSCo’s authorized ROE threshold of 10 percent for 2012-2014. In April 2014, PSCo filed its 2013 earnings test

with the CPUC proposing a refund obligation of $45.7 million to electric customers. This tariff was approved by the CPUC in July

2014. As of Dec. 31, 2014, PSCo has also recognized management’s best estimate of the expected customer refund obligation for the

2014 earnings test of $74.0 million. PSCo will file its 2014 earnings test with the CPUC in April 2015. The final sharing obligation

will be based on the CPUC-approved tariff and could vary from the current estimate.