Westjet 1999 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 1999 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

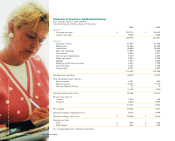

(f) Capital assets:

Capital assets are to be depreciated over their estimated useful lives at the

following rates and methods.

Asset Basis Rate

Aircraft net of estimated

residual value Flight hours Hours flown

Computer hardware

and software Straight-line 5 years

Equipment Straight-line 5 years

Leasehold improvements Straight-line Over the term of the lease

(g) Maintenance costs:

Maintenance costs related to the cost of acquiring the aircraft and

preparation for service are capitalized and included in aircraft costs.

Heavy maintenance ("D" check) costs incurred on aircraft are deferred and

amortized over the remaining useful service life of the aircraft.

All other maintenance costs are expensed as incurred.

(h) Deferred income taxes:

The Corporation follows the deferral method of tax allocation accounting

under which the provision for corporate income taxes is based on the

earnings reported in the accounts and takes into account the tax effects of

timing differences between financial statement income and taxable income.

(i) Financial instruments:

The Corporation manages its foreign exchange exposure through the use of

options, forward contracts and cross currency swaps. Resulting gains and

losses are accrued as exchange rates change to offset gains and losses

resulting from the underlying hedged transactions. Premiums and discounts

are amortized over the term of the contracts.

The Corporation manages its exposure to jet fuel price volatility through

the use of fixed price and fixed ceiling price agreements. Premiums and

discounts are amortized over the term of the contracts.

(j) Comparative figures:

Certain prior period balances have been reclassified to conform with current

presentation.

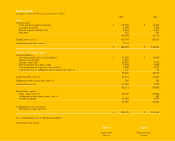

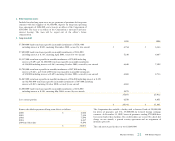

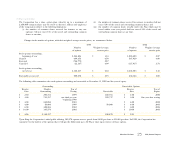

2. Capital assets:

Accumulated Net book

1999 Cost depreciation value

Aircraft $ 117,084 $ 14,385 $ 102,699

Spare engines and parts 14,331 - 14,331

Computer hardware and software 3,539 1,148 2,391

Computer hardware under capital lease 643 230 413

Equipment 2,484 787 1,697

Leasehold improvements 979 536 443

$ 139,060 $ 17,086 $ 121,974

Aircraft $ 77,766 $ 7,188 $ 70,578

Spare engines and parts 11,521 - 11,521

Computer hardware and software 2,404 709 1,695

Computer hardware under capital lease 476 116 360

Equipment 1,584 493 1,091

Leasehold improvements 592 314 278

$ 94,343 $ 8,820 $ 85,523

During the year capital assets were acquired at an aggregate cost of $168,000 by means of capital leases.

20

WestJet Airlines 1999 Annual Report