Western Union 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE WESTERN UNION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

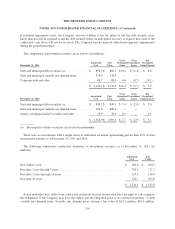

If potential impairment exists, the Company assesses whether it has the intent to sell the debt security, more

likely than not will be required to sell the debt security before its anticipated recovery or expects that some of the

contractual cash flows will not be received. The Company had no material other-than-temporary impairments

during the periods presented.

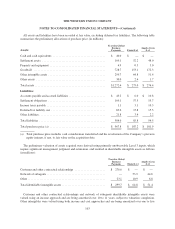

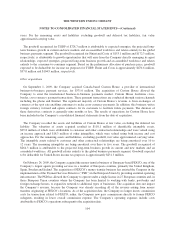

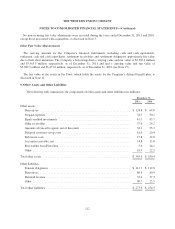

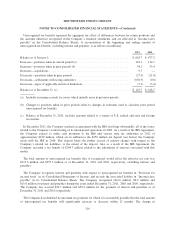

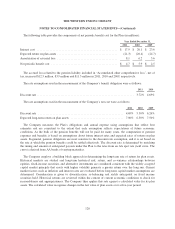

The components of investment securities are as follows (in millions):

December 31, 2011

Amortized

Cost

Fair

Value

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Net

Unrealized

Gains/(Losses)

State and municipal debt securities (a) ...............$ 858.5 $ 866.5 $10.4 $ (2.4) $ 8.0

State and municipal variable rate demand notes ........ 376.9 376.9 — — —

Corporate debt and other .......................... 88.7 88.6 0.6 (0.7) (0.1)

$ 1,324.1 $ 1,332.0 $11.0 $ (3.1) $ 7.9

December 31, 2010

Amortized

Cost

Fair

Value

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Net

Unrealized

Gains/(Losses)

State and municipal debt securities (a) ...............$ 844.1 $ 849.1 $ 7.0 $ (2.0) $ 5.0

State and municipal variable rate demand notes ........ 490.0 490.0 — — —

Agency mortgage-backed securities and other ......... 29.9 30.0 0.1 — 0.1

$ 1,364.0 $ 1,369.1 $ 7.1 $ (2.0) $ 5.1

(a) The majority of these securities are fixed rate instruments.

There were no investments with a single issuer or individual securities representing greater than 10% of total

investment securities as of December 31, 2011 and 2010.

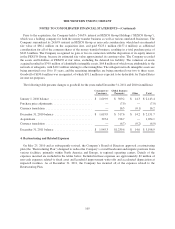

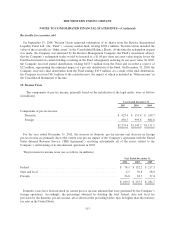

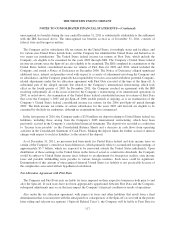

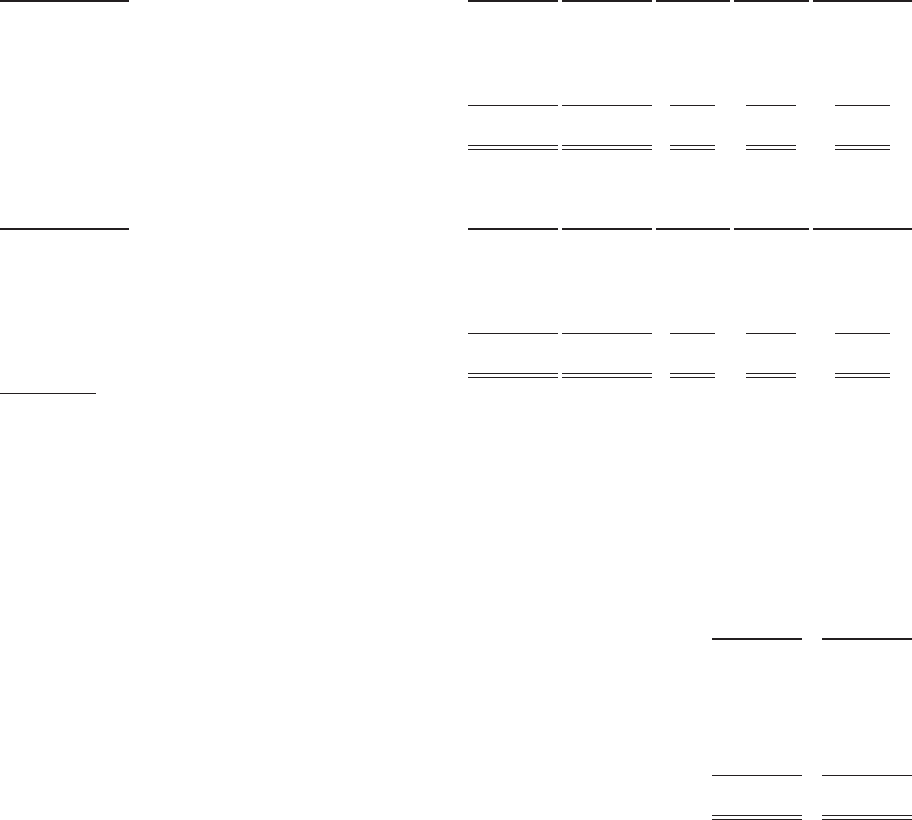

The following summarizes contractual maturities of investment securities as of December 31, 2011 (in

millions):

Amortized

Cost

Fair

Value

Due within 1 year ...................................................... $ 180.0 $ 180.5

Due after 1 year through 5 years ........................................... 705.6 713.3

Due after 5 years through 10 years ......................................... 115.8 114.6

Due after 10 years ...................................................... 322.7 323.6

$ 1,324.1 $ 1,332.0

Actual maturities may differ from contractual maturities because issuers may have the right to call or prepay

the obligations or the Company may have the right to put the obligation prior to its contractual maturity, as with

variable rate demand notes. Variable rate demand notes, having a fair value of $12.4 million, $65.4 million,

110