Western Digital 1998 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1998 Western Digital annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

Messrs. Haggerty, Massengill, Nussbaum, Schafer, Slavin and Williams have been employed by the Company for

more than five years and have served in various executive capacities with the Company before being appointed to

their present positions.

Mr. Cornelius joined the Company in his current position in January 1995. Prior to joining the Company, he held

the position of Vice President of Corporate Affairs for Nissan North America for two years.

Mr. Stern joined the Company in November 1994 as Vice President, New Product Introductions. He also served as

Vice President, Asian Operations for the Personal Storage Division. He was promoted to his current position in July

1998. Immediately prior to joining the Company, he served as Vice President, Asian Operations for MiniStor

Peripherals Corporation.

Mr. Van Berkel joined the Company in January 1995 as Director of Human Resources for the Personal Storage

Division and was promoted to his current position in May 1997. Prior to joining the Company, he served as Vice

President of Human Resources for Walker Interactive Systems for five years.

PART II

Item 5. Market for Registrant's Common Equity and Related Stockholder Matters

Western Digital's common stock is listed on the New York Stock Exchange ("NYSE") under the symbol "WDC."

The approximate number of holders of record of common stock of the Company as of July 25, 1998 was 3,758.

The Company has not paid any cash dividends on its common stock and does not intend to pay any cash dividends

in the foreseeable future. The Company's line of credit agreement prohibits the payment of cash dividends.

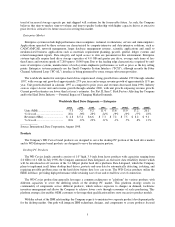

The high and low sales prices (retroactively adjusted for the two-for-one stock split effected as a stock dividend in

June 1997) of the Company's common stock, as reported by the NYSE, for each quarter of 1997 and 1998 are as

follows:

First Second Third Fourth

1997

High ................................................................................. $ 20 5/8 $ 31 11/16 $ 38 5/8 $ 37 1/8

Low.................................................................................. 9 15/16 19 3/16 26 1/4 26 5/16

1998

High ................................................................................. $ 54 3/4 $ 49 9/16 $ 20 7/16 $ 22 1/16

Low.................................................................................. 30 5/8 14 1/2 14 3/4 10 1/4

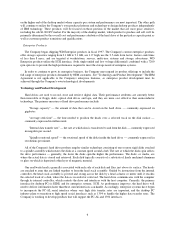

Item 6. Selected Financial Data

Financial Highlights

Years Ended

June 30,

1994 July 1,

1995 June 29,

1996 June 28,

1997 June 27,

1998

(in millions, except per share and employee data)

Revenues, net............................................ $1,539.7 $2,130.9 $ 2,865.2 $ 4,177.9 $ 3,541.5

Gross profit .............................................. 317.9 394.1 382.1 650.3 100.1

Operating income (loss) ........................... 91.9 133.0 77.5 301.6 (295.8)

Net income (loss) ..................................... $ 73.1 $ 123.3 $ 96.9 $ 267.6 $ (290.2)

Earnings (loss) per share:

Basic....................................................... $ .93 $ 1.34 $ 1.05 $ 3.07 $ (3.32)

Diluted.................................................... $ .86 $ 1.23 $ 1.01 $ 2.86 $ (3.32)

Working capital........................................ $ 261.7 $ 360.5 $ 280.2 $ 364.2 $ 463.5

Total assets............................................... $ 640.5 $ 858.8 $ 984.1 $ 1,307.1 $ 1,442.7

Total long-term debt................................. $ 58.6 $ $ $ $ 519.2

Shareholders' equity ................................. $ 288.2 $ 473.4 $ 453.9 $ 620.0 $ 317.8