Vtech 2002 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2002 Vtech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Annual Report 2002 5

This should allow VTech to now move forward with a strategy that

combines proven excellence in product development and cost-

effective manufacturing with a new customer-centric approach that

stresses the integral importance to our operations in supply chain

management, market research, customer service, branding and

marketing.

Back in Profit

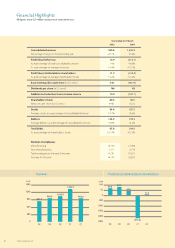

In line with our strategy to focus on profitability, Group turnover

declined 28.1% to US$959.8 million. This reflects a 18.7% reduction

in sales of our telecommunication products, as we shifted our focus

to the higher margin models. It also results from a decline in sales of

electronic learning products (ELPs), which faced strong competition

from other producers and where we have been undertaking a

comprehensive redesign of our product range.

Partly as a result of the shift in orientation, profits nonetheless

rebounded. From a loss of US$215.0 million in our 2001 financial year,

VTech reported net earnings of US$11.2 million for 2002. This is the

result not only of our success in increasing the proportion of higher

margin products in our sales, but of reducing our operating costs

(excluding restructuring and impairment charges), which are now 38.

7% lower than they were in our 2001 financial year. Substantially

lower levels of provisions and write-downs also contributed to the

improvement, as the restructuring entered its final phase. Finally,

a new approach to managing the inventory cut working capital

requirements, boosting cash flow.

Significant Improvement in Financial Position

The difficulties we faced in the 2001 financial year saw a deterioration

of the balance sheet which is now behind us, as strong cash flows

have enabled us to reduce debt dramatically to a comfortable level.

Net operating cash in-flow for the year was US$146.8 million. Total

interest bearing liabilities as at 31st March 2002 stood at US$95.8

million, down by 61.6% as compared to 2001, while net debt was

US$32.5 million down by 83.2%. This gives VTech a total debt to

shareholders’ funds of 107.2% and an interest coverage of 2.6 times.

One of the main contributors to this dramatic improvement to our

financial position is the large reduction in stocks and debtors, which

fell from US$382.8 million at the end of the last financial year to

US$223.3 million at the end of this year. This freeing of cash-flow was

the result of much hard work on the part of our telecommunication

products business in particular, as it permanently reduced inventory

held in our supply chain through tighter management.

Leaner and Smarter Operations

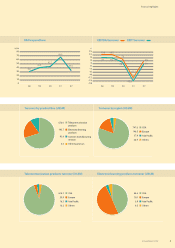

In the financial year 2002, telecommunication products remained as

VTech’s major source of revenue, accounting for 69.8% of the Group

turnover at US$670.0 million. In order to drive bottom line growth,

we cut production of loss-making models and focused on higher

margin products. VTech’s share of the US fixed-line telephone market

remained dominant. In January 2002, we announced the launch of the

industry’s first 5.8GHz cordless phone model, a technological

breakthrough that reaffirms our lead in R&D. This new platform would

allow us to build on the success of the 2.4GHz model.

To improve profitability further, the telecommunication products

business conducted a radical overhaul in the way it handles inventory,

subjecting the entire supply chain to intense – indeed daily – scrutiny.

This resulted in a major reduction in inventory held to the equivalent

of around two month’s sales, as a result of better demand forecasting.

As importantly, it has improved relations with the retailers who carry

our products through raising reliability of supply.

Moving further in the direction of our customers, we conducted

considerable research among the retailers who purchase our products,

in an effort to understand their requirements better. This has led us to

reorganize our sales and marketing operations in the United States

according to a new customer-centric model, with specific teams now

closely serving the needs of the 20 leading customers who account for

the vast majority of our sales. We are now co-operating with these

business partners on sharing point-of-sale data, supply chain

management, in-store arrangements and promotional programs. This

will benefit sales, costs and product development.

Electronic learning products faced a tougher challenge, with turnover

down 33.5% over 2001 to US$193.7 million. Although the ELP market

continues to grow, as a complement to the personal computer market,

VTech has recently faced strong competition in the United States. To

counter this pressure, we have made a major commitment to returning

to our roots in this market, in which we are the pioneers. Extensive

market research we commissioned from the Omnicom Group showed

that VTech retained tremendous brand equity in the 6–11 years old

category that was severely underutilized. While we remain the world’s

leader, we had for some years failed to respond to changes in the

market. We currently began to re-focus our business back towards this

higher margin category, around our original concept of combining

education with entertainment. The result has been the exceptionally

rapid development, based on sound consumer research, of a new

range of products targeting precisely this area, across the spectrum

from education to entertainment. We achieved this while at the same

time making substantial cost reduction through a streamlining of

operations, reducing inventories and reigning in accounts receivables.

In a year when the contract manufacturing industry was severely

shaken by a precipitous fall in demand, VTech’s contract manufacturing

services (CMS) performed extremely well, maintaining profitability on

turnover which fell by 27.0% to US$92.8 million. This solid performance

testifies to the high regard in which we are held by some of the world’s

leading brand names and the deep, co-operative relationships we have

built with our customers. It also reflects the success of the New

Product Introduction program that we put in place during the year,

Letter to Shareholders