Visa 2015 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2015 Visa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In summary, we are delighted to be

reuniting the Visa family. We believe

that we have structured this in a way

that creates value for both Visa Europe

members, our shareholders and our clients

globally.

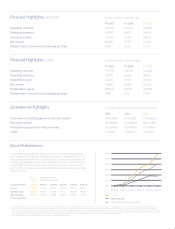

U.S. vs. Non-U.S. Mix

Our world is constantly evolving. With our

acquisition of Visa Europe, our global mix

of business will continue to become less

concentrated in the U.S. Our U.S. payments

volume will go from 53% to approximately

38% after the transaction. While we love

the U.S. market and continue to believe

that there is great opportunity for growth,

our non-U.S. payments volume is growing

approximately 1.5 times as fast as our U.S.

payments volume.

China

China is writing final rules which will

create a process to allow us and others

to apply for a license to compete in the

domestic Chinese electronic payments

market. We are actively working on

our plans and intend to submit our

application as quickly as possible once

the final rules are published. We view

this as a long-term commitment and

a long-term opportunity to help grow

commerce domestically in China. Our

initial investment will be substantial as

we build local processing capabilities

and the necessary infrastructure to

grow the issuance and acceptance of

our products. As an example, today our

acceptance has been targeted at those

locations catering to inbound tourism and

as such we are accepted at only about

370,000 merchant locations. China Union

Pay, the government-controlled entity

which processes all domestic Chinese

transactions is accepted in about 10

million domestic merchant acceptance

locations. Having said that, we have strong

relationships with the Chinese banks as we

have worked together for years helping

them successfully build their outgoing

Chinese cross-border business. We are

excited about the long-term potential

China represents for Visa and we are

confident that we will be able to develop

strong local capabilities which will help

grow the domestic Chinese economy and

deliver safe, convenient, and innovative

payment alternatives for Chinese

consumers.

Competition

We are often asked about how we

compete in the marketplace.

We have always had, and still have,

formidable competition. We compete

vigorously every day, doing our best to

earn our clients’ business and preserve our

share.

We are lucky to participate in an industry

which still has enormous growth potential.

There is about $16 trillion of cash and check

in the world used annually for commerce,

and consumers and merchants would be

better off if almost all of these transactions

were conducted electronically. This is

where we look for growth and it is also the

most valuable and sustainable source of

growth. Increasing our payments volume

by displacing cash and check, expanding

participants in the electronic payments

universe, and helping to grow commerce

We have always had, and still have, formidable

competition. We compete vigorously every

day, doing our best to earn our clients’

business and preserve our share.