US Cellular 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

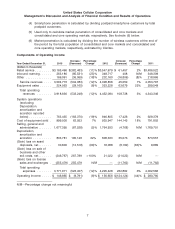

(4) Smartphone penetration is calculated by dividing postpaid smartphone customers by total

postpaid customers.

(5) Used only to calculate market penetration of consolidated and core markets and

consolidated and core operating markets, respectively. See footnote (6) below.

(6) Market penetration is calculated by dividing the number of wireless customers at the end of

the period by the total population of consolidated and core markets and consolidated and

core operating markets, respectively, estimated by Claritas.

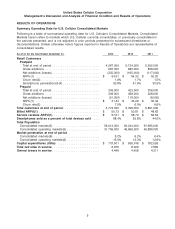

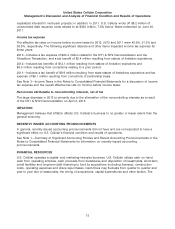

Components of Operating Income

Increase/ Percentage Increase/ Percentage

Year Ended December 31, 2013 (Decrease) Change 2012 (Decrease) Change 2011

(Dollars in thousands)

Retail service ......... $3,165,496 $(382,483) (11)% $3,547,979 $ 61,457 2% $3,486,522

Inbound roaming ...... 263,186 (85,531) (25)% 348,717 408 N/M 348,309

Other .............. 166,091 (36,069) (18)% 202,160 (16,806) (8)% 218,966

Service revenues .... 3,594,773 (504,083) (12)% 4,098,856 45,059 1% 4,053,797

Equipment sales ...... 324,063 (29,165) (8)% 353,228 63,679 22% 289,549

Total operating

revenues ........ 3,918,836 (533,248) (12)% 4,452,084 108,738 3% 4,343,346

System operations

(excluding

Depreciation,

amortization and

accretion reported

below) ............ 763,435 (183,370) (19)% 946,805 17,426 2% 929,379

Cost of equipment sold . 999,000 63,053 7% 935,947 144,145 18% 791,802

Selling, general and

administrative ....... 1,677,395 (87,538) (5)% 1,764,933 (4,768) N/M 1,769,701

Depreciation,

amortization and

accretion .......... 803,781 195,148 32% 608,633 35,076 6% 573,557

(Gain) loss on asset

disposals, net ....... 30,606 (12,518) (69)% 18,088 (8,199) (83)% 9,889

(Gain) loss on sale of

business and other

exit costs, net ....... (246,767) 267,789 >100% 21,022 (21,022) N/M —

(Gain) loss on license

sales and exchanges . (255,479) 255,479 N/M — (11,762) N/M (11,762)

Total operating

expenses ........ 3,771,971 (523,457) (12)% 4,295,428 232,862 6% 4,062,566

Operating income ..... $ 146,865 $ (9,791) (6)% $ 156,656 $(124,124) (44)% $ 280,780

N/M—Percentage change not meaningful

7