Tyson Foods 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53 2008 Annual Report

Notes to Consolidated Financial Statements (continued)

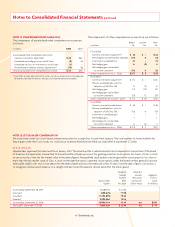

A foreign subsidiary pension plan had $15 million and $17 million in plan

assets at September 27, 2008, and September 29, 2007, respectively.

All of this plan’s assets are held in annuity contracts consistent with

its target asset allocation.

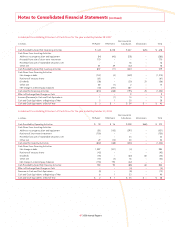

The Plan Trustees have established a set of investment objectives

related to the assets of the pension plans and regularly monitor the

performance of the funds and portfolio managers. Objectives for

the pension assets are (1) to provide growth of capital and income,

(2) to achieve a target weighted average annual rate of return com-

petitive with other funds with similar investment objectives and

(3) to diversify to reduce risk. The investment objectives and target

asset allocation were adopted in January 2004 and amended in

January 2008.

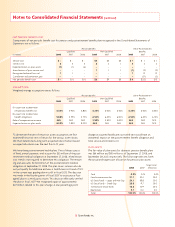

CONTRIBUTIONS

Our policy is to fund at least the minimum contribution required

to meet applicable federal employee benefi t and local tax laws.

In our sole discretion, we may from time to time fund additional

amounts. Expected contributions to pension plans for fi scal 2009

are approximately $2 million. For fi scal 2008, 2007 and 2006, we

funded $2 million, $5 million and $0, respectively, to defi ned

benefi t plans.

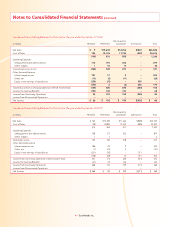

ESTIMATED FUTURE BENEFIT PAYMENTS

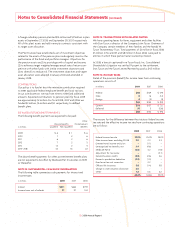

The following benefi t payments are expected to be paid:

Other

Pension Benefi ts Postretirement

in millions Qualifi ed Non-Qualifi ed Benefi ts

2009 $ 6 $ 1 $ 6

2010 7 2 6

2011 6 2 6

2012 7 2 5

2013 12 2 5

2014–2018 33 16 22

The above benefi t payments for other postretirement benefi t plans

are not expected to be offset by Medicare Part D subsidies in 2009

or thereafter.

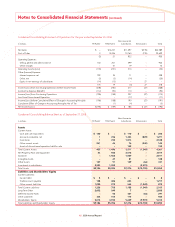

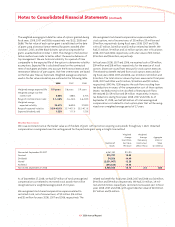

NOTE 14: SUPPLEMENTAL CASH FLOW INFORMATION

The following table summarizes cash payments for interest and

income taxes:

in millions 2008 2007 2006

Interest $211 $262 $159

Income taxes, net of refunds 51 97 144

NOTE 15: TRANSACTIONS WITH RELATED PARTIES

We have operating leases for farms, equipment and other facilities

with Don Tyson, a director of the Company, John Tyson, Chairman of

the Company, certain members of their families and the Randal W.

Tyson Testamentary Trust. Total payments of $3 million in fi scal 2008,

$5 million in fi scal 2007, and $8 million in fi scal 2006, were paid to

entities in which these parties had an ownership interest.

In 2008, a lawsuit captioned In re Tyson Foods, Inc. Consolidated

Shareholder’s Litigation was settled. Pursuant to the settlement,

Don Tyson and the Tyson Limited Partnership paid us $4.5 million.

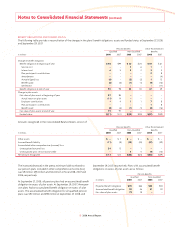

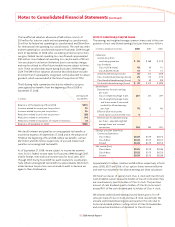

NOTE 16: INCOME TAXES

Detail of the provision (benefi t) for income taxes from continuing

operations consists of:

in millions 2008 2007 2006

Federal $56 $129 $ (79)

State 8 16 (12)

Foreign 4 (3) (3)

$68 $142 $ (94)

Current $33 $137 $ 32

Deferred 35 5 (126)

$68 $142 $ (94)

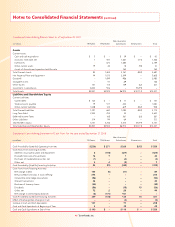

The reasons for the difference between the statutory federal income

tax rate and the effective income tax rate from continuing operations

are as follows:

2008 2007 2006

Federal income tax rate 35.0% 35.0% 35.0%

State income taxes, excluding FIN 48 2.0 2.3 3.3

Extraterritorial income exclusion – (1.1) –

Unrecognized tax benefi ts, net 4.4 (4.6) –

Medicare Part D (0.8) 3.2 (1.8)

Adjustment for tax review – – (5.1)

General business credits (3.8) (2.6) 2.6

Domestic production deduction (2.2) (1.0) –

Fixed asset tax cost correction – 4.2 –

Offi cers life insurance 3.8 (1.4) 0.8

Change in state valuation allowance 5.0 – –

Other 1.2 0.6 0.2

44.6% 34.6% 35.0%