Travelzoo 2006 Annual Report Download - page 20

Download and view the complete annual report

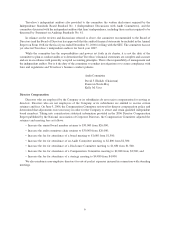

Please find page 20 of the 2006 Travelzoo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Mr. Holger Bartel agreed that the Company will own any discoveries and work product (as defined in the

agreement) made during the term of his employment and to assign all of his interest in any and all such discoveries

and work product to the Company. Furthermore, Mr. Holger Bartel agreed to not, directly or indirectly, perform

services for, or engage in, any business competitive with the Company during the period of his employment. He also

agreed to not, directly or indirectly, solicit the Company’s customers or employees during the term of his

employment and for a period of one year thereafter.

Mr. Christopher Loughlin entered into an employment agreement with the Company on May 16, 2005. The

term of the agreement is three years, commencing on May 16, 2005, after which time either party may terminate the

agreement, with or without cause, upon twelve months prior written notice. During the initial term, the Company

can terminate the agreement for cause (as defined in the agreement) without any severance obligations. The

Company can also terminate the agreement without cause by making a payment equal to the amount of base salary

that Mr. Loughlin would be entitled to receive during the balance of the initial term or any notice period. Assuming

that Mr. Loughlin was terminated by the Company without cause as of December 31, 2006, Mr. Loughlin would be

entitled to receive $506,811.

Mr. Loughlin is paid a base salary and is entitled to certain annual and quarterly bonuses. See Components of

Executive Compensation — Other Incentive Bonus Pay above for a description of such bonuses. Mr. Loughlin is

also eligible to participate in the Company’s UK Employee Pension Contribution Program, pursuant to which the

Company contributes 7% of his base salary to the pension. Mr. Loughlin is also entitled to participate in any private

health insurance scheme that may be arranged by the Company for its executives. The Company agreed to pay for

six economy class tickets from the United States to London for Mr. Loughlin’s spouse between May 16, 2005 and

May 31, 2006. Mr. Loughlin did not use any such tickets during 2006.

Mr. Loughlin agreed to not, directly or indirectly, engage or become interested in any business competitive

with the Company during the term of the agreement. In addition, Mr. Loughlin agreed to not, directly or indirectly,

solicit any of the Company’s customers or perform services for, or engage in, any business competitive with the

Company for a period for six months after the termination of his employment. Mr. Loughlin also agreed that the

Company will own any inventions or intellectual property created during the term of his employment and to assign

all of his interest in any such intellectual property to the Company.

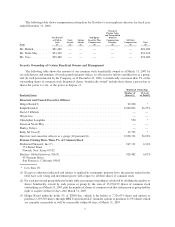

Certain Relationships and Related Party Transactions

The Company maintains policies and procedures to ensure that our directors, executive officers and employees

avoid conflicts of interest. Our Chief Executive Officer, Chief Financial Officer and Controller for North America

are subject to our Code of Ethics and each signs the policy to ensure compliance. Our Code of Ethics requires our

leadership to act with honesty and integrity, and to fully disclose to the Audit Committee any material transaction

that reasonably could be expected to give rise to an actual or apparent conflict of interest. The Code of Ethics

requires that our leadership obtain the prior written approval of the Audit Committee before proceeding with or

engaging in any conflict of interest.

Our Audit Committee Charter further provides that the Audit Committee will review all related party

transactions and potential conflict of interest situations involving the Company’s principal stockholders, directors

or senior management. Upon notice of a potential conflict of interest, the Audit Committee will evaluate the

transaction to determine if it is in the Company’s best interests and whether, in the Audit Committee’s judgment, the

terms of such transaction are at least as beneficial to us as the terms we could obtain in a similar transaction with an

independent third party.

In 2006, there were no related party transactions exceeding $120,000 between the Company and its directors,

executive officers or principal stockholders.

16