Toro 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 Toro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and sand spreaders occurring primarily between April and Decem-

Patents and Trademarks

ber, which also resulted in a greater variability of sales volumes

We own patents, trademarks, and trade secrets related to our

due to dependency on snow falls for these products.

products in the U.S. and certain countries outside the U.S. in

Overall, our worldwide sales levels are historically highest in our

which we conduct business. We expect to apply for future patents

fiscal second quarter and retail demand is generally highest in our

and trademarks, as appropriate, in connection with the develop-

fiscal third quarter. Typically, our accounts receivable balances

ment of innovative new products, services, and enhancements.

increase between January and April because of higher sales

Although we believe that, in the aggregate, our patents are valua-

volumes and extended payment terms made available to our cus-

ble, and patent protection is beneficial to our business and com-

tomers. Accounts receivable balances typically decrease between

petitive positioning, our patent protection will not necessarily deter

May and December when payments are received. Our financing

or prevent competitors from attempting to develop similar products.

requirements are subject to variations due to seasonal changes in

We are not materially dependent on any one or more of our pat-

working capital levels, which typically increase in the first half of

ents. However, certain Toro trademarks that contribute to our iden-

our fiscal year and decrease in the second half of our fiscal year.

tity and the recognition of our products and services, including the

Seasonal cash requirements of our business are financed from a

Toro name and logo, are an integral part of our business.

combination of cash balances, cash flows from operations, and

We regularly review certain patents issued by the United States

short-term borrowings under our credit facilities.

Patent and Trademark Office (‘‘USPTO’’) and international patent

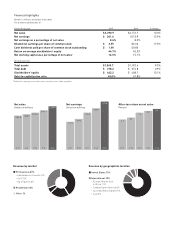

The following table shows total consolidated net sales and net

offices to help avoid potential liability with respect to others’ pat-

earnings for each fiscal quarter as a percentage of the total fiscal

ents. Additionally, we periodically review competitors’ products to

year.

prevent possible infringement of our patents by others. We believe

these activities help us minimize our risk of being a defendant in

patent infringement litigation. We are currently involved in patent Fiscal 2015 Fiscal 2014

litigation cases where we are asserting our patents against com- Net Net Net Net

petitors and defending against patent infringement assertions by Quarter Sales Earnings Sales Earnings

others. Such cases are at varying stages in the litigation process. First 20% 15% 21% 15%

Second 35 47 34 50

Similarly, we periodically monitor various trademark registers and

Third 25 26 26 29

the market to prevent infringement of and damage to our trade- Fourth 20 12 19 6

marks by others. From time to time, we are involved in trademark

oppositions where we are asserting our trademarks against third

Effects of Weather

parties who are attempting to establish rights in trademarks that

From time to time, weather conditions in particular geographic

are confusingly similar to ours. We believe these activities help

regions or markets may adversely or positively affect sales of

minimize risk of harm to our trademarks, and help maintain distinct

some of our products and field inventory levels and result in a

products and services that we believe are well regarded in the

negative or positive impact on our future net sales. If the percent-

marketplace.

age of our net sales from outside the U.S. increases, our depen-

dency on weather in any one part of the world decreases. None-

Seasonality

theless, weather conditions could materially affect our future net

Sales of our residential products, which accounted for 30 percent

sales.

of total consolidated net sales in fiscal 2015, are seasonal, with

sales of lawn and garden products occurring primarily between

Working Capital

February and June, depending upon seasonal weather conditions

Our businesses are seasonally working capital intensive and

and demand for our products. Sales of snow thrower products

require funding for purchases of raw materials used in production;

occur primarily between July and January, depending upon prior

replacement parts inventory; payroll and other administrative costs;

season snow falls, preseason demand, and product availability.

capital expenditures; establishment of new facilities; expansion,

Opposite seasons in global markets in which we sell our products

renovation, and upgrading of existing facilities; as well as for

somewhat moderate this seasonality of our residential product

financing receivables from customers that are not financed with

sales. Seasonality of professional product sales also exists but is

Red Iron Acceptance, LLC (‘‘Red Iron’’), our joint venture with TCF

tempered because the selling season in the Southern U.S. and our

Inventory Finance, Inc. (‘‘TCFIF’’). We fund our operations through

markets in the Southern hemisphere continue for a longer portion

a combination of cash and cash equivalents, cash flows from oper-

of the year than in Northern regions of the world. The addition of

ations, short-term borrowings under our credit facilities, and

the BOSS business added a portfolio of counter-seasonal products

to our professional segment with our sales of snowplows and salt

8