Toro 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Toro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SERVING CUSTOMERS THROUGH

INNOVATION

THE TORO COMPANY

2015 Annual Report

Table of contents

-

Page 1

THE TORO COMPANY 2015 Annual Report SERVING CUSTOMERS THROUGH INNOVATION -

Page 2

... productivity to Toro's stand-on mower line, the new GrandStand® MULTI FORCE™ allows landscape contractors to switch between a mowing deck, BOSS® snowplow and other future attachments in a matter of minutes. t Expanding Exmark's industry-leading line of propane-fueled commercial mowers, the new... -

Page 3

... well-balanced with strong contributions from our new BOSS® professional snow and ice management business, our core residential and landscape contractor businesses, and our newer rental and specialty construction business. The dedication, drive and hard work of each member of our enterprise helped... -

Page 4

... Company in the years ahead. For example, our BOSS team is busy developing and testing several new products for 2016 that we expect will help us continue to expand in the snow and ice management industry. Our landscape contractor businesses are also launching a number of product enhancements across... -

Page 5

... launched three new TimeCutter® zero-turn riders for fiscal 2016 that were designed with customer feedback in mind. They include two new lever-steer models that are equipped with commercial-grade decks for more challenging terrain, and a third steering wheel model with a wider 54-inch cutting deck... -

Page 6

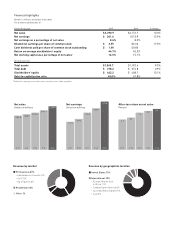

... ¢ Professional 69% • Landscape & Grounds 41% • Golf 22% • Ag Irrigation 6% ¢ Residential 30% ¢ Other 1% Revenue by geographical location ¢ United States 75% ¢ International 25% • Europe, Middle East & Africa 11% • Canada/Latin America 6% • Australia/New Zealand 5% • Asia 3% -

Page 7

... the closing price of the common stock on May 1, 2015, the last business day of the registrant's most recently completed second fiscal quarter, as reported by the New York Stock Exchange, was approximately $3.8 billion. The number of shares of common stock outstanding as of December 11, 2015 was 54... -

Page 8

...Market Risk ...Financial Statements and Supplementary Data ...Management's Report on Internal Control over Financial Reporting ...Report of Independent Registered Public Accounting Firm ...Consolidated Statements of Earnings for the fiscal years ended October 31, 2015, 2014, and 2013 ...Consolidated... -

Page 9

... this report. We design, manufacture, and market professional turf maintenance equipment and services, turf irrigation systems, landscaping equipment and lighting, agricultural micro-irrigation systems, rental and specialty construction equipment, and residential yard and snow thrower products. With... -

Page 10

... lighting fixtures designed to illuminate putting greens during club events or special functions. Landscape Contractor Equipment Market. We market products to landscape contractors under the Toro and Exmark brands. Products for the landscape contractor market include zero-turn radius riding mowers... -

Page 11

... first quarter of fiscal 2015, we acquired the BOSS professional snow and ice management business. Products for the snow and ice management market are marketed mainly in North America under the BOSS brand and include snowplows, salt and sand spreaders, and related parts and accessories for light and... -

Page 12

...as electric, gas, and cordless grass trimmers; electric and cordless hedge trimmers; and electric, gas, and cordless blower-vacuums. In Australia, we also design and market garden product offerings, such as underground and hose-end retail irrigation products under the Pope brand name. In fiscal 2015... -

Page 13

... and component costs are generally for steel, engines, hydraulic components, transmissions, plastic resin, and electric motors, all of which we purchase from several suppliers around the world. Service and Warranty Our products are warranted to ensure customer confidence in design, workmanship, and... -

Page 14

... in production; replacement parts inventory; payroll and other administrative costs; capital expenditures; establishment of new facilities; expansion, renovation, and upgrading of existing facilities; as well as for financing receivables from customers that are not financed with Red Iron Acceptance... -

Page 15

... retail irrigation products are sold directly to home centers. Products for the rental and specialty construction market are sold directly to dealers and rental companies. Toro and Exmark landscape contractor products are also sold directly to dealers in certain regions of North America. BOSS snow... -

Page 16

... as Red Iron. The purpose of Red Iron is to provide inventory financing, including floor plan and open account receivable financing, to distributors and dealers of our products in the U.S. and select distributors of our products in Canada. Under a separate arrangement, TCF Commercial Finance Canada... -

Page 17

... open account terms directly to home centers and mass retailers; general line irrigation dealers; international distributors and dealers other than the Canadian distributors and dealers to whom Red Iron provides financing arrangements; micro-irrigation dealers and distributors; government customers... -

Page 18

... at applicable exchange rates. Accordingly, we are exposed to foreign currency exchange rate risk arising from transactions in the normal course of business, such as sales and loans to wholly owned subsidiaries, as well as sales to third party customers, purchases from suppliers, and bank lines of... -

Page 19

... level of new golf course development and golf course closures; the level of homeowners who outsource their lawn care; the level of residential and commercial construction; acceptance of and demand for micro-irrigation solutions for agricultural markets; the integration of the BOSS business into our... -

Page 20

... in acceptance of and demand for micro-irrigation solutions for agricultural markets and our products in the rental and specialty construction market; and • reduced tax revenue, increased governmental expenses in other areas, tighter government budgets and government deficits, generally resulting... -

Page 21

... distributors and dealers of acquired businesses to using our Red Iron financing joint venture with TCFIF; • violation of any non-compete agreement by any key employee of an acquired business; • adverse impact on overall profitability if our expanded operations do not achieve the financial... -

Page 22

... and financial resources, expose us to difficulties presented by international economic, political, legal, accounting, and business factors, and may not be successful or produce desired levels of net sales. We currently manufacture our products in the U.S., Mexico, Australia, the United Kingdom... -

Page 23

... new manufacturing and distribution facilities, and move production between such facilities as needed from time to time. For example, if our micro-irrigation facility in China, which was acquired and opened in order to support anticipated growth of our micro-irrigation business and enable future... -

Page 24

... our accounting and financial functions, including maintaining our internal controls; our manufacturing and supply chain processes; and the data related to our research and development efforts. The failure of our management information systems or those of our business partners or third party service... -

Page 25

... costs related to research, development, engineering, and other expenses to design Tier 4 diesel engine compliant products in the form of price increases to our customers, we may experience lower market demand for our products that may, ultimately, adversely affect our profit margins, net sales, and... -

Page 26

... impacts the lawn and garden, outdoor power equipment, or irrigation industries generally by promoting the purchase, such as through customer rebate or other incentive programs, of certain types of mowing, snow and ice management or irrigation equipment or other products that we sell, could impact... -

Page 27

... result of our Red Iron Acceptance LLC financing joint venture with TCFIF, we are dependent upon the joint venture to provide competitive inventory financing programs, including floor plan and open account receivable financing, to certain distributors and dealers of our products. Any material change... -

Page 28

... information technology and office space. These expansion efforts included the construction of a new corporate facility that was completed in fiscal 2014, and we are renovating our original corporate facility located in Bloomington, Minnesota to accommodate expansion needs of our product development... -

Page 29

...; and unanticipated cost increases. • financial viability of distributors and dealers, changes in distributor ownership, changes in channel distribution of our products, relationships with our distribution channel partners, our success in partnering with new dealers, and our customers' ability to... -

Page 30

... fiscal 2016, although strategies for future operational growth are currently being assessed. We are expanding and renovating our corporate facilities located in Bloomington, Minnesota, which included the construction of a 75,000 square foot facility that was completed in fiscal 2014 and renovation... -

Page 31

...December 2008 to June 2013, he served as Vice President, Corporate Controller. Group Vice President, Residential and Contractor Businesses since March 2012, which includes responsibility for our Residential and Landscape Contractor - Toro, Exmark, and Sitework Systems businesses. From August 2010 to... -

Page 32

...EQUITY SECURITIES Our common stock is listed for trading on the New York Stock Exchange and trades under the symbol ''TTC.'' The high, low, and last sales prices for our common stock and cash dividends paid for each of the quarterly periods for fiscal 2015 and 2014 were as follows: Fiscal year ended... -

Page 33

... 10/31/2010 10/31/2011 10/31/2012 10/31/2013 10/31/2014 10/31/2015 The Toro Company S&P 500 Peer Group 15DEC201509544677 *$100 invested on 10/31/2010 in stock or index, including reinvestment of dividends. Fiscal year ending October 31. Fiscal year ending October 31 The Toro Company S&P 500 Peer... -

Page 34

... equipment and services, turf irrigation systems, landscaping equipment and lighting, agricultural micro-irrigation systems, rental and specialty construction equipment, and residential yard and snow thrower products. Beginning in fiscal 2015 with our acquisition of BOSSா, we also design... -

Page 35

... zero-turn radius riding and walk power mower products and expanded product placement. However, residential segment net sales in Australia were down due to unfavorable foreign currency exchange rate changes. • International net sales for fiscal 2015 decreased by 1.9 percent compared to fiscal 2014... -

Page 36

...growth in the landscape contractor market. We also expect continued growth in the rental equipment market and strong demand for new rental and specialty construction equipment products. Sales in the golf and grounds and irrigation markets are expected to slightly increase in fiscal 2016 as compared... -

Page 37

... foreign currency exchange rates and continued adverse political and economic conditions in key international markets. • Increased sales of residential segment products due to strong shipments and demand for our newly introduced zero-turn radius riding and walk power mower products and expanded... -

Page 38

... thrower products and parts as a result of heavy snow falls during the 2013-2014 snow season in key markets and strong preseason demand for the 2014-2015 snow season. Additionally, higher shipments and demand for our zero-turn radius riding mowers and increased sales of electric trimmers and blowers... -

Page 39

... products, such as our new INFINITYா sprinklers, that were well received by customers, as well as new international golf course projects. • Increased sales and demand for rental and specialty construction equipment, including products that we introduced under the Toro brand. • Improved price... -

Page 40

... for snow thrower products and parts as a result of heavy snow falls during the 2013-2014 snow season in key markets and strong preseason demand for the 2014-2015 snow season. • Increased sales and demand of zero-turn radius riding products, including our enhanced products, as customers continued... -

Page 41

... our reporting units as their related fair values were substantially in excess of their carrying values. FINANCIAL CONDITION Working Capital During fiscal 2015, our average net working capital (accounts receivable plus inventory less trade payables) as a percentage of net sales increased primarily... -

Page 42

... a term loan that was utilized for the purchase of the BOSS business early in the first quarter of fiscal 2015. Liquidity and Capital Resources Our businesses are seasonally working capital intensive and require funding for purchases of raw materials used in production, replacement parts inventory... -

Page 43

...share paid each quarter in fiscal 2014. As announced on December 3, 2015, our Board of Directors increased our fiscal 2016 first quarter cash dividend by 20 percent to $0.30 per share from the quarterly cash dividend paid in the first quarter of fiscal 2015. Share Repurchase Plan During fiscal 2015... -

Page 44

...of open account terms to home centers and mass retailers; general line irrigation dealers; international distributors and dealers other than the Canadian distributors and dealers to whom Red Iron provides financing arrangements; micro-irrigation dealers and distributors; government customers; rental... -

Page 45

... 2015, we acquired substantially all of the assets of the BOSS professional snow and ice management business of privately held Northern Star Industries, Inc. BOSS designs, manufactures, markets, and sells a broad line of snowplows, salt and sand spreaders, and related parts and accessories for light... -

Page 46

... customers, product failure rates, and higher or lower than expected service costs for a repair. We believe that analysis of historical trends and knowledge of potential manufacturing or design problems provide sufficient information to establish a reasonable estimate for warranty claims at the time... -

Page 47

... current knowledge of potential collection problems provide us with sufficient information to establish a reasonable estimate for an allowance for doubtful accounts. However, since we cannot predict with certainty future changes in the financial stability of our customers or in the general economy... -

Page 48

... with foreign currency exchange rate changes and not for trading purposes. We are exposed to foreign currency exchange rate risk arising from transactions in the normal course of business, such as sales to third party customers, sales and loans to wholly owned foreign subsidiaries, foreign plant... -

Page 49

...Analysis of Financial Condition and Results of Operations'' of this report in the section entitled ''Inflation.'' We enter into fixed-price contracts for future purchases of natural gas in the normal course of operations as a means to manage natural gas price risks. In fiscal 2015, our manufacturing... -

Page 50

... registered public accounting firm, as stated in their report, which is included herein. In the first quarter of 2015, the company acquired substantially all of the assets of the BOSS professional snow and ice management business of privately held Northern Star Industries, Inc. BOSS represented... -

Page 51

Report of Independent Registered Public Accounting Firm The Stockholders and Board of Directors The Toro Company: We have audited the accompanying consolidated balance sheets of The Toro Company and subsidiaries (the Company) as of October 31, 2015 and 2014 and the related consolidated statements of... -

Page 52

... Weighted-average number of shares of common stock outstanding - Diluted CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Dollars in thousands) Fiscal years ended October 31 2015 $201,591 (11,792) (120) (2,226) (14,138) $187,453 2014 $173,870 (4,758) (1,583) 3,206 (3,135) $170,735 2013 $154,845... -

Page 53

...Property, plant, and equipment, net Long-term deferred income taxes Goodwill Other intangible assets, net Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current portion of long-term debt Short-term debt Accounts payable Accrued liabilities: Warranty Advertising and marketing programs... -

Page 54

... in short-term debt (Repayments of) increase in long-term debt Excess tax benefits from stock-based awards Proceeds from exercise of stock options Purchases of Toro common stock Dividends paid on Toro common stock Net cash (used in) provided by financing activities Effect of exchange rates on cash... -

Page 55

...Balance as of October 31, 2012 Cash dividends paid on common stock - $0.56 per share Issuance of 669,426 shares for stock options exercised and restricted stock vested Stock-based compensation expense Contribution of stock to a deferred compensation trust Purchase of 2,147,185 shares of common stock... -

Page 56

... 31, 2015, cash and short-term investments held by the company's foreign subsidiaries that are not available to fund domestic operations unless repatriated were $61,272. Receivables The company's financial exposure to collection of accounts receivable is reduced due to its Red Iron Acceptance, LLC... -

Page 57

... over 10 to 45 years, and equipment over two to seven years. Tooling costs are generally depreciated over three to five years using the straight-line method. Software and web site development costs are generally amortized over two to five years utilizing the straight-line method. Expenditures for... -

Page 58

...'s foreign operations is generally the applicable local currency. The functional currency is translated into U.S. dollars for balance sheet accounts using current exchange rates in effect as of the balance sheet date and for revenue and expense accounts using a weighted-average exchange rate during... -

Page 59

..., selling expenses, engineering and research costs, information systems costs, incentive and profit sharing expense, and other miscellaneous administrative costs, such as legal costs for internal and outside services that are expensed as incurred. Cost of Financing Distributor / Dealer Inventory... -

Page 60

...-average number of shares of common stock, assumed issuance of contingent and restricted shares, and effect of dilutive securities 2015 2014 2013 2015 55,554 11 2014 56,346 13 2013 57,898 24 Advertising General advertising expenditures are expensed the first time advertising takes place. Production... -

Page 61

... vehicles, skid steers, and front-end loaders. Through this acquisition, the company added another professional contractor brand; a portfolio of counter-seasonal equipment; manufacturing and distribution facilities located in Iron Mountain, Michigan; and a distribution network for these products... -

Page 62

... to the company. The net amount of new receivables financed for dealers and distributors under this arrangement during fiscal 2015, 2014, and 2013 was $1,430,855, $1,280,505, and $1,211,470, respectively. Summarized financial information for Red Iron is presented as follows: For the twelve months... -

Page 63

October 31, 2014 Patents Non-compete agreements Customer-related Developed technology Trade names Other Total amortizable Non-amortizable - trade names Total other intangible assets, net Estimated Life (Years) 9.4 5.4 10.7 7.6 5.0 Gross Carrying Amount $10,711 7,039 8,650 28,841 1,515 800 57,556 ... -

Page 64

... 11, 2012, the company's Board of Directors authorized the repurchase of 5,000,000 shares of the company's common stock in open-market or in privately negotiated transactions. This program has no expiration date but may be terminated by the Board at any time. During fiscal 2015, 2014, and 2013, the... -

Page 65

... related to employee stock-based award transactions. The tax effects of temporary differences that give rise to the net deferred income tax assets are presented below: October 31 Deferred tax assets (liabilities): Compensation and benefits Warranty and insurance Advertising and sales allowance... -

Page 66

... price equal to the closing price of the company's common stock on the date of grant, as reported by the New York Stock Exchange. Options are generally granted to executive officers, other employees, and non-employee members of the company's Board of Directors on an annual basis in the first quarter... -

Page 67

... 2014 $19,017 12,311 2013 $23,160 13,875 Restricted Stock and Restricted Stock Units. Under the 2010 plan, restricted stock and restricted stock unit awards are generally granted to certain employees that are not executive officers. Occasionally, restricted stock or restricted stock unit awards... -

Page 68

... officers and other employees under which they are entitled to receive shares of the company's common stock contingent on the achievement of performance goals of the company and businesses of the company, which are generally measured over a three-year period. The number of shares of common stock... -

Page 69

..., landscape creation and renovation equipment, rental and specialty construction equipment, and other maintenance equipment. Irrigation and lighting products consist of sprinkler heads, electric and hydraulic valves, controllers, computer irrigation central control systems, and micro-irrigation drip... -

Page 70

... golf course and sports fields and grounds equipment customers in the The following table presents net sales for groups of similar products and services: Fiscal years ended October 31 Equipment Irrigation and lighting Total 2015 $2,004,274 386,601 $2,390,875 2014 $1,765,845 406,846 $2,172,691 2013... -

Page 71

...suppliers for materials and supplies as part of the normal course of business. The company also entered into a construction agreement for the renovation of its original corporate facility located at Bloomington, Minnesota, to accommodate needs for expansion of product development and test capacities... -

Page 72

... maximum amount of time the company hedges its exposure to the variability in future cash flows for forecasted trade sales and purchases is two years. Results of hedges of intercompany loans are recorded in other income, net as an offset to the remeasurement of the foreign loan balance. The company... -

Page 73

The following table presents the fair value of the company's derivatives and consolidated balance sheet location. Asset Derivatives October 31, 2015 Balance Sheet Location Derivatives Designated as Hedging Instruments Forward currency contracts Cross currency contracts Derivatives Not Designated as ... -

Page 74

... amounts in the consolidated balance sheets, which are reasonable estimates of their fair value due to their short-term nature. Forward currency contracts are valued based on observable market transactions of forward currency prices and spot currency rates as of the reporting date. The fair value of... -

Page 75

... 14, 2014, during the first quarter of fiscal 2015, the company acquired substantially all of the assets (excluding accounts receivable) of the BOSSா professional snow and ice management business of privately held Northern Star Industries, Inc., as discussed in Note 2. The purchase price included... -

Page 76

... affect, the company's internal control over financial reporting. In the first quarter of 2015, the company acquired substantially all of the assets of the BOSS professional snow and ice management business of privately held Northern Star Industries, Inc. BOSS represented approximately 19 percent of... -

Page 77

... Supplementary Data'' of this report: • Management's Report on Internal Control over Financial Reporting. • Report of Independent Registered Public Accounting Firm. • Consolidated Statements of Earnings for the fiscal years ended October 31, 2015, 2014, and 2013. • Consolidated Statements of... -

Page 78

... Toro Company and TCF Inventory Finance, Inc. (incorporated by reference to Exhibit 2.1 to Registrant's Quarterly Report on Form 10-Q for the fiscal quarter ended May 4, 2012, Commission File No. 1-8649).** 2.3 (1) Limited Liability Company Agreement of Red Iron Acceptance, LLC dated August 12, 2009... -

Page 79

... of Performance Share Award Agreement between The Toro Company and its officers and other employees under The Toro Company 2010 Equity and Incentive Plan (incorporated by reference to Exhibit 10.18 to Registrant's Annual Report on Form 10-K for the fiscal year ended October 31, 2014, Commission File... -

Page 80

... Current Report on Form 8-K dated August 12, 2009, Commission File No. 1-8649). 10.29 (2) First Amendment to Credit and Security Agreement, dated June 6, 2012, by and between Red Iron Acceptance, LLC and TCF Inventory Finance, Inc. (incorporated by reference to Exhibit 10.1 to Registrant's Quarterly... -

Page 81

... accounts charged off. (Dollars in thousands) Fiscal year ended October 31, 2015 Accrued advertising and marketing programs Fiscal year ended October 31, 2014 Accrued advertising and marketing programs Fiscal year ended October 31, 2013 Accrued advertising and marketing programs 1 Balance... -

Page 82

... of the Board and Chief Executive Officer and Director (principal executive officer) Vice President, Treasurer and Chief Financial Officer (principal financial officer) Vice President, Corporate Controller (principal accounting officer) Director December 23, 2015 December 23, 2015 December 23... -

Page 83

Intentionally left blank -

Page 84

...Judy L. Altmaier Vice President, Exmark William E. Brown, Jr. Group Vice President, Commercial and Irrigation Businesses Jeffrey M. Ettinger Darren L. Redetzke Vice President, International Business Chairman and Chief Executive Officer Hormel Foods Corporation Gregg W. Steinhafel Former Chairman... -

Page 85

... in one easy-to-use, time-saving machine - like Quick Stick® chute control and, for the first time on a snow blower, our innovative Personal Pace® drive system. q Enhancing productivity for rental and contractor fleets, the new Toro® Dingo® TX 1000 compact utility loader is the strongest... -

Page 86

The Toro Company 8111 Lyndale Avenue South Bloomington, MN 55420-1196 952-888-8801 www.thetorocompany.com