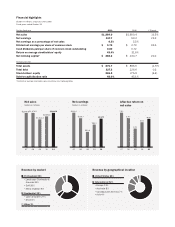

Toro 2011 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2011 Toro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

expense is accrued at the time of sale based on the type and Overall, worldwide sales levels are historically highest in our fis-

estimated number of products under warranty, historical average cal second quarter and retail demand is generally highest in our

costs incurred to service warranty claims, the trend in the historical fiscal third quarter. Typically, accounts receivable balances

ratio of claims to sales, the historical length of time between the increase between January and April because of higher sales

sale and resulting warranty claim, and other minor factors. Special volumes and extended payment terms made available to our cus-

warranty reserves are also accrued for major rework campaigns. tomers. Accounts receivable balances typically decrease between

Service support outside of the warranty period is provided by May and December when payments are received. Our financing

authorized distributors and dealers at the customer’s expense. We requirements are subject to variations due to seasonal changes in

also sell extended warranty coverage on select products for a pre- working capital levels, which typically increase in the first half of

scribed period after the factory warranty period expires. our fiscal year and then decrease in the second half of our fiscal

year. Seasonal cash requirements of our business are financed

Product Liability from a combination of cash balances, cash flows from operations,

We have rigorous product safety standards and continually work to and our bank credit lines.

improve the safety and reliability of our products. We monitor for The following table shows total consolidated net sales and net

accidents and possible claims and establish liability estimates with earnings for each fiscal quarter as a percentage of the total fiscal

respect to claims based on internal evaluations of the merits of year.

individual claims. We purchase excess insurance coverage for cat-

astrophic product liability claims for incidents that exceed our Fiscal 2011 Fiscal 2010

self-insured retention levels. Net Net Net Net

Quarter Sales Earnings Sales Earnings

Patents and Trademarks First 20% 15% 20% 12%

We hold patents in the United States and foreign countries and Second 33 51 33 49

apply for patents as applicable. Although we believe our patents Third 27 30 27 36

are valuable and patent protection is beneficial, our patent protec- Fourth 20 4 20 3

tion will not necessarily deter or prevent competitors from attempt-

ing to develop similar products. We are not materially dependent Effects of Weather

on any one or more of our patents. From time to time, weather conditions in a particular geographic

To prevent possible infringement of our patents by others, we region or market may adversely or positively affect sales of some

periodically review competitors’ products. To help avoid potential of our products and field inventory levels and result in a negative

liability with respect to others’ patents, we regularly review certain or positive impact on our future net sales. If the percentage of our

patents issued by the United States Patent and Trademark Office net sales from outside the United States increases, our depen-

(‘‘USPTO’’) and foreign patent offices. We believe these activities dency on weather in any one part of the world decreases. None-

help us minimize our risk of being a defendant in patent infringe- theless, weather conditions could materially affect our future net

ment litigation. We are currently involved in patent litigation cases sales.

where we are asserting our patents against competitors and

defending against patent infringement assertions by others. Working Capital

We fund our operations through a combination of cash and cash

Seasonality equivalents, cash flows from operations, short-term borrowings

Sales of our residential products, which accounted for 33 percent under our credit facilities, and long-term debt. Wherever possible,

of total consolidated net sales in fiscal 2011, are seasonal, with cash management is centralized and intercompany financing is

sales of lawn and garden products occurring primarily between used to provide working capital to subsidiaries as needed. In addi-

February and May, depending upon seasonal weather conditions tion, our credit facilities are available for additional working capital

and demand for our products. Sales of snow removal products needs, acquisitions, or other investment opportunities.

occur primarily between July and January, depending upon sea-

sonal snow falls, product availability, and demand for our snow Distribution and Marketing

removal products. Opposite seasons in global markets in which we We market the majority of our products through approximately 40

sell our products somewhat moderate this seasonality of residential domestic and 120 foreign distributors, as well as a large number of

product sales. Seasonality of professional product sales also exists outdoor power equipment dealers, hardware retailers, home cen-

but is tempered because the selling season in the Southern U.S. ters, and mass retailers in more than 90 countries worldwide.

and in our markets in the Southern hemisphere continues for a Residential products, such as walk power mowers, riding prod-

longer portion of the year than in Northern regions of the world. ucts, and snow throwers, are mainly sold directly to home centers,

7