Toro 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Toro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Leadership through

innovation

The Toro Company

2010 Annual Report

Table of contents

-

Page 1

The Toro Company 2010 Annual Report Leadership through innovation -

Page 2

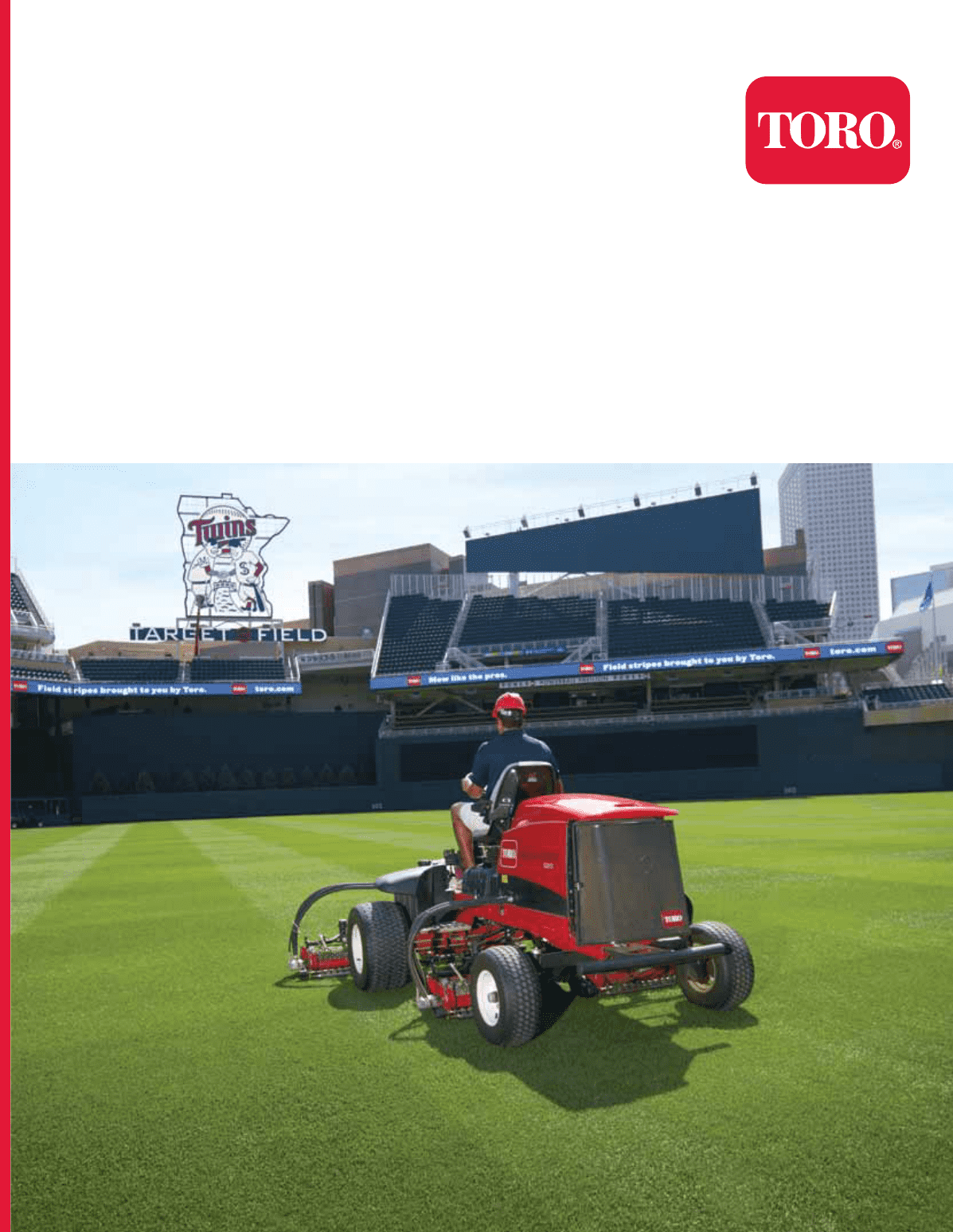

... models, and MH-400 material handler (acquired from TY-CROP) Toro® Precision™ Series spray and rotating nozzles Exmark® Vantage™ stand-on mower About the front cover: Toro® Reelmaster ® 5210 reel mower stripes the outfield during the inaugural season at Target Field, home of the Minnesota... -

Page 3

... golf central control system - among other water-saving solutions. As for residential equipment, our Toro® and Lawn-Boy® brands received high marks by a leading consumer magazine taking top honors in the categories of zero-turn riding mowers, gas-powered self-propelled and push walk power mowers... -

Page 4

... of dealer and distributor partners in North America and has helped reduce accounts receivable by over 50 percent since fiscal 2007. • Trade Payables - Implementation of a new supply chain initiative, which provides suppliers with attractive financing options, helped increase trade payables by... -

Page 5

... economic conditions for golf customers and landscape contractors, combined with low field inventory levels, should translate into increased sales as they invest back in their businesses. Additionally, we are moving forward with a new manufacturing plant in Eastern Europe to serve increasing demands... -

Page 6

...10 Revenue by Market n Professional 64% Revenue by Geographical Location n United States 68% n Europe 13% n Australia 8% • Landscape Contractor & Grounds 32% • Golf 26% • Micro Irrigation 6% n Residential 35% • Lawn & Garden 30% • Snow 5% n Other 1% Canada & n Latin America 7% n Asia... -

Page 7

..., based on the closing price of the Common Stock on April 30, 2010, the last business day of the registrant's most recently completed second fiscal quarter, as reported by the New York Stock Exchange, was approximately $1.9 billion. The number of shares of Common Stock outstanding as of December 16... -

Page 8

... Disclosures about Market Risk ...Management's Report on Internal Control over Financial Reporting ...Report of Independent Registered Public Accounting Firm ...Consolidated Statements of Earnings for the fiscal years ended October 31, 2010, 2009, and 2008 ...Consolidated Balance Sheets as of... -

Page 9

... be considered part of this report. We design, manufacture, and market professional turf maintenance equipment and services, turf and agricultural micro-irrigation systems, landscaping equipment, and residential yard and snow removal products. We produced our first mower for golf course use in 1921... -

Page 10

...cutting; riding and walking mowers for putting greens and specialty areas; turf sprayer equipment; utility vehicles; aeration equipment; and bunker maintenance equipment. We also manufacture and market underground irrigation systems, including sprinkler heads, controllers, turf sensors, and electric... -

Page 11

...-turn radius mowers that save homeowners time by using superior maneuverability to cut around obstacles more quickly and easily than tractor technology. We also sell lawn and garden tractor models, as well as rear engine and direct-collect riding mowers manufactured and sold in the European market... -

Page 12

..., product and platform design, application of advanced technologies, enhanced environmental management systems, SKU consolidation, safety improvements, and improved supply-chain management. We also manufacture products sold under a private label agreement to a third party on a competitive basis... -

Page 13

... foreign distributors, as well as a large number of outdoor power equipment dealers, hardware retailers, home centers, and mass retailers in more than 90 countries worldwide. Residential products, such as walk power mowers, riding products, and snow throwers, are mainly sold directly to home centers... -

Page 14

...are sold directly to home centers. Compact utility loaders and attachments are sold to dealers and directly to large rental companies. Toro and Exmark landscape contractor products are also sold directly to dealers in certain regions of the United States. During the first quarter of fiscal 2010, our... -

Page 15

... government customers. Some independent international dealers continue to finance their products with third party sources. End-User Financing. We have agreements with third party financing companies to provide lease-financing options to golf course and sports fields and grounds equipment customers... -

Page 16

... SEC's home page on the Internet at http://www.sec.gov. We make available, free of charge on our Internet web site www.thetorocompany.com (select the ''Investor Information'' link and then the ''Financials'' link), our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on... -

Page 17

... golf course development and golf course closures; the level of homeowners who outsource their lawn care; the level of residential and commercial construction; the availability of credit to professional segment customers on acceptable terms to finance new product purchases; and amount of government... -

Page 18

... to fund advertising, marketing, promotional programs, and research and development. Our residential segment net sales are dependent upon The Home Depot, Inc. as a major customer, the amount of product placement at retailers, consumer confidence and spending levels, and changing buying patterns of... -

Page 19

... to new or emerging technologies and changes in customer preferences, or to devote greater resources to the development, promotion, and sale of their products than we can. In addition, competition could increase if new companies enter the market or if existing competitors expand their product lines... -

Page 20

... party customers, purchases from suppliers, and bank lines of credit with creditors denominated in foreign currencies. Our reported net sales and net earnings are subject to fluctuations in foreign currency exchange rates. Because our products are manufactured or sourced primarily from the United... -

Page 21

... upon the joint venture to provide competitive inventory financing programs, including floor plan and open account receivable financing, to certain distributors and dealers of our products. Any material change in the availability or terms of credit offered to our customers by the joint venture, any... -

Page 22

... execute such plans our ability to sell our products into the market may be inhibited, which could adversely affect our competitive position and financial results. Additionally, we have incurred and expect to continue to incur research, development and engineering costs to design Tier 4 compliant... -

Page 23

demand for our products relative to the product offerings of our competitors. For example, any fiscal-stimulus or other legislative enactment that impacts the lawn and garden, outdoor power equipment, or irrigation industries generally by promoting the purchase, such as through customer rebate or ... -

Page 24

... sales or financial difficulties of our distributors or dealers, which could cause us to repurchase financed product; • termination or material change to the terms of our end-user financing arrangements, availability of credit for our customers, including any delay in securing replacement credit... -

Page 25

...planned future site for a micro-irrigation manufacturing facility. Plant utilization varies during the year depending on the production cycle. We consider each of our current facilities in use to be in good operating condition. Management believes we have sufficient manufacturing capacity for fiscal... -

Page 26

... served as Managing Director, Corporate Controller. From November 2003 to January 2006, he served as Director, Corporate Finance. Vice President, Residential and Landscape Contractor Businesses since August 2010. From December 2008 to July 2010, he served as Vice President, Commercial Business. From... -

Page 27

... for trading on the New York Stock Exchange and trades under the symbol ''TTC.'' The high, low, and last sales prices for Toro common stock and cash dividends paid for each of the quarterly periods for fiscal 2010 and 2009 were as follows: Fiscal year ended October 31, 2010 Market price per share of... -

Page 28

...in each of Toro common stock, the S&P 500 Index, and an industry peer group for the five year period from October 31, 2005 through October 31, 2010. $180 $160 $140 $120 $100 $80 $60 $40 $20 $0 2005 2006 2007 2008 2009 2010 The Toro Company Fiscal year ending October 31 The Toro Company S&P 500 Peer... -

Page 29

... equipment and services, turf and agricultural micro-irrigation systems, landscaping equipment, and residential yard and snow removal products worldwide. We sell our products worldwide through a network of distributors, dealers, hardware retailers, home centers, mass retailers, and over the Internet... -

Page 30

...contractor equipment. • Our residential segment net sales were also up by 10.7 percent to $589.7 million in fiscal 2010 compared to fiscal 2009 as a result of continued strong demand for our products and additional product placement for our zero-turn radius riding mowers. Shipments of snow thrower... -

Page 31

... our international sales to increase in fiscal 2011 compared to fiscal 2010. • We anticipate fiscal 2011 net sales in our professional segment to increase compared to those in fiscal 2010, as we expect continued strong demand for our landscape contractor equipment, namely new products that we plan... -

Page 32

... markets to meet growing worldwide demand. • An increase in residential segment net sales attributable to continued strong demand, resulting in part from customer acceptance of and additional product placement for zero-turn radius riding mowers. In addition, shipments of snow thrower products... -

Page 33

... for our new line of zero-turn radius riding mowers, a decrease in electric blower product sales, and a decrease in sales of snow thrower products due to the timing of the introduction for our redesigned offering of snow thrower products that shipped to customers in the first quarter of fiscal 2010... -

Page 34

... and commercial construction markets. In addition, landscape contractor equipment net sales decreased, despite the fact that our new products, which included our next generation of zero-turn radius riding mowers and Toro GrandStandா stand-on mowers, were well received by customers. Residential... -

Page 35

... zero-turn radius riding mowers attributable to continued strong demand, resulting in part from customer acceptance of new products and additional product placement. • An increase in sales of snow thrower products due to increased demand from heavy snow falls during the winter season of 2009-2010... -

Page 36

...well as floor plan receivables previously financed by a third party financing company, during our first quarter of fiscal 2010. The sale of these receivables enables us to use our working capital for strategic purposes, such as research and development of innovative new products, improvements in the... -

Page 37

... in new markets and expand existing markets, help us to meet product demand, and increase our manufacturing efficiencies and capacity. Cash used in investing activities was up 32.3 percent in fiscal 2010 compared to fiscal 2009 due mainly to an increase in purchases of property, plant, and equipment... -

Page 38

...government customers. End-User Financing. We have agreements with third party financing companies to provide lease-financing options to golf course and sports fields and grounds equipment customers in the Share Repurchase Plan During fiscal 2010, we continued repurchasing shares of our common stock... -

Page 39

..., respectively, from two distribution companies. The amounts are included in other current and long-term assets on our consolidated balance sheets. As of October 31, 2010, we also had $13.3 million in outstanding letters of credit issued during the normal course of business, as required by some... -

Page 40

... of Southern Green's versatile line of Soil Relieverா aerators increased our offering of highly-productive turf cultivation equipment and provided entry into a new product category for our golf course and sports field markets. In fiscal 2008, we also completed the purchase of Turf Guard wireless... -

Page 41

..., including information on purchases, sales, issuances, and settlements on a gross basis in the reconciliation of Level 3 fair-value measurements. We adopted the provision of ASU No. 2010-06 for Level 1 and Level 2 fair-value measurements in our second fiscal quarter ended April 30, 2010, as... -

Page 42

... to foreign currency exchange rate risk arising from transactions in the normal course of business, such as sales and loans to wholly owned foreign subsidiaries, foreign plant operations, and purchases from suppliers. Because our products are manufactured or sourced primarily from the United States... -

Page 43

... buy these commodities and components based upon market prices that are established with the vendor as part of the purchase process. We generally attempt to obtain firm pricing from most of our suppliers for volumes consistent with planned production. To the extent that commodity prices increase... -

Page 44

...'s Chairman of the Board, President, and Chief Executive Officer and Vice President, Finance and Chief Financial Officer, evaluated the effectiveness of the company's internal control over financial reporting as of October 31, 2010. In making this evaluation, management used the criteria set forth... -

Page 45

Report of Independent Registered Public Accounting Firm The Stockholders and Board of Directors The Toro Company: We have audited the accompanying consolidated balance sheets of The Toro Company and subsidiaries as of October 31, 2010 and 2009 and the related consolidated statements of earnings, ... -

Page 46

CONSOLIDATED STATEMENTS OF EARNINGS (Dollars and shares in thousands, except per share data) Fiscal years ended October 31 2010 $1,690,378 1,113,987 576,391 425,125 151,266 (17,113) 7,115 141,268 48,031 $ $ $ 93,237 2.83 2.79 32,982 33,437 $ $ $ ... -

Page 47

...-term debt Accounts payable Accrued liabilities: Warranty Advertising and marketing programs Compensation and benefit costs Insurance Income taxes Other Total current liabilities Long-term debt, less current portion Deferred revenue Other long-term liabilities Stockholders' equity: Preferred stock... -

Page 48

... as of the end of the fiscal year Supplemental disclosures of cash flow information: Cash paid during the fiscal year for: Interest Income taxes Shares issued in connection with stock-based compensation plans Long-term debt issued in connection with acquisitions The financial statements should be... -

Page 49

... Total comprehensive income Balance as of October 31, 2008 Cash dividends paid on common stock - $0.60 per share Issuance of 1,201,256 shares under stock-based compensation plans Contribution of stock to a deferred compensation trust Purchase of 3,316,536 shares of common stock Excess tax benefits... -

Page 50

..., thus reducing cost of sales by $3,284 in fiscal 2009 below the amount that would have resulted from replacing the liquidated inventory at end of year prices. Inventories as of October 31 were as follows: 2010 Raw materials and work in progress Finished goods and service parts Total FIFO value Less... -

Page 51

... on their respective balance sheets with their corresponding carrying amount (with goodwill) during the fourth quarter of fiscal 2010. The company determined that it has seven reporting Accounts Payable In fiscal 2009, the company entered into a customer-managed services agreement with a third... -

Page 52

...is the applicable local currency. The functional currency is translated into U.S. dollars for balance sheet accounts using current exchange rates in effect as of the balance sheet date and for revenue and expense accounts using a weighted-average exchange rate during the fiscal year. The translation... -

Page 53

...These financing arrangements are used by the company as a marketing tool to assist customers to buy inventory. The financing costs for distributor and dealer inventories were $14,490, $9,452, and $12,597 for the fiscal years ended October 31, 2010, 2009, and 2008, respectively. Sales Promotions and... -

Page 54

... fiscal 2010, 2009, and 2008, respectively, were excluded from the diluted net earnings per share calculation because their exercise prices were greater than the average market price of the company's common stock during the same respective periods. Cash Flow Presentation The consolidated statements... -

Page 55

... Iron also began financing floor plan receivables during the company's fourth quarter of fiscal 2009. The company sold to Red Iron certain inventory receivables, including floor plan and open account receivables, from distributors and dealers of the company's products, at a purchase price equal to... -

Page 56

...Red Iron to purchase the company's inventory financing receivables and to provide financial support for Red Iron's inventory financing programs. Red Iron borrows the remaining requisite estimated cash utilizing a $450,000 secured revolving credit facility established under a credit agreement between... -

Page 57

...were priced at 98.513% of par value, and the resulting discount of $1,859 associated with the issuance of these senior notes is being amortized over the term of the notes using the Stock repurchase program. The company's Board of Directors authorized the repurchase of shares of the company's common... -

Page 58

... 1, 2010, the company's Board of Directors authorized the repurchase of up to an additional 3,000,000 shares of its common stock in open-market or privately negotiated transactions. This repurchase authorization has no expiration date but may be terminated by the company's Board of Directors at... -

Page 59

... date of grant, as reported by the New York Stock Exchange. Options are generally granted to non-employee directors, officers, and other key employees in the first quarter of the company's fiscal year. Option awards generally vest one-third each year over a three-year period and have a ten-year term... -

Page 60

...$58.96 2010 2009 2008 11 EMPLOYEE RETIREMENT PLANS The company maintains The Toro Company Investment, Savings, and Employee Stock Ownership Plan for eligible employees. The company's expenses under this plan were $15,500, $15,200, and $16,150 for the fiscal years ended October 31, 2010, 2009, and... -

Page 61

... as directly to government customers and rental companies. The Residential segment consists of walk power mowers, riding mowers, snow throwers, replacement parts, and home solutions products, including trimmers, blowers, blower-vacuums, and underground and hose-end retail irrigation products sold... -

Page 62

... the company during fiscal 2010. As of October 31, 2010, $12,711 of receivables financed by third party financing companies, excluding Red Iron, was outstanding. The following table presents net sales for groups of similar products and services: Fiscal years ended October 31 Equipment Irrigation... -

Page 63

... under these repurchase agreements. End-User Financing. The company has agreements with third party financing companies to provide lease-financing options to golf course and sports fields and grounds equipment customers in the U.S. and Europe. During fiscal 2007, the company entered into an amended... -

Page 64

... for outdoor landscape equipment and irrigation systems. The credit risk associated with these segments is limited because of the large number of customers in the company's customer base and their geographic dispersion, except for the residential segment that has significant sales to The Home Depot... -

Page 65

... of the company's derivatives and consolidated balance sheet location. Asset Derivatives October 31, 2010 Balance Sheet Location Derivatives Designated as Hedging Instruments Foreign exchange contracts Derivatives Not Designated as Hedging Instruments Foreign exchange contracts Total Derivatives... -

Page 66

... balance sheets, which are reasonable estimates of their fair value due to their short maturities. Foreign currency forward exchange contracts are valued at fair market value using the market approach based on exchange rates as of the reporting date, which is the amount the company would receive... -

Page 67

...the projected cash flows using the rate at which similar amounts of debt could currently be borrowed. 16 QUARTERLY FINANCIAL DATA (unaudited) Summarized quarterly financial data for fiscal 2010 and 2009 are as follows: Fiscal year ended October 31, 2010 Quarter Net sales Gross profit Net earnings... -

Page 68

... fourth fiscal quarter ended October 31, 2010 that has materially affected, or is reasonably likely to materially affect, the company's internal control over financial reporting. ITEM 9B.OTHER INFORMATION None. PART III ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE Information on... -

Page 69

...Data'' of this report: • Management's Report on Internal Control over Financial Reporting. • Report of Independent Registered Public Accounting Firm. • Consolidated Statements of Earnings for the fiscal years ended October 31, 2010, 2009, and 2008. • Consolidated Balance Sheets as of October... -

Page 70

... to Registrant's Annual Report on Form 10-K for the fiscal year ended October 31, 2008, Commission File No. 1-8649).* 10.13 Form of Nonemployee Director Stock Option Agreement between The Toro Company and its Non-Employee Directors under The Toro Company 2010 Equity and Incentive Plan (incorporated... -

Page 71

... to Registrant's Annual Report on Form 10-K for the fiscal year ended October 31, 2005, Commission File No. 1-8649). 10.25 Amendment No. 2 to Credit Agreement dated as of January 10, 2007, among The Toro Company, Toro Credit Company, Toro Manufacturing LLC, Exmark Manufacturing Company Incorporated... -

Page 72

... following financial information from The Toro Company's Annual Report on Form 10-K for the fiscal year ended October 31, 2010, filed with the SEC on December 22, 2010, formatted in eXtensible Business Reporting Language (XBRL): (i) Consolidated Statements of Earnings for each of the fiscal years in... -

Page 73

... TORO COMPANY AND SUBSIDIARIES Valuation and Qualifying Accounts Balance as of the beginning of the fiscal year $4,151 2,726 4,147 Charged to costs and expenses1 $ 666 1,811 (291) Balance as of the end of the fiscal year $3,904 4,151 2,726 (Dollars in thousands) Fiscal year ended October 31, 2010... -

Page 74

..., thereunto duly authorized. THE TORO COMPANY (Registrant) By: /s/ Stephen P. Wolfe Stephen P. Wolfe Vice President, Finance and Chief Financial Officer Dated: December 22, 2010 Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, this report has been signed below by... -

Page 75

Exhibit 10.17 PERFORMANCE SHARE AWARD AGREEMENT THE TORO COMPANY 2010 EQUITY AND INCENTIVE PLAN This Agreement (this "Agreement") dated [_____] ("Grant Date") between The Toro Company, a Delaware corporation ( "Toro"), and [_____] ("you") sets forth the terms and conditions of a grant to you of a ... -

Page 76

... financial statements, management's discussion and analysis or other filings with the Secur ities and Exchange Commission by Toro: [(i) items related to a change in accounting or measurement principles; (ii) items relating to financing activities; (iii) expenses for restructuring or productivity... -

Page 77

... litigation, arbitration and contractual settlements; (S) foreign exchange gains and losses; or (T) items relating to any other unusual or nonrecurring events or changes in applicable laws, accounting principles or business conditions.] d. The actual number of Shares that become vested and issuable... -

Page 78

... with respect to the portion of the applicable Performance Period completed at the date of such event, with proration based on full fiscal years only and no Shares to be delivered for partial fiscal years. b. In the event your employment or other service with Toro or any Affiliate or Subsidiary, as... -

Page 79

...obligations of Toro under the Plan with respect to this Performance Share Award shall be binding on any successor to Toro, whether the existence of such successor is the result of a direct or indirect purchase, merger, consolidation or otherwise, of all or substantially all of the business or assets... -

Page 80

14. No Right to Continue Employment or Service. Neither the Plan, this Performance Share Award, the Performance Share Award Acceptance Agreement nor any related material shall give you the right to continue in employment by or perform services to Toro or any Affiliate or Subsidiary or shall ... -

Page 81

IN WITNESS WHEREOF, this Agreement has been executed and delivered by The Toro Company and has been executed by you by execution of the attached Performance Share Award Acceptance Agreement. [_____] By: Chairman and CEO 7 -

Page 82

... governing the Performance Share Award as set forth in the Performance Share Award Agreement, this Agreement and as supplemented by the terms and conditions set forth in the Plan. In accepting the Performance Share Award, I hereby acknowledge that: (a) The Plan is established voluntarily by Toro... -

Page 83

... or any future Prospectuses relating the Plan and copies of all reports, proxy statements and other communications distributed to Toro's security holders generally by email directed to my Toro email address. Note: If you do not wish to accept the Performance Share Award on the terms stated in the... -

Page 84

... 10.18 ANNUAL PERFORMANCE AWARD AGREEMENT (FISCAL [____]) THE TORO COMPANY 2010 EQUITY AND INCENTIVE PLAN This Agreement (this "Agreement") dated [_____] ("Grant Date") between The Toro Company, a Delaware corporation ("Toro"), and [_____] ("you") sets forth the terms and conditions of a grant... -

Page 85

...(100% payout) Weighting Performance Measure Threshold ([__]% payout) Maximum ([___]% payout) No payout for the Corporate ...Control prior to the end of the Performance Period, and to the extent not previously forfeited or terminated pursuant to Section 5, 6 or 7 of this Agreement, this Annual... -

Page 86

... financial statements, management's discussion and analysis or other filings with the Securities and Exchange Commission by Toro: [(i) items related to a change in accounting or measurement principles; (ii) items relating to financing activities; (iii) expenses for restructuring or productivity... -

Page 87

... under The Toro Company Deferred Compensation Plan, as such plan may be amended from time to time, or any similar successor plan, you will receive such payment in accordance with your deferral election. e. The payment pursuant to this Annual Performance Award shall be subject to all applicable laws... -

Page 88

... direct or indirect purchase, merger, consolidation or otherwise, of all or substantially all of the business or assets of Toro. 13. No Right to Continue Employment or Service. Neither the Plan, this Annual Performance Award, the Annual Performance Award Acceptance Agreement nor any related material... -

Page 89

... are inconsistent with the Plan, the provisions of the Plan shall control and supersede any inconsistent provision of this Agreement or the Annual Performance Award Acceptance Agreement. 16. Non-Negotiable Terms. The terms of this Annual Performance Award and the Annual Performance Award Acceptance... -

Page 90

IN WITNESS WHEREOF, this Agreement has been executed and delivered by The Toro Company and has been executed by you by execution of the attached Annual Performance Award Acceptance Agreement. [_____] By: Chairman and CEO 7 -

Page 91

... hereby agree to the terms and conditions governing the Annual Performance Award as set forth in the Annual Performance Award Agreement, this Annual Performance Award Acceptance Agreement and as supplemented by the terms and conditions set forth in the Plan. In accepting the Annual Performance Award... -

Page 92

... or any future Prospectuses relating the Plan and copies of all reports, proxy statements and other communications distributed to Toro's security holders generally by email directed to my Toro email address. Note: If you do not wish to accept the Annual Performance Award on the terms stated in the... -

Page 93

...TORO COMPANY AND SUBSIDIARIES Computation of Ratio of Earnings to Fixed Charges (Not Covered by Independent Auditors' Report) 10/31/2010 10/31/2009 10/31/2008 10/31/2007 10/31/2006 Earnings before income taxes Plus...,908,000 8.98 Interest expense Rentals (interest expense) Total fixed charges... -

Page 94

...Inc. Irritrol Systems Europe S.r.l. Irritrol Systems Europe Productions S.r.l. MTI Distributing, Inc. Rain Master Irrigation Systems, Inc. Red Iron Acceptance, LLC Red Iron Holding Corporation Red Iron Insurance, Limited The ShopToro Company Toro Australia Pty. Limited Toro Australia Group Sales Pty... -

Page 95

... statement schedule for each of the years in the three year period ended October 31, 2010, and the effectiveness of internal control over financial reporting as of October 31, 2010, which report is included in the Annual Report on Form 10-K of The Toro Company. /s/ KPMG LLP Minneapolis, Minnesota... -

Page 96

... and report financial information; and b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: December 22, 2010 /s/ Michael J. Hoffman Michael J. Hoffman Chairman of the Board... -

Page 97

... or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: December 22, 2010 /s/ Stephen P. Wolfe Stephen P. Wolfe Vice President, Finance and Chief Financial Officer (Principal Financial Officer) -

Page 98

... with the Quarterly Report of The Toro Company (the "Company") on Form 10 -K for the fiscal year ended October 31, 2010 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), we, Michael J. Hoffman, Chairman of the Board, President and Chief Executive Officer of the... -

Page 99

... Vice President, Corporate Controller Robert C. Buhrmaster * Retired Jostens, Inc. Michael J. Hoffman Chairman and Chief Executive Officer The Toro Company Judy L. Altmaier Vice President, Operations Michael J. Happe Vice President, Residential and Landscape Contractor Business Janet K. Cooper... -

Page 100

... US Praxis) Toro® Z Master ® Propane commercial zero turn mower Hayter ® Harrier 56 Pro walk power mower Toro® TITAN® zero turn mower Toro® ProCore® SR Series deep tine aerator (acquired from Southern Green) About the back cover: Toro® Greensmaster ® riding greens mowers take to the... -

Page 101

The Toro Company 8111 Lyndale Avenue South Bloomington, MN 55420-1196 952-888-8801 www.thetorocompany.com