Toro 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Toro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Driven by Innovation

As we saw the signals of market contraction, we were

determined to stay focused on the needs of our

customers and seize the opportunity to gain market

share. One of the best ways to do this was to further

leverage our commitment to customer-valued innovation,

where we once again introduced our highest level of

new products in recent history. While products alone

could not fully counter the recession, they truly made a

difference in helping us take share in most of our markets.

In the residential segment, we launched a new line of

Toro® and Lawn-Boy® walk power mowers across a

broader range of price points that resulted in signifi cant

share growth. Another area of strong customer

acceptance came from our redesigned platform of Toro

TITAN® zero-turn mowers. For professional customers,

we entered an entirely new product category with the

introduction of the Toro Grand Stand™ stand-on mower

to expand our offering to landscape contractors. We

advanced our position in water management with

several breakthrough irrigation technologies, including

Toro’s Precision™ Series spray nozzles that reduce water

usage by up to 30 percent. And, we made our Toro

Workman® HD Series utility vehicle even better with

unmatched towing and hauling capacity. We expect

these and other industry-leading advancements to

continue to build momentum in the marketplace, and

our ongoing engineering investments mean even more

innovation is on the way. While we needed to adjust

R&D spending for the year due to contracting revenues,

our spending as a percentage of sales was up slightly

for fi scal 2009.

In addition to our innovative products, we continue to

earn the trust of customers around the world who value

our brands, our people and our service. For example,

we established new or expanded relationships with

the U.S. Army, Hilton Golf, Trump Golf, Shanghai Expo

Park, Glasgow’s Hampden Park and our hometown

Minnesota Twins — among many others. We also were

recognized by The Home Depot® as “Supplier of the

Year” in the lawn and garden category. Achieving this

prestigious award is the result of our quality products,

expert supply chain management team and genuine

business partnership. We are grateful for all of our

customer relationships and strive to earn their business

each and every day.

Striking the Right Balance

In response to the decline in demand, we took immediate

action in several critical areas to weather the short-term

challenges without impeding the long-term health of

the organization. To move our cost structure in the

necessary direction, we reduced our overall workforce

by approximately 15 percent from the previous year.

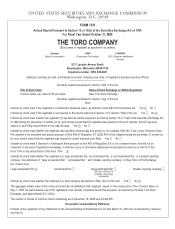

Financial Highlights

(dollars in millions, except per share data)

Fiscal years ended October 31

For the Fiscal Year 2009 2008 % Change

Net sales $1,523.4 $1,878.2 (18.9)%

Net earnings 62.8 119.7 (47.5)

Net earnings as a percentage of net sales 4.1% 6.4%

Diluted net earnings per share of common stock $ 1.73 $ 3.10 (44.2)

Cash dividends paid per share of common stock outstanding 0.60 0.60

Return on average stockholders’ equity 18.5% 32.6%

At Fiscal Year End

Net working capital* $ 228.9 $ 370.3 (38.2)%

Total assets 872.7 932.3 (6.4)

Total debt 233.3 233.1 0.1

Stockholders’ equity 315.2 364.7 (13.6)

Debt-to-capitalization ratio 42.5% 39.0%

*Defi ned as average receivables plus inventory, less trade payables