Thrifty Car Rental 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

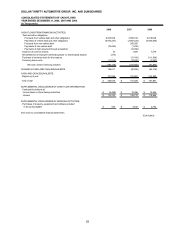

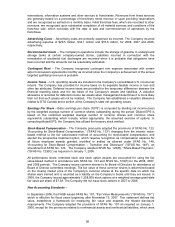

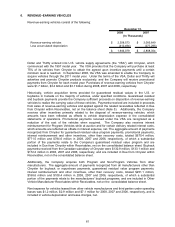

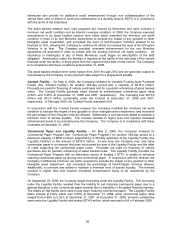

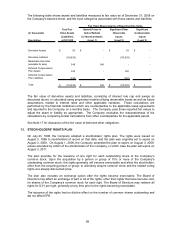

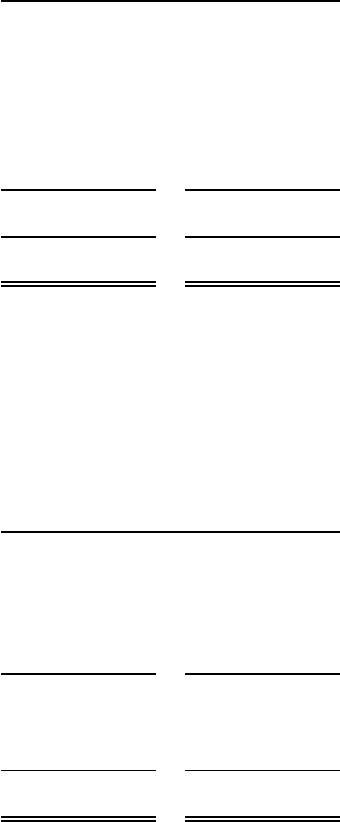

7. PROPERTY AND EQUIPMENT

Major classes of property and equipment consist of the following:

2008 2007

Land 12,135$ 12,240$

Buildings and improvements 21,069 22,575

Furniture and equipment 93,008 93,905

Leasehold improvements 125,589 129,542

Construction in progress 7,759 13,876

259,560 272,138

Less accumulated depreciation and amortization (155,118) (149,835)

104,442$ 122,303$

December 31,

(In Thousands)

During 2008, the Company completed its long-lived assets impairment testing under SFAS No. 144,

“Accounting for the Impairment or Disposal of Long-Lived Assets”, and, based on projections for

future cash flows, concluded that substantially all of the long-lived assets in its Canadian operation

were impaired. The Company recorded a $5.9 million non-cash charge (pre-tax) related to this

impairment.

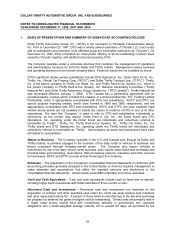

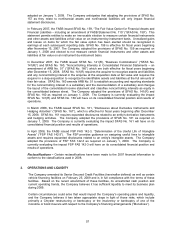

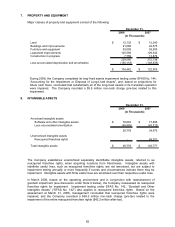

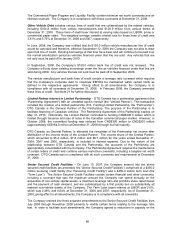

8. INTANGIBLE ASSETS

2008 2007

Amortized intangible assets

Software and other intangible assets 78,663$ 77,888$

Less accumulated amortization (48,885) (43,312)

29,778 34,576

Unamortized intangible assets

Reacquired franchise rights - 69,201

Total intangible assets 29,778$ 103,777$

December 31,

(In Thousands)

The Company establishes unamortized separately identifiable intangible assets, referred to as

reacquired franchise rights, when acquiring locations from franchisees. Intangible assets with

indefinite useful lives, such as reacquired franchise rights, are not amortized, but are subject to

impairment testing annually or more frequently if events and circumstances indicate there may be

impairment. Intangible assets with finite useful lives are amortized over their respective useful lives.

In March 2008, based on the operating environment and in conjunction with reassessment of

goodwill impairment (see discussion under Note 9 below), the Company reassessed its reacquired

franchise rights for impairment. Impairment testing under SFAS No. 142, “Goodwill and Other

Intangible Assets” (“SFAS No. 142”) also applies to reacquired franchise rights. Based on the

assessment at March 31, 2008, management concluded that reacquired franchise rights were

impaired, and the Company recorded a $69.0 million non-cash charge (pre-tax) related to the

impairment of the entire reacquired franchise rights ($42.2 million after-tax).

62