Texas Instruments 2007 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2007 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

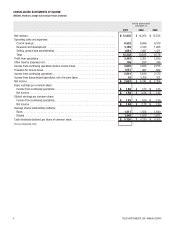

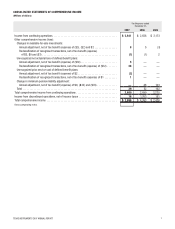

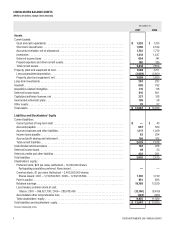

TEXAS INSTRUMENTS 2007 ANNUAL REPORT 11

1. Description of Business and Significant Accounting Policies and Practices

Business: Texas Instruments (TI) makes, markets and sells high-technology components; more than 50,000 customers all over the

world buy our products. We have two reportable operating segments: Semiconductor, which accounted for 96 percent of our revenue

in 2007, and Education Technology. Over time, Semiconductor averages a higher growth rate than Education Technology, although the

semiconductor market is characterized by wide swings in growth rates from year to year. The former Sensors & Controls business has

been reflected as discontinued operations (see below and Note 2).

Acquisitions – During 2007, we made three acquisitions, including an asset acquisition, for net cash of $87 million. These acquisitions

were made to obtain design expertise and technology. These acquisitions were integrated into the Semiconductor business segment.

As a result of these acquisitions, we recognized $48 million in goodwill and $45 million of other acquisition-related intangible assets.

In January 2006, we acquired 100 percent of the equity of Chipcon Group ASA (Chipcon), a leading company in the design of short-

range, low-power wireless radio frequency semiconductors, based in Oslo, Norway, for net cash of $177 million. The acquisition

was accounted for as a purchase business combination, and the results of operations of this business have been included in the

Semiconductor segment of our consolidated statements of income from the date of acquisition. As a result of the acquisition, we

recorded a $5 million charge for in-process research and development (R&D) in Corporate in 2006. We also recognized $115 million of

goodwill and $86 million of other acquisition-related intangible assets, acquired $6 million of cash and assumed $29 million of other net

liabilities. We also made an acquisition in the second quarter of 2006, primarily to obtain a patent portfolio. This acquisition was also

integrated into the Semiconductor segment.

Pro forma information has not been presented for these acquisitions as it would not be materially different from amounts reported.

Dispositions – On July 31, 2007, we completed the sale of our broadband digital subscriber line (DSL) customer-premises equipment

semiconductor product line to Infineon Technologies AG for $61 million and recognized in cost of revenue a pretax gain of $39 million

in Corporate. Contingent consideration of up to $16 million may be received or may be required to be paid, depending upon the level

of revenue generated by this product line subsequent to the closing date, which could increase or decrease the gain on sale. The

resolution of the contingent consideration will be concluded by the third quarter of 2008.

In January 2006, we entered into a definitive agreement to sell substantially all of our Sensors & Controls segment, excluding the

radio frequency identification (RFID) systems operations, to an affiliate of Bain Capital, LLC, a global private equity investment firm,

for $3 billion in cash. The sale was completed on April 27, 2006. The operations and cash flows of the former Sensors & Controls

business have been eliminated from our ongoing operations, and we have no significant continuing involvement in the operations of the

sold business. Beginning in the first quarter of 2006, the former Sensors & Controls business has been presented as a discontinued

operation (see Note 2 for detailed information on discontinued operations).

Basis of Presentation: The consolidated financial statements have been prepared in accordance with accounting principles generally accepted

in the United States (U.S. GAAP). The basis of these financial statements is comparable for all periods presented herein, except for:

•theadoptionofanew accounting standard for income tax uncertainties as of January 1, 2007 (see the discussion in Note 12),

•theadoptionofanewaccountingstandardonpensionsandotherpostretirementbenefitsasofDecember31,2006(seethe

discussion in Note 10),

•achangeindepreciationmethodbeginningJanuary1,2006(seeChangeinDepreciationMethodbelow),and

•theadoption of a new accounting standard for the expensing of stock options beginning July 1, 2005 (see Effects of Stock-based

Compensation below and the discussion in Note 9).

The consolidated financial statements include the accounts of all subsidiaries. All intercompany balances and transactions have been

eliminated in consolidation. All dollar amounts in the financial statements and tables in the notes, except per-share amounts, are

stated in millions of U.S. dollars unless otherwise indicated. All amounts in the notes reference continuing operations unless otherwise

indicated. Certain amounts in the prior periods’ financial statements have been reclassified to conform to the 2007 presentation.

NOTES TO FINANCIAL STATEMENTS