Sunoco 2003 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2003 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

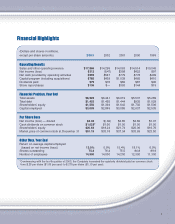

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis is the Company’s analysis of its financial performance

and of significant trends that may affect future performance. It should be read in conjunction with

Sunoco’s consolidated financial statements and related notes. Those statements in Management’s

Discussion and Analysis that are not historical in nature should be deemed forward-looking state-

ments that are inherently uncertain. See “Forward-Looking Statements” on page 38 for a dis-

cussion of the factors that could cause actual results to differ materially from those projected.

Overview

Sunoco’s profitability is primarily determined by refined product and chemical margins and

the reliability and efficiency of its operations. The volatility of crude oil, refined product

and chemical prices and the overall supply/demand balance for these commodities have

had, and should continue to have, a significant impact on margins and the financial results

of the Company.

During the first half of 2001, refined product margins in Sunoco’s principal refining centers

in the Northeast and Midwest were extremely strong, benefiting from exceptionally low

industry refined product inventory levels and very strong product demand. However, prod-

uct margins declined significantly in the second half of 2001 and remained low throughout

the first nine months of 2002 due to high industry inventory levels, rising crude oil prices,

a higher level of gasoline imports from Europe and warmer winter weather in early 2002. In

the latter part of 2002, refining margins began to improve, and throughout most of 2003

were once again very strong, benefiting from low industry refined product inventory levels,

colder winter weather in early 2003, strong gasoline demand and supply disruptions.

Chemical margins for most products were weak during 2001 and most of 2002 as a result of

an oversupplied marketplace. In the latter part of 2002, chemical margins began to

strengthen in response to price increases due to phenol supply disruptions in the United

States and an improvement in product demand. This improvement continued during 2003

as chemical prices continued to rise and product demand strengthened further as a result of

an improving U.S. and global economy.

In 2004, the Company believes refined product margins should remain above historical

averages, primarily due to more stringent fuel specifications as a result of sulfur reductions

in gasoline and MTBE-related product changes, and to higher transportation rates. These

factors are expected to tighten the supply/demand balance. In addition, the Company be-

lieves chemical margins and volumes will improve in 2004 assuming the strengthening

U.S. and global economy continues to favorably impact demand. However, the absolute

level of refined product and chemical margins is difficult to predict as they are influenced

not only by the above factors but also by a number of other extremely volatile factors in

the global marketplace including: crude oil, natural gas and other feedstock price levels

and availability; crude oil, petroleum and chemical product inventory levels; product de-

mand; refinery and chemical plant utilization rates; and geopolitical events.

The Company expects 2004 operating results to be adversely impacted by an approx-

imately $15 million after-tax increase in pension and postretirement benefits expense,

largely as a result of the impact of falling interest rates on projected plan benefit

obligations.

The Company’s future operating results and capital spending plans will also be impacted by

environmental matters (see “Environmental Matters” below).

11