Starwood 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

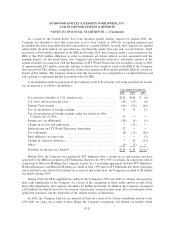

For the year ended December 31, 2004, the net gain on disposition primarily consists of the reversal of

$10 million of reserves set up in conjunction with the sale of the Company's former gaming business in 1999.

The related contingencies were resolved in January 2005 and, therefore, the reserves are no longer required.

The gain on disposition also includes a tax beneÑt of $16 million associated with the disposition of the

Company's former gaming business as a result of the favorable resolution of certain tax matters.

For the year ended December 31, 2003, the net gain on disposition consists of $174 million of gains

recorded in connection with the sale of the Principe on June 30, 2003 and the reversal of $32 million of

reserves relating to the Company's former gaming business disposed of in 1999 that are no longer required as

the related contingencies have been resolved.

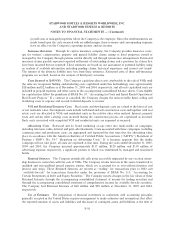

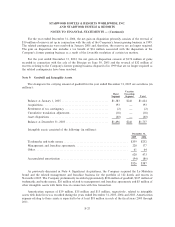

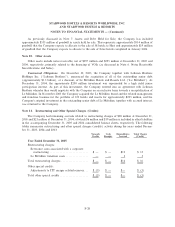

Note 9. Goodwill and Intangible Assets

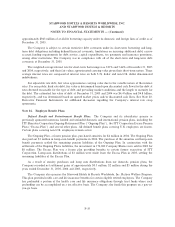

The changes in the carrying amount of goodwill for the year ended December 31, 2005 are as follows (in

millions):

Vacation

Hotel Ownership

Segment Segment Total

Balance at January 1, 2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,383 $241 $1,624

Acquisitions ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 193 Ì 193

Settlement of tax contingency ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (2) Ì (2)

Cumulative translation adjustment ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (18) Ì (18)

Asset dispositions ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (60) Ì (60)

Balance at December 31, 2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,496 $241 $1,737

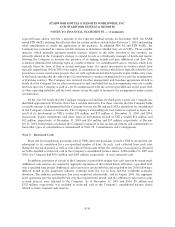

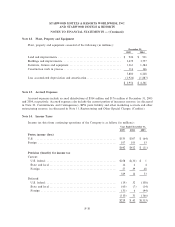

Intangible assets consisted of the following (in millions):

December 31,

2005 2004

Trademarks and trade names ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $339 $232

Management and franchise agreementsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 220 177

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 61 64

620 473

Accumulated amortization ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (94) (86)

$526 $387

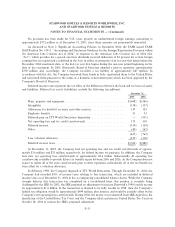

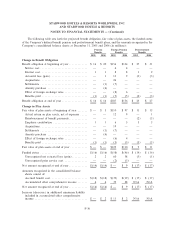

As previously discussed in Note 4. SigniÑcant Acquisitions, the Company acquired the Le Mπeridien

brand and the related management and franchise business for the portfolio of 122 hotels and resorts in

November 2005. The Company preliminarily recorded approximately $186 million of goodwill, $107 million of

trademarks and trade names, $26 million related to management and franchise agreements and $5 million of

other intangible assets with Ñnite lives in connection with this transaction.

Amortization expense of $19 million, $15 million and $13 million, respectively, related to intangible

assets with Ñnite lives was recorded during the years ended December 31, 2005, 2004 and 2003. Amortization

expense relating to these assets is expected to be at least $18 million in each of the Ñscal years 2005 through

2011.

F-27