Staples 2003 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2003 Staples annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

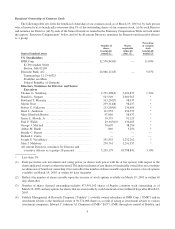

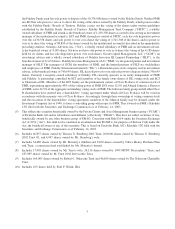

Beneficial Ownership of Common Stock

The following table sets forth the beneficial ownership of our common stock as of March 19, 2003 (i) by each person

who is known by us to beneficially own more than 5% of the outstanding shares of our common stock, (ii) by each Director

and nominee for Director, (iii) by each of the Senior Executives named in the Summary Compensation Table set forth under

the caption “Executive Compensation” below, and (iv) by all current Directors, nominees for Directors and executive officers

as a group:

Name of beneficial owner

Number of

shares

beneficially

owned (1)

Shares

acquirable

within 60

days (2)

Percentage

of common

stock

beneficially

owned (3)

5% Stockholders

FMR Corp. ...............................................

82 Devonshire Street

Boston, MA 02109

52,570,843(4) — 11.09%

Deutsche Bank AG .......................................

Taunusanlage 12, D-60325

Frankfurt am Main

Federal Republic of Germany

26,886,121(5) — 5.67%

Directors, Nominees for Director and Senior

Executives

Thomas G. Stemberg ..................................... 2,791,208(6) 3,692,835 1.36%

Ronald L. Sargent ........................................ 543,549 2,960,363 *

Rowland T. Moriarty ..................................... 313,201(7) 98,437 *

Martin Trust .............................................. 239,314(8) 98,437 *

Robert C. Nakasone ...................................... 213,205(9) 136,405 *

Basil L. Anderson ........................................ 113,953 256,333 *

Mary Elizabeth Burton .................................... 47,000 98,437 *

James L. Moody, Jr. ...................................... 39,555 91,125 *

Paul F. Walsh ............................................. 29,165(10) 136,405 *

George J. Mitchell ........................................ 30,607 38,250 *

Arthur M. Blank .......................................... 800 5,250 *

Brenda C. Barnes ......................................... — — —

Richard J. Currie ......................................... — — —

Joseph S. Vassalluzzo ..................................... 291,852 1,252,262 *

John J. Mahoney .......................................... 270,761 1,291,557 *

All current Directors, nominees for Director and

executive officers as a group (18 persons) .............. 5,203,179 10,788,841 3.30%

* Less than 1%

(1) Each person has sole investment and voting power (or shares such power with his or her spouse) with respect to the

shares indicated, except as otherwise noted. The inclusion herein of any shares as beneficially owned does not constitute

an admission of beneficial ownership. Does not reflect the number of shares issuable upon the exercise of stock options

available on March 19, 2003 or within 60 days thereafter.

(2) Reflects the number of shares issuable upon the exercise of stock options available on March 19, 2003 or within 60

days thereafter.

(3) Number of shares deemed outstanding includes 473,991,162 shares of Staples common stock outstanding as of

March 19, 2003 and any options for shares that are exercisable by such beneficial owner within 60 days after March 19,

2003.

(4) Fidelity Management & Research Company (“Fidelity”), a wholly owned subsidiary of FMR Corp. (“FMR”) and an

investment adviser, is the beneficial owner of 50,374,008 shares as a result of acting as investment adviser to various

investment companies. Edward C. Johnson 3d, Chairman of FMR (“ECJ”), FMR, through its control of Fidelity, and

4