Staples 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Staples annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

Table of contents

-

Page 1

-

Page 2

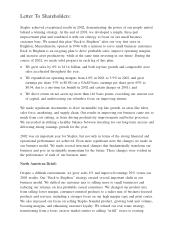

...on our high margin copy and print center. We also increased our focus on selling Staples branded product, growing total unit volume, boosting margins, and enhancing customer loyalty. We reï¬ned our real estate strategy, transitioning from a focus on new market entries to adding "in-ï¬ll" stores to...

-

Page 3

... weak economy as well as poor execution. On the Delivery side, we created an exciting new growth platform with the acquisition of a leading European direct mail business with attractive growth prospects and strong operating margins. This acquisition increases Staples' global presence with access to...

-

Page 4

... to make buying ofï¬ce products easy with enhanced in-store signage, easier to navigate websites, the launch of our ink and toner in-stock guarantee and our copy center quality promise, and there is more in the pipeline. Other signiï¬cant goals for the year are executing a program to transform...

-

Page 5

... Street, Boston, Massachusetts, on June 9, 2003 at 4:00 p.m., local time, to consider and act upon the following matters: (1) To elect ï¬ve Class 3 Directors to serve for a three-year term expiring at the 2006 Annual Meeting of Stockholders. (2) To approve Staples' Executive Ofï¬cer Incentive Plan...

-

Page 6

-

Page 7

STAPLES, INC. 500 Staples Drive Framingham, Massachusetts 01702

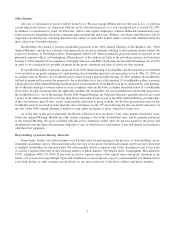

PROXY STATEMENT For the Annual Meeting of Stockholders on June 9, 2003 This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Staples, Inc. ("We", "Staples" or the "Company") for ...

-

Page 8

... Internet or by telephone. Can I change my proxy after I return my proxy card? Yes. Any proxy may be revoked by a stockholder at any time before it is exercised at the Annual Meeting by delivering to our Corporate Secretary a written notice of revocation or a duly executed proxy bearing a later date...

-

Page 9

... of the document to you if you write or call the Corporate Secretary at the following address or phone number: 500 Staples Drive, Framingham, Massachusetts 01702, telephone (508) 253-5000. If you want to receive separate copies of the annual report and proxy statement in the future, or if you are...

-

Page 10

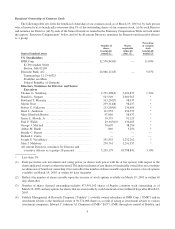

...Senior Executives named in the Summary Compensation Table set forth under the caption "Executive Compensation" below, and (iv) by all current Directors, nominees for Directors and executive ofï¬cers as a group:

Number of shares beneï¬cially owned (1) Shares acquirable within 60 days (2) Percentage...

-

Page 11

... Investment Company Act of 1940, to form a controlling group with respect to FMR. This is based on FMR's Schedule 13G ï¬led with the Securities and Exchange Commission as of February 14, 2003. (5) This reï¬,ects the securities beneï¬cially owned by the Private Clients and Asset Management business...

-

Page 12

... designated by the Board of Directors. Set forth below are the names and certain information with respect to each of the nominees to serve as a Director of Staples. Nominees to Serve as Directors for a Three-Year Term Expiring at the 2006 Annual Meeting (Class 3 Directors)

Served as a Director...

-

Page 13

... the Incentive Plan, a copy of which is available upon request from our Corporate Secretary and is on ï¬le with the Securities and Exchange Commission ("SEC") as an exhibit to our Annual Report on Form 10-K for ï¬scal 2002. Term of Plan The Incentive Plan will cover ï¬ve ï¬scal years, beginning...

-

Page 14

...shopping, customer comment card statistics, customer relations statistics (e.g., number of customer complaints), and delivery response levels. The Compensation Committee believes that disclosure of further details concerning the performance criteria for each Plan Year may be conï¬dential commercial...

-

Page 15

... Annual Meeting, the bonus payments made in accordance with the terms of the Incentive Plan will be deductible for Staples and not subject to disallowance under Section 162(m) of the Code. THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE APPROVAL OF THE COMPANY'S EXECUTIVE OFFICER INCENTIVE...

-

Page 16

..., Compensation and Corporate Governance Committees are independent directors. For this purpose, Directors are "independent" if they (1) receive no direct or indirect compensation from us other than compensation for service as a director, and (2) meet the "independence" deï¬nitions of the SEC and...

-

Page 17

... below are the names and certain information with respect to each of our current Directors (other than the nominees). Directors Serving a Term Expiring at the 2004 Annual Meeting (Class 1 Directors)

Served as a Director Since

Arthur M. Blank, age 60 Chairman, President & Chief Executive Ofï¬cer of...

-

Page 18

...-Cola North America from 1996 to February 1998. Ms. Barnes is also a Director of Avon Products, Inc., New York Times Company, Sears, Roebuck & Co. and PepsiAmericas. Mary Elizabeth Burton, age 51 Chief Executive Ofï¬cer of BB Capital, Inc., a retail advisory and management services company, since...

-

Page 19

... Plan and option grants under the 1997 United Kingdom Company Share Option Plan. The Committee has adopted a policy prohibiting us from loaning money to executive ofï¬cers and Directors for personal purposes. The Committee met four times during the ï¬scal year ended February 1, 2003. Corporate...

-

Page 20

... the date of the ï¬rst regularly scheduled Board of Directors meeting following the end of each ï¬scal year, each Outside Director will automatically receive a grant of options to purchase 3,000 shares of Staples common stock for each regularly scheduled meeting day of the Board of Directors that...

-

Page 21

...ï¬ned by its charter and the rules of the SEC and NASDAQ. The Audit Committee oversees the Company's ï¬nancial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the ï¬nancial statements and the reporting process, including the systems of internal...

-

Page 22

..., for professional services rendered in connection with the audit of our ï¬nancial statements included in our Annual Report on Form 10-K, quarterly reviews of the ï¬nancial statements included in each of our reports on Form 10-Q, ï¬ling of SEC registration statements, debt offerings and issuance...

-

Page 23

... Awards." The split dollar insurance program payments represent an actuarial equivalent beneï¬t to the Senior Executive from payment of annual premiums by us. Our matching contributions under our 401(k) and Supplemental Executive Retirement Plans are made in the form of Staples common stock that...

-

Page 24

...." (18) 9,000 of these options were granted to Mr. Anderson for service as an Outside Director in ï¬scal year 2001 prior to becoming an executive ofï¬cer of the Company. (19) Reï¬,ects $7,619 for split dollar insurance premiums paid in 2002. (20) Reï¬,ects an award of 52,800 shares of PARS to Mr...

-

Page 25

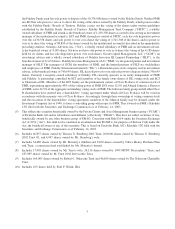

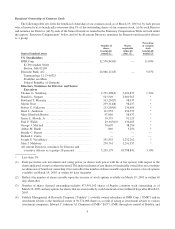

... of the Senior Executives. OPTION GRANTS IN LAST FISCAL YEAR

Number of Securities Underlying Options Granted (1) Individual Grants Percent of Total Options Granted to Exercise Employees in Price per Fiscal Year Share (2) Grant Date Value

Name

Expiration Date

Grant Date Present Value (3)

Ronald...

-

Page 26

... Company Share Option Plan, the 1997 United Kingdom Savings Related Share Option Plan, the Employees' 401(k) Savings Plan and the Supplemental Executive Retirement Plan. EQUITY COMPENSATION PLAN INFORMATION

Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights...

-

Page 27

... Plan with the SEC as an exhibit to our Annual Report on Form 10-K for the ï¬scal year ended January 31, 1998. The UK Option Plan was designed to be approved by the United Kingdom's Department of Inland Revenue so that associates could avoid income tax on the difference between the exercise price...

-

Page 28

... shares of Staples common stock at a discounted price. We ï¬led the UK Savings Plan with the SEC as an exhibit to our Annual Report on Form 10-K for the ï¬scal year ended February 1, 2003. Each associate of our United Kingdom businesses, including an ofï¬cer or director who is also an associate...

-

Page 29

... of a total of 225,000 shares of Staples common stock that have been registered for issuance under the SERP on a Registration Statement on Form S-8. The SERP is administered by the Committee on Employee Beneï¬t Plans. This committee has the general authority to control and manage the operation and...

-

Page 30

... of the market, based on performance.

Status of the Executive Compensation Program The Committee targeted total annual compensation (base salary, cash bonus and long-term stock incentives) to fall above the median relative to the pay practices of a peer group of publicly traded companies in the...

-

Page 31

...' option eligible associates, as to 25% of the underlying shares one year from the date of grant and ratably monthly thereafter over the next three years. Performance Accelerated Restricted Stock (PARS): In order to maintain Staples' high risk-high reward philosophy, help retain key executives...

-

Page 32

... Rule 10b5-1(c) Plans, our Directors and executive ofï¬cers ï¬led a number of late Section 16(a) reports. Based solely on our review of copies of reports ï¬led by the Directors and the executive ofï¬cers required to ï¬le such reports pursuant to Section 16(a) under the Securities and Exchange...

-

Page 33

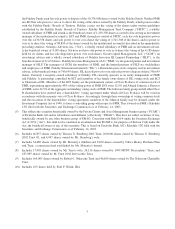

... return on Staples common stock between January 31, 1998 and February 1, 2003 (the end of ï¬scal year 2002) with the cumulative total return of (1) Standard & Poor's 500 Composite Index and (2) the Standard & Poor's 500 Retailing Index, which was formerly called the Standard & Poor's Retail Store...

-

Page 34

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

Page 35

... or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended February 1, 2003

(Exact name of registrant as specified in its charter) Delaware (State of Incorporation) Five Hundred Staples Drive, Framingham, Massachusetts 01702 (Address of principal executive offices and zip code) 508...

-

Page 36

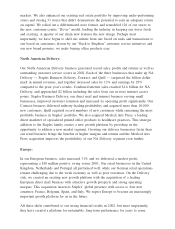

... our customer service, we have expanded our training of sales associates, added labor hours to certain store departments and changed our associate bonus plan. North American Retail Our North American Retail segment, consisting of 1,300 stores throughout the United States and Canada at the end of...

-

Page 37

... initial marketing programs that build brand awareness and drive customer traffic. We are re-launching our initiatives in some markets and are giving more latitude to some store managers to improve profitability by implementing strategies that are unique to their marketplace. North American Delivery...

-

Page 38

... the internet channel through Quill.com. To attract and retain its customers, Quill offers outstanding customer service, superior private label products and special services. In July 2002, we acquired Medical Arts Press, Inc., or MAP, a leading direct marketer of specialized printed office products...

-

Page 39

... to our customers. We also offer an array of services, including high-speed, color and self-service copying, other printing services, faxing, pack and ship services, payroll services and product warranty contracts. Our strategy is to tailor our product mix to meet the needs of customers by regularly...

-

Page 40

...number of areas, including, where appropriate, sales techniques, management skills and product knowledge. We have continued to make an investment in computer-based, multi-media training programs to upgrade staff selling skills and improve customer service at our retail stores and delivery operations...

-

Page 41

... Office, and the marks ''Staples the Office Superstore'' and ''Staples'' in Canada. In connection with our North American Delivery businesses, we have registered the marks ''Staples.com'', ''Staples National Advantage'', ''Staples Business Advantage'', ''StaplesLink.com'', ''Quill'', ''Medical Arts...

-

Page 42

...-North American Operations from October 1997 to November 1998, and President-Staples Contract & Commercial from June 1994 to October 1997. Thomas G. Stemberg, age 54 Mr. Stemberg has served as Chairman of the Board of Directors of Staples since February 1988 and an executive officer of Staples...

-

Page 43

... expiring on dates between 2003 and 2020. In most instances, we have renewal options at increased rents. Leases for 192 of the existing stores provide for contingent rent based upon sales. Our Framingham, Massachusetts corporate office is owned by us and consists of approximately 650,000 square feet...

-

Page 44

... under the heading ''Executive Officers of the Registrant'' in Part I of this Annual Report on Form 10-K. Other information required by this Item will appear under the headings ''Election of Directors'' and ''Corporate Governance-Directors of Staples'' in our Proxy Statement, which sections are...

-

Page 45

.... Based on their evaluation of our disclosure controls and procedures (as defined in Rules 13a-14(c) and 15d-14(c) under the Securities Exchange Act of 1934) as of a date within 90 days of the filing date of this Annual Report on Form 10-K, our chief executive officer and chief financial officer...

-

Page 46

..., on March 4, 2003. STAPLES, INC.

By:

/s/ RONALD L. SARGENT Ronald L. Sargent, President and Chief Executive Officer (Principal Executive Officer)

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the...

-

Page 47

...Robert C. Nakasone

Director

/s/ MARTIN TRUST Martin Trust

Director

/s/ PAUL F. WALSH Paul F. Walsh

Director

/s/ JOHN J. MAHONEY John J. Mahoney

Executive Vice President, Chief Administrative Officer and Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer)

13

-

Page 48

... with respect to the period covered by this annual report; Based on my knowledge, the financial statements, and other financial information included in this annual report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of...

-

Page 49

... with respect to the period covered by this annual report; Based on my knowledge, the financial statements, and other financial information included in this annual report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of...

-

Page 50

-

Page 51

...at period end): Stores open ...Balance Sheet Data: Working capital ...Total assets ...Total long-term debt, Stockholders' equity ...less current portion ...

(1) Results of operations for this period include a tax benefit of $29.0 million related to Staples Communications. In fiscal 2000, the Company...

-

Page 52

... units that sell and deliver office products and services directly to customers, and includes Staples Business Delivery (North American catalog and internet operations), our contract stationer operations (Staples National Advantage and Staples Business Advantage) and Quill. The European Operations...

-

Page 53

...long term success and delivering strong current earnings growth. During 2002, we chose to make significant investments to drive sustainable revenue growth by investing in productivity improvements and better processes in such areas as store labor, sales force, marketing and supply chain. Fiscal year...

-

Page 54

... the effective management of operating costs despite softer sales and the benefits of expense leveraging in our e-commerce businesses. Pre-opening expenses: Pre-opening expenses relating to new store openings, consisting primarily of salaries, supplies, marketing and distribution costs, are expensed...

-

Page 55

... upgraded to our current store model. In connection with this plan, we recorded a charge of $49.7 million. During the first quarter of fiscal year 2000, we decided not to close several stores that were included in the original store closure plan due to changes in market conditions. Accordingly, we...

-

Page 56

STAPLES, INC. AND SUBSIDIARIES Management's Discussion and Analysis of Financial Condition and Results of Operations (Continued) Segment Performance: The following tables are a summary of our sales and business unit income by reportable segment and store activity for the last three fiscal years (see...

-

Page 57

... expanding our training of store associates, adding labor hours to certain departments and changing our bonus plan. In addition, we believe our Dover format and reduced store size are significant competitive advantages that enable us to provide customers with a better view of our products while...

-

Page 58

... assets for impairment at a store level for retail operations and an operating unit level for our other operations. Our retail stores typically take three years to achieve their full profit potential. If actual market conditions are less favorable than management's projections, future write-offs...

-

Page 59

... Dover format during 2003 at an estimated cost of $400,000 per store. We also plan to continue to make investments in information systems and distribution centers to improve operational efficiencies and customer service. We currently plan to spend approximately $325 million on capital expenditures...

-

Page 60

...qualified institutional investors pursuant to Rule 144A and Regulation S of the Securities Act of 1933, as amended. We used the net proceeds to finance a portion of the purchase price of the European mail order acquisition. In February 2003, we filed an exchange offer registration statement with the...

-

Page 61

... operations compete with numerous mail order firms, contract stationer businesses, electronic commerce distributors and direct manufacturers. Many of our competitors have increased their presence in our markets in recent years. Some of our current and potential competitors in the office products...

-

Page 62

... our number of stores. We opened 86 stores during fiscal 2002 and currently plan to open up to 110 new stores in fiscal 2003. For our growth strategy to be successful, we must identify and lease favorable store sites, hire and train employees and adapt management and operational systems to meet the...

-

Page 63

... European mail order acquisition has increased our exposure to these foreign operating risks, which could have an adverse impact on our European income and worldwide profitability. Our debt level could impact our ability to obtain future financing and continue our growth strategy. Our consolidated...

-

Page 64

ITEM 8 INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Financial Statements.

APPENDIX C

Page

Report of Independent Auditors ...Consolidated Balance Sheets-February 1, 2003 and February 2, 2002 ...Consolidated Statements of Income-Fiscal years ended February 1, 2003, February 2, 2002, and February 3, ...

-

Page 65

... the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States. Those standards require that we plan and perform the...

-

Page 66

STAPLES, INC. AND SUBSIDIARIES Consolidated Balance Sheets (Dollar Amounts in Thousands, Except Share Data)

February 1, 2003 February 2, 2002

ASSETS Current Assets: Cash and cash equivalents ...Merchandise inventories, net ...Receivables, net ...Deferred income taxes ...Prepaid expenses and other ...

-

Page 67

... of Income (Dollar Amounts in Thousands, Except Share Data)

Fiscal Year Ended February 2, 2002

February 1, 2003

February 3, 2001

Sales ...Cost of goods sold and occupancy costs ...Gross profit ...Operating and other expenses: Operating and selling ...Pre-opening ...General and administrative...

-

Page 68

... ...Issuance of shares of Staples.com Stock ...Tax benefit on exercise of options . Contribution of common stock to Employees' 401(K) Savings Plan . Sale of common stock under Employee Stock Purchase Plan . Issuance of Performance Accelerated Restricted Stock ...Unrealized loss on investments, net...

-

Page 69

... to net cash provided by operating activities: Depreciation and amortization ...Asset impairment and other charges ...Store closure charge (credit) ...Deferred income taxes expense (benefit) ...Other ...Change in assets and liabilities, net of companies acquired/divested: (Increase) decrease in...

-

Page 70

... units that sell and deliver office products and services directly to customers, and includes Staples Business Delivery (North American catalog and internet operations), the Company's contract operations (Staples National Advantage and Staples Business Advantage) and Quill. The European Operations...

-

Page 71

... sold, changes to the key assumptions would not materially impact the recorded loss on the sale of receivables. Private Label Credit Card: Staples offers a private label credit card which is managed by a financial services company. Under the terms of the agreement, Staples is obligated to pay fees...

-

Page 72

... by discounted cash flow analyses based on Staples' current incremental borrowing rates for similar types of borrowing arrangements. Advertising: Staples expenses the production costs of advertising the first time the advertising takes place, except for the cost of direct-response advertising...

-

Page 73

... Costs: Pre-opening costs, which consist primarily of salaries, supplies, marketing and distribution costs, are charged to expense as incurred. Stock Option Plans: Staples accounts for its stock-based plans under Accounting Principles Board Opinion No. 25, ''Accounting for Stock Issued to Employees...

-

Page 74

...the revenues and direct expenses associated with the sale are deferred and recognized over the life of the service contract, which is typically one to five years. Derivative Instruments and Hedging Activities: As of February 4, 2001, the Company adopted Financial Accounting Standards Board Statement...

-

Page 75

...that date. The acquired companies are reported as part of the European Operations segment for segment reporting. The European mail order acquisition allowed Staples to enter the fast-growing office supplies mail order market in France, Italy, Spain and Belgium and strengthens its mail order presence...

-

Page 76

...segment reporting. MAP is a leading direct marketer of specialized printed office products and practice-related supplies to medical offices. The acquisition of MAP provides an opportunity to sell traditional office products to MAP's customer base and expand Quill's and Staples' product offerings. In...

-

Page 77

... fiscal year 2001, Staples committed to a plan related to workforce reductions and distribution and call center closures. As a result, the Company recognized charges totaling $10.7 million, comprised of $6.8 million of severance related to the elimination of positions in Staples' corporate offices...

-

Page 78

...to Staples' current store model. In connection with this plan, Staples recorded a charge to operating expense of $49.7 million. During the first quarter of fiscal year 2000, management decided not to close several stores that were included in the original store closure plan, due to changes in market...

-

Page 79

... of the following (in thousands): 364-Day Term Loan (see ''Credit Agreements'' below) ...Current portion of long-term debt ...Total debt maturing within one year ...

$ 325,000 2,671 $ 327,671

$ $

- 4,983 4,983

Aggregate annual maturities of long-term debt and capital lease obligations are as...

-

Page 80

...-Day Term Loan Agreement (the ''Term Loan'') with a group of commercial banks. The Company used the Term Loan to finance a portion of the purchase price of the European mail order acquisition. Borrowings under the Term Loan bear interest, at the Company's option, at either (a) the higher of the lead...

-

Page 81

..., scheduled to terminate on November 15, 2004, is designated as a fair value hedge of the Euro Notes. Under the interest rate swap agreement, Staples is entitled to receive annual interest payments at a fixed rate of approximately 5.875% and is required to make quarterly interest payments at...

-

Page 82

...required by certain vendor contracts. As of February 1, 2003, Staples had open letters of credit totaling $46.7 million. The Company fully guaranteed loans taken by certain executives used to exercise the options of Staples.com Stock granted to them in fiscal year 1999. The options were subsequently...

-

Page 83

...):

February 1, 2003 February 2, 2002

Deferred Tax Assets: Deferred rent ...Deferred revenue ...Foreign tax credit carryforwards . Net operating loss carryforwards . Insurance ...Employee benefits ...Merger related charges ...Store closure charge ...Capital loss/asset write-downs ...Other-net...

-

Page 84

... an impairment charge related to the goodwill and fixed assets of Staples Communications. As management was not certain of the ultimate deductibility of these losses no corresponding tax benefit was recognized. In 2002, the Company received approval from the Internal Revenue Service to take an...

-

Page 85

... four years and expire ten years from the date of grant, subject to earlier termination in the event the optionee ceases to serve as a director. Information with respect to Staples' stock options granted under the above plans is as follows:

Number of Shares Weighted Average Exercise Price Per Share...

-

Page 86

... in compensation expense in fiscal year 2002. Performance Accelerated Restricted Stock (''PARS'') PARS are shares of Staples common stock granted under the Company's Equity Incentive Plan and Director Stock Option Plan to employees and non-employee directors without cost to the employee or director...

-

Page 87

...SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

NOTE J Employee Benefit Plans (Continued) Plan is available to all United States based employees of Staples who meet minimum age and length of service requirements. Company contributions are based upon a matching formula applied to...

-

Page 88

...Canadian business units that sell and deliver office products and services directly to customers, and includes Staples Business Delivery (North American catalog and internet operations), Staples' contract stationer operations (Staples National Advantage and Staples Business Advantage) and Quill. The...

-

Page 89

... recorded at Staples' cost; therefore, there is no intercompany profit or loss recognized on these transactions. Staples' North American Retail and North American Delivery segments are managed separately because the way they market products is different, the classes of customers they service may be...

-

Page 90

... the Office Superstore East, Inc. and Staples Contract & Commercial, Inc., all of which are wholly owned subsidiaries of Staples (the ''Guarantor Subsidiaries''). The term of guarantees is equivalent to the term of the related debt. The following condensed consolidating financial data is presented...

-

Page 91

...SHEET As of February 1, 2003 (in thousands)

Staples, Inc. (Parent Co.) Guarantor Subsidiaries NonGuarantor Subsidiaries Eliminations Consolidated

Cash and cash equivalents ...Merchandise inventories ...Other current assets ...Total current assets ...Net property, equipment and other assets Goodwill...

-

Page 92

... (in thousands)

Staples, Inc. (Parent Co.) Guarantor Subsidiaries NonGuarantor Subsidiaries Consolidated

Sales Cost of goods sold and occupancy costs ...Gross profit ...Operating and other expenses ...Income before income taxes ...Income tax (benefit) expense ...Net income (loss) ...

$

- 757 (757...

-

Page 93

... operating activities Investing Activities: Acquisition of property, equipment and lease rights ...Other ...Cash used in investing activities ...Financing Activities: Payments on borrowings ...Proceeds from borrowings and other ...Cash used in financing activities ...Effect of exchange rate changes...

-

Page 94

... operating activities Investing Activities: Acquisition of property, equipment and lease rights ...Other ...Cash used in investing activities ...Financing Activities: Payments on borrowings ...Proceeds from borrowings and other ...Cash used in financing activities ...Effect of exchange rate changes...

-

Page 95

... Revenue Service to take an ordinary deduction for the Company's investment in, and advances to, Staples Communication (see Note I). (2) Results of operations for this period include the results of Medical Arts Press since its acquisition on July 17, 2002 and the result of the European mail order...

-

Page 96

... Restated 1992 Equity Incentive Plan 10.3 (11)*- 1997 United Kingdom Company Share Option Scheme 10.4* - Executive Officer Incentive Plan 10.5* - 1997 UK Savings Related Share Option Scheme 10.6* - International Employee Stock Purchase Plan 10.7* - Employment Agreement, dated as of February 3, 2002...

-

Page 97

...-31249). Incorporated by reference from the Annual Report on Form 10-K for the fiscal year ended February 3, 1996. Incorporated by reference from the Quarterly Report on Form 10-Q for the quarter ended April 29, 1995. A management contract or compensatory plan or arrangement filed as an exhibit to...

-

Page 98

... A. George Senior Vice President, General Merchandise Manager, Supplies Shira D. Goodman Executive Vice President, Marketing Thomas W. Heisroth Senior Vice President, Sales, Staples National Advantage Patrick A. Hickey Senior Vice President, Finance, U.S. Stores Kevin J. Holian Senior Vice President...

-

Page 99

... Corporate Offices Staples, Inc. 500 Staples Drive Framingham, MA 01702 Telephone: 508-253-5000 Internet address: www.staples.com Investor Information Account Questions Mellon Investor Services is the Transfer Agent and Registrar for the Company's Common Stock and maintains shareholder accounting...

-

Page 100