Stamps.com 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 Stamps.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

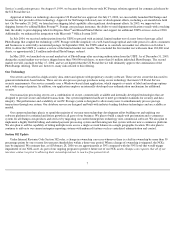

PART II.

Item 5. Market for the Registrant’s Common Stock and Related Stockholder Matters

Market Information

Our common stock is traded on The Nasdaq National Market under the symbol “STMP”. The following table sets forth the range of high

and low closing sales prices reported on The Nasdaq National Market for our common stock for the periods indicated (adjusted to give

retroactive effect resulting from our stock dividend and reverse stock split as discussed below):

In January 2004, the Board of Directors declared a return of capital cash dividend of $1.75 per share to stockholders of record as of the

close of business on February 9, 2004, which was paid on February 23, 2004. Based on 45,045,514 (22,522,757 shares after the 1:2 reverse

split in May 2004) common shares outstanding, less treasury stock of approximately 648,000 (324,000 shares after the 1:2 reverse split) on the

date of record, February 9, 2004, the total cash dividend was approximately $78 million.

In April 2004, following stockholder approval, the Board of Directors authorized a reverse stock split of our common stock with a ratio of

one-for-two (1:2), effective for all shares beginning on May 12, 2004.

As a result, every 2 shares of our common stock were combined into one

share. We paid cash in lieu of fractional shares.

Recent Share Prices

The following table sets forth the closing sales prices per share of our common stock on The Nasdaq National Market on (i) December 31,

2005 and (ii) February 28, 2006.

Holders

As of February 28, 2006, there were approximately 1,268 stockholders of record and approximately 23,643,274 shares of our common

stock issued and outstanding.

Dividend Policy

Future declaration and payment of dividends will be in the discretion of our Board of Directors and will be dependent upon our future

earnings, financial condition and capital requirements. The Board of Directors does not presently contemplate the payment of any dividends in

the near future.

Securities Authorized for Issuance Under Equity Compensation Plans

The information under the caption “Executive Compensation and Related Information,” appearing in the Proxy Statement, is hereby

incorporated by reference. For additional information on our stock incentive plans and activity, see Note 14 of Notes to Consolidated Financial

Statements, included in Part IV, Item 15 of this Report.

17

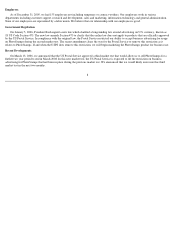

High

Low

Fiscal 2004

First Quarter

$

13.00

$

9.18

Second Quarter

$

14.78

$

10.19

Third Quarter

$

17.47

$

9.06

Fourth Quarter

$

16.00

$

12.93

Fiscal 2005

First Quarter

$

18.27

$

12.36

Second Quarter

$

22.54

$

15.53

Third Quarter

$

19.73

$

15.99

Fourth Quarter

$

23.98

$

15.98

Closing Price

December 31, 2005

$

22.96

February 28, 2006

$

32.21