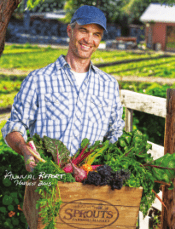

Sprouts Farmers Market 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Sprouts Farmers Market annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

Table of contents

-

Page 1

-

Page 2

-

Page 3

...in team mem mbe b r training, because our passion for learning and education allows our ur tea e m me m mbers to achieve personal and professional growth as we scale this great brand. In conclusion, every day we hear from customers who are transitioning g their grocery shop ppi p ng to Sprouts. They...

-

Page 4

... expectations as as of of the date of of this annual report.These Theserisks risksand anduncertainties uncertaintiesinclude, include, without limitation, risks associated with the Company's ability successfully open new stores and execute growth report. without limitation, risks associated with the...

-

Page 5

...the fiscal year ended January 3, 2016 Commission File Number: 001-36029

Sprouts Farmers Market, Inc.

(Exact name of registrant as specified in its charter) Delaware

(State or other jurisdiction of incorporation or organization)

32-0331600

(I.R.S. Employer Identification No.)

5455 East High Street...

-

Page 6

-

Page 7

... and Financial Disclosure...Item 9A. Controls and Procedures ...Item 9B. Other Information ...PART III Item 10. Directors, Executive Officers and Corporate Governance...Item 11. Executive Compensation ...Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder...

-

Page 8

... Results of Operations-Corporate Conversion." As used in this Annual Report on Form 10-K, unless the context otherwise requires, references to the "Company," "Sprouts," "we," "us" and "our" refer to Sprouts Farmers Markets, LLC and, after the corporate conversion, to Sprouts Farmers Market, Inc. and...

-

Page 9

... as a healthy grocery store that offers fresh, natural and organic food that includes fresh produce, bulk foods, vitamins and supplements, grocery, meat and seafood, deli, bakery, dairy, frozen foods, body care and natural household items catering to consumers' growing interest in eating and living...

-

Page 10

... new markets. We have opened 19, 24 and 27 new stores in fiscal 2013, 2014 and 2015, respectively, representing 14% unit growth each year. We expect to continue to expand our store base with 36 store openings planned in fiscal 2016, of which seven have opened as of the date of this Annual Report...

-

Page 11

... offering, our targeted and personalized marketing efforts and our in-store and digital education. We believe these factors, combined with the continued strong growth in fresh, natural and organic food consumption, will allow Sprouts to gain new customers, increase customer loyalty and, over time...

-

Page 12

... of fresh, natural and organic food in the United States. In connection with our initial public offering (referred to as our "IPO"), on July 29, 2013, Sprouts Farmers Markets, LLC, a Delaware limited liability company, converted into Sprouts Farmers Market, Inc., a Delaware corporation. As part of...

-

Page 13

... high service standards and that this helps us successfully open new stores. We believe Sprouts is an attractive place to work with significant growth opportunities for our team members. We regularly assess prevailing wages in the markets in which we operate and offer competitive wages and benefits...

-

Page 14

... meat, seafood, deli and bakery. Non-perishable product categories include grocery, vitamins and supplements, bulk items, dairy and dairy alternatives, frozen foods, beer and wine, and natural health and body care. The following is a breakdown of our perishable and nonperishable sales mix:

2015 2014...

-

Page 15

... an 'old-time grocery store' as customers are able to select and scoop as much of these items as they wish. Bakery. Our focus on fresh, high-quality and unique "signature" products is evident in our bakery department, which is located at the entrance to each store. Sprouts' bakery offering includes...

-

Page 16

..., exclusive-to-Sprouts and even non-alcoholic wines. Private Label We have been expanding the breadth of our Sprouts branded products over the last several years and have a dedicated product development team focused on continuing this growth. These products feature competitively priced specialty and...

-

Page 17

... our brand image through the use of local radio, as well as targeted direct mail in specific markets. We also continue to promote and enhance our digital presence. We maintain a smartphone app and our website, www.sprouts.com, on which we display our weekly sales flyers and offer special deals and...

-

Page 18

each store throughout the year, which included our Vitamin Extravaganza, Frozen Frenzy, Gluten-Free Favorites, and Incredible Bulk Sales, in addition to our routine Double-Ad Wednesday promotion and 72-Hour Sales.

Our Communities We are actively involved in the communities in which we operate, and ...

-

Page 19

... 1,200 Sprouts Farmers Market stores operating under our current format, and that we have significant growth opportunity in existing markets, as approximately 400 of these 1,200 potential stores are located in our current markets (13 states). We intend to achieve 14% annual new store growth over at...

-

Page 20

..., receiving, inventory, point of sale, warehousing, distribution, accounting, reporting and financial systems. We also maintain modern supply chain systems allowing for operating efficiencies and scalability to support our continued growth. All of our stores operate under one integrated information...

-

Page 21

... our relations with our team members to be good, and we have never experienced a strike or significant work stoppage.

Corporate Offices Our principal executive offices are located at 5455 E. High Street, Suite 111, Phoenix, Arizona 85054. Our website address is www.sprouts.com. The information on...

-

Page 22

...1,200 Sprouts Farmers Market stores operating under our current format, we anticipate that it will take years to grow our store count to that number. We cannot assure you that we will grow our store count to approximately 1,200 stores. We opened 27 and 24 stores in fiscal 2015 and 2014, respectively...

-

Page 23

...; cycling against any year of above-average sales results; consumer preferences, buying trends and spending levels; product price inflation or deflation; the number and dollar amount of customer transactions in our stores; our ability to provide product offerings that generate new and repeat visits...

-

Page 24

...-party service providers could adversely impact our ability to distribute produce to our stores. Such interruptions could result in lost sales and a loss of customer loyalty to our brand. While we maintain business interruption and property insurance, if the operation of our distribution centers...

-

Page 25

...our financial results in the short-term due to the effect of store opening costs and lower sales and contribution to overall profitability during the initial period following opening. New stores build their sales volume and their customer base over time and, as a result, generally have lower margins...

-

Page 26

... our assets. As a fresh, natural and organic retailer, we believe that many customers choose to shop our stores because of their interest in health, nutrition and food safety. As a result, we believe that our customers hold us to a high food safety standard. Therefore, real or perceived quality or...

-

Page 27

...require us to continue paying rent for store locations that we no longer operate. We are subject to risks associated with our current and future store, distribution center and administrative office real estate leases. Our high level of fixed lease obligations will require us to use a portion of cash...

-

Page 28

...at all. The fact that a substantial portion of our cash flow from operations could be needed to make payments on this indebtedness could have important consequences, including the following: x x x x x reducing our ability to execute our growth strategy, including new store development; impacting our...

-

Page 29

... close proximity to our stores, our results of operations may be negatively impacted through a loss of sales, decrease in market share, reduction in margin from competitive price changes or greater operating costs. We rely heavily on sales of fresh produce and quality natural and organic products...

-

Page 30

...particularly in produce, could reduce sales growth and earnings if our competitors react by lowering their retail pricing, while food inflation, when combined with reduced consumer spending, could reduce sales and gross profit margins. As a result, our operating results and financial condition could...

-

Page 31

... effect on our business, operating results, financial condition or prospects. Increasing energy costs, unless offset by more efficient usage or other operational responses, may impact our profitability. We utilize natural gas, water, sewer and electricity in our stores and use gasoline and diesel...

-

Page 32

...in the past, or otherwise adversely affect our business, reputation, results of operations and financial condition. As a retailer of food, vitamins and supplements and a seller of many of our private label products, we are subject to numerous health and safety laws and regulations. Our suppliers and...

-

Page 33

... business, financial condition and results of operations. Our reputation could also suffer from real or perceived issues involving the labeling or marketing of products we sell as "natural." Although the FDA and the USDA have each issued statements regarding the appropriate use of the word "natural...

-

Page 34

... our brand and products could be negatively affected, and our sales and profitability could suffer as a result. We also license the SPROUTS FARMERS MARKETS trademark to a third party for use in operating two grocery stores. If the licensee fails to maintain the quality of the goods and services used...

-

Page 35

...over financial reporting in the future, we may fail to prevent or detect material misstatements in our financial statements, in which case investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our common stock may decline. As a public company...

-

Page 36

... on historical experience, current market trends and other information. In estimating future cash flows, we rely on internally generated forecasts for operating profits and cash flows, including capital expenditures. Based on our annual impairment test during Fiscal 2013, 2014 and 2015, no goodwill...

-

Page 37

...; fluctuations in stock market prices and trading volumes of securities of similar companies; sales, or anticipated sales, of large blocks of our stock; short selling of our common stock by investors; additions or departures of key personnel; new store openings or entry into new markets by us or by...

-

Page 38

...affect the price that some investors are willing to pay for our common stock. If securities or industry analysts cease publishing research or reports about us, our business, or our market, or if they adversely change their recommendations regarding our stock, our stock price and trading volume could...

-

Page 39

...performance. In fiscal 2015, we remodeled six stores and in fiscal 2016, we plan to remodel approximately six stores. As of January 3, 2016, we leased our two distribution warehouses, as well as our current corporate office in Phoenix, Arizona, from unaffiliated third parties. Information about such...

-

Page 40

... are a party to legal proceedings, including matters involving personnel and employment issues, product liability, personal injury, intellectual property and other proceedings arising in the ordinary course of business, which have not resulted in any material losses to date. Although management does...

-

Page 41

... 1, 2013. The price range per share of common stock presented below represents the highest and lowest closing prices for our common stock on the NASDAQ Global Select Market for each full quarterly period for fiscal years 2014 and 2015.

High 2014 Low

First quarter...Second quarter ...Third quarter...

-

Page 42

...1, 2013 was the closing sale price on that day of $40.11 per share and not the initial offering price to the public of $18.00 per share. The performance shown on the graph below is based on historical results and is not intended to suggest future performance.

COMPARISON OF 29 MONTH CUMULATIVE TOTAL...

-

Page 43

... Fiscal Fiscal 2014(4) 2013(3) 2012(2) (dollars in thousands, except per share data) Fiscal 2011(1)

Statements of Operations Data: Net sales ...Cost of sales, buying and occupancy...Gross profit ...Direct store expenses...Selling, general and administrative expenses ...Amortization of Henry's trade...

-

Page 44

... 61st week following the store's opening. We use pro forma comparable store sales to calculate pro forma comparable store sales growth. During fiscal 2014, we also relocated one store. Supplemental Pro Forma Data-Net Sales

Fiscal 2015 Fiscal 2014 Fiscal 2013 (dollars in thousands) Fiscal 2012 Fiscal...

-

Page 45

... as a healthy grocery store that offers fresh, natural and organic food that includes fresh produce, bulk foods, vitamins and supplements, grocery, meat and seafood, deli, bakery, dairy, frozen foods, body care and natural household items catering to consumers' growing interest in eating and living...

-

Page 46

... disposable income and consumer confidence; consumer preferences and buying trends; our ability to identify market trends, and to source and provide product offerings that promote customer traffic and growth in average ticket; the number of customer transactions and average ticket; the prices of our...

-

Page 47

..., gross margin is affected by the relative mix of products sold, pricing strategies, inventory shrinkage and improved leverage of fixed costs of sales, buying and occupancy. Direct store expenses Direct store expenses consist of store-level expenses such as salaries and benefits, related equitybased...

-

Page 48

...29, 2013, Sprouts Farmers Markets, LLC, a Delaware limited liability company, converted into Sprouts Farmers Market, Inc., a Delaware corporation. As part of the corporate conversion, holders of membership interests of Sprouts Farmers Markets, LLC in the form of Class A and Class B units received 11...

-

Page 49

... stock, including the additional shares, and certain stockholders sold the remaining 797,785 shares. We received net proceeds from our IPO of approximately $344.1 million, after deducting underwriting discounts and offering expenses. We used the net proceeds to repay $340.0 million of outstanding...

-

Page 50

... Fiscal 2013 consisted of 52 weeks.

Fiscal 2015 Fiscal 2014 (in thousands) Fiscal 2013

Consolidated Statement of Operations Data: Net sales ...$3,593,031 $2,967,424 $2,437,911 Cost of sales, buying and occupancy...2,541,403 2,082,221 1,712,644 Gross profit ...1,051,628 885,203 725,267 Direct store...

-

Page 51

...in sales from comparable store sales growth, new store openings and the 53rd week in 2015. Gross profit increased $186.6 million as a result of increased sales volume, offset by a decrease of $20.2 million related to decreased margin. The gross margin decrease was primarily driven by continued price...

-

Page 52

... support growth into new markets, $4.0 million for corporate payroll to support growth and internalize outsourced functions, $2.4 million of increased share-based compensation expense related to changes in the executive team, $1.8 million for regional payroll and benefits to support additional store...

-

Page 53

... income growth was attributable to strong business performance driven by comparable store sales, strong performance of new stores opened, change in loss on extinguishment of debt, reduced interest expense and lower effective tax rate. Net income growth included the benefit of the 53rd week in 2015...

-

Page 54

...growth at stores operated prior to December 29, 2013 contributed $343.0 million, or 65% of the increase in net sales for 2014. New store openings during 2014 contributed $186.5 million, or 35%, of the increase in net sales during 2014. Cost of sales, buying and occupancy and gross profit

Fiscal 2014...

-

Page 55

.... Selling, general and administrative expenses decreased as a percentage of net sales due to leverage in corporate expenses. Store pre-opening costs Store pre-opening costs were $7.7 million for 2014 and $5.7 million for 2013. Store pre-opening costs during 2014 included $7.0 million related to...

-

Page 56

... statements of operations data for each of the fiscal quarters in fiscal 2015 and fiscal 2014.

Fiscal Quarter Ended March 29, December 28, September 28, 2015 2014 2014(2)

January 3, September 27, 2016* 2015

June 28, 2015(1)

June 29, 2014

March 30, 2014(3)

Net sales ...$930,303 $ Gross profit...

-

Page 57

...million for 2014 compared to $160.6 million for 2013. The increase in 2014 includes the impact of stores opened since 2013. In addition to the increase in the number of stores we operate, we leveraged occupancy, buying, utilities and fixed direct store expenses with comparable store sales growth. We...

-

Page 58

... to $160.0 million at January 3, 2016. These payments are reflected as a reduction to the Credit Facility, in the "4-5 Years" column. See Note 12 "Long-Term Debt" to our audited consolidated financial statements contained elsewhere in this Annual Report on Form 10-K. Represents estimated interest...

-

Page 59

...prices of food and other products we sell may periodically affect our sales, gross profit and gross margin. The short-term impact of inflation and deflation is largely dependent on whether or not the effects are passed through to our customers, which is subject to competitive market conditions. Food...

-

Page 60

... 28, 2014 and December 29, 2013. We now count non-perishable store inventories on a rotational basis and perishable store inventories at the end of every quarter. The change in timing necessitates making an estimate for non-perishable inventory shrink between the count date and the reporting date...

-

Page 61

... stock. Refer to Note 22 to our audited consolidated financial statements included elsewhere in this Annual Report on Form 10-K for further discussion of these inputs. In addition to assumptions used in the Black-Scholes option pricing model, we must also estimate a forfeiture rate to calculate...

-

Page 62

... the cost of acquired businesses in excess of the fair value of assets and liabilities acquired. Our indefinite-lived intangible assets consist of trade names related to "Sprouts Farmers Market" and liquor licenses. We also hold intangible assets with finite useful lives, consisting of favorable and...

-

Page 63

... or positive impact on our current and future earnings. Self-Insurance Reserves We use a combination of insurance and self-insurance programs to provide reserves for potential liabilities associated with general liability, workers' compensation and team member health benefits. Liabilities for self...

-

Page 64

... which the change becomes known, considering timing of new information regarding market, subleases or other lease updates. Adjustments in the closed store reserves are recorded in store closure and exit costs in the consolidated statements of operations. Recently Issued Accounting Pronouncements See...

-

Page 65

... Farmers Market, Inc. and Subsidiaries: Report of Independent Registered Public Accounting Firm...Consolidated Balance Sheets as of January 3, 2016 and December 28, 2014 ...Consolidated Statements of Operations for the fiscal years ended January 3, 2016, December 28, 2014 and December 29, 2013...

-

Page 66

...flows present fairly, in all material respects, the financial position of Sprouts Farmers Market, Inc. and its subsidiaries at January 3, 2016 and December 28, 2014, and the results of their operations and their cash flows for each of the three years in the period ended January 3, 2016 in conformity...

-

Page 67

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (IN THOUSANDS, EXCEPT SHARE AMOUNTS)

January 3, 2016 December 28, 2014

ASSETS Current assets: Cash and cash equivalents ...Accounts receivable, net ...Inventories ...Prepaid expenses and other current assets...Deferred income...

-

Page 68

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

Year Ended December 28, 2014

January 3, 2016

December 29, 2013

Net sales ...Cost of sales, buying and occupancy...Gross profit ...Direct store expenses...Selling, general ...

-

Page 69

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (IN THOUSANDS, EXCEPT SHARE AMOUNTS)

(Accumulated Deficit) / Total Retained Stockholders' Earnings Equity

Shares

Common Stock

Additional Paid-in Capital

Balances at December 30, 2012 ...Net income ......

-

Page 70

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (IN THOUSANDS)

January 3, 2016 Year Ended December 28, 2014 December 29, 2013

Cash flows from operating activities Net income ...Adjustments to reconcile net income to net cash provided by operating activities: ...

-

Page 71

... a healthy grocery store that offers fresh, natural and organic food that includes fresh produce, bulk foods, vitamins and supplements, grocery, meat and seafood, bakery, dairy, frozen foods, body care and natural household items catering to consumers' growing interest in eating and living healthier...

-

Page 72

...-perishable. Perishable product categories include produce, meat and seafood, deli and bakery. Non-perishable product categories include grocery, vitamins and supplements, bulk items, dairy and dairy alternatives, frozen foods, beer and wine, and body care and natural household items. The following...

-

Page 73

... be identified with a specific store location, are charged to direct store expenses in the accompanying consolidated statements of operations. Asset Retirement Obligations The Company's asset retirement obligations ("ARO") are related to the Company's commitment to return leased facilities to the...

-

Page 74

... of acquired businesses in excess of the fair value of assets and liabilities acquired. The Company's indefinite-lived intangible assets consist of trade names related to "Sprouts Farmers Market" and liquor licenses. The Company also holds intangible assets with finite useful lives, consisting of...

-

Page 75

..." for further discussion. The trade name related to "Sunflower Farmers Market" meets the definition of a defensive intangible asset and is amortized on a straight line basis over an estimated useful life of 10 years from the date of its acquisition by the Company. Favorable and unfavorable leasehold...

-

Page 76

...the asset and the corresponding financing lease obligations at the end of the construction periods for the stores during 2016. At December 28, 2014 the Company also recorded a current financing lease obligation and related construction in progress totaling $25.0 million for one of its administrative...

-

Page 77

... is estimated using information from comparable companies and management's judgment related to the risk associated with the operations of the stores. Cash and cash equivalents, accounts receivable, prepaid expenses and other current assets, accounts payable, accrued salaries and benefits and other...

-

Page 78

... 24% and 23% of total purchases, expressed as a percentage of our cost of sales, buying and occupancy expense, during 2015 and 2014, respectively. Direct Store Expenses Direct store expenses consist of store-level expenses such as salaries and benefits, related equitybased compensation, supplies...

-

Page 79

...interest and penalties related to unrecognized tax benefits as part of income tax expense. Share Repurchases The Company has elected to retire shares repurchased to date. Shares retired become part of the pool of authorized but unissued shares. The Company has elected to record purchase price of the...

-

Page 80

... financial statements. In May 2014, the FASB issued ASU No. 2014-09, "Revenue from Contracts with Customers." ASU No. 2014-09 provides guidance for revenue recognition. The standard's core principle is that a company will recognize revenue when it transfers promised goods or services to customers...

-

Page 81

...estimated selling prices in the ordinary course of business; less reasonably predictable costs of completion, disposal and transportation. This guidance will be effective for the Company for its fiscal year 2017. The Company is currently evaluating the potential impact of this guidance. In July 2015...

-

Page 82

... ...4,143 Other ...4,632 Total ...$ 20,424 $

8,246 1,993 3,852 14,091

As of January 3, 2016 and December 28, 2014, the Company had recorded an allowance of $0.1 million and $0.3 million, respectively, for certain receivables. 5. Prepaid Expenses and Other Current Assets A summary of prepaid...

-

Page 83

... 29, 2013 Balance at December 28, 2014

Additions

Other(a)

Gross Intangible Assets Indefinite-lived trade names ...Indefinite-lived liquor licenses ...Finite-lived trade names...Finite-lived leasehold interests...Total intangible assets ...Accumulated Amortization Finite-lived trade names...Finite...

-

Page 84

...total 11.6 years. The remaining amortization period of the finite-lived trade name is 6.4 years. 8. Goodwill The balance of our goodwill has been $368.1 million as of January 3, 2016, December 28, 2014 and December 29, 2013. As of January 3, 2016, December 28, 2014 and December 29, 2013, the Company...

-

Page 85

...28, 2016 2014

Workers' compensation / general liability reserves ...$ 11,295 $ Gift cards...10,616 Sales and use tax liabilities...7,038 Medical insurance claim reserves...6,064 Unamortized lease incentives...5,190 Accrued occupancy related (CAM, property taxes, etc.) ...4,689 Closed store reserves...

-

Page 86

...Facility April 2015 Refinancing On April 17, 2015, the Company's subsidiary, Sprouts Farmers Markets Holdings, LLC ("Intermediate Holdings"), as ... credit facility, dated April 23, 2013 (the "Former Credit Facility") and to pay transaction costs related to the April 2015 Refinancing. Such repayment...

-

Page 87

... tested on the last day of each fiscal quarter, starting with the fiscal quarter ended June 28, 2015. The Company was in compliance with all applicable covenants under the Credit Agreement as of January 3, 2016. Former Credit Facility On April 23, 2013, Intermediate Holdings, as borrower, refinanced...

-

Page 88

... for claims, both reported and incurred but not reported ("IBNR"). IBNR claims are estimated using historical claim information, demographic factors, severity factors and other actuarial assumptions. At January 3, 2016, the Company had recorded a $0.8 million receivable from its insurance carrier...

-

Page 89

... 2016. No receivable was recorded as of December 28, 2014 as the stop-loss limit was not exceeded. 15. Defined Contribution Plan The Company maintains the Sprouts Farmers Market, Inc. Employee 401(k) Savings Plan (the "Plan"), which is a defined contribution plan covering all eligible team members...

-

Page 90

... consists of the following:

Year Ended January 3, December 28, December 29, 2016 2014 2013

U.S. Federal-current ...$(51,322) $ U.S. Federal-deferred ...(15,155) U.S. Federal-total...(66,477) State-current ...(9,619) State-deferred ...(906) State-total...(10,525) Total provision ...$(77,002) $ Tax...

-

Page 91

... 2013 the Internal Revenue Service issued final regulations related to tangible property, which govern when a taxpayer must capitalize or deduct expenses for acquiring, maintaining, repairing and replacing tangible property. The regulations are effective for tax years beginning January 1, 2014...

-

Page 92

... deferred tax balances for prior years. 18. Related-Party Transactions A member of the Company's board of directors is an investor in a company that is a supplier of coffee to the Company. During 2015, 2014 and 2013, purchases from this company were $9.7 million, $8.3 million and $7.9 million...

-

Page 93

... stores, office and warehouse buildings. These leases had an average remaining lease term of approximately nine years as of January 3, 2016. Rent expense charged to operations under operating leases in 2015, 2014 and 2013 totaled $88.1 million, $72.9 million and $64.7 million, respectively. Future...

-

Page 94

... fulfilled with no adverse consequences to the Company's operations or financial conditions. 20. Capital stock Common stock On August 6, 2013, the Company completed its initial public offering of 21,275,000 shares of common stock of Sprouts Farmers Market, Inc., including 2,775,000 shares of common...

-

Page 95

... may be purchased from time to time over two year period, subject to general business and market conditions and other investment opportunities, through open market purchases, privately negotiated transactions or other means, including through Rule 10b5-1 trading plans. The board's authorization of...

-

Page 96

... expire seven years from grant date. On March 4, 2014, under the 2013 Incentive Plan, the Company granted to certain officers and team members time-based options to purchase an aggregate of 320,041 shares of common stock at an exercise price of $39.01 per share, with a grant date fair value of...

-

Page 97

... expire seven years from grant date. On March 11, 2015, under the 2013 Incentive Plan, the Company granted to certain officers and team members time-based options to purchase an aggregate of 277,833 shares of common stock at an exercise price of $34.33 per share, with a grant date fair value of...

-

Page 98

.... The following table summarizes grant date weighted average fair value of options granted and options forfeited:

Year Ended January 3, December 28, December 29, 2016 2014 2013

Grant date weighted average fair value of options granted...$ Grant date weighted average fair value of options forfeited...

-

Page 99

... in the applicable team member award agreement. Shares issued for RSU vesting are newly issued shares. The estimated fair value of RSUs granted during 2015 and 2014 range from $20.98 to $39.01, and were calculated based on the closing price on the grant date. The total grant date fair value of RSUs...

-

Page 100

... schedule outlined in the applicable team member award agreement. Shares issued for PSA vesting are newly issued shares. The estimated fair values of PSAs granted during 2015 is $34.33, and was calculated based on the closing price on the grant date. The total grant date fair value of PSAs granted...

-

Page 101

Equity-based compensation expense was as follows:

Year Ended January 3, December 28, December 29, 2016 2014 2013

Cost of sales, buying and occupancy...$ Direct store expenses...Selling, general and administrative expenses...Total equity-based compensation expense ...$

681 $ 1,103 6,234 8,018 $

...

-

Page 102

... with the consolidated financial statements in Item 8 of this Annual Report on Form 10-K. Changes in Internal Control Over Financial Reporting There were no changes in our internal control over financial reporting that occurred during the quarterly period ended January 3, 2016 that have materially...

-

Page 103

... provide disclosure of future updates, amendments or waivers from the Code by posting them to our investor relations website located at investors.sprouts.com. The information contained on or accessible through our website is not incorporated by reference into this Annual Report on Form 10-K. Except...

-

Page 104

...15, 2011, by and between Sprouts Farmers Markets, LLC and Amin N. Maredia (2) Amendment No. 1, dated April 18, 2013, to the Employment Agreement, dated July 25, 2011 by and between Sprouts Farmers Markets, LLC and Amin N. Maredia (7) Amendment No. 2, dated April 29, 2015, to the Employment Agreement...

-

Page 105

...York Branch, as documentation agent (10) Form of Confidentiality, Non-Competition, and Non-Solicitation Agreement (11) Executive Severance and Change in Control Plan (12) Aircraft Purchase Agreement, dated November 3, 2015, by and between Sprouts Farmers Markets Holdings, LLC and CJ Leasing Services...

-

Page 106

...with the SEC on July 22, 2013, and incorporated herein by reference. (8) Filed as an exhibit to the Registrant's Current Report on Form 8-K filed with the SEC on March 12, 2014, and incorporated herein by reference. (9) Filed as an exhibit to the Registrant's Quarterly Report on Form 10-Q filed with...

-

Page 107

..., thereunto duly authorized. SPROUTS FARMERS MARKET, INC. Date: February 25, 2016 By: /s/ Amin N. Maredia Name:Amin N. Maredia Title: Chief Executive Officer

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of...

-

Page 108

...15, 2011, by and between Sprouts Farmers Markets, LLC and Amin N. Maredia (2) Amendment No. 1, dated April 18, 2013, to the Employment Agreement, dated July 25, 2011 by and between Sprouts Farmers Markets, LLC and Amin N. Maredia (7) Amendment No. 2, dated April 29, 2015, to the Employment Agreement...

-

Page 109

...York Branch, as documentation agent (10) Form of Confidentiality, Non-Competition, and Non-Solicitation Agreement (11) Executive Severance and Change in Control Plan (12) Aircraft Purchase Agreement, dated November 3, 2015, by and between Sprouts Farmers Markets Holdings, LLC and CJ Leasing Services...

-

Page 110

...with the SEC on July 22, 2013, and incorporated herein by reference. (8) Filed as an exhibit to the Registrant's Current Report on Form 8-K filed with the SEC on March 12, 2014, and incorporated herein by reference. (9) Filed as an exhibit to the Registrant's Quarterly Report on Form 10-Q filed with...

-

Page 111

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

Page 112

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

Page 113

...VP of Store Operations

Lawrence P. Moll lloy

Chie e f Fi F na nanc n ial ia a Officer, r Unde d r Ar Armo mo m o ur, ur r In n c. c

SUPP SU PPOR PP ORT OR T OF OFFI FICE FI CE

545 5 E. H igh 5 i Street, Suite 111 P eni Ph Pho n x, x AZ 850 5054 54 | 48 4 0-8 0 814144-801 8016 801 6

Vitamin Angels

-

Page 114