Southwest Airlines 2001 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2001 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

YEAR IN REVIEW

In 2001, Southwest posted a profit for the 29th consecutive year in

one of the most challenging operating environments the air travel

industry has ever faced. During the year, Southwest also increased our

domestic market share, made enhancements that will improve our

Customer Service, and ended the year with more Employees and aircraft

than we had when we began the year. Despite the onset of a recession

early in 2001 and the September 11, 2001, terrorist attacks against the

United States (the terrorist attacks), Southwest was profitable in each

quarter of the year, including the third and fourth quarters after

excluding federal grants recognized in these quarters under the Air

Transportation Safety and System Stabilization Act (the Act). (See

Note 3 to the Consolidated Financial Statements for further details on

the terrorist attacks and the Act.) Although we were unable to match

some of the Company’s record-setting performance levels reached in

2000, our business strategy — primarily shorthaul, high frequency, low-fare,

point-to-point, high-quality Customer Service — continued to serve us

well during some difficult times in 2001.

In 2001, we continued to maintain our cost advantage over our

industry while the recession and events of September 11 put downward

pressure on revenues. In response to uncertainties following

September 11 and the precipitous drop in demand for air travel,

Southwest amended its agreement with The Boeing Company to defer

aircraft deliveries (see Note 4 to the Consolidated Financial

Statements) but did not ground airplanes, reduce service, or furlough

Employees. Following the temporary FAA shutdown of U.S. air space

after the terrorist attacks, load factors have steadily improved to

somewhat normal, average historical levels. However, these load factors

have resulted from significant fare discounting, which continues to

result in year-over-year declines in passenger revenue yields per RPM

(passenger yields) and operating revenue yields per ASM.

As we begin 2002, in addition to the difficult revenue environment for

commercial airlines, the Company is faced with increased war risk insurance

and passenger security costs resulting from continually evolving security

laws and directives. In response to the terrorist attacks, the airline

industry has worked diligently with Congress, the DOT, the FAA, and

law enforcement officials to enhance security. During fourth quarter

2001, the Company was able to offset these additional costs because of

lower jet fuel prices and through internal cost reduction initiatives

implemented following the terrorist attacks. However, there can be no

assurance the Company will be able to continue to offset future cost

increases resulting from the changing commercial airline environment.

(The immediately preceding sentence is a forward-looking statement

that involves uncertainties that could result in actual results differing

materially from expected results. Some significant factors include, but

may not be limited to, additional laws or directives that could increase

the Company’s costs or result in changes to the Company’s operations, etc.)

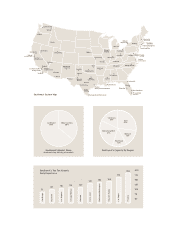

During 2001, we began service to two new cities, West Palm Beach,

Florida, and Norfolk, Virginia, while also discontinuing service to San

Francisco International Airport due to airport congestion. We have

been pleased with the initial results in both of the new Southwest

cities. Prior to September 11, the Company also continued to add flights

between cities already served. Southwest ended 2001 serving 58 cities in

30 states. Immediately following the terrorist attacks, Southwest suspended

fleet growth. However, by the end of the year, Southwest had

announced plans for modest growth to resume in early 2002.

Currently, available seat mile (ASM) capacity is expected to grow

approximately 3.5 percent in 2002 with the planned net addition of at

least eight aircraft. The Company will place in service at least 11 new

Boeing 737-700s scheduled for delivery during the year and will retire

three of the Company’s older 737-200s. (The immediately preceding

sentences are forward-looking statements that involve uncertainties that

could result in actual results differing materially from expected results.

Some significant factors include, but may not be limited to, future

capacity decisions made by the Company, demand for air travel,

changes in the Company’s aircraft retirement schedule, etc.)

RESULTS OF OPERATIONS

2001 COMPARED WITH 2000 The Company’s consolidated net

income for 2001 was $511.1 million ($.63 per share, diluted), as compared

to 2000 net income, before the cumulative effect of change in

accounting principle, of $625.2 million ($.79 per share, diluted), a

decrease of 18.2 percent. The prior years’ net income per share

amounts have been restated for the 2001 three-for-two stock split (see

Note 11 to the Consolidated Financial Statements). Consolidated results

for 2001 included $235 million in gains that the Company recognized

from grants under the Act and special pre-tax charges of approximately

$48 million arising from the terrorist attacks (see Note 3 to the

Consolidated Financial Statements). Excluding the grant and special

charges related to the terrorist attacks, net income for 2001 was

$412.9 million ($.51 per share, diluted). The cumulative effect of

change in accounting principle for 2000 was $22.1 million, net of taxes

of $14.0 million (see Note 2 to the Consolidated Financial Statements).

Net income and net income per share, diluted, after the cumulative

change in accounting principle, for 2000 were $603.1 million and $.76,

respectively. Operating income for 2001 was $631.1 million, a decrease

of 38.2 percent compared to 2000.

Following the terrorist attacks, all U.S. commercial flight operations

were suspended for approximately three days. However, the Company

continued to incur nearly all of its normal operating expenses (with the

exception of certain direct trip-related expenditures such as fuel, landing

fees, etc.). The Company cancelled approximately 9,000 flights before

resuming flight operations on September 14, although we did not

resume our normal pre-September 11 flight schedule until September 18,

2001. Once the Company did resume operations, load factors and

passenger yields were severely impacted, and ticket refund activity

increased. The Company estimates that from September 11 through

September 30, it incurred operating losses in excess of $130 million.

The effects of the terrorist attacks continued to be felt throughout

fourth quarter 2001. The Company’s operating income during fourth quarter

2001 was $37.1 million, a decrease of 85.2 percent compared to fourth

quarter 2000. Without consideration of any federal grant under the Act

the Company expects to recognize (see Note 3 to the Consolidated

Financial Statements), it is not yet known whether the Company will be

profitable in first quarter 2002, due to uncertain economic conditions

and the difficult airline industry revenue environment.

OPERATING REVENUES Consolidated operating revenues decreased

1.7 percent primarily due to a 1.6 percent decrease in passenger

revenues. The decrease in passenger revenues was a direct result of the

terrorist attacks. Because of the terrorist attacks, fluctuations in

passenger revenue can best be explained by discussing the year in two

distinct time periods: January through August 2001, and September

through December 2001.

From January through August 2001, passenger revenues were

approximately 8.7 percent higher than the same period in 2000 due

SOUTHWEST AIRLINES CO. 2001 ANNUAL REPORT

F2