Southwest Airlines 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$4,924,052 $4,628,4 1 5

$631,122 $ 1,021,145

11.4% 18.1%

$511,147 $625,224

9.2% 11.1%

$0.67 $0.84

$0.63 $0.79

$4,014,053 $3,451,320

13.7% 19.9%

$5.24 $4.53

64,446,773 63,678,261

44,493,916 42,215,162

65,295,290 59,909,965

68.1% 70.5%

12.09¢ 12.95¢

8.5 1 ¢ 9.43¢

7. 5 4 ¢ 7.7 3 ¢

31,580 29,274

6.4%

(38.2)%

(6.7)pts.

(18.2)%

(1.9)pts.

(20.2)%

(20.3)%

16.3%

(6.2)pts.

15.7%

1.2%

5.4%

9.0%

(2.4)pts.

(6.6)%

(9.8)%

(2.5)%

7.9 %

Operating expenses

Operating income

Operating margin

Net income

Net margin

Net income per share – basic

Net income per share – diluted

Stockholders’ equity

Revenue passengers carried

Revenue passenger miles {RPMs} (000s)

Available seat miles {ASMs} (000s)

Passenger load factor

Passenger revenue yield per RPM

Operating revenue yield per ASM

Operating expenses per ASM

Employees at yearend

Stockholders’ equity per common share outstanding

*Excludes cumulative effect of change in accounting principle of $22.1 million ($.03 per share)

Return on average stockholders’ equity

Net Margin

1997 1998 1999 2000 2001

2%

12%

8.3%

10.4% 10.0%

11.1%

9.2% 10%

8%

6%

4%

Net Income Per Share, Diluted

1997 1998 1999 2000 2001

$0.80

$0.70

$0.60

$0.50

$0.40

$0.30

$0.20

$0.41

$0.55 $0.59

$0.79

$0.63

Return On Stockholders’ Equity

1997 1998 1999 2000 2001

20%

18%

16%

14%

12%

10%

8%

17.4%

19.7%

18.1%

19.9%

13.7%

CONSOLIDATED HIGHLIGHTS

Operating revenues

2000

$5,555,1 74 $5,649,560

2001

(1.7)%

CHANGE

*

*

*

*

*

*

*

*

(DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

2001 marks Southwest Airlines

’

30th Anniversary. For 30 years now, we have had one mission: low fares. In that

respect, this year was no different. But as we all know, 2001 was a year like no other, in both our Company’s and our

country’s history. In first quarter, we unveiled our new look for the new millennium — beautiful Canyon Blue jets with

all-leather interiors. In second quarter, our Chairman, Herb Kelleher, announced that he would be sharing his

responsibilities with our new Vice Chairman and CEO, Jim Parker, and our new President and COO, Colleen Barrett.

The National Tragedy struck our collective hearts, minds, and lives in third quarter. In fourth quarter, our nation

and our Company began the difficult process of healing together. Nothing will keep us from moving ahead.

Freedom, and the Freedom to Fly, will most certainly endure.

Southwest Airlines Co. is the nation’s low-fare, high Customer Satisfaction airline. We primarily serve shorthaul city

pairs, providing single-class air transportation which targets the business commuter as well as leisure travelers.

The Company, incorporated in Texas, commenced Customer Service on June 18, 1971, with three Boeing 737 aircraft

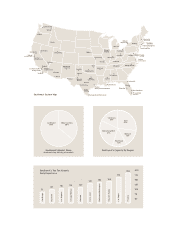

serving three Texas cities — Dallas, Houston, and San Antonio. At yearend 2001, Southwest operated 355 Boeing 737

aircraft and provided service to 59 airports in 30 states throughout the United States. Southwest has one of the

lowest operating cost structures in the domestic airline industry and consistently offers the lowest and simplest fares.

Southwest also has one of the best overall Customer Service records. LUV is our stock exchange symbol, selected to

represent our home at Dallas Love Field, as well as the theme of our Employee and Customer relationships.

Table of contents

-

Page 1

... serving three Texas cities - Dallas, Houston, and San Antonio. At yearend 2001, Southwest operated 355 Boeing 737 aircraft and provided service to 59 airports in 30 states throughout the United States. Southwest has one of the lowest operating cost structures in the domestic airline industry and... -

Page 2

... Company and, thus, of our People's livelihoods. A conservative balance sheet and high credit ratings are good, not bad! 3. On September 11, Southwest had the lowest cost per Available Seat Mile (ASM) flown of any major passenger air carrier. In the sparse ridership, very low-fare airline industry... -

Page 3

...; and Long Island/Islip to Orlando and Ft. Lauderdale; 5. Southwest prepared to implement its first nonstop flights between Chicago's Midway Airport and both Seattle and Oakland, utilizing four previously deferred new aircraft deliveries; 6. Year over year, Southwest's fourth quarter 2001 ASM... -

Page 4

...! On September 11, Southwest had the lowest cost per available seat mile of any of the major air carriers; the strongest balance sheet in the American airline industry; plenty of cash on hand; ample credit available; and the strongest, most resilient, adaptable, united, Customer-focused, and willing... -

Page 5

... total trip time. We serve many conveniently located satellite or downtown airports such as Baltimore/Washington, Chicago Midway, Dallas Love Field, Houston Hobby, Long Island/Islip, Oakland, and Providence. Although we have successful operations at major hub airports such as Los Angeles (LAX), we... -

Page 6

... for air travel dramatically declined following the terrorist attacks, we chose not to reduce our total flights or postpone our new Norfolk, Virginia, service. This decision protected our 30-year history of complete job security for our Employees and now places Southwest in a competitively strong... -

Page 7

...For example, our top ten cities' daily departures are currently Phoenix, 183; Las Vegas, 170; Houston Hobby, 143; Baltimore/Washington, 134; Dallas Love Field, 131; Oakland, 120; Chicago Midway, 119; Los Angeles (LAX), 114; Nashville, 87; and San Diego, 77. While our new city focus over the past few... -

Page 8

... Tulsa Amarillo Little Rock Oklahoma City Ontario Phoenix Tucson El Paso Lubbock Birmingham Midland/ Odessa Austin San Antonio Corpus Christi New Orleans Houston (Hobby & Intercontinental) Tampa Bay West Palm Beach Ft. Lauderdale Harlingen/South Padre Island (Miami Area) Dallas (Love Field... -

Page 9

...P O RT FINANCIAL REVIEW Management's Discussion and Analysis Consolidated Financial Statements Notes to Consolidated Financial Statements Report of Independent Auditors Quarterly Financial Data Common Stock Price Ranges and Dividends Ten-Year Summary Corporate Data Directors and Officers F2 F8 F12... -

Page 10

...that could increase the Company's costs or result in changes to the Company's operations, etc.) During 2001, we began service to two new cities, West Palm Beach, Florida, and Norfolk, Virginia, while also discontinuing service to San Francisco International Airport due to airport congestion. We have... -

Page 11

... became amendable in August 2001. Southwest is currently in negotiations with the Teamsters for a new contract. The Company's Flight Attendants are subject to an agreement with the TWU, which becomes amendable in June 2002. The Company's Customer Service and Reservations Agents are subject to an... -

Page 12

.../Washington International Airport and Chicago Midway Airport. As a result of the terrorist attacks, most other major airlines have reduced their flight schedules and/or have retired aircraft early due to the decrease in demand for air travel. Since Southwest has not reduced the number of flights it... -

Page 13

... by higher benefits costs, primarily workers' compensation expense, and increases in average wage rates within certain workgroups. Employee retirement plans expense per ASM increased 11.1 percent, primarily due to the increase in Company earnings available for profitsharing. Fuel and oil expense... -

Page 14

...holds floating rate debt instruments and has commodity price risk in that it must purchase jet fuel to operate its aircraft fleet. The Company purchases jet fuel at prevailing market prices, but seeks to minimize its average jet fuel cost through execution of a documented hedging strategy. Southwest... -

Page 15

... industry standard valuation models and holds all inputs constant at December 31, 2001, levels, except underlying futures prices. Airline operators are inherently capital intensive as the vast majority of the Company's assets are expensive aircraft, which are long-lived. The Company's strategy is to... -

Page 16

...SOUTHWEST AIRLINES CO. CONSOLIDATED BALANCE SHEET D EC E M B E R 3 1 , (in thousands, except per share amounts) ASSETS Current assets: Cash and cash equivalents Accounts and other receivables Inventories of parts and supplies, at cost Deferred income taxes Prepaid expenses and other current assets... -

Page 17

... AIRLINES CO. CONSOLIDATED STATEMENT OF INCOME Y E A R S E N D E D D EC E M B E R 3 1 , (in thousands, except per share amounts) OPERATING REVENUES: Passenger Freight Other Total operating revenues OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs... -

Page 18

...SOUTHWEST AIRLINES CO. CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY Y E A R S E N D E D D EC E M B E R 3 1 , 2 0 0 1 , 2 0 0 0, A N D 1 9 9 9 ACCUMULATED OTHER COMMON CAPITAL IN EXCESS RETAINED COMPREHENSIVE TREASURY STOCK OF PAR VALUE EARNINGS INCOME (LOSS) STOCK (in thousands, except per share... -

Page 19

... of scheduled airframe inspections and repairs Income tax benefit from Employee stock option exercises Changes in certain assets and liabilities: Accounts and other receivables Other current assets Accounts payable and accrued liabilities Air traffic liability Other Net cash provided by operating... -

Page 20

... be reported under different assumptions or conditions. FREQUENT FLYER PROGRAM The Company accrues the estimated incremental cost of providing free travel for awards earned under its Rapid Rewards frequent flyer program. The Company also sells flight segment credits and related services to companies... -

Page 21

... all commercial airline flights on the morning of September 11. The Company resumed flight activity on September 14 and was operating its normal pre-September 11 flight schedule by September 18, 2001. From September 11 until the Company resumed flight operations on September 14, Southwest cancelled... -

Page 22

...the decrease in demand for air travel since the terrorist attacks, the Company modified its schedule for future aircraft deliveries and the timing of its future capital expenditure commitments. In November 2001, Southwest entered into a trust arrangement with a special purpose entity (the Trust) and... -

Page 23

...market value, generally limited to a stated percentage of the lessor's defined cost of the aircraft. 9. DERIVATIVE AND FINANCIAL INSTRUMENTS Airline operators are inherently dependent upon energy to operate and, therefore, are impacted by changes in jet fuel prices. Jet fuel and oil consumed in 2001... -

Page 24

... methods or standard option value models with assumptions about commodity prices based on those observed in underlying markets. As of December 31, 2001, the Company had approximately $31.1 million in unrealized losses, net of tax, in "Accumulated other comprehensive income (loss)" related to fuel... -

Page 25

....3 million shares at an average cost of $10.85 per share between October 1999 and December 2000. No shares were repurchased in 2001. All of these acquired shares were subsequently reissued under Employee stock plans. 12. STOCK PLANS At December 31, 2001, the Company had 12 stock-based compensation... -

Page 26

... in 2001, 1,029,000 shares in 2000, and 974,000 shares in 1999 at average prices of $16.42, $13.34, and $10.83, respectively. Pro forma information regarding net income and net income per share is required by SFAS 123 and has been determined as if the Company had accounted for its Employee stock... -

Page 27

...effective tax rate on income before income taxes differed from the federal income tax statutory rate for the following reasons: (in thousands) 2001 2000 1999 DEFERRED TAX ASSETS: Deferred gains from sale and leaseback of aircraft Capital and operating leases Accrued employee benefits State taxes... -

Page 28

... of Southwest Airlines Co. as of December 31, 2001 and 2000, and the related consolidated statements of income, stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2001. These financial statements are the responsibility of the Company's management. Our... -

Page 29

... STOCK PRICE RANGES AND DIVIDENDS Southwest's common stock is listed on the New York Stock Exchange and is traded under the symbol LUV. The high and low sales prices of the common stock on the Composite Tape and the quarterly dividends per share, as adjusted for the February 2001 three-for-two stock... -

Page 30

... on average total assets Return on average stockholders' equity CONSOLIDATED OPERATING STATISTICS(2) Revenue passengers carried RPMs (000s) ASMs (000s) Passenger load factor Average length of passenger haul Trips flown Average passenger fare (9) (3) 5 1 1, 1 47 $.67 $.63 $.0180 Cash dividends per... -

Page 31

... certain estimates for Morris (7) Excludes merger expenses of $10.8 million (8) Includes leased aircraft (9) Includes effect of reclassification of revenue reported in 1999 through 1995 related to the sale of flight segment credits from Other to Passenger due to the accounting change implementation... -

Page 32

..., 2002, at the Southwest Airlines Corporate Headquarters, 2702 Love Field Drive, Dallas, Texas. STOCK EXCHANGE LISTING New York Stock Exchange Ticker Symbol: LUV FINANCIAL INFORMATION A copy of the Company's Annual Report on Form 10-K as filed with the U.S. Securities and Exchange Commission (SEC...