Sonic 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shiftin’Into

OVERDRIVE

Annual Report 2013

Table of contents

-

Page 1

OVERDRIVE Shiftin'Into Annual Report 2013 -

Page 2

... footlong quarter pound coneys, six-inch premium beef hot dogs, popcorn chicken, chicken strips and chicken sandwiches. Likewise, we are famous for our fresh-made onion rings, tater tots and over a million drink choices including our famous cherry limeade. Customers also enjoy drive-thru service and... -

Page 3

... company and franchise drive-in information, is a non-GAAP measure. We believe system-wide information is useful in analyzing the growth of the Sonic brand as well as our revenues, since franchisees pay royalties based on a percentage of sales. Changes in same-store sales based on drive-ins open... -

Page 4

...our innovative products, friendly service and ability to engage our customers, through effective advertising and improved media effectiveness, drove sales across all day-parts. New product introductions and limited-time offers, including a premium chicken sandwich, all beef hot dogs in a pretzel bun... -

Page 5

... 2013 to achieve interest expense savings of up to $2.5 million per year. This strong cash flow also supports our push to adopt new technology that will drive sales and service improvements well into the future. Just as important, the success of our sales-driving initiatives signals good things... -

Page 6

WE GETIT. 4 -

Page 7

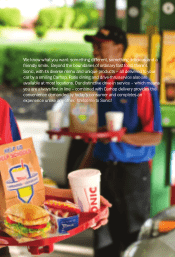

...Beyond the boundaries of ordinary fast food, there's Sonic, with its diverse menu and unique products - all delivered to your car by a smiling Carhop. Patio dining and drive-thru service also are available at most locations. Our distinctive drive-in service - which means you are always first in line... -

Page 8

..., Cherry Limeades and handbattered Onion Rings right alongside a steady stream of new product news and innovative selections for breakfast, lunch and dinner. Take, for instance, the limitedtime offer of our premium Asiago Caesar Chicken Club Sandwich or new premium beef Pretzel Dogs, both... -

Page 9

... manage the menu. Everything on it is available all day long. Whether it's an Ultimate Meat & Cheese Breakfast Burritoâ„¢ and Red Button Roastâ„¢ coffee in the afternoon or a Chicago Dog, Tots and a Cherry Limeade at the crack of dawn, it's your call. " Brand? Performance? All I know is the shakes... -

Page 10

... have changed. Our customers travel more, experience more and frankly, expect more. Recognizing these changes - and what they mean for how we do business, how we remain successful and how we grow - is critical. That's why we have committed to reach a new standard for fast food. We love to... -

Page 11

...we also are reaching new highs in how we go to market. From our "Two Guys" creative campaign to reaching the greatest number of customers with our national advertising and digital marketing efforts, we're achieving new milestones in how we engage the consumer. Already in limited deployment, over the... -

Page 12

... and friendly Carhop service all add up to an experience that is redefining fast food. Here' s the challenge How do you successfully grow to be a national brand and expand into new states and markets where, in the early going, you won't have the critical mass needed to support local advertising? At... -

Page 13

..., this is Sonic, with the quality and variety you expect from sit-down restaurants and specialty shops. Sonic's 20/20 media initiative has allowed us to partner with powerful brands with loyal followers. "I see Sonic advertising more than ever now. It's like they can read my mind every time." Jon... -

Page 14

... SPG Management, which owns and operates six Sonic Drive-Ins in the San Diego area, recently agreed to develop 15 new drive-ins in Southern California, including 10 in the greater Los Angeles area. From SPG are principals Frank Sur yan (left), Max Gelwix (center) and Kasey Suryan (right). TAKING... -

Page 15

...has been a franchise-driven company. Today, we're building a 21st century drive-in that appeals not only to our customers, but also to franchisees who are passionate about the potential of the Sonic brand. During the past year, several existing franchise groups committed to new development that will... -

Page 16

... of a new point-ofsale system, designed to improve customer service and allow for better food and labor 10 2 cost management, along with a supply chain management system created to improve forecasting, promotion planning and product development. That's why Sonic has gained not only the support of... -

Page 17

... to increase, setting the stage for renewed development growth. In 2013, franchisees executed agreements to build 79 new drive-ins over the coming years. "I've operated several national QSr concepts for almost 40 years. to me, Sonic stands out for many reasons, including a high return on investment... -

Page 18

...102 OPERATIONAL SNAPSHOT 89% Franchise Drive-Ins 11% Company Drive-Ins Net Income Per Diluted Share As Reported Adjusted System-wide Drive-Ins System-wide Average Sales Per Drive-In (in thousands) $0.531 $0.60 $0.60 $0.64 $0.722 $0.31 3,561 3,556 3,522 $1,037 2013 Business Mix '11 '12... -

Page 19

...,701 2012 2009 Income Statement Data: Company Drive-In sales $ Franchise Drive-Ins: Franchise royalties and fees Lease revenue Other Total revenues Cost of Company Drive-In sales Selling, general and administrative Depreciation and amortization Provision for impairment of long-lived assets Other... -

Page 20

... franchise fees are directly affected by the number of operating Franchise Drive-Ins and new drive-in openings. Lease revenues are generated by the leasing of land and buildings for Company Drive-Ins that have been sold to franchisees. Overview of Business Performance. System-wide same-store sales... -

Page 21

... includes both Company Drive-In and Franchise Drive-In information, which we believe is useful in analyzing the growth of the brand as well as the Company's revenues, since franchisees pay royalties based on a percentage of sales. System-wide Performance Year Ended August 31, 2013 2012 2011... -

Page 22

... change for drive-ins open for a minimum of 15 months. Same-store sales for Company Drive-Ins increased 2.5% for fiscal year 2013 and 2.8% for fiscal year 2012, showing continued momentum from the Company's successful implementation of initiatives to improve product quality, service and value... -

Page 23

... time. Represents percentage change for drive-ins open for a minimum of 15 months. Consists of revenues derived from franchising activities, including royalties, franchise fees and lease revenues. See Revenue Recognition Related to Franchise Fees and Royalties in the Critical Accounting Policies... -

Page 24

...marketing, telephone and utilities, repair and maintenance, rent, property tax and other controllable expenses. Percentage Company Drive-In Margins Points Year Ended August 31, Increase 2013 2012 (Decrease) Costs and expenses: Company Drive-Ins: Food and packaging Payroll and other employee benefits... -

Page 25

... quarter of fiscal year 2012 for the Sonic system's legacy point-of-sale technology that is expected to be replaced over the next several years. Provision for Impairment of Long-Lived Assets. Provision for impairment of long-lived assets increased $1.0 million to $1.8 million in fiscal year 2013... -

Page 26

...existing drive-ins Total purchases of property and equipment $ 17.1 13.2 4.1 3.9 1.9 1.1 $ 41.3 Financing Cash Flows. Net cash used in financing activities increased $13.5 million to $61.4 million for fiscal year 2013 as compared to $47.9 million in fiscal year 2012. This increase primarily relates... -

Page 27

... fourth quarter of fiscal year 2012. In August 2013, the Board of Directors extended the share repurchase program through August 31, 2014, with a total authorization of up to $40.0 million, which was available as of August 31, 2013. Share repurchases may be made from time to time in the open market... -

Page 28

...estimated share of system-wide commitments to purchase food products. We have excluded agreements that are cancelable without penalty. These amounts require estimates and could vary due to the timing of volumes and changes in market pricing. Includes $2.6 million of unrecognized tax benefits related... -

Page 29

... and development fees are generally recognized upon the opening of a Franchise Drive-In or upon termination of the agreement between Sonic and the franchisee. Our franchisees pay royalties based on a percentage of sales. Royalties are recognized as revenue when they are earned. Accounting for Stock... -

Page 30

... on the best available information at the time that we prepare the provision, including legislative and judicial developments. We generally file our annual income tax returns several months after our fiscal year end. Income tax returns are subject to audit by federal, state and local governments... -

Page 31

...leases due after one year Long-term debt due after one year Deferred income taxes Other noncurrent liabilities Commitments and contingencies (Notes 7,8,15,16) Stockholders' equity: Preferred stock, par value $.01; 1,000 shares authorized; none outstanding Common stock, par value $.01; 245,000 shares... -

Page 32

... Income Year Ended August 31, 2012 2011 $ 404,443 128,013 6,575 4,699 543,730 $ 410,820 125,871 6,023 3,237 545,951 (In thousands, except per share amounts) 2013 Revenues: Company Drive-In sales Franchise Drive-Ins: Franchise royalties and fees Lease revenue Other Total revenues Costs... -

Page 33

... and issuance of restricted stock Other Balance at August 31, 2011 Total comprehensive income, net of income taxes Stock-based compensation expense Purchase of treasury stock Exercise of stock options and issuance of restricted stock Other Balance at August 31, 2012 Total comprehensive income, net... -

Page 34

... of Cash Flows Year Ended August 31, 2012 2011 $ 36,085 $ 19,225 (In thousands) 2013 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Stock-based compensation expense Net loss from early... -

Page 35

... 2012 and 2011 (In thousands, except per share data) 1. Summary of Significant Accounting Policies Operations Sonic Corp. (the "Company") operates and franchises a chain of quick-service restaurants in the United States. It derives its revenues primarily from Company Drive-In sales and royalty fees... -

Page 36

Notes to Consolidated Financial Statements August 31, 2013, 2012 and 2011 (In thousands, except per share data) Accounting for Long-Lived Assets The Company reviews long-lived assets whenever events or changes in circumstances indicate that the carrying amount of an asset might not be recoverable. ... -

Page 37

... August 31, 2013, 2012 and 2011 (In thousands, except per share data) Revenue Recognition, Franchise Fees and Royalties Revenue from Company Drive-In sales is recognized when food and beverage products are sold. Company DriveIn sales are presented net of sales tax and other sales-related taxes. The... -

Page 38

... to the effect of the related allowance for doubtful accounts. • Long-term debt - The Company prepares a discounted cash flow analysis for its fixed rate borrowings to estimate fair value each quarter. This analysis uses Level 2 inputs from market information available for public debt transactions... -

Page 39

... Impairment of Long-Lived Assets During the fiscal years ended August 31, 2013, 2012 and 2011, the Company identified impairments for certain brand technology assets, surplus property and drive-in assets through regular quarterly reviews of long-lived assets. The recoverability of Company Drive-Ins... -

Page 40

...related to the write-off of assets associated with a change in the vendor providing technology for the Sonic system's new point-of-sale technology. The remaining $0.2 million reflects reducing the carrying amount of surplus properties to fair value. In fiscal years 2012 and 2011 the Company recorded... -

Page 41

... lease term, write-down of real estate and other costs associated with store closures. Additionally, in the second quarter of fiscal year 2013, a franchisee purchased land and buildings leased or subleased from the Company relating to previously refranchised drive-ins. At the time of the sale... -

Page 42

... Direct Financing Years ending August 31: 2014 2015 2016 2017 2018 Thereafter Less unearned income 6,173 6,371 6,280 6,304 6,283 47,334 $ 78,745 $ $ $ 407 896 174 133 65 26 1,701 (170) 1,531 Leasing Arrangements as a Lessee Certain Company Drive-Ins lease land and buildings from third parties... -

Page 43

....3 million for fiscal years 2013, 2012 and 2011, respectively. Land, buildings and equipment with a carrying amount of $157.0 million at August 31, 2013, were leased under operating leases to franchisees and other parties. The accumulated depreciation related to these buildings and equipment was $51... -

Page 44

...Consolidated Financial Statements August 31, 2013, 2012 and 2011 (In thousands, except per share data) At August 31, 2013, future maturities of long-term debt were $10.0 million for fiscal year 2014, $9.8 million annually for fiscal years 2015, 2016 and 2017, and $253.0 million for fiscal year 2018... -

Page 45

...royalties, certain Company and Franchise Drive-In real estate, intangible assets and restricted cash balances of $18.6 million. The 2011 Notes and the 2013 Fixed Rate Notes are secured by franchise fees, royalty payments and lease payments, and the repayment of the 2011 Notes and the 2013 Fixed Rate... -

Page 46

... The fair value of the 2011 Fixed Rate Notes and the 2013 Fixed Rate Notes is estimated using Level 2 inputs from market information available for public debt transactions for companies with ratings that are similar to the Company's ratings and from information gathered from brokers who trade in the... -

Page 47

... million in fiscal year 2013. The majority of the change was due to the favorable resolution of a federal tax audit, a statute of limitations expiration of a state tax position and a tax method change, offset by a new uncertain position related to a federal credit. Of this change, only $0.7 million... -

Page 48

... may purchase shares of common stock each year up to the lesser of 10% of their base compensation or $25 thousand in the stock's fair market value. At August 31, 2013, 0.9 million shares were available for grant under the ESPP. Stock-Based Compensation The Sonic Corp. 2006 Long-Term Incentive Plan... -

Page 49

...estimate the fair value of stock option grants in the respective periods are listed in the table below: 2013 4.9 48% 0.8% -% 2012 4.9 48% 0.8% -% 2011 4.7 46% 2.0% -% Expected term (years) Expected volatility Risk-free interest rate Expected dividend yield The Company estimates expected volatility... -

Page 50

... time to time in the open market or in negotiated transactions, depending on share price, market conditions and other factors. The stock repurchase program may be extended, modified, suspended or discontinued at any time. Subsequent to the end of fiscal year 2013, the Company purchased approximately... -

Page 51

...initiatives and an impairment charge of $1.6 million related to the write-off of assets associated with a change in the vendor for the Sonic system's new point-of-sale technology in the fourth quarter of fiscal year 2013. The sum of per share data may not agree to annual amounts due to rounding. 49 -

Page 52

... financial position of Sonic Corp. at August 31, 2013 and 2012, and the consolidated results of its operations and its cash flows for each of the three years in the period ended August 31, 2013, in conformity with U.S. generally accepted accounting principles. Also, in our opinion, the related... -

Page 53

... assurance to the Company's management and Board of Directors regarding the preparation and fair presentation of published financial statements. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide... -

Page 54

... Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Sonic Corp. as of August 31, 2013 and 2012, and the related consolidated statements of income and comprehensive income, stockholders' equity, and cash flows for each of the three years in the period ended... -

Page 55

... Information Officer Robert P. Franke Senior Vice President of Franchise Sales and International Development Andrew G. Ritger, Jr. Senior Vice President of Franchise Services E. Edward Saroch Senior Vice President of Franchise Relations Larry G. Archibald Vice President of Brand Technology Tanishia... -

Page 56

...not pay any cash dividends on our common stock during our two most recent fiscal years and do not intend to pay any dividends in the foreseeable future as profits are reinvested in the Company to fund expansion of our business, make payments under the Company's financing arrangements, repurchase the... -

Page 57

-

Page 58

300 Johnny Bench Drive Oklahoma City, OK 73104 sonicdrivein.com