Sonic 2002 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2002 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

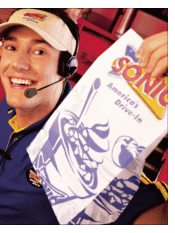

With so many menu choices,

it’s hard to think of us as just

Plain Vanilla.

Simple.

From its earliest days, Sonic has operated with a simple, cash-oriented business

model. And while Sonic has become larger through the years, stretching out with more

than 2,500 drive-ins across 30 states and into northeastern Mexico, it remains

homegrown and uncomplicated.

This simplicity in operations can be traced to its origin and tradition as a

franchisor. Perhaps nothing typifies its simple approach to operations better than one

of Sonic’s first decisions: to figure royalties at the rate of one penny for each paper sack

ordered by franchisees. Similarly, the company has collaborated since then in a strong,

two-way relationship with its franchisees to build the Sonic brand, not create complex

transactions. For example, all franchisees control their own real estate, and Sonic sells

neither food nor equipment to its franchisees.

Sonic’s franchising orientation has provided it with a straightforward, capital-

efficient way to expand its brand, manage growth and reduce development risk. In fact,

franchisees have developed more than 80% of the drive-ins in the chain, which has

expanded by almost one-third over the past five years. During this same time frame,

Sonic’s earnings have increased steadily, as has the company’s return on equity.

Today, royalties are no longer a penny a bag. In fact, they are uniquely ascending,

which increases Sonic’s earnings as drive-ins build volume. Even so, Sonic’s royalties

remain among the lowest in the industry, which in turn allows its franchisees to enjoy

more financial success with the brand and see more incentive to grow. As a result of its

ascending royalty rates and with steady growth in its base of franchised drive-ins,

franchising income has become a predictable, stable element in the company’s financial

results. In more recent years, with the continued development of its company-owned

drive-ins and the contributions to growth that they offer, together with the company’s

other multi-layered growth strategies, Sonic’s business model has become even more

balanced.

Today, Sonic is strongly positioned to deliver consistent sales and earnings growth

and continues to build one of the most-loved restaurant brands in the country.

With so many menu choices,

it’s hard to think of us as just

Plain Vanilla.