Sonic 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 Annual Report

Table of contents

-

Page 1

2 0 0 2 A n n u a l R e p o r t -

Page 2

... Sonic's unique menu and personalized carhop service, position the company as one of the most highly differentiated concepts in the restaurant industry's quick-service sector. Financial Highlights ($ in thousands, except per share data) 2002 2001 % Change Operations (for the year) Total revenues... -

Page 3

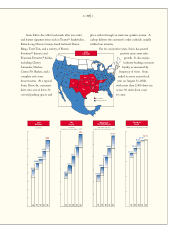

.... Sonic ended its most recent fiscal year on August 31, 2002, with more than 2,500 drive-ins across 30 states from coast 34 65 to coast. Core Markets Developing Markets Total Revenues (in millions) Net Income (in millions) (excludes non-recurring charges in 1998) Net Income Per Diluted Share... -

Page 4

... 30 states. For investors, this progress translated into a 22% return on equity for the year, our third consecutive year above 20% and the highest return in our history as a public company. That growth generated free cash flow of about $23 million, before acquisitions and share repurchases, helping... -

Page 5

...Customer feedback on our breakfast menu continues to be very positive and its availability all day long, just like the rest of our menu, clearly is a factor in the growth of our average unit sales. Moreover, breakfast is helping us win new customers to the brand; in fact, our early, limited research... -

Page 6

... Sonic's name selection almost 50 years ago - Sonic offers the most differentiated dining experience in quick service today. It's an experience that the customer controls, starting with the push of a little red button and ending with smiles and satisfaction. Quality food made after you order, menu... -

Page 7

-

Page 8

-

Page 9

... growth that they offer, together with the company's other multi-layered growth strategies, Sonic's business model has become even more balanced. Today, Sonic is strongly positioned to deliver consistent sales and earnings growth and continues to build one of the most-loved restaurant brands in the... -

Page 10

... years since the original test, and along with these increased sales, breakfast also creates higher drive-in profits since it requires little capital investment to extend operations into the morning hours. Clearly, Sonic's roots as a franchising organization help account for the company's spirit... -

Page 11

-

Page 12

Sonic 02 10 System Highlights Stores in Operation System-wide Sales (in millions) System-wide Average Sales Per Restaurant (in thousands) System-wide Marketing Expenditures (in millions) $906 $2,205 2,533 2,359 2,175 2,011 $1,588 1,847 $54 $1,971 $758 $1,779 $68 $874 $853 $823 $80 $90 $1,334... -

Page 13

... ...2 1 Consolidated Statements of Income ...2 2 Consolidated Statements of Stockholders' Equity ...2 3 Consolidated Statements of Cash Flows ...2 4 Notes to Consolidated Financial Statements ...2 5 Report of Independent Auditors ...3 8 Directors and Officers ...3 9 Corporate Information ...4 0 -

Page 14

... Financial Data Year ended August 31, 2000 1999 2002 2001 1998 (In thousands, except per share data) Income Statement Data: Company-owned restaurant sales Franchised restaurants: Franchise royalties Franchise fees Other Total revenues Cost of restaurant sales Selling, general and administrative... -

Page 15

..., and general and administrative expenses, relate to both company-owned restaurant operations, as well as the company's franchising operations. The company's revenues and expenses are directly affected by the number and sales volumes of companyowned restaurants. The company's revenues and... -

Page 16

...s i s Year ended August 31, 2001 ($ in thousands) 2002 Income Statement Data: Revenues: Company-owned restaurant sales Franchised restaurants: Franchise royalties Franchise fees Other Costs and expenses: Company-owned restaurants (1) Selling, general and administrative Depreciation and amortization... -

Page 17

... wage rates, increased investment in store-level labor as a part of the company's commitment to outstanding customer service, and an increase in training and store-level management for the rollout of the breakfast program. Other operating expenses, as a percentage of company-owned restaurant sales... -

Page 18

... 2000. One hundred fiftyseven franchise drive-ins opened in fiscal year 2001 compared to 150 in fiscal year 2000, resulting in an 18.6% increase in franchise fee revenues. Restaurant cost of operations, as a percentage of company-owned restaurant sales, was 73.0% in fiscal year 2001, compared to 72... -

Page 19

... expenditures, from cash generated by operating activities and through borrowings under the company's line of credit. During fiscal year 2002, the company purchased the real estate for 46 of the 65 newly-constructed and acquired restaurants. The company expects to own the land and building for most... -

Page 20

... potential acquisitions and share repurchases. These capital expenditures primarily relate to the development of additional company-owned restaurants, stall additions, relocations of older restaurants, store equipment upgrades, and enhancements to existing financial and operating information systems... -

Page 21

... insurance or would not have a material adverse effect on the company's business or financial condition. Advertising. Under the company's license agreements, each drive-in, either company-owned or franchise, must contribute a minimum percentage of revenues to a national media production fund (Sonic... -

Page 22

...% and 11%. The company believes the fair market value of these notes approximates their carrying amount. The impact on the company's results of operations of a one-point interest rate change on the outstanding balances under the line of credit as of the end of fiscal year 2002 would be approximately... -

Page 23

... after one year Other noncurrent liabilities Deferred income taxes Commitments and contingencies (Notes 6, 7, 14, and 15) Stockholders' equity: Preferred stock, par value $.01; 1,000,000 shares authorized; none outstanding Common stock, par value $.01; 100,000,000 shares authorized; shares issued 48... -

Page 24

Sonic 02 22 Consolidated Statements of Income Year ended August 31, 2001 (In thousands, except per share data) 2002 Revenues: 2000 Company-owned restaurant sales Franchised restaurants: Franchise royalties Franchise fees Other Costs and expenses: $ 330,707 61,392 4,020 4,043 400,162 $ 267,463 ... -

Page 25

...Earnings Treasury Stock Shares Amount (In thousands) Balance at August 31, 1999 Exercise of common stock options Tax benefit related to exercise of employee stock options Purchase of treasury stock Three-for-two stock split Net income Balance at August 31, 2000 Exercise of common stock options Tax... -

Page 26

... Amortization of franchise and development fees Franchise and development fees collected Provision (benefit) for deferred income taxes Provision for impairment of long-lived assets Tax benefit related to exercises of employee stock options Other (Increase) decrease in operating assets: Accounts and... -

Page 27

...thousands, except share data) 1. Summary of Significant Accounting Policies Operations Sonic Corp. (the "company") operates and franchises a chain of quick-service drive-in restaurants in the United States. It derives its revenues primarily from company-owned restaurant sales and royalty fees from... -

Page 28

...income on a pro rata basis when the conditions for revenue recognition under the individual development agreements are met. Both initial franchise fees and area development fees are generally recognized upon the opening of a franchise drive-in or upon termination of the agreement between the company... -

Page 29

...a System Marketing Fund, which purchases advertising on national cable and broadcast networks and other national media and sponsorship opportunities. As stated in the terms of existing license agreements, these funds do not constitute assets of the company and the company acts with limited agency in... -

Page 30

... a term of five years, bear interest at market rates, and are secured by the partner's equity interest. The company evaluates whether the partner notes are collectible and makes estimates of bad debts based on the restaurant's financial performance and collection history with individual partners. As... -

Page 31

... sale of restaurants Balance as of August 31, 6. Leases Description of Leasing Arrangements The company's leasing operations consist principally of leasing certain land, buildings and equipment (including signs) and subleasing certain buildings to franchise operators. The land and building portions... -

Page 32

... and 2000 (In thousands, except share data) Future minimum rental payments receivable as of August 31, 2002 are as follows: Operating Year ending August 31: 2003 2004 2005 2006 2007 Thereafter Less unearned income $ $ 1,243 1,157 615 595 576 3,815 8,001 - 8,001 Direct Financing 1,854 1,825 1,795... -

Page 33

Sonic 02 31 Notes to Consolidated Financial Statements August 31, 2002, 2001 and 2000 (In thousands, except share data) 7. Property, Equipment and Capital Leases Property, equipment and capital leases consist of the following at August 31, 2002 and 2001: Estimated Useful Life Home office: Land ... -

Page 34

...agreement allows for annual renewal options, subject to approval by the banks. The company plans to use the line of credit to finance the opening of newlyconstructed restaurants, acquisitions of existing restaurants, purchases of the company's common stock, retirement of senior notes and for general... -

Page 35

... depreciation related to direct financing leases and different year ends for financial and tax reporting purposes State net operating losses Property, equipment and capital leases Allowance for doubtful accounts and notes receivable Deferred income from affiliated franchise fees Accrued liabilities... -

Page 36

...Sonic Corp. Directors' Stock Option Plan (collectively, the "1991 Plans"), because the 1991 Plans were expiring after 10 years as required by the Internal Revenue Code. Options previously granted under the 1991 Plans continue to be outstanding after the adoption of the 2001 Plans and are exercisable... -

Page 37

Sonic 02 35 Notes to Consolidated Financial Statements August 31, 2002, 2001 and 2000 (In thousands, except share data) The Black-Scholes option valuation model was developed for use in estimating the fair value of traded options which have no vesting restrictions and are fully transferable. In ... -

Page 38

... to purchase, at the right's then current exercise price, shares of common stock of such other person having a value of twice the right's then current exercise price. Unless a triggering event occurs, the rights will not trade separately from the common stock. The company will generally be entitled... -

Page 39

..., except share data) 16. Selected Quarterly Financial Data (Unaudited) First Quarter 2002 2001 Income statement data: Company-owned restaurant sales $ 71,721 Other 15,608 Total revenues 87,329 Company-owned restaurants operating expenses 54,022 Selling, general and administrative 7,658 Other... -

Page 40

...financial position of Sonic Corp. at August 31, 2002 and 2001, and the consolidated results of its operations and its cash flows for each of the three years in the period ended August 31, 2002, in conformity with accounting principles generally accepted in the United States. Oklahoma City, Oklahoma... -

Page 41

... Officer Sonic Corp. Margaret M. Blair 1, 2 Visiting Professor Georgetown University Law Center Research Director Sloan-GULC Project on Business Institutions Leonard Lieberman 1, 3 Private Investor Pattye L. Moore President Sonic Corp. Federico F. Peña 1, 3 Managing Director Vestar Capital Partners... -

Page 42

Sonic 02 40 Corporate Information Corporate Offices Stock Market Information Annual Report on Form 10-K 101 Park Avenue Oklahoma City, Oklahoma 73102 405/280-7654 Web Address www.sonicdrivein.com Stock Transfer Agent The company's common stock trades on the NASDAQ National Market System under ... -

Page 43

-

Page 44

1 0 1 O k l a h o m a P a r k A v e n u e O k l a h o m a 7 3 1 0 2 C i t y , 4 0 5 / 2 8 0 - 7 6 5 4 w w w . s o n i c d r i v e i n . c o m