SkyWest Airlines 2012 Annual Report Download - page 48

Download and view the complete annual report

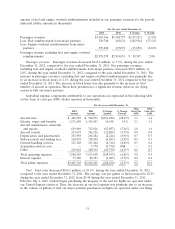

Please find page 48 of the 2012 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and other such costs that are passed through to the major airline partner. Regional airlines benefit

from a fixed-fee arrangement because they are sheltered from most of the elements that cause volatility

in airline financial performance, including variations in ticket prices, passenger loads and fuel prices.

However, regional airlines in fixed-fee arrangements do not benefit from positive trends in ticket prices,

passenger loads or fuel prices and, because the major airline absorbs most of the costs associated with

the regional airline flight, the margin between the fixed-fees for a flight and the expected per-flight

costs tends to be smaller than the margins associated with revenue-sharing arrangements.

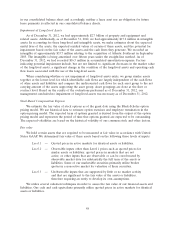

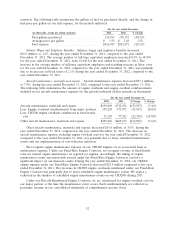

Under our fixed-fee arrangements, two compensation components have a significant impact on

comparability of revenue and operating expense for the periods presented. One item is the

reimbursement of fuel expense, which is a directly-reimbursed expense under all of our fixed-fee

arrangements. Our major partners directly reimburse us for fuel expense incurred under each respective

fixed fee contract and we record such reimbursement as passenger revenue. Thus, the price volatility of

fuel and the volume of fuel expensed under our fixed-fee arrangements will impact our fuel expense

and our passenger revenue equally, with no impact on our operating income.

The second item is the compensation we receive for engine maintenance under our fixed-fee

arrangements. Under our United, American, US Airways and Alaska flying contracts, a portion of our

compensation is based upon fixed hourly rates, which is intended to compensate us for engine

maintenance costs (‘‘Fixed-Rate Engine Contracts’’). Under the compensation structure for our Delta

Connection and United CPA flying contracts, our major partner directly reimburses us for engine

maintenance expense when the expense is incurred (‘‘Directly-Reimbursed Engine Contracts’’). We use

the direct-expense method of accounting for our CRJ200 regional jet aircraft engine overhaul costs

and, accordingly, we recognize engine maintenance expense on our CRJ200 engines on an as-incurred

basis. Under the direct-expense method, the maintenance liability is recorded when the maintenance

services are performed (‘‘CRJ200 Engine Overhaul Expense’’).

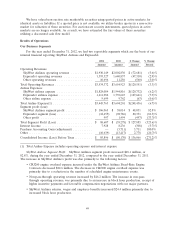

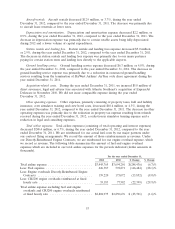

Because we use the direct-expense method of accounting for our CRJ200 engine expense, and

because we recognize revenue using the applicable fixed hourly rates under our Fixed-Rate Engine

Contracts, the number of engine maintenance events and related expense we incur each reporting

period under the Fixed-Rate Engine Contracts has a direct impact on the comparability of our

operating income for the presented reporting periods. The CRJ200 Engine Overhaul Expense incurred

under the Fixed-Rate Engine Contracts decreased $22.4 million during the year ended December 31,

2012, compared to the year ended December 31, 2011. The decrease in CRJ200 Engine Overhaul

Expense was primarily due to a reduction in the number of scheduled engine maintenance events

during the year ended December 31, 2012.

Because we recognize revenue when we incur engine maintenance expense on engines operating

under our Directly-Reimbursed Engine Contracts, the number of engine events and related expense we

incur each reporting period does not have a direct impact on the comparability of our operating

income for the presented reporting periods.

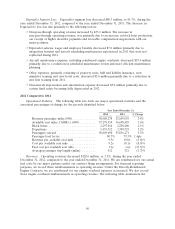

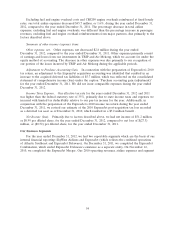

We have an agreement with a third-party vendor to provide long-term engine maintenance

covering scheduled and unscheduled repairs for engines on our CRJ700s operating under our

Fixed-Rate Engine Contracts (‘‘Power by the Hour Agreement’’). Under the terms of the Power by the

Hour Agreement, we are obligated to pay a set dollar amount per engine hour flown on a monthly

basis and the vendor assumes the obligation to repair the engines at no additional cost to us, subject to

certain specified exclusions. Thus, under the Power by the Hour Agreement, we expense the engine

maintenance costs as flight hours are incurred on the engines and using the contractual rate set forth in

the agreement. Because we record engine maintenance expense based on the fixed hourly rate pursuant

to the Power by the Hour Agreement on our CRJ700s operating under our Fixed-Rate Engine

Contracts, and because we recognize revenue using the applicable fixed hourly rates under our

Fixed-Rate Engine Contracts, the number of engine events and related expense we incur each reporting

44