SkyWest Airlines 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

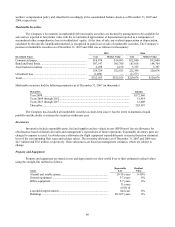

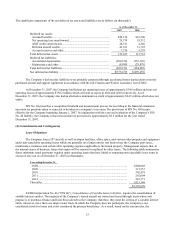

December 31, 2007, as compared to the carrying amount of $1,851.0 million. The Company’ s fair value of long-term debt as

of December 31, 2006 was $1,760.8 million as compared to the carrying amount of $1,784.1 million.

Segment Reporting

SFAS No. 131, Disclosures about Segments of an Enterprise and Related Information requires disclosures related to

components of a company for which separate financial information is available that is evaluated regularly by the Company’ s

chief operating decision maker in deciding how to allocate resources and in assessing performance. Management believes

that the Company has only one reportable segment in accordance with SFAS No. 131 because the Company’ s business

consists of scheduled regional airline service.

New Accounting Standards

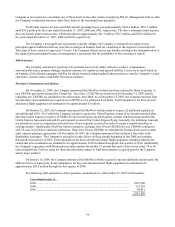

In July 2006, the Financial Accounting Standards Board (the “FASB”) issued Interpretation No. 48, Accounting for

Uncertainty in Income Taxes—an interpretation of FASB Statement No. 109 (“FIN No. 48”), which clarifies the accounting

and disclosure for uncertainty in tax positions. FIN No. 48 seeks to reduce the diversity in practice associated with certain

aspects of the recognition and measurement related to accounting for income taxes. The Company is subject to the provisions

of FIN No.48 as of January 1, 2007, and has analyzed filing positions in all of the federal and state jurisdictions where it is

required to file income tax returns, as well as all open tax years in these jurisdictions. The periods subject to examination for

the Company’ s federal return are the 2004 through 2006 tax years. The adoption of FIN No. 48 did not have a material effect

on the Company’ s consolidated financial position or results of operations. The Company’ s policy for recording interest and

penalties on tax positions is to record such items as a component of the provision for income taxes.

In September 2006, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 157, Fair Value

Measurements. This standard defines fair value, establishes a framework for measuring fair value in accounting principles

generally accepted in the United States of America, and expands disclosure about fair value measurements. This

pronouncement applies to other accounting standards that require or permit fair value measurements. Accordingly, this

statement does not require any new fair value measurement. This statement is effective for fiscal years beginning after

November 15, 2007, and interim periods within those fiscal years. Management does not believe the adoption of this standard

will have a material impact on the Company’ s consolidated financial position or results of operations.

In February 2007, the FASB issued Statement No. 159, The Fair Value Option for Financial Assets and Financial

Liabilities (Statement 159). Statement 159 allows entities the option to measure eligible financial instruments at fair value as

of specified dates. Such election, which may be applied on an instrument by instrument basis, is typically irrevocable once

elected. Statement 159 is effective for fiscal years beginning after November 15, 2007. The Company does not believe

Statement 159 will result in a material adverse effect on its financial condition, results of operations, or cash flow.