SkyWest Airlines 2002 Annual Report Download - page 48

Download and view the complete annual report

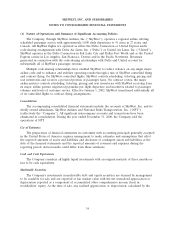

Please find page 48 of the 2002 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Purchase Commitments and Options

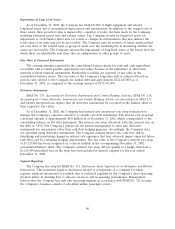

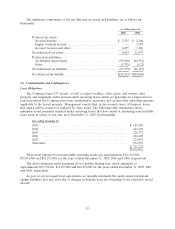

During the year ended December 31, 2002, SkyWest took delivery of 26 CRJs in connection with

the Delta Connection and United Express contract flying arrangements. Additionally, as of

December 31, 2002 SkyWest had agreed to acquire an additional 70 CRJs and related spare parts

inventory and support equipment through purchase commitments at an aggregate cost of approximately

$1.4 billion. SkyWest commenced delivery of these aircraft beginning in January 2003 and deliveries are

scheduled to continue through January 2005. Depending on the state of the aircraft financing market at

the time of delivery, management will determine whether to acquire these aircraft through third party,

long-term loans or lease agreements. SkyWest also has options to acquire 119 additional CRJs at fixed

prices (subject to cost escalations) and delivery schedules and are exercisable at various dates through

April 2008.

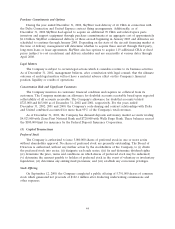

Legal Matters

The Company is subject to certain legal actions which it considers routine to its business activities.

As of December 31, 2002, management believes, after consultation with legal counsel, that the ultimate

outcome of such legal matters will not have a material adverse effect on the Company’s financial

position, liquidity or results of operations.

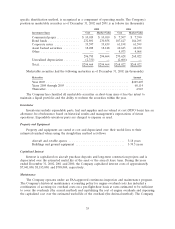

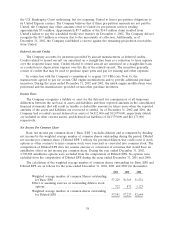

Concentration Risk and Significant Customers

The Company monitors its customers’ financial condition and requires no collateral from its

customers. The Company maintains an allowance for doubtful accounts receivable based upon expected

collectability of all accounts receivable. The Company’s allowance for doubtful accounts totaled

$723,000 and $63,000 as of December 31, 2002 and 2001, respectively. For the years ended

December 31, 2002, 2001 and 2000, the Company’s code-sharing and contract relationships with Delta

and United combined accounted for more than 95% of the Company’s total revenues.

As of December 31, 2002, the Company has demand deposits and money market accounts totaling

$4,923,000 with Zions First National Bank and $720,000 with Wells Fargo Bank. These balances exceed

the $100,000 limit for insurance by the Federal Deposit Insurance Corporation.

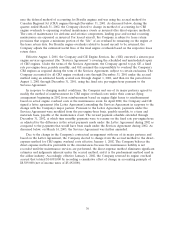

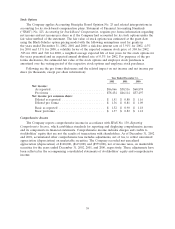

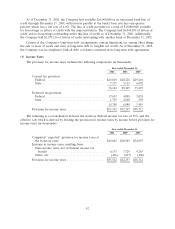

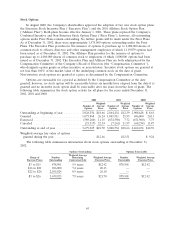

(5) Capital Transactions

Preferred Stock

The Company is authorized to issue 5,000,000 shares of preferred stock in one or more series

without shareholder approval. No shares of preferred stock are presently outstanding. The Board of

Directors is authorized, without any further action by the stockholders of the Company, to (i) divide

the preferred stock into series; (ii) designate each such series; (iii) fix and determine dividend rights;

(iv) determine the price, terms and conditions on which shares of preferred stock may be redeemed;

(v) determine the amount payable to holders of preferred stock in the event of voluntary or involuntary

liquidation; (vi) determine any sinking fund provisions; and (vii) establish any conversion privileges.

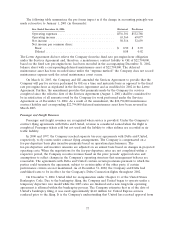

Stock Offering

On September 12, 2000, the Company completed a public offering of 5,791,000 shares of common

stock which generated net proceeds of $122.1 million after deducting underwriting commissions and

other expenses.

44