Siemens 2011 Annual Report Download - page 313

Download and view the complete annual report

Please find page 313 of the 2011 Siemens annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

153 D. Consolidated Financial Statements 273 E. Additional information

158 D. Consolidated Statements of Changes in Equity

160 D. Notes to Consolidated Financial Statements

266 D. Supervisory Board and Managing Board

154 D. Consolidated Statements of Income

155 D.2 Consolidated Statements of Comprehensive Income

156 D. Consolidated Statements of Financial Position

157 D. Consolidated Statements of Cash Flow

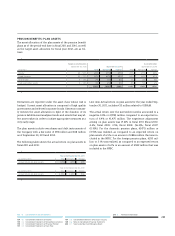

() Authorized Capital , granted in January , expired

in January . It granted the right to increase capital

stock by up to € million through issuing up to million

shares for contributions in cash. As of September , ,

€. million representing . million shares were avail-

able for issuance. Pre-emptive rights of existing sharehold-

ers were excluded.

CONDITIONAL CAPITAL (NOT ISSUED)

Conditional Capital is provided for the purpose of a) serving

the issuance of bonds with conversion rights and (or) with

warrants, b) accommodating the exercise of stock option

plans and c) settling claims of former Siemens Nixdorf Infor-

mationssysteme AG (SNI AG) shareholders.

() Conditional Capital to service the issuance of bonds

with conversion rights and / or with warrants or a combina-

tion thereof in an aggregate principal amount of up to €

billion, entitling the holders to subscribe to up to mil-

lion shares of Siemens AG with no par value, representing

up to € million of capital stock. The authorization to is-

sue such bonds was granted in January and will ex-

pire on January , .

() Conditional Capital to service the issuance of bonds with

conversion rights and / or with warrants in an aggregate

principal amount of up to € billion, entitling the holders

to subscribe to up to million shares of Siemens AG

with no par value, representing up to € million of capi-

tal stock (Conditional Capital ). The authorization to

issue such bonds was granted on January , and will

expire on January , .

() Conditional Capital to service the and Siemens

Stock Option Plans amounts to € million, representing

. million shares of Siemens AG as of September ,

and . Of the € million Conditional capital, € mil-

lion, representing million shares, is reserved to solely

service the Siemens Stock Option Plan and € million,

representing . million shares, services both the and

Siemens Stock Option Plans. The last tranche of stock

options expired in November and from that date on, no

further shares are to be issued, see

Note 34 Share-based

payment for further information on stock options.

() Conditional Capital provided to issue shares to settle claims

offered to former SNI AG shareholders who had not ten-

dered their SNI AG share certificates amounts to €. mil-

lion, representing thousand shares as of September ,

and . Such rights to claim Siemens shares expired

in and no further shares are to be issued.

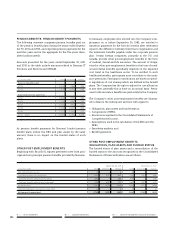

TREASURY STOCK

The Company is authorized by its shareholders to acquire

treasury stock of up to % of its capital stock existing at the

date of the shareholders’ resolution, which represents up to

,, Siemens shares or – if this value is lower – as of

the date on which the authorization is exercised. The authori-

zation became effective on March , and remains in force

through January , . The previous authorization, grant-

ed at the Shareholders’ Meeting on January , , termi-

nated as of the effective date of the new authorization. Ac-

cording to the resolutions, repurchased shares may be () sold

via a stock exchange or through a public sales offer made to

all shareholders; () retired; () offered for purchase to individ-

uals currently or formerly employed by the Company or any of

its subsidiaries or granted and transferred to such individuals

with a vesting period of at least two years; () offered and

transferred with the approval of the Supervisory Board to

third parties against contributions in kind, particularly in con-

nection with business combinations or the acquisition of

companies, businesses, parts of businesses or interests there-

in; () with the approval of the Supervisory Board sold to third

parties against payment in cash if the price at which such

Siemens shares are to be sold is not significantly lower than

the market price of the Siemens stock at the time of selling; or

() used to service convertible bonds or warrants granted by

the Company or any of its subsidiaries and, () regarding the

resolution, used to meet the obligations under the

Siemens Stock Option Plan. In addition, the Supervisory Board

is authorized to offer repurchased shares to members of the

Managing Board within the framework of Managing Board

compensation.

The current authorization to acquire Siemens shares is sup-

plemented by an authorization to repurchase up to five per-

cent of its capital stock existing at the date of the sharehold-

ers’ resolution by using equity derivatives or forward purchas-

es with a maximum maturity term of months; the repur-

chase of treasury stock upon the exercise of such instruments

shall be no later than January , . The previous authori-

zation was supplemented by an authorization to repurchase

up to half of those shares by using equity derivatives, such as

put and call options and a combination of put and call op-

tions; the term of such options had to be chosen in a way that

any repurchase of the Company ’s own shares upon the exer-

cise of the option would take place no later than on the expi-

ration date of the supplemented authorization.