Shaw 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

Notes to the Consolidated Financial Statements

August 31, 2015 and 2014

[all amounts in millions of canadian dollars except share and per share amounts]

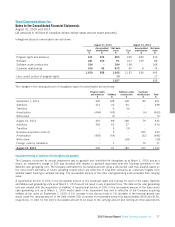

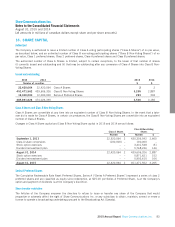

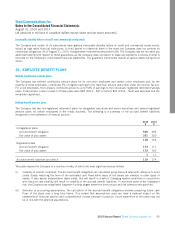

Deferred share unit plan

The Company has a DSU plan for its Board of Directors whereby directors can elect to receive their annual cash compensation,

or a portion thereof, in DSUs. In addition, the Company may adjust and/or supplement directors’ compensation with periodic

grants of DSUs. A DSU is a right that tracks the value of one Class B Non-Voting Share. Holders will be entitled to a cash

payout when they cease to be a director. The cash payout will be based on market value of a Class B Non-Voting Share at the

time of payout. When cash dividends are paid on Class B Non-Voting Shares, holders are credited with DSUs equal to the

dividend. DSUs do not have voting rights as there are no shares underlying the plan.

During 2015, $2 was recognized as compensation expense (2014 – $3). The carrying value and intrinsic value of DSUs at

August 31, 2015 was $15 and $13, respectively (August 31, 2014 – $13 and $11, respectively).

Employee share purchase plan

The Company’s ESPP provides employees with an incentive to increase the profitability of the Company and a means to

participate in that increased profitability. Generally, all non-unionized full time or part time employees of the Company are

eligible to enroll in the ESPP. Under the ESPP, eligible employees may contribute to a maximum of 5% of their monthly base

compensation. The Company contributes an amount equal to 25% of the employee’s contributions.

During 2015, $6 was recorded as compensation expense (2014 – $5).

Share appreciation rights

A subsidiary of the Company grants SARs to eligible employees of ViaWest. A SAR entitles the holder to the appreciation in

value of one share of ViaWest over the exercise price over a period of time. SARs granted to ViaWest employees post-acquisition

vest 25% per year over four years, have a 10 year contractual term and are cash settled. During 2015, $4 was recognized as

compensation expense. The carrying value of SARs liabilities, including the SARs granted as partial consideration for the

acquisition of ViaWest (see note 3), at August 31, 2015 was $13. At August 31, 2015, no SARs had vested.

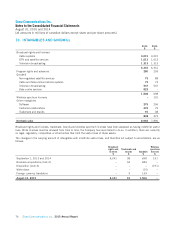

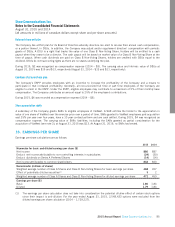

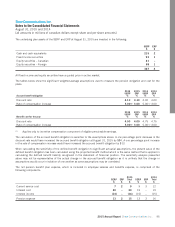

18. EARNINGS PER SHARE

Earnings per share calculations are as follows:

2015 2014

Numerator for basic and diluted earnings per share ($)

Net income 880 887

Deduct: net income attributable to non-controlling interests in subsidiaries (24) (30)

Deduct: dividends on Series A Preferred Shares (14) (14)

Net income attributable to common shareholders 842 843

Denominator (millions of shares)

Weighted average number of Class A Shares and Class B Non-Voting Shares for basic earnings per share 468 457

Effect of potentially dilutive securities(1) 32

Weighted average number of Class A Shares and Class B Non-Voting Shares for diluted earnings per share 471 459

Earnings per share ($)

Basic 1.80 1.84

Diluted 1.79 1.84

(1) The earnings per share calculation does not take into consideration the potential dilutive effect of certain stock options

since their impact is anti-dilutive. For the year ended August 31, 2015, 2,548,433 options were excluded from the

diluted earnings per share calculation (2014 – 1,729,227).

2015 Annual Report Shaw Communications Inc. 85