Sara Lee 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Sara Lee annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to financial statements

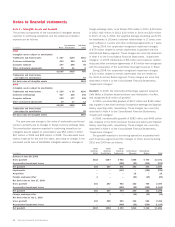

Shipping and Handling Costs Shipping and handling costs are

$607 million in 2010, $655 million in 2009 and $644 million in

2008. The majority of these costs are recognized in the “Selling,

general and administrative expenses” line of the Consolidated

Statements of Income.

Inventory Valuation Inventories are stated at the lower of cost or

market. Cost is determined by the first-in, first-out (FIFO) method.

Rebates, discounts and other cash consideration received from a

vendor related to inventory purchases is reflected as a reduction

in the cost of the related inventory item, and is therefore, reflected

in cost of sales when the related inventory item is sold.

Recognition and Reporting of Planned Business Dispositions

When a decision to dispose of a business component is made, it

is necessary to determine how the results will be presented within

the financial statements and whether the net assets of that business

are recoverable. The following summarizes the significant account-

ing policies and judgments associated with a decision to dispose

of a business.

Discontinued Operations

A discontinued operation is a business

component that meets several criteria. First, it must be possible to

clearly distinguish the operations and cash flows of the component

from other portions of the business. Second, the operations need

to have been sold or classified as held for sale. Finally, after the

disposal, the cash flows of the component must be eliminated from

continuing operations and the corporation may not have any signifi-

cant continuing involvement in the business. Significant judgments

are involved in determining whether a business component meets

the criteria for discontinued operation reporting and the period in

which these criteria are met.

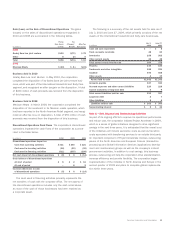

If a business component is reported as a discontinued operation,

the results of operations through the date of sale are presented on

a separate line of the income statement. Interest on corporate level

debt is not allocated to discontinued operations. Any gain or loss

recognized upon the disposition of a discontinued operation is

also reported on a separate line of the income statement. Prior to

disposition, the assets and liabilities of discontinued operations are

aggregated and reported on separate lines of the balance sheet.

Gains and losses related to the sale of business components

that do not meet the discontinued operation criteria are reported

in continuing operations and separately disclosed if significant.

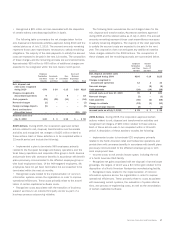

Businesses Held for Sale

In order for a business to be classified

as held for sale, several criteria must be achieved. These criteria

include, among others, an active program to market the business

and locate a buyer, as well as the probable disposition of the busi-

ness within one year. Upon being classified as held for sale, the

recoverability of the carrying value of a business must be assessed.

Evaluating the recoverability of the assets of a business classified

as held for sale follows a defined order in which property and intan-

gible assets subject to amortization are considered only after the

recoverability of goodwill, intangible assets not subject to amortization

and other assets are assessed. After the valuation process is

completed, the held for sale business is reported at the lower of its

carrying value or fair value less cost to sell and no additional depre-

cation expense is recognized related to property. The carrying value

of a held for sale business includes the portion of the cumulative

translation adjustment related to the operation.

Businesses Held for Use

If a decision to dispose of a business

is made and the held for sale criteria are not met, the business

is considered held for use and its assets are evaluated for recover-

ability in the following order: assets other than goodwill, property

and intangibles; property and intangibles subject to amortization;

and finally, goodwill. In evaluating the recoverability of property and

intangible assets subject to amortization, in a held for use business,

the carrying value of the business is first compared to the sum of

the undiscounted cash flows expected to result from the use and

eventual disposition of the operation. If the carrying value exceeds

the undiscounted expected cash flows, then an impairment is rec-

ognized if the carrying value of the business exceeds its fair value.

There are inherent judgments and estimates used in determining

future cash flows and it is possible that additional impairment charges

may occur in future periods. In addition, the sale of a business can

result in the recognition of a gain or loss that differs from that

anticipated prior to the closing date.

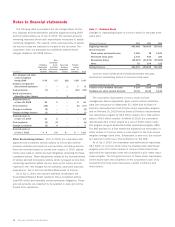

Property Property is stated at historical cost and depreciation

is computed using the straight-line method over the lives of the

assets. Machinery and equipment are depreciated over periods

ranging from 3 to 25 years and buildings and building improvements

over periods of up to 40 years. Additions and improvements that

substantially extend the useful life of a particular asset and interest

costs incurred during the construction period of major properties

are capitalized. Leasehold improvements are capitalized and amor-

tized over the shorter of the remaining lease term or remaining

economic useful life. Repairs and maintenance costs are charged

to expense. Upon sale or disposition of a property element, the

cost and related accumulated depreciation are removed from the

accounts. Capitalized interest was $10 million in 2010, $10 million

in 2009 and $18 million in 2008.

Property is tested for recoverability whenever events or changes

in circumstances indicate that its carrying value may not be recover-

able. Such events include significant adverse changes in the business

climate, current period operating or cash flow losses, forecasted

continuing losses or a current expectation that an asset group will

be disposed of before the end of its useful life. Recoverability of

property is evaluated by a comparison of the carrying amount of an

asset or asset group to future net undiscounted cash flows expected

to be generated by the asset or asset group. If the carrying amount

exceeds the estimated future undiscounted cash flows then an

asset is not recoverable. The impairment loss recognized is the

amount by which the carrying amount of the asset exceeds the

estimated fair value using discounted estimated future cash flows.

58 Sara Lee Corporation and Subsidiaries